Crypto Bubbles: What Lessons to Learn from the History

If you’re willing to see past the hype, the world of crypto is exhilarating, unpredictable, and educational. From the early surges of Bitcoin to the collapse of FTX, the history of the cryptocurrency bubbles is a playbook of human psychology and financial extremes.

In this guide, we break down the crypto bubble, the most infamous crashes, and how to invest smarter to thrive in the next bull or bear market.

Key Takeaways

- Emotion plays a greater role than fundamentals in driving crypto bubbles.

- Smart investing requires patience, diversification and self-custody.

- Every failure paves the way for more robust endeavors.

What Is a Financial Bubble?

A financial bubble happens when the price of an asset (like stocks, real estate, or cryptocurrencies) balloons far above its intrinsic value, spurred by overjoyed market behaviour instead of fundamentals. This meteoric rise is often driven by investor speculation, media attention, and a general conviction that prices will only go up.

Reality hits at a time. This could be a shift in sentiment, a regulatory change, or a surprise happening. The bubble is then burst. Prices then tumble down quickly. In most cases, a huge amount of wealth is lost at this time.

Fast Fact

Over 80% of ICOs in 2017 were labeled as scams, however, billions were raised before the crash.

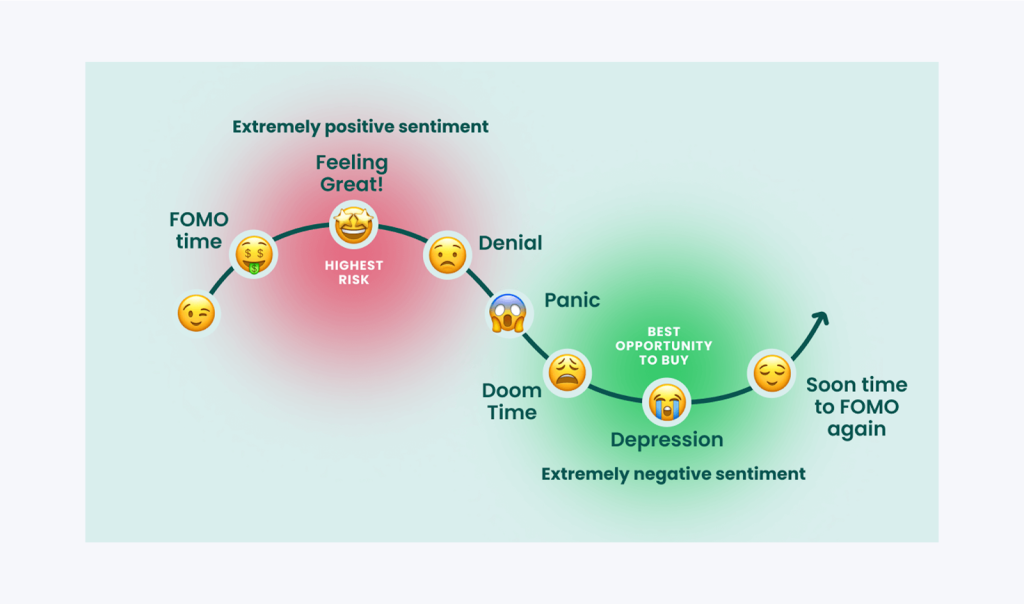

The Psychology Behind Crypto Bubbles

One intriguing aspect of financial bubbles is the way they are spurred by group psychology. Many investors experience a fear of missing out (FOMO), thinking they need to get in before the prices go higher. This herd mentality leads to a self-fulfilling prophecy. Prices surge as more people purchase, attracting more investors.

