How to Start a Prop Trading Firm?

Welcome to the age of modern prop trading—where talent meets technology, and anyone with skill and strategy can build a career or business around market mastery.

Gone are the days when proprietary trading was reserved for Wall Street giants. In 2025, it’s a global, fast-moving space filled with opportunity and competition.

We’ll walk you through what prop trading really is, how to launch and grow your own firm, the models you can choose from, and what the future holds in a world increasingly shaped by AI, crypto, and decentralisation.

Key Takeaways

- Prop trading firms can be built around remote, on-site, or hybrid models—each with its own risk-reward balance and operational needs.

- Automation, global accessibility, and strong risk controls are essential for scaling successfully in today’s competitive environment.

- Future growth will be driven by AI, crypto integration, and decentralised models, reshaping how funding and trader performance are managed.

What Is Prop Trading?

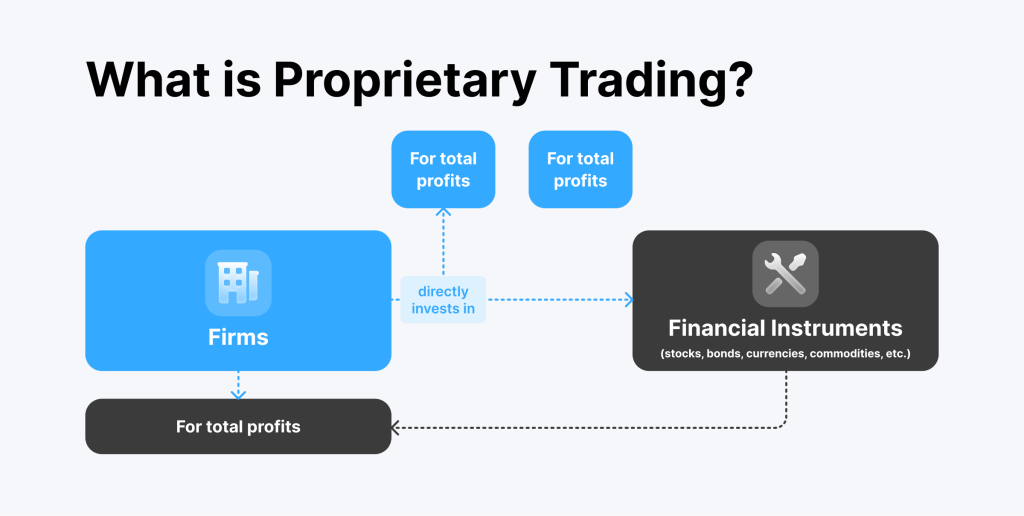

Prop trading—short for proprietary trading—is when a firm trades the financial markets using its own money rather than on behalf of clients. Think of it as a company betting on its own ideas, strategies, and expertise to make a profit.

Instead of merely offering trading services or managing portfolios for customers (as traditional brokerages or asset managers do), prop trading firms take direct positions in markets such as Forex, stocks, commodities, futures, or cryptocurrencies. Their goal? To earn from market movements using skilled traders and smart strategies.

In a typical prop trading setup, the firm recruits skilled traders or trains them, then funds their trades with the company’s capital. Profits made from those trades are split between the trader and the firm, often with performance-based incentives. That way, both the trader and the company benefit from good performance, and risk is tightly controlled through predefined rules and limits.

Prop firms exist because there’s an opportunity to multiply returns when you have talented traders and well-built risk systems. They also serve as a great alternative for skilled individuals who can’t or don’t want to risk their personal funds but still want to trade professionally. Plus, the firm can grow quickly by scaling the best-performing strategies and traders.

Fast Fact

The average payout split in modern prop trading firms ranges from 70% to 90% in favour of the trader, giving top talent more reason than ever to ditch retail accounts.

Key Steps to Starting a Prop Trading Firm

Starting a proprietary trading firm isn’t just about having trading skills—it’s about building a business that can scale, manage risk, and support a team of traders. It’s part finance, part tech, and part leadership.

