Top 10 Crypto Payment Processors: Features, Trends, and How to Choose The Best One

Thinking about accepting crypto? This idea has rapidly moved from a fringe experiment to a core business strategy. For companies of all sizes, from local coffee shops to global SaaS platforms, accepting digital currencies is now a practical way to tap into a new generation of customers and simplify the nightmare of cross-border sales.

However, the market is flooded with hundreds of crypto payment processor options, all promising to be the fastest, cheapest, and most secure. For a business owner, the choice can be paralyzing. How do you separate the genuine partners from the hype?

We’ll look at the top 10 players for 2025 and give you a simple framework for making the right choice.

Key Takeaways

- Crypto payments are becoming more common in e-commerce, SaaS, and retail, as they offer faster transactions without borders.

- The “best” gateway for you comes down to practical things: your business type, where you operate, and whether you want to hold crypto or cash out to fiat.

- Look for a partner that balances good features, solid security, and clear pricing.

What Is a Crypto Payment Processor?

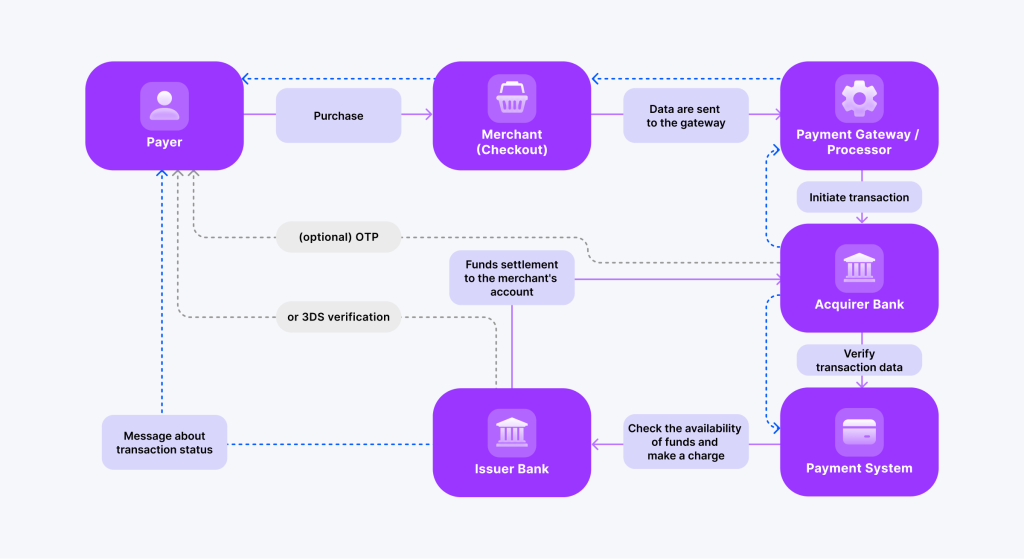

At its simplest, a crypto payment processor is a service that allows your business to accept digital currencies as payment. Essentially, it is the crypto equivalent of a standard credit card processor. The key difference is that instead of handling fiat currencies like USD or EUR, it processes transactions on blockchain networks.

A good processor handles all the intimidating technical steps behind the scenes. When a customer chooses to pay with crypto, the processor:

- Generates a unique invoice: It creates a specific payment request with a unique wallet address and a QR code.

- Locks in an exchange rate: To protect against volatility, it holds the exchange rate (e.g., BTC to USD) for a short window, usually 10-15 minutes, giving the customer time to pay.

- Monitors the blockchain: It watches the relevant blockchain network for incoming transactions to confirm it has been sent and validated.

- Manages the funds: Once the payment is confirmed, it credits your account according to your preferences.

Some processors offer more advanced features. This can include physical point-of-sale (POS) terminals for retail stores, ready-made plugins for e-commerce platforms like Shopify or WooCommerce, or white-label APIs that allow for full customization.

Security and compliance are also core to how these processors operate. A reputable crypto payment processor will use strong encryption, follow strict AML and KYC guidelines, and support secure wallet integrations. This protects both the merchant and their customers.

Fast Fact

The volume of crypto transactions flowing through payment processors is expected to surpass $2 trillion globally in 2025. This figure is double the volume recorded just two years prior.

Best Crypto Payment Processors in 2025

As cryptocurrency adoption grows in 2025, more businesses need scalable and reliable processors to handle their crypto transactions. Here we will review ten of the most innovative and dependable crypto payment processors available this year.

Below is an in-depth review of the top ten innovative and reliable crypto payment processors this year:

B2BINPAY

B2BINPAY is an institutional-grade powerhouse. Its biggest selling point is its comprehensive approach to regulation and security, offering robust AML/KYC procedures.

With support for over 350 cryptocurrencies across multiple blockchains (Ethereum, Tron, Solana, etc.), you’re unlikely to ever have a customer who wants to pay with a coin you can’t accept. They offer both crypto and fiat settlements, detailed reporting for accounting, and 24/7 technical support.

Easy to integrate and simple to use, B2BINPAY offers powerful APIs, detailed analytics, and a clean interface that works for all types of businesses—from e-commerce to forex and gaming. If your business operates at scale and you need a partner that can satisfy regulators and auditors, B2BINPAY is a top-tier, battle-tested choice.