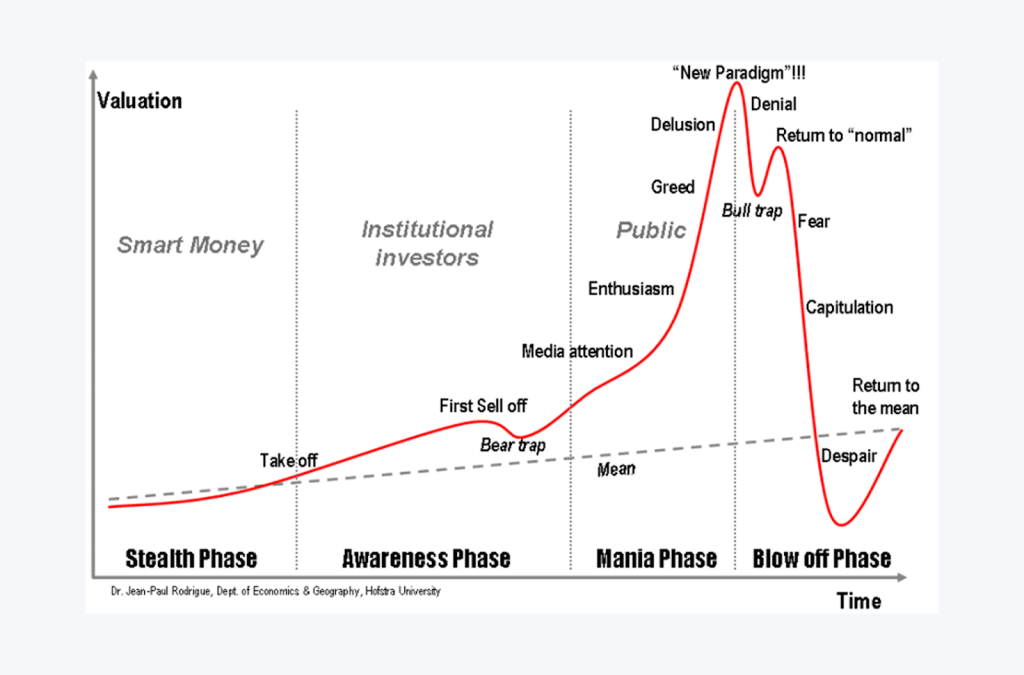

Market Stages of Typical Crypto Bubbles

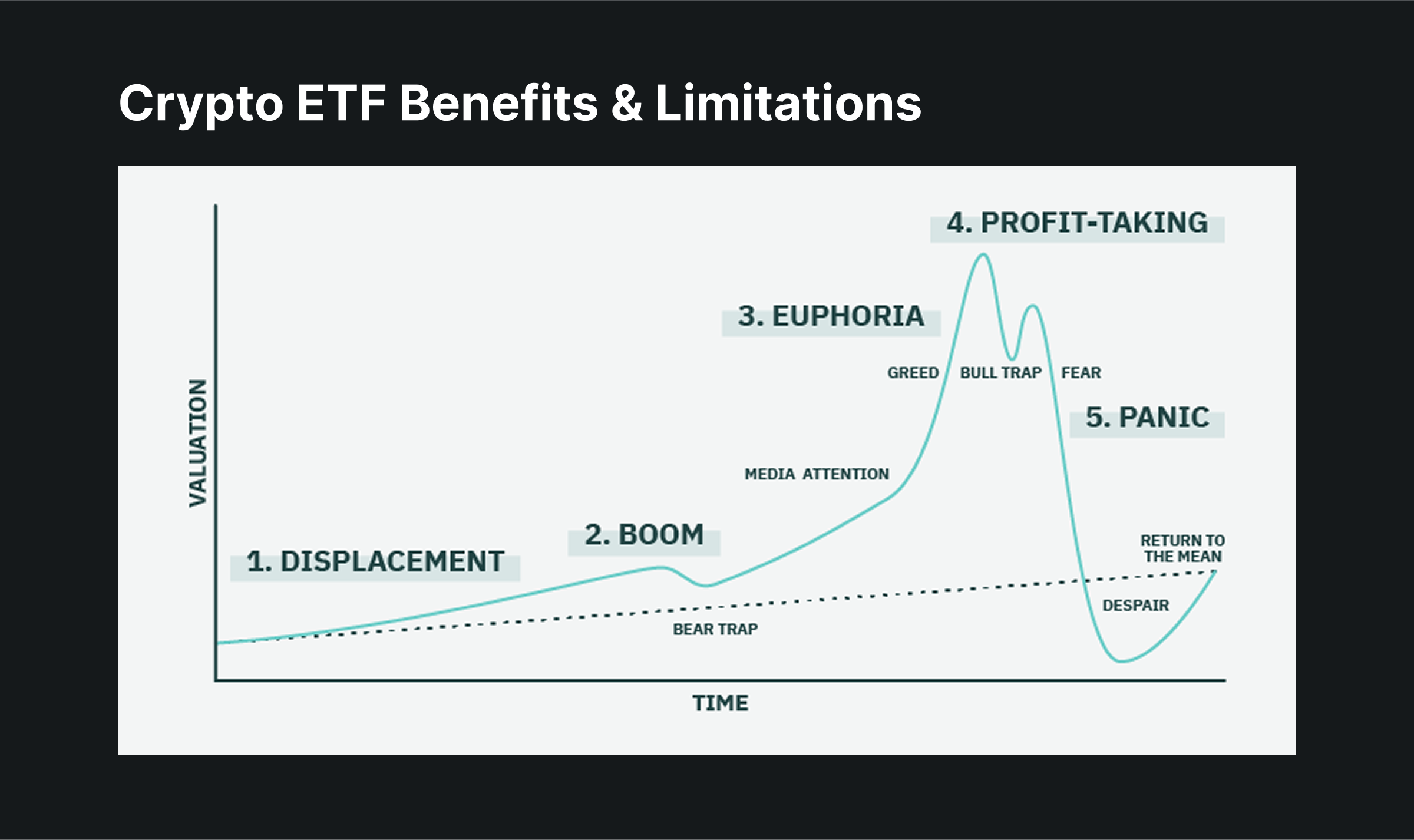

Crypto bubbles can often feel random, but in many ways, they are predictable and follow a pattern. The pattern is often driven by human nature, the media cycle, and investor behavior. These market stages are not unique to crypto; however, in a young and volatile asset class, they unfold faster and more dramatically than in traditional finance.