Here’s how you can bring that vision to life, step by step.

- Define Your Trading Focus and Vision

Before diving into operations, you need a crystal-clear picture of the kind of prop firm you want to create. Will your firm specialise in Forex, crypto, equities, or futures? Are you building an environment for algorithmic trading, manual strategies, or both?

Also, consider your target trader profile. Are you catering to scalpers who thrive on speed, swing traders who spot mid-term trends, or long-term macro strategists? And what’s your operational structure—fully remote, on-site, or a mix of both?

Answering these foundational questions helps you shape everything else, from the kind of technology you’ll deploy to how you’ll fund and scale your operation.

- Choose a Legal Structure and Handle Compliance

Getting the legal framework right is critical. You’ll need to register your company based on your preferred jurisdiction—many opt for an LLC or LLP, depending on the local regulations. Some jurisdictions are more welcoming to trading firms than others, so choose wisely.

It’s also essential to check whether your business model requires a financial license. This can vary significantly based on your structure and location. Consulting with a legal expert in financial regulation will save you from compliance issues later.

Remember, strong legal foundations don’t just protect you—they also boost your credibility with banks, traders, and tech partners.

- Secure Initial Capital

Even though you’re not handling client funds, your firm needs a healthy cash reserve. You’ll use this capital to fund trader accounts, cover monthly expenses like tech licenses and staff salaries, and create a cushion for inevitable trading drawdowns.

Most firms start with anywhere from $100,000 to $500,000, though you could scale faster with more backing. Whether you self-fund, bring on silent partners, or attract external investors, make sure your capital plan aligns with your risk appetite and growth vision.

- Build the Right Technology Stack

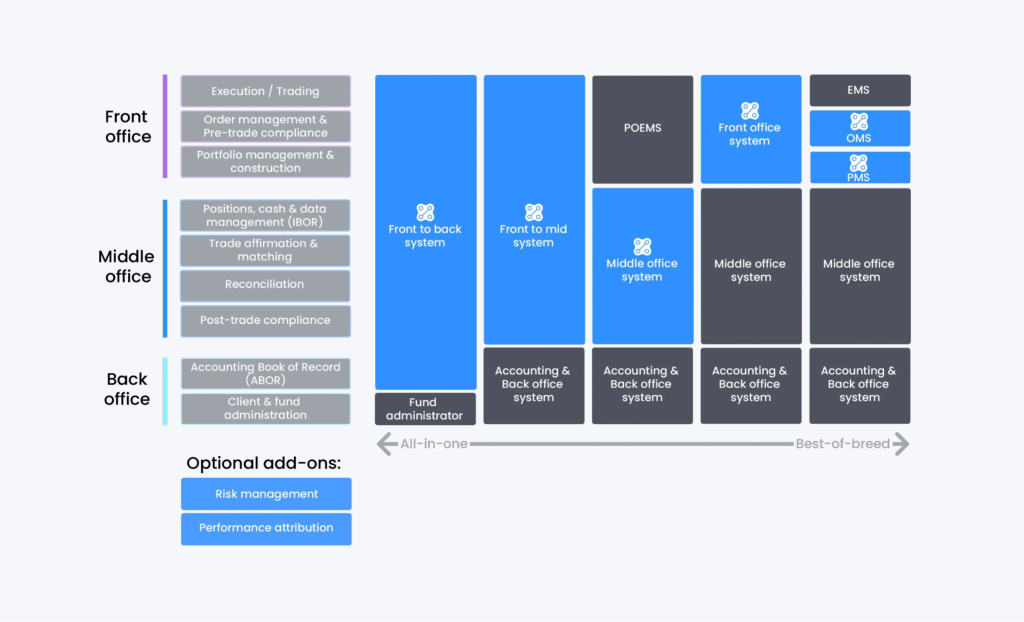

Technology is your backbone. Start with a robust trading platform, such as MetaTrader 5, cTrader, DXtrade, or a custom-built solution—whatever aligns with your firm’s focus.

