Don’t Make The Same Mistakes: Crypto Projects That Failed

Cryptocurrency has been a part of the financial landscape for over a decade and is here to stay. Today, there are more than 23,000 crypto projects as of August 2023, and this number is constantly growing.

However, not every project is successful. Hundreds of crypto projects have miserably failed due to various reasons. In this article, we will take a look at some of the most notable crypto projects that have failed in the past and examine what went wrong.

Key Takeaways:

- The biggest project crashes in the cryptocurrency space serve as cautionary tales for both crypto investors and developers.

- Crypto projects fail due to a lack of user adoption, technical issues, and fraudulent behaviour.

- Investors should always perform due diligence before investing in projects, and diversifying their investments across multiple projects can help reduce risk.

The Most Notable Failed Crypto Projects

Bitconnect

Bitconnect was a cryptocurrency project that emerged in 2016 as a lending and exchange platform. The platform targeted investors with the promise of high returns from its proprietary crypto trading bot, which allegedly could spot different profitable opportunities in the market. To attract users, it offered an attractive referral program and native token (BCC) as incentives to join and deposit funds onto the platform. By December 2017, the BCC token had reached an all-time high of $400 per coin.

Unfortunately, it was soon revealed that Bitconnect was, in fact, a classic Ponzi scheme, relying on unsustainable returns and new crypto investments to keep up the facade of success. In January 2018, the platform was closed by authorities, and the extent of the fraud was revealed when its founder Satish Kumbhani was charged with a range of fraud-related crimes in early 2022.

The collapse of Bitconnect had a devastating impact on its investors, leaving thousands with large losses and no potential return. The BCC token dropped 90% and was rapidly delisted from all crypto platforms.

Lesson to Learn:

This serves as an important reminder to all investors to approach financial opportunities with caution and be sceptical of overly optimistic claims. Always do your research and proceed only when you are confident that the investment is legitimate and sound.

Mt. Gox

Mt. Gox, which stands for “Magic The Gathering Online Exchange”, is a defunct Tokyo-based bitcoin exchange founded in July 2010 by Jed McCaleb. Initially, it was used as a marketplace for trading Magic the Gathering cards before being repurposed for bitcoin trading. The company quickly gained popularity and, at its peak, handled over 70% of all Bitcoin transactions worldwide.

However, all operations ceased in February 2014 when Mt. Gox filed for bankruptcy after claiming that 850,000 bitcoins belonging to its customers and the company were missing and likely stolen. This amounted to approximately $450 million at the time and was equivalent to 7% of all bitcoins in existence.

The hack is considered one of the largest thefts in cryptocurrency history and has had profound effects on the industry at large. The bankruptcy trustee later found that only around 200,000 bitcoins were lost to hackers, while the remaining bitcoins were found to have been transferred by Mark Karpeles, the CEO of Mt. Gox, to his own bank account.

Mt. Gox’s poor security practices and mismanagement have been blamed for the theft, and its former CEO, Mark Karpeles, was arrested in Japan and accused of embezzling funds.

Lesson to Learn:

This event has caused a significant shift in the way organisations approach digital asset security, with many exchanges now implementing more robust security measures. Mt. Gox has come to serve as a cautionary tale for those in the cryptocurrency industry and has changed the landscape of digital asset trading forever.

Ethereum’s DAO

Ethereum’s Decentralised Autonomous Organization (DAO) was an ambitious crypto project that aimed to decentralise venture capital investments. The idea was to create a platform where members could pool funds and vote on which projects they wanted to invest in using the native token DAO.

The DAO attracted a lot of attention, and its token was listed on major exchanges. However, it was quickly revealed that the code behind the project contained several security vulnerabilities which could be exploited by malicious actors. In June 2016, an anonymous hacker managed to exploit these flaws and withdrew 3.6 million ETH (around $50 million at the time).

In response to the attack, the crypto community voted to hard fork the network, undoing all transactions that had taken place since the hack and effectively restoring 3.6 million ETH back to investors. This controversial decision sparked a heated debate in the crypto world about whether it was an appropriate way of responding to security threats and set a precedent for future cases.

Lesson to Learn:

The failure of the DAO project brought to light the critical need for performing meticulous code audits, implementing comprehensive security measures, and establishing well-defined dispute resolution mechanisms prior to launching any ambitious venture.

Coinye

Coinye was a digital asset created in 2014 as an alternative to Bitcoin. It was designed as a more user-friendly and accessible cryptocurrency, featuring a cartoon likeness of rap star Kanye West instead of a traditional logo.

The project quickly gained traction, and its native token was listed on several major exchanges. This attracted the attention of Kanye West’s legal team, who claimed that the coin was an infringement of his intellectual property rights. The developers were then served with two cease and desist orders, forcing them to shut down the project in January 2015 and delist its token from all exchanges.

Lesson to Learn:

Coinye’s short-lived success serves as an important reminder that projects should never infringe on the intellectual property rights of others and always seek permission if necessary. Projects that do not follow proper procedures and regulations may face legal action, which can lead to severe financial penalties or the total closure of the project.