Here is a breakdown of the six primary phases most cryptocurrency bubbles experience.

Displacement

This first phase is distinguished by the emergence of something new, be it a breakthrough in technology, changes in regulation, or a major macroeconomic event, which disrupts existing markets and becomes the focus of investors’ interest. In crypto, the advent of Bitcoin as a decentralized digital currency was a classic displacement event.

Equally, the internet prompted the dot-com boom. Investor sentiment at this stage is characterized by curiosity and cautious optimism, and while capital starts flowing in, the overall excitement still appears grounded.

Boom

Innovation gets more attention as it becomes viable. Interest from investors increases. Prices start to rise. Early success stories and more media coverage contribute to the rise. Conversation changes from possibility to profitability.

Institutional investors can participate in the market, lending credibility and speeding up the boom. Optimism becomes mainstream, valuations start to go beyond the scope of their fundamental support.

Euphoria

Rationality is lost in the wave. Prices skyrocket without much rationale. Everybody is making the best out of what they can. They are investing in companies they blindly trust. People are borrowing to be part of the mania. People are quitting their means of earning a living to trade on a full-time basis.

There are skeptics, but they are neglected, ridiculed, or these voices of caution are dissolved in the phrase “this time it’s different”. The market goes wild, and the difference between price and value is becoming dangerous.

Profit-Taking

The smart money is quietly exiting, recognizing that the market is getting unhealthy. The euphoria is still high in the broader market, and it doesn’t pay attention to these early signs yet.

Volatility escalates, with some parties selling and others buying. The media narrative might change somewhat, but the belief in endless growth takes precedence.

The sentiment at this stage is curious and cautiously optimistic. What is more, even as the capital begins to come in, the general excitement seems to be tempered.

Panic (or Crash)

It’s a tipping point that is often triggered due to external shocks. It could be due to regulation, fraud, or the collapse of a major player. It results in a sharp reversal. In such instances, the confidence often evaporates almost overnight. As a result, panic selling begins, due to which the asset prices often plunge.

Those who came in at the peak are experiencing huge losses. There is a general market panic and fear. Liquidation is being carried out at a frantic pace, and long-term psychosis is more than inevitable.

Return to Normal (Optional but Common)

Afterward, the market could slowly stabilize. Presuming that the core innovation that was at the root of the crypto bubbles was, indeed, valuable, it might endure and even prosper in a more modest and healthier way.

Projects with robust fundamentals stick around; weaker, hype-driven ventures disappear. Investor sentiment shifts to become more measured and smart capital re-enters slowly, with the potential for long-term growth laid down.

Notable Crypto Bubbles in History

Cryptocurrencies, being a young kind of asset, have endured a few wild growth and rapid decline cycles, each having its own cause, story, and effect. These cycles provide insightful lessons about the speculative markets, human psychology, and the development of the digital financial industry.

Here are the two largest and most important bubbles in the history of the cryptocurrency space.

Bitcoin’s 2011 Bubble

Bitcoin was a niche project in 2011, essentially confined to libertarian circles and tech forums; it traded below $1 all year, but interest in a decentralized, censorship-resistant currency grabbed an increasing number of people by the throat. By June, Bitcoin hit around $32, according to early adopters, word-of-mouth enthusiasm, and a flood of speculative interest.

That said, the infrastructure was fragile, and the crash was ruthless indeed. By November, Bitcoin was trading at $2. This translated to losing almost 94% of its worth.

The first of many crypto bubbles taught early adopters many valuable lessons, such as the importance of volatility, market immaturity, and robust trading infrastructure.