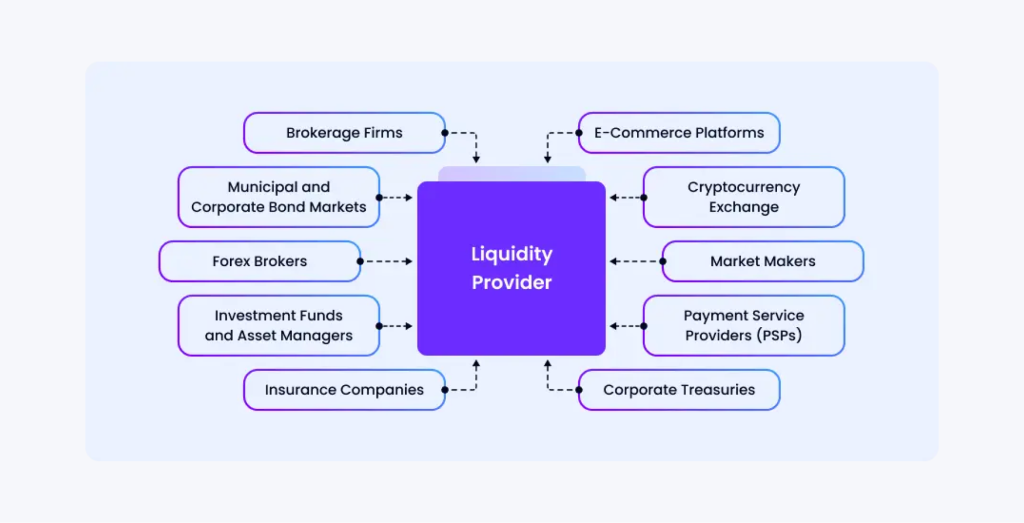

You’ll also need integrated risk management tools to monitor trader behaviour in real time, plus a client portal where traders can view their metrics and manage accounts. If your firm is connected to live markets, securing a reliable liquidity provider is crucial.

Invest in user-friendly systems, ensure everything runs securely, and prioritise automation if you plan to scale globally.

- Set Clear Risk Management Rules

A well-run prop firm doesn’t just hand out capital and hope for the best. You need defined rules to protect your funds and guide trader behaviour.

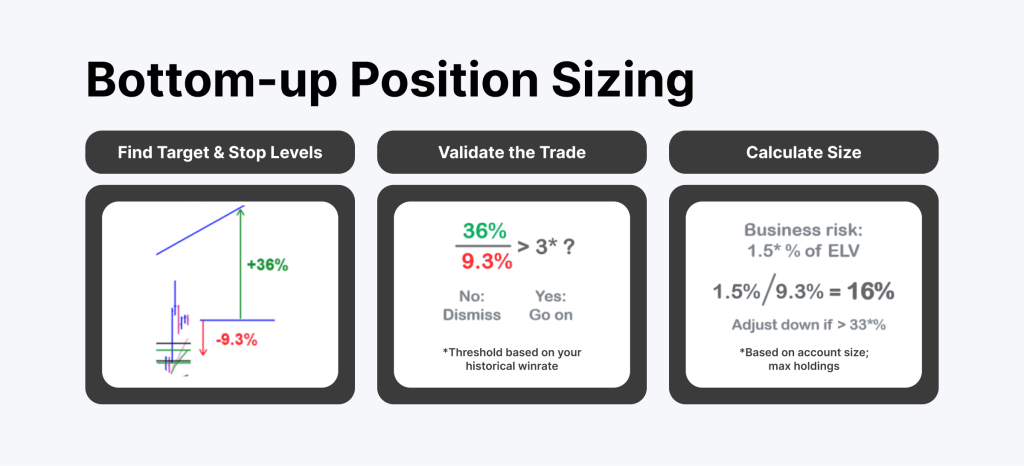

These rules include daily and overall drawdown limits, maximum leverage ratios, and clear position sizing guidelines. Set limits on trade durations or restrict trading during high-impact news events, depending on your risk tolerance.

Ultimately, risk management is what keeps your firm alive during rough patches and sustainable during growth.