OneCoin

OneCoin was a digital asset created by Dr Ruja Ignatova in 2014 as an alternative to Bitcoin. Unlike other cryptocurrencies, it was not decentralised and instead relied on a centralised structure with its own network of miners, which was the OneCoin company itself. The project made bold promises such as “guaranteed returns” and quickly gained popularity among investors.

However, it was soon revealed that OneCoin was a Ponzi scheme with no real technology behind it and no public ledger. The supposed “guaranteed returns” were nothing more than the funds of new investors being used to pay older ones.

Due to its fraudulent nature, OneCoin was met with strong opposition from authorities around the world. The Hungarian Central Bank recognised it as a Ponzi scheme in late 2016, and other countries such as Italy, Germany and Belize followed suit shortly afterwards. The Indian government even put Ruja Ignatova and 30 of her employees on their wanted list in 2017.

In the US, Mark Scott was arrested in 2018 for helping OneCoin with money laundering. The most serious event came in 2019 when Konstantin Ignatov, brother of Ruja and co-owner of the company, was arrested by FBI agents in Los Angeles. He now faces up to 20 years in prison for his role in the fraudulent project.

Lesson to Learn:

It is important to do your own research on any project before investing, as well as take extra precautions when facing promises of “guaranteed returns” or other signs of potential fraud.

TerraUSD

TerraUSD (UST) is an algorithmic stablecoin developed by the Terra Protocol. The coin was pegged to the U.S. dollar (USD), meaning it, in theory, minimised cryptocurrency volatility and offered users an investment vehicle or payment option with less risk of market fluctuations.

Every time UST tokens were minted, US$1 worth of Luna was burned and vice versa. This unique supply dynamics encouraged traders to burn their tokens when the price fell below US$1 in order to create Luna for arbitrage profit.

In early 2022, TerraUSD experienced a surge in demand as users actively participated in another savings protocol on the blockchain called Anchor, which offered attractive interest rates of up to 20% on staked UST tokens. The protocol created a lot of excitement among crypto traders and further popularised the TerraUSD stablecoin in the cryptocurrency market.

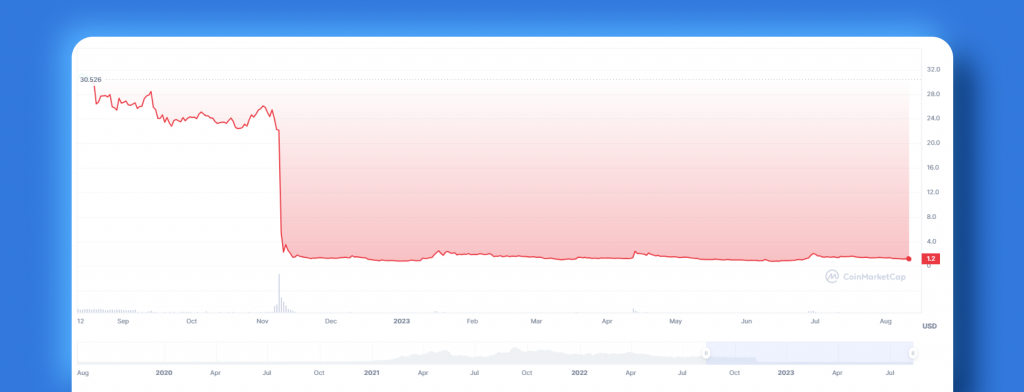

Unfortunately, TerraUSD encountered several issues and ultimately failed in early 2022.

The primary cause for the failure of TerraUSD was a massive selloff from crypto investors when one investor sold over 85 million UST tokens. This selloff created pressure on the UST peg, and further selling activity ensued. Momentum built as Terra began to slide below its usual trading point of US$1, causing investors to switch to other stablecoins that were still holding their pegs.

In order to try and prop up TerraUSD, large amounts of Luna tokens were printed, resulting in a drastic decrease in value. This created a negative feedback loop that further devalued both TerraUSD and Luna tokens, leading to their eventual demise. Crypto exchanges such as Coinbase and Binance eventually halted trading on both tokens.

Critics and reporters have called the collapse of Terra the biggest crypto crash in history, with prices for both tokens down more than 99% and many investors losing millions overnight.

Lesson to Learn:

The current crypto ecosystem is riddled with flaws, as evidenced by the fact that all tokens are closely connected, and the entire market can crash if just one popular crypto experiences a nose dive. Furthermore, risky high-interest rates from DeFi protocols are based on the assumption of perpetual crypto growth, which has historically led to economic bubbles.

FTX

FTX is a cryptocurrency exchange founded in 2019 by Sam Bankman-Fried. It has quickly made its way up the ranks as one of the largest and most liquid exchanges on the crypto markets.

FTX’s collapse was an unprecedented event in the cryptocurrency industry, occurring over a 10-day period from November 2 to November 12, 2022. The catalyst for this dramatic collapse was the revelation by CoinDesk that Alameda Research, run by FTX CEO Sam Bankman-Fried, held a position valued at $5 billion in FTT – the native token of FTX – which sparked concern across the industry over undisclosed leverage and solvency.