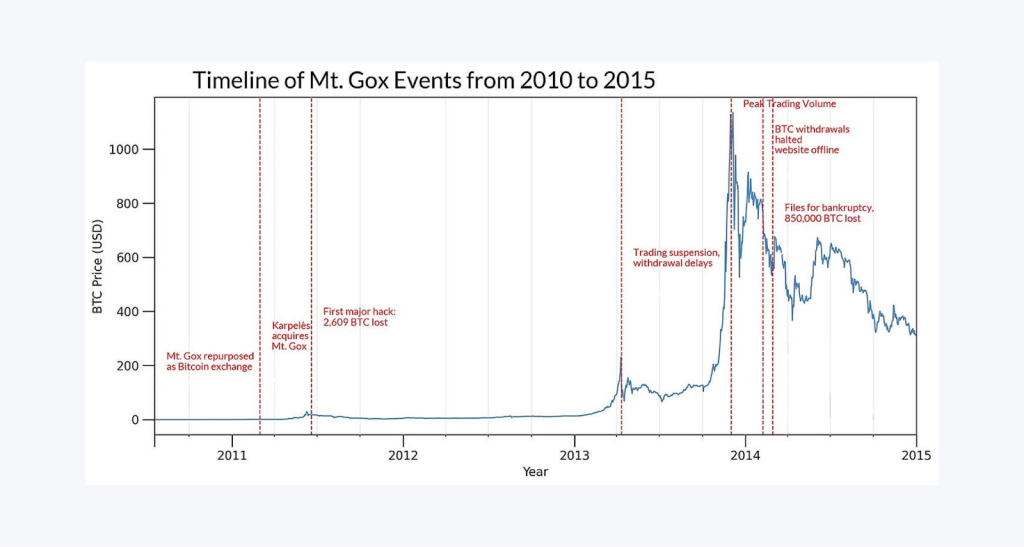

The Mt. Gox Collapse (2013–2014)

Completed in 2013, Bitcoin began to get the attention of the mainstream public. The interest broadened, and attention increased. That year, the price more than doubled from about $13 in January to over $1,150 by the end of it, partly due to negative sentiment related to the Cyprus banking crisis.

Yet Mt. Gox — the major exchange in global BTC trading — was seething with internal issues. Early 2014 exposed the firm’s true picture. It had lost 850,000 BTC. The hackers had breached the exchange wallets, leading to a complete disaster. Bitcoin nosedived to $150. Investor trust was gone.

This accident revealed the dangers of centralized bourses, insufficient transparency, and soft safety, paving the way for the forthcoming revolution of decentralization.