- Design a Trader Evaluation and Funding Program

Your evaluation program is how you find and filter talent. Most firms use a challenge-based system where traders must meet profit targets while staying within specific drawdown limits.

You can structure this as a one-step or two-step challenge, with optional time limits and either refundable or subscription-based fees. Top performers then receive access to a live-funded account, often with a profit-sharing model.

- Build the Back Office and Support Team

As your firm grows, so do your operational needs. You’ll need compliance staff to monitor trades, support representatives to handle payouts and issues, technical personnel to maintain systems, and marketing professionals to attract new talent.

Even if you start solo or lean, plan to bring on help as you grow. A strong support team keeps the firm running smoothly, allowing you to focus on strategy and scaling.

- Start Small, Then Scale Smart

Many successful firms begin with a handful of traders and basic infrastructure. As you grow, you can expand your offerings, automate your workflows, and refine your processes.

Build educational resources to help your traders succeed, and use performance data to spot your top talent. Don’t just chase more traders—build a system that supports them and ensures the firm’s long-term resilience.

Business Models in Prop Trading

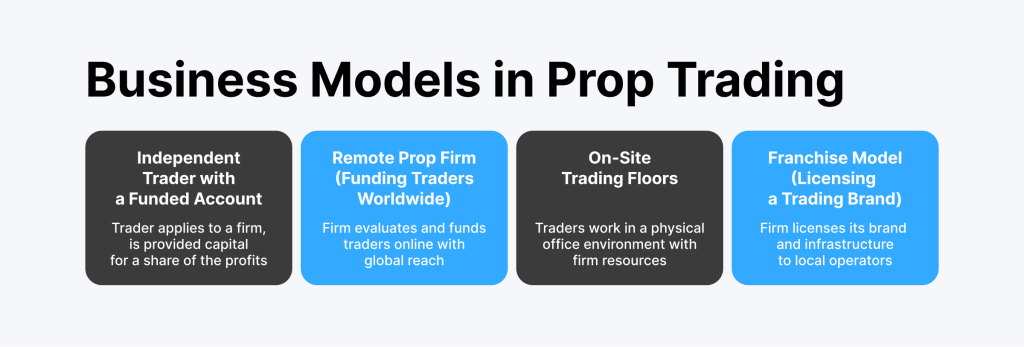

Prop trading isn’t a one-size-fits-all business. In fact, firms today come in a variety of shapes and sizes, ranging from a solo trader managing a funded account to full-fledged global operations with hundreds of traders.

Let’s break down the most common business models and how they work in practice.

Independent Trader with a Funded Account

This is perhaps the simplest form of prop trading—and a great entry point for solo traders. Here, an individual applies to a prop firm, passes an evaluation (usually a trading challenge), and gains access to a firm-funded trading account.

The trader doesn’t risk their own money but agrees to a profit-sharing agreement, often keeping 70–90% of the profits while the firm keeps the rest.

There’s no office, no team, and often no upfront capital—just the trader, their laptop, and a solid strategy. The firm provides the tools, capital, and risk rules. It’s a win-win: the trader gets leverage and a safety net, while the firm scales its returns without hiring full-time staff.

This model is ideal for disciplined, independent traders who are confident in their edge but lack large personal capital.

Remote Prop Firm (Funding Traders Worldwide)

This is the dominant model in the modern prop trading world, especially post-pandemic. In a remote prop firm, everything happens online. Traders from around the globe can apply, complete evaluations, and get funded without ever having to step into an office.

These firms usually offer:

- Structured evaluations with clear targets and drawdown limits

- Proprietary platforms or integrations with MetaTrader/cTrader

- Transparent dashboards and payout systems

- Global support and multilingual resources

Firms such as FTMO, MyFundedFX, and Topstep have popularised this model. They often operate on a subscription or refundable challenge fee basis, using advanced analytics to manage risk and reward.

The beauty of this model lies in its scalability—you can support thousands of traders with a lean back-office team, all while tapping into global talent.