Coinbase Commerce

Backed by one of the most trusted brands in crypto, Coinbase Commerce is a purely non-custodial solution. This is its defining feature: payments go directly to your own wallet. It supports a curated list of the most popular cryptocurrencies and integrates easily with major e-commerce platforms.

The appeal of the platform is ideological and practical control. If the phrase “not your keys, not your coins” resonates with you, and you’re comfortable managing your own security, this platform gives you true financial sovereignty.

CoinsPaid

CoinsPaid excels with a full-fledged enterprise solution beyond simple processing. It accepts more than 20 cryptocurrencies and multiple fiat currencies, and it has instant conversion as well as complete regulatory compliance.

Its appeal to sectors such as iGaming and fintech is well underpinned, thanks to its deep European presence and powerful reporting capabilities. CoinsPaid offers scale, speed, and security to high-volume merchants.

NOWPayments

NOWPayments is a non-custodial platform that supports an enormous list of over 250 cryptocurrencies. What makes it stand out for smaller users is its simple tools: ready-made donation buttons, easy-to-integrate e-commerce plugins, and even POS solutions. You retain control of your funds without needing to be a technical genius.

If you want to start accepting crypto payments this afternoon with minimal fuss, NOWPayments is one of the fastest and most accessible ways to do it.

CoinGate

CoinGate is a fantastic all-rounder. It supports over 70 cryptos and offers a wide range of integration options, from simple plugins to API access. Its key strength is flexibility. You can accept a payment, and then choose to withdraw it as fiat to your bank, or even spend it on gift cards. It was also an early adopter of the Bitcoin Lightning Network for faster, cheaper BTC payments.

If you want a single platform that can adapt to different business models (B2B, B2C) and changing market conditions, CoinGate’s versatility is hard to beat.

Binance Pay

Developed by the world’s largest crypto exchange, Binance Pay‘s killer feature is fee-free, instant transactions between Binance users. It supports over 80 assets and is seamlessly integrated into the Binance app. For a merchant, this provides access to a huge, built-in global audience.

If a large portion of your customer base already uses Binance, this is an incredibly efficient and cost-effective solution. It leverages a closed-loop system for unparalleled speed.

Alchemy Pay

Alchemy Pay‘s mission is to create a single gateway for both crypto and local fiat payments. It has aggressively built partnerships across the globe to integrate local payment methods (like e-wallets in Asia) alongside cryptocurrencies in one unified checkout experience. They provide SDKs and white-label solutions for deep customization.

If your business serves a global audience and you want to offer customers the choice to pay with BTC or their local bank app, Alchemy Pay is one of the few platforms solving this complex problem.

TripleA

Headquartered and licensed in Singapore, a global financial hub, TripleA is built from the ground up around regulation. It is a fully licensed crypto payment provider. While its list of supported currencies is more focused (BTC, ETH, USDT), its adherence to strict AML/KYC controls and PCI-DSS security standards is its main draw.

For businesses where legal and regulatory peace of mind is the number one priority, TripleA offers an exceptionally safe and compliant choice.

GoCrypto

In areas like Central Europe and Latin America, GoCrypto has been gaining popularity, providing merchants with both cryptocurrency and fiat payment solutions. It includes physical POS terminals, mobile integrations, and good relationships with local wallets and banks.

This processor is superior in the physical retail environment, offering multilingual functionality and strong infrastructure to merchants operating on the ground in emerging economies.

PayPal Crypto Checkout

Leveraging its massive global network, PayPal now enables users to pay with crypto at checkout in supported regions.

While the platform instantly converts crypto to fiat behind the scenes, it enables businesses to accept BTC, ETH, BCH, and LTC without needing to deal with blockchain infrastructure.

While more centralised than others, PayPal offers massive brand trust and accessibility, key for mainstream adoption.

Key Features to Look For in Crypto Payment Processors

As either a boutique online shop or an international SaaS company, the processor you select can influence how your customers pay in crypto, how you comply, and how fluid your crypto payment processing experience is going to be.

Multi-Currency and Token Support

Don’t just check for Bitcoin and Ethereum. The world of crypto payments is increasingly dominated by stablecoins like USDT and USDC for their price stability. Support for these is crucial. A deep list of altcoins is a bonus that can capture niche customer segments. The more payment options you offer, the lower your cart abandonment rate will be.

Settlement Flexibility (Crypto vs. Fiat)

Do you want to receive payments and have them instantly converted to your local currency to eliminate volatility and simplify accounting? Or do you believe in the long-term value of crypto and want to hold it on your balance sheet? The best providers offer you the choice, and some even let you split settlements (e.g., 50% to your bank, 50% to your crypto wallet).

Integration and Onboarding

How easy is it to get this thing working? Is there a simple, one-click plugin for your Shopify or WooCommerce store? Or will you need to hire a developer to work with their API for a week? Analyze the technical documentation and look for reviews on the ease of setup. A smooth onboarding process saves you time and money.