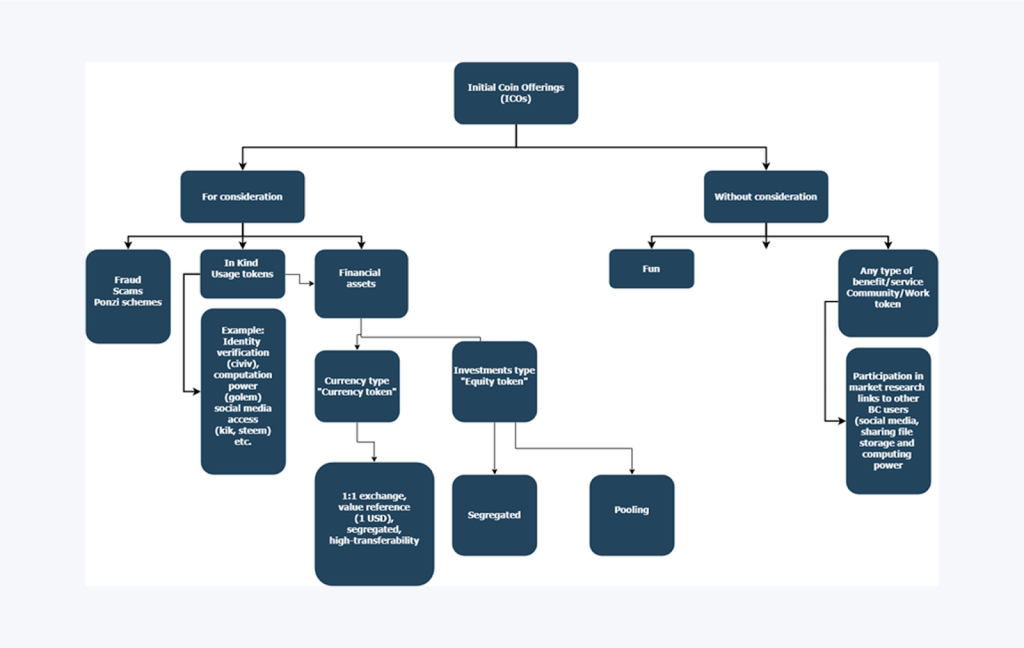

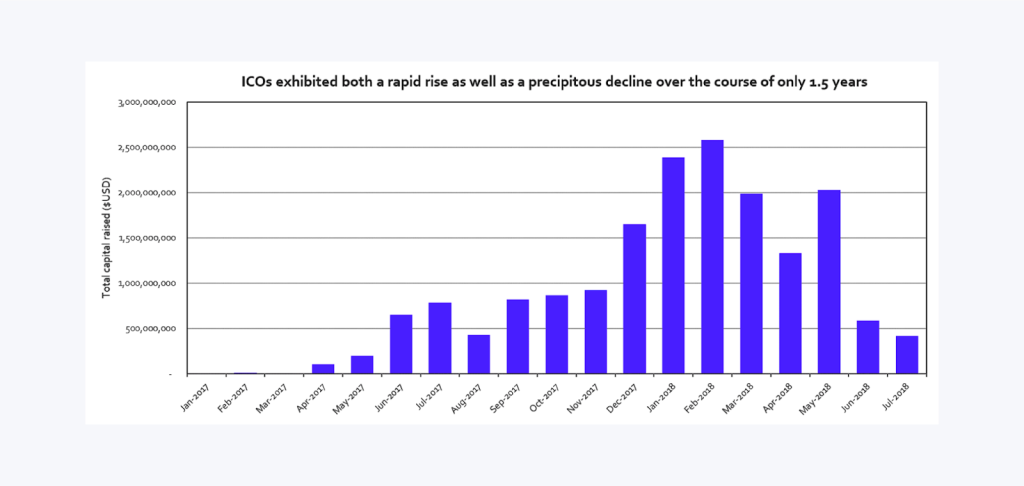

The 2017 ICO Boom

The year 2017 witnessed the ICO mania, powered by Ethereum’s smart contract platform. With startups now able to issue tokens and raise millions directly from the public, the process often didn’t require more than a slick website and vague promises.

Rising to nearly $20,000 by December from around $1,000 in January, Bitcoin was joined on the podium by Ethereum, which went from $10 to over $1,400. Thousands of new tokens popped up, with most of them not having real-world utility.

It was during 2018 that the speculative bubble popped. Bitcoin fell to about $3,200 while Ethereum went below $100. A lot of the ICO projects were washed away. The SEC started to crack down on the fraudulent fundraising. The market was beginning to clean house.

Though harmful, the bubble also helped to popularize cryptocurrencies and was a forerunner to more conscientious projects that appeared after the collapse of the market.