On-Site Trading Floors

The classic model—think Wall Street in the ’90s or the early days of London’s City. On-site trading floors are physical offices where traders work side by side, often utilising the firm’s infrastructure, training, and direct market access.

These environments are intense, fast-paced, and highly collaborative. They allow for real-time mentorship, team-based strategy development, and instant feedback loops. The firm provides workstations, software, connectivity, and often, in-house analysts or coaches.

While less common today due to the shift toward remote models, on-site prop firms still exist, particularly in big financial hubs like New York, London, and Singapore. They’re ideal for traders who thrive in a competitive, team-driven atmosphere and prefer face-to-face communication.

That said, they require a significant upfront investment, including office space, hardware, staff, and regulatory overhead.

Franchise Model (Licensing a Trading Brand)

In this model, a prop trading firm expands its presence by licensing its brand and infrastructure to local operators. It’s similar to a fast-food franchise—but for trading.

Here’s how it typically works:

- The parent firm provides the trading platform, risk tech, funding structure, and brand

- The franchisee sets up a local office, recruits traders, and manages day-to-day operations

- Both parties share profits, with royalties or licensing fees involved

This model is attractive to experienced traders or entrepreneurs who want to run a prop firm without having to start from scratch. It allows the main brand to scale quickly across multiple geographies without micromanaging each location.

Franchises are common in regions where language, culture, or regulations make it difficult for a centralised firm to operate effectively. They combine the reach of a remote model with the localised support of an on-site operation.

Scaling the Prop Trading Business

Building a prop trading firm is a bold first step—but taking it to the next level requires vision, systems, and scale. Many traders want to become prop traders today, and the market for top-tier firms is growing rapidly. But growth without structure leads to chaos. That’s why scaling is about more than numbers—it’s about building something sustainable.

Let’s explore how successful proprietary trading firms expand smartly and sustainably.

Automating Onboarding and Risk Controls

If you’re manually reviewing every trader application, managing evaluations by hand, or enforcing rules one trade at a time, growth will bottleneck fast. That’s where automation becomes essential.

Modern prop trading firms invest early in systems that automate onboarding, from user verification and platform access to evaluation registration and trader dashboards.

A streamlined experience helps new applicants get started quickly, increasing your conversion rate and reaching more aspiring traders seeking prop trading jobs.

Just as critical is automation in risk management. Using smart prop trading software, you can monitor daily drawdowns, open positions, and violations in real time—without constant oversight. These systems enforce trading rules, protect firm capital, and create transparency for both you and the trader.

Expanding to Global Markets

Prop trading has gone global—and so should you. Today, someone in Indonesia, Brazil, or Nigeria can pass an evaluation, get funded, and become a prop trader in a matter of days. That kind of reach is only possible if your firm is built to support international users.

To scale globally, your infrastructure must be reliable, secure, and accessible across multiple time zones. Localisation matters, too—having a user interface and documentation that are easy to understand across cultures can make all the difference.

Global expansion isn’t just about numbers; it’s about inclusivity. Traders worldwide are eager for opportunities, and many of them possess highly specialised skills. The top prop trading firms recognise this and provide tools, support, and clear paths to success—regardless of where the trader resides.

Building Partnerships and Communities

No firm scales alone. The most successful proprietary trading firms understand the power of partnerships and community.

Strategic partnerships can open new doors—whether it’s with educational platforms that funnel talent your way, tech providers who enhance your platform, or influencers who amplify your brand. These relationships enhance your visibility and establish you as a credible player in a competitive landscape.

But just as important as partnerships is building a trader community. Hosting webinars, maintaining an active Discord or Telegram group, and celebrating trader milestones aren’t just “nice to have”—they turn your brand into a living, breathing ecosystem. Traders feel seen. They’re motivated. They stay longer.

When traders feel they’re part of something meaningful—not just completing prop trading challenges for payouts—they talk about your firm, recommend it to others, and contribute to its culture.