Non-Custodial or Custodial Options

Do you want your cryptocurrency to be entirely in your control, or do you wish to have a third party handle the security and exchange? There are custodial and non-custodial crypto payment solutions available.

Non-custodial gateways transfer money directly into your wallet, providing more control and anonymity. Custodial sites are more convenient for individuals who prefer not to manage their own wallets and private keys.

Fees: The Full Picture

Don’t be fooled by “zero processing fees” headlines. Fees can be complex. You need to ask about the total cost, which can include: a transaction fee (a percentage of the sale), a network fee (the cost to use the blockchain), a settlement fee (to convert to fiat or withdraw), and potentially setup or monthly fees. Calculate the “all-in” rate for a typical transaction to make a true comparison.

Security & Compliance

This is an area where you cannot compromise. Look for bank-grade security features like mandatory two-factor authentication (2FA), data encryption, and whitelisting for withdrawal addresses. On the compliance side, ensure the processor is registered and licensed to operate in your jurisdiction and follows strict AML/KYC regulations. Seek adherence to PCI-DSS standards and prioritize wallet protection.

Real-Time Reporting and Analytics

Like in conventional payment systems, your cryptocurrency payments solution must be able to provide comprehensive dashboards, history of transactions, and reports. These are necessary for accounting, auditing, and strategic planning purposes. Some high-end processors even provide tax-ready reports to simplify year-end submissions.

Customer Support and Dispute Resolution

When a customer’s payment is stuck or you have a settlement issue, you need to talk to a knowledgeable human, fast. Check their support options. Do they offer 24/7 live chat, or is it just email support with a 48-hour response time? Good support is a lifeline when you need it.

How to Choose the Right Processor for Your Business?

Choosing the best crypto payment processor doesn’t mean signing with the trendiest brand out there—it means selecting one that aligns with the individual requirements of your company.

From your business model to how you prefer to be paid, the correct crypto payment gateway needs to facilitate your expansion without introducing complexity.

Here’s what to focus on.

Business Size and Type: Match Features to Your Model

Each business category deals with crypto differently. Online businesses require processors that integrate seamlessly with Shopify or WooCommerce, offering customers a frictionless checkout experience. Your customers can then pay with crypto simply, without friction or disorientation.

If you have a physical location, you’ll need to have a processor with either point-of-sale functionality, mobile apps, or QR-based solutions in order to allow simple, real-time transactions between your customers and staff while on the go. SaaS companies have distinct requirements.

Recurring billings, invoicing, and easy-to-work-with APIs are important. The back end needs to be flexible enough to accommodate automated payments and sophisticated customer lifecycles within this business model.

Regional Availability and Licensing: Stay Compliant and Safe

Before going into crypto transactions, double-check whether your processor is legally approved to do business in your area. Regulations regarding crypto differ significantly, and it is indispensable to use one that is registered or licensed within your jurisdiction.

It is particularly necessary when your business deals with customer money, is based in the EU or Asia, or is looking to expand worldwide.

Having a regulated crypto payments gateway not only offers legal security, but it also increases the confidence of customers and provides greater banking and financial service provider collaboration as well.

Settlement Preferences: Crypto, Fiat, or a Hybrid?

How you want to receive your money plays a big role in processor selection. Some businesses prefer to hold crypto for long-term value or for spending within the Web3 ecosystem. Others want immediate fiat conversion to avoid volatility and make cash flow easier to manage.

Crypto-native companies often opt for direct wallet settlements, while more traditional firms lean toward instant conversion and bank deposits. The best crypto payment processing platforms offer both options, allowing you to choose what best fits your financial strategy.

Volume and Fee Sensitivity: Balance Cost and Scalability

Processing fees can greatly affect your margins, particularly as volumes increase. If your company makes frequent, low-ticket payments, such as in gaming or digital content, even small differences in fees can be meaningful. Larger businesses, by contrast, might need tailored rate plans, high-volume capacity, and customised support.

It’s also worth considering how network fees are handled—some processors batch transactions or support Layer 2 solutions to reduce blockchain gas costs. Always evaluate the total cost, not just the headline rate.

Conclusion

Crypto payments aren’t just reshaping how we transact—they’re transforming how businesses grow and operate. From stablecoin settlements and embedded finance to AI-powered fraud detection and Layer 2 integrations, today’s crypto payment processors are smarter, faster, and more adaptable than ever.

Whether you’re a global SaaS firm or a local retailer, selecting the right partner will empower you to future-proof your finances, expand into new markets, and deliver an exceptional payment experience. The future of finance isn’t coming—it’s already here. And it’s crypto-powered.

FAQ

Can small businesses accept crypto payments?

Yes! Many processors, such as NOWPayments and CoinGate, are designed specifically for startups and small merchants.

Do I need a wallet to use a crypto payment gateway?

Not necessarily. Some gateways handle custody and convert crypto to fiat automatically, while others let you control your own wallet.

Are crypto payments taxed?

In most countries, yes. Crypto payments are treated as taxable income, and proper reporting is essential for compliance.

How fast are crypto transactions with these processors?

Most are near-instant, especially when using stablecoins or Layer 2 solutions like the Lightning Network or Arbitrum.