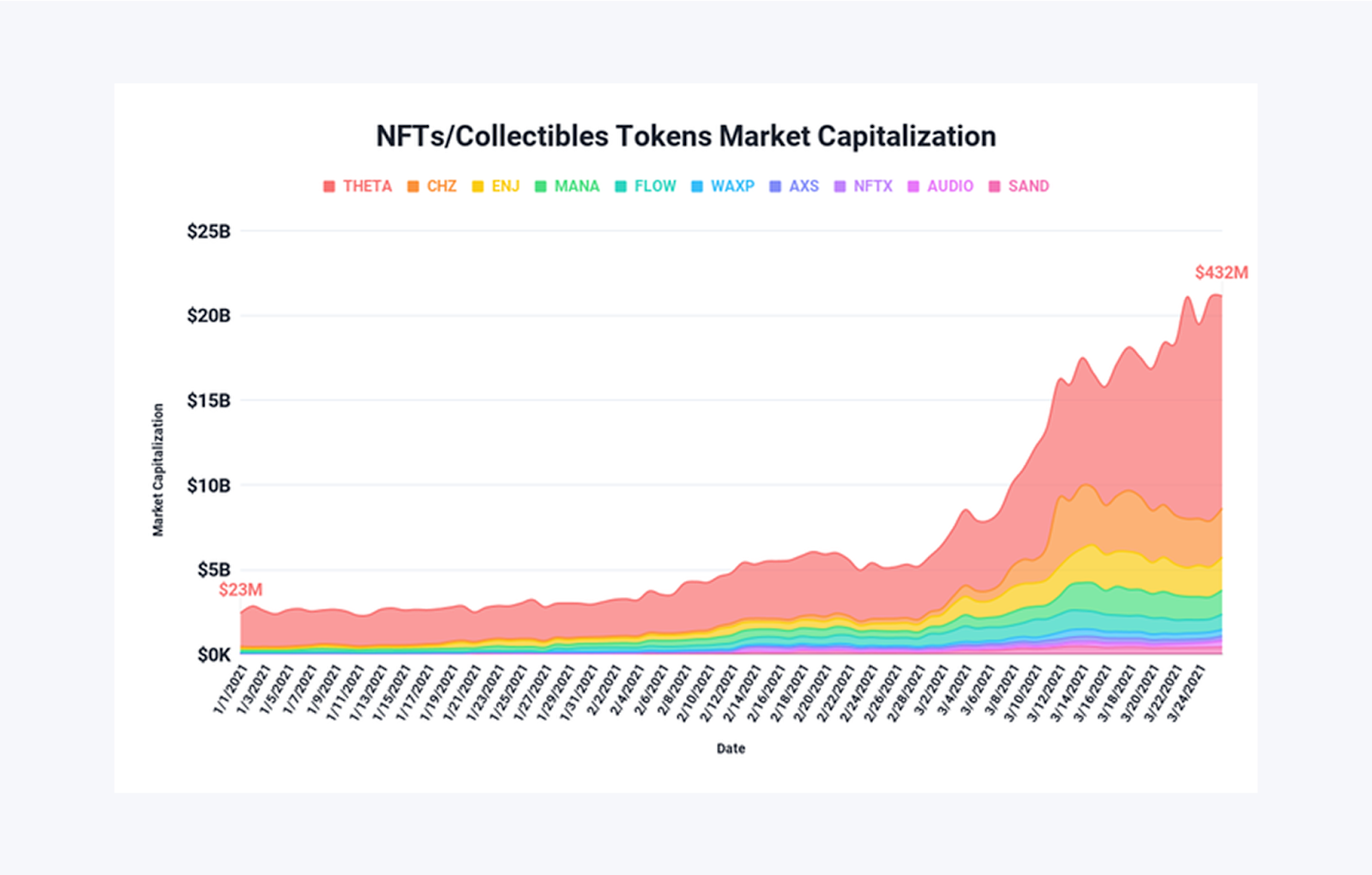

The 2021 DeFi and NFT Mania

In 2021, crypto entered a new phase. It was driven by macroeconomic factors such as low interest rates, pandemic stimulus, and maturing blockchain technologies. Also, decentralized finance (DeFi) platforms appeared, providing alternatives to traditional banking, and NFTs (non-fungible tokens) captured the imagination of many creators and collectors.

In November, Bitcoin broke a new all-time high, reaching $69,000, and Ethereum broke $4,800 for the first time. NFTs like Bored Ape Yacht Club and CryptoPunks are selling for millions each, with Beeple’s $69 million sale marking a cultural milestone.

However, the vast majority was speculation-driven, with meme coins, celebrity hype, and yield farming causing unsustainable dynamics. By 2022, the market collapsed, with Bitcoin dropping below 16,000 and NFT trading volumes declining over 90%.