Future Trends in Prop Trading

The world of prop trading is evolving at a faster pace than ever. What was once the domain of elite, in-house traders glued to Bloomberg terminals is now being disrupted by algorithms, crypto, and decentralisation. As financial technology continues to accelerate, prop trading firms that want to thrive must remain agile and adapt to what’s next.

Let’s examine the key trends shaping the future of proprietary trading.

AI and Algorithmic Trading

Artificial intelligence is no longer science fiction—it’s trading fact. Increasingly, prop trading firms are utilising AI to analyse markets, predict price movements, and execute trades with remarkable precision. Machine learning models can process millions of data points in real time, identifying patterns that human eyes might miss.

This trend doesn’t just affect firms—it also changes the role of the prop trader. Instead of relying solely on instinct and chart patterns, traders are increasingly expected to work in tandem with algorithms, adjust parameters, and interpret data-driven signals. In some cases, traders even design their own models and train them on historical data.

This shift is making prop trading jobs more tech-heavy, more dynamic, and more rewarding for those willing to blend traditional market knowledge with modern programming and statistical skills.

As prop trading software continues to evolve, we can expect to see greater integration of AI-powered risk management, real-time anomaly detection, and even AI-driven trader evaluation systems.

Integration of DeFi and Crypto Assets

Crypto trading is no longer a niche—it’s a core part of the global financial system. And proprietary trading firms are taking note. Many have already added digital assets, such as Bitcoin, Ethereum, and Solana, to their portfolios. But the next big frontier? Decentralised Finance (DeFi).

DeFi opens new opportunities for yield generation, arbitrage, and liquidity provision—all of which are highly relevant to prop traders. From trading perpetuals on decentralised exchanges (DEXs) to providing liquidity in DeFi protocols, the line between crypto enthusiasts and prop traders is blurring rapidly.

This trend has also led to new prop trading challenges, such as handling wallet security, managing on-chain risk, and dealing with high volatility. But for firms that get it right, the rewards are immense—access to 24/7 markets, high liquidity, and a rapidly growing pool of globally connected traders.

As more prop trading firms enter the crypto and DeFi space, we can expect to see hybrid evaluation models that blend traditional trading performance with on-chain analytics and smart contract interaction metrics.

The Rise of Decentralised Prop Firm Models

Here’s where things get really interesting. The concept of a decentralised prop trading firm—where operations, funding, and even decision-making are managed by a distributed community—is gaining momentum.

Imagine a DAO (decentralised autonomous organisation) that:

- Pools capital from token holders

- Evaluates and funds traders based on transparent smart contracts

- Uses blockchain to manage payouts, performance stats, and governance

It’s early days, but experiments in this space are already happening. These decentralised models aim to remove intermediaries, create global access to funding, and offer a level of transparency that traditional firms can’t match.

Of course, challenges remain: regulation is still murky, scalability is a work in progress, and the tech isn’t perfect. But the idea of a trader working for a token-governed, community-owned prop firm isn’t as far-fetched as it once sounded.

For traders looking for autonomy, transparency, and global access, these models may soon offer a compelling alternative to centralised firms.

Conclusion

Starting a prop trading firm in 2025 isn’t just about building a team or selecting a platform—it’s about crafting a long-term vision supported by intelligent infrastructure, robust risk frameworks, and a culture that empowers traders.

As markets continue to evolve, the firms that succeed will be those that blend discipline with innovation—combining traditional strategy with cutting-edge technology. Whether you’re launching your own firm or dreaming of one day joining the ranks of the top prop trading firms, now is the time to make your move.

FAQ:

Do I need a license to start a prop trading firm?

Not always. It depends on your jurisdiction and whether you manage external funds or just firm capital. Legal advice is essential.

How much capital is required to launch a prop firm?

Most firms start with $ 100,000–$ 500,000, though some bootstrap with less or raise investor backing to scale faster.

Can I run a fully remote prop trading business?

Yes. Many successful firms operate entirely online, using automated tech and global talent pools.

What’s the difference between a trader challenge and an evaluation program?

They’re similar—both assess a trader’s skill before funding—but some firms use one-step challenges while others include multi-phase evaluations.