In response to this, rival exchange Binance sold all FTT tokens on November 6, followed by FTX announcing a liquidity crisis and seeking a bailout from venture capitalists and then Binance on November 7. On the same day, Binance announced they would buy FTX’s non-U.S. business. However, this was quickly rescinded on November 9 after due diligence had been conducted.

As speculation grew, investors began selling off their FTT tokens rapidly. This caused the value of the FTT token to drop, leading to a ripple effect that spread across FTX’s entire platform. The decline in price affected other digital assets as well. In order to stem the losses incurred by their clients, FTX had to halt all trading operations. Unfortunately, this was not enough to stop the catastrophic collapse.

On November 10, Bankman-Fried admitted to the liquidity crisis and announced that affiliate Alameda Research would wind down operations. On November 11, Bankman-Fried stepped down as FTX CEO and was replaced by a court-appointed CEO with restructuring experience. This was followed by FTX filing for Chapter 11 bankruptcy protection on the same day.

The magnitude of this collapse is disconcerting – it had a domino effect that quickly spread to other digital assets, and the loss of funds was staggering.

Lesson to Learn:

FTX’s collapse demonstrates how quickly an entire industry can be destabilised.

This incident has also highlighted the need for more stringent regulations and oversight of cryptocurrency exchanges and digital asset investments. Governments are now pushing for greater transparency in the crypto industry, with many countries introducing new legislation to ensure the stability of digital asset investments. It is hoped that these measures will help prevent similar collapses from occurring in the future.

Squid Game

The Squid Game Token is a cryptocurrency developed by unknown developers to accompany the newly released Netflix series Squid Game. Launched in October 2021, SQUID had an impressive initial growth of 23 million per cent within a week.

Unfortunately, due to a lack of clarity about its non-official affiliation with Netflix, many investors were lured into a false sense of security. Marketed as a utility token for play-to-earn games, malicious developers used the backdoor within SQUID’s code to access funds held in a decentralised exchange liquidity pool. They then stole assets worth around $3.4 million from investors before the currency collapsed. This type of fraud is commonly referred to as a ‘rug pull‘.

Lesson to Learn:

Clearly, it is important for investors to be aware of the risks involved in crypto investing and understand the full scope of any associated token. It is also essential to research heavily into any potential investment before making a commitment and address every opportunity in the market with caution. Furthermore, investors should be aware of how crypto scams work so they are not left holding the bag.

Why Do Crypto Projects Fail?

Cryptocurrency projects fail for many reasons, including lack of user adoption, technical issues, and fraudulent behaviour. For example, some projects are unable to gain enough traction and become popular due to their limited features or marketing strategies. Similarly, if a project is based on a weak or poorly-designed technology platform, its development process could be slowed down by difficult coding or scalability issues.

The crypto market is also plagued with unscrupulous individuals and groups that engage in fraud and manipulation. Bad actors can take advantage of the unregulated nature of the industry to scam investors and artificially inflate asset prices for their own benefit. This type of behaviour often results in large losses for unwitting investors who have put their trust in these projects. Crypto projects should also focus on creating products that are truly useful to users, as this will help them gain traction in the market.

Overall, the crypto market is still in its infancy and has a long way to go before it can become regulated. Projects must strive to be transparent and accountable in order to gain the trust of users and investors, which will ultimately lead to more successful projects and fewer failures. With better project management practices, rigorous code testing, and increased awareness of fraudulent activities, the crypto industry can become a more secure and reliable platform for investments.

FAQs

What are the most common reasons that crypto projects fail?

The most common reason for a crypto project to fail is a lack of user adoption. Technical issues, such as poor coding or scalability issues, can also cause a project to fail. Also, some projects are scams by bad actors who make use of the industry’s unregulated nature.

How can I ensure that my crypto investments are safe?

When investing in any crypto project, it’s important to do your due diligence and assess all the risks involved. Make sure to research the team behind the project and read reviews from other investors.

Additionally, keep up with the latest developments in the industry and be aware of potential protocol issues that could lead to a crash. Finally, it’s always wise to spread your investments across different projects instead of placing all your eggs in one basket.

What measures are being taken to prevent crypto project failures?

Governments around the world are pushing for greater transparency and oversight in the crypto industry. This includes introducing new legislation to ensure the stability of digital asset investments and preventing fraudulent activities.

Additionally, crypto projects should strive to be transparent and accountable in order to gain the trust of users and investors. Finally, better project management practices, rigorous code testing, and increased awareness of fraudulent activities can all help prevent future failures.

How can I financially recover losses if the crypto project I invested in fails?

Depending on the amount of your investment, you might be eligible for a financial recovery plan. However, it’s important to note that these plans are typically only available in cases where the project was found to have been fraudulent or engaged in other illegal activities.

If this is not the case, then the best way to recover your losses is to diversify your investments and spread them across different projects. This way, you can minimise the damage caused by any single project failure.