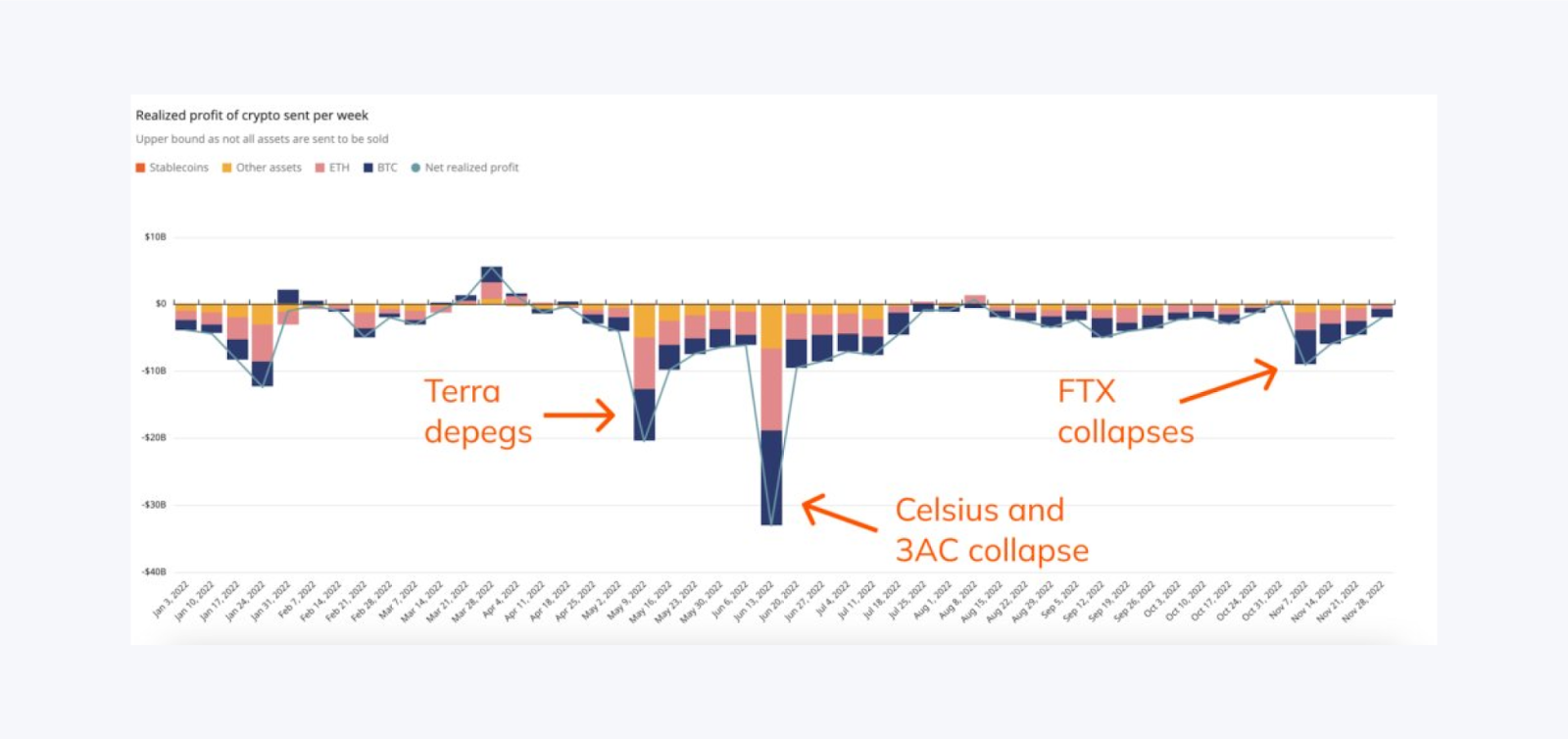

The 2022 Collapse – Terra, Celsius, FTX

The dramatic and destructive crash of 2022 stands out most of all among crypto bubbles. What had been a correction turned into an all-out systemic meltdown, as major project failures revealed the deep-rooted flaws of the crypto ecosystem.

UST, Terra’s algorithmic stablecoin, crashed in May 2022, obliterating over $40 billion of value and kicking off a chain reaction. Lending platforms such as Celsius and Voyager froze withdrawals and declared bankruptcy.

Next was the collapse of FTX, the second-largest exchange in the world, which was accused of fraud and misusing client funds. Bitcoin fell below $16,000, Ethereum fell below $900, and users lost billions of dollars.

Key Lessons from Crypto Bubbles

The cryptocurrency saga is a history of innovative ideas that often morph into speculative manias. Each bubble may have its own reasons, but the outcomes usually look familiar.

Here are key lessons from the spectacularly chaotic history of digital assets that investors, speculators, builders, and regulators can take away.

Speculation Can Outpace Innovation

One key trend in all crypto bubbles is how speculation often outpaces real-world adoption. In 2017, ICOs drew enormous valuations for things that had minimal development or, in some cases, no product at all. And in 2021, NFTs quickly jumped from curio to mainstream and began commanding massive sums for projects that are early in development or, in some cases, have no product.

Disconnecting promises from performance can cause crypto bubbles in the short term, but the technologies themselves often persist in the long run. The trick is in determining which innovations are real and which are just overblown hype.

Lesson:

Newness doesn’t automatically equal value. It’s important to look beyond market sentiment. Ask if a project solves real problems or merely rides the trend.

Herd Mentality and FOMO Are Powerful

The increasingly emotion-driven. FOMO often pushes people to buy high, driven by social media noise, influencer backing, and celebrity endorsement rather than quality analysis.

Such a mental burden is only intensified by the fast price rise and success stories. Unfortunately, the crowd, which managed to push the prices, will crash as soon as the market turns.

Lesson:

Emotional investing does not often lead to profits. Try not to make decisions based on the hype or peer pressure, stay on your research and risk management plan.

Regulation Matters — Even in a Decentralised Space

A lot of the largest crypto catastrophes occurred in grey areas. These include Mt. Gox, 2017 ICO hype, the Terra-Luna disaster, and FTX fraud. The lack of a controlling force allowed people with bad intentions to act on behalf of the investors, which resulted in huge losses and discrediting all pretty crypto in the eyes of traditional finance.

Though decentralization remains the core principle of cryptocurrencies, it is also true that opacity and unaccountability can be easily utilized when platforms or projects have no oversight.

Lesson:

Regulation is not the enemy of innovation – it’s the safeguard for investors and legit projects. The support of clear, thoughtful regulation can help crypto mature into a more solid and trustworthy financial system.

Not Your Keys, Not Your Coins

The fall of centralised entities like Mt. Gox, Celsius, and FTX reminded investors of one of crypto’s foundational truths: if you don’t control your private keys, you don’t truly own your assets. Many users lost funds they assumed were safe simply because they left their crypto in custodial platforms.

Lesson:

Self-custody is crucial. Use hardware wallets or trusted decentralised solutions to protect your assets, especially during market instability.

Market Cycles Are Inevitable — Prepare, Don’t Panic

Every crypto market follows natural cycles of boom, correction, and recovery. The emotional rollercoaster of crypto bubbles can lead investors to make poor decisions: buying too high, selling too low, or abandoning the space entirely after a crash. However, history shows that some of the best opportunities arise during bear markets when hype fades and real value is built.

Lesson:

Long-term success in crypto often comes down to staying informed, being patient, and avoiding reactionary decisions. Zoom out and focus on the bigger picture.

Survivors Shape the Future

After each crash, a handful of strong projects usually emerge stronger. Bitcoin survived multiple 80%+ crashes. Ethereum was often declared “dead,” yet it became the backbone of DeFi and NFTs. Bear markets often serve as a filter, removing weak or fraudulent projects and allowing serious builders to shine.

Lesson:

Don’t underestimate the resilience of the space. Look for projects with strong teams, real use cases, and consistent development activity — even when the market is quiet.

Transparency and Education Are Essential

Many retail investors enter the crypto market without fully understanding the risks involved. This knowledge gap leaves them vulnerable to scams, hype-driven projects, and panic selling. Crypto bubbles thrive in environments where information is distorted, withheld, or misunderstood.

Lesson:

Do your own research (DYOR). Before investing, educate yourself on tokenomics, governance models, technical fundamentals, and market trends. The more informed you are, the less likely you’ll fall prey to the pitfalls of crypto bubbles.

How to Invest Smarter in Crypto?

Investing in cryptocurrency can be highly rewarding, but also extremely risky. The history of crypto bubbles and repeated market crashes shows that smart investing requires more than just enthusiasm.

To navigate the highs of a crypto bull market and survive the lows, here are four essential principles every investor should follow.

Avoid Chasing Hype or FOMO

One of the most common pitfalls in crypto investing is the tendency to jump into an asset just because “everyone else is doing it.” This fear of missing out — FOMO — often leads to buying at the peak of a hype cycle, right before the market corrects or crashes.

Many who bought altcoins or NFTs at all-time highs in 2021 during the DeFi and NFT mania were left holding massive losses after the crypto market crash of 2022.

Instead of reacting emotionally to trends or influencers, focus on projects with real-world utility, strong fundamentals, and transparent development teams. Always take the time to DYOR, especially during the late stages of a cryptocurrency bubble, when excitement is high, but risk is even higher.

Diversify and Manage Risk

Crypto assets can be incredibly volatile. Even blue-chip coins like Bitcoin and Ethereum have experienced drops of 70–90% in past cycles. The key to surviving these downturns is diversification — not just across cryptocurrencies but also across asset types (e.g., stablecoins, crypto equities, or traditional investments).

Don’t put all your capital into a single coin or token. Spread your investment across a mix of assets to reduce the impact of any single failure. Use position sizing and stop-loss strategies; never invest more than you can afford to lose.

The goal is to survive the hype of a crypto bull market and the pain of the next crash.

Think Long-Term, Not Short-Term

Short-term speculation is tempting — especially during rapid price surges — but it’s also one of the easiest ways to get caught in a bubble. History shows that the biggest winners in crypto often took a long-term perspective, held through volatility, and avoided panic selling during downturns.

Treat crypto as a long-term investment rather than a get-rich-quick scheme. Understand that crypto bubble history is filled with sharp corrections and strong rebounds. Focus on assets and protocols with long-term roadmaps, active development, and clear real-world applications.

Store Assets Securely (Not Just on Exchanges)

One of the most painful lessons from past cryptocurrency bubbles and collapses (like Mt. Gox in 2014 and FTX in 2022) is that if you don’t control your keys, you don’t control your crypto. Centralised platforms can be hacked, frozen, or mismanaged, and billions of customer funds have been lost.

Use non-custodial wallets and hardware wallets like Ledger or Trezor to store your crypto safely, especially long-term holdings. Understand the difference between hot wallets, cold storage, and multisig options. Self-custody protects you from exchange failures and is a core principle of true crypto ownership.

Conclusion

The crypto market doesn’t forget, but forgives those who learn. Every crypto bull market creates new wealth, but every crash reminds us of the risks.

Whether you’re here to build, invest, or simply understand the madness, one thing is clear: the people who win in crypto aren’t the loudest — they’re the smartest. Thus, with the right mindset, knowledge, and risk management, you won’t just survive the next cycle — you’ll thrive.

FAQ

What is a crypto bubble?

A crypto bubble is when cryptocurrency prices rise rapidly due to hype and speculation, only to crash when reality sets in.

Why do crypto markets crash so often?

Crypto markets lack regulation, are highly speculative, and are sensitive to news, which makes them prone to dramatic booms and busts.

What was the biggest crypto crash?

The 2022 crash, triggered by Terra’s collapse and the FTX scandal, wiped out over $2 trillion from the global crypto market.

How can I protect my crypto investments?

Diversify, avoid hype-driven buys, think long-term, and use hardware wallets to store assets securely.