Crypto Points Farming: New Trend in Crypto Rewards

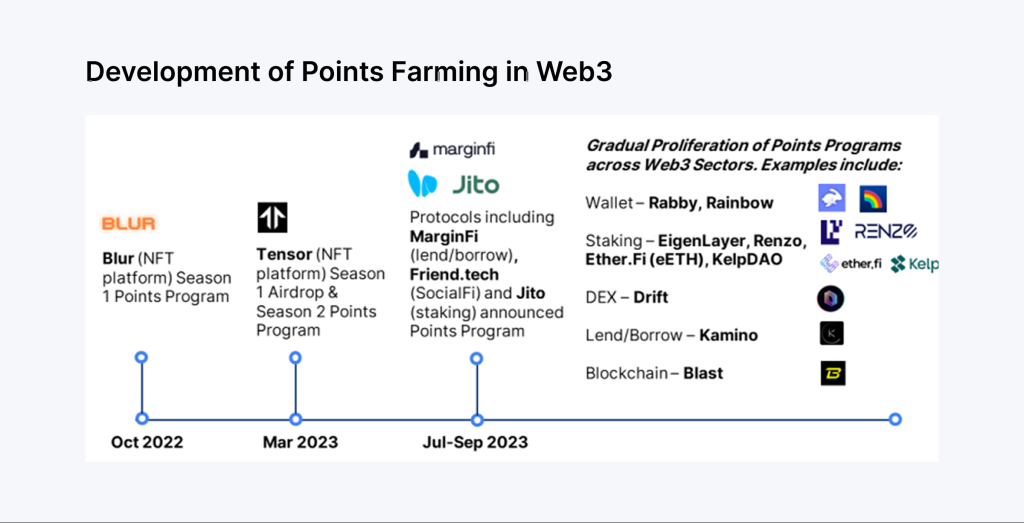

In the fast-evolving world of DeFi, innovation never sleeps—and neither do savvy users looking for new opportunities. Enter crypto points farming, the fresh face of Web3 reward systems that are taking over traditional yield farming strategies.

Instead of earning tokens upfront, users now rack up non-transferable points—potentially unlocking airdrops, early access, and a slice of future token launches. Its loyalty meets speculation in the world of DeFi, and it’s quickly becoming the new gold rush for early adopters.

Key Takeaways

- Projects now reward user activity with non-tradable points rather than immediate crypto tokens.

- Many DeFi protocols use points farming to build engagement before launching a native token.

- Points systems help boost loyalty through consistent participation, not just capital.

What Is Crypto Points Farming?

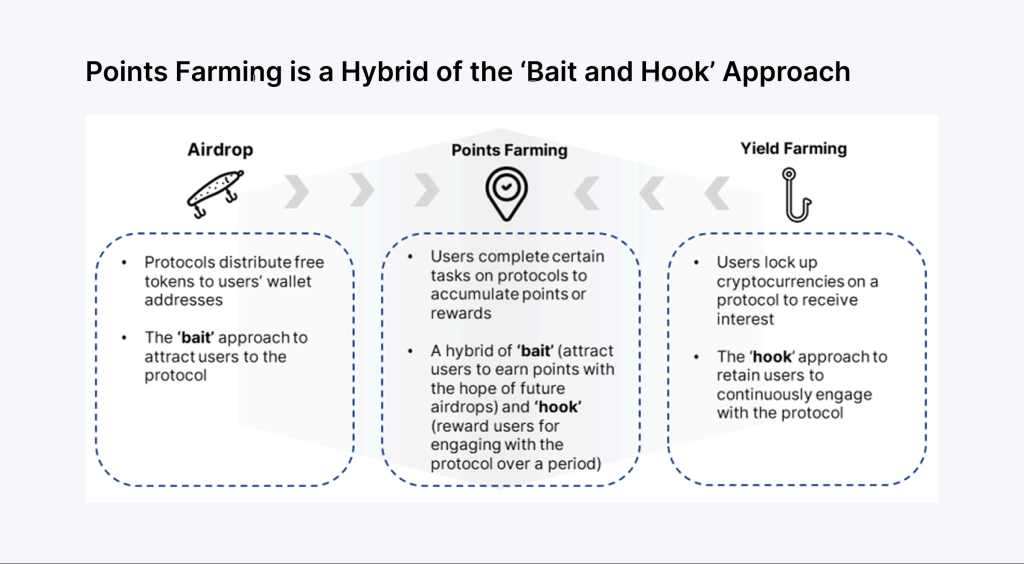

Points farming is a new development in the DeFi farming market that doesn’t reward traditional tokens but, instead, points. The points are a part of Web3 reward programs designed to reward user activity, loyalty, and engagement throughout a protocol or a crypto ecosystem.

Unlike regular crypto farming, which involves staking or lending tokens for yield-bearing tokens, points farming focuses on non-transferable points that can be redeemed for crypto rewards, such as airdrops or early access to token sales.

At its most basic, crypto points farming is a decentralized finance-specific variation on loyalty campaigns, i.e., frequent flyer programs. Such tokens are used to reward users for providing liquidity, chain-bridging, or acting regularly in the protocol.

It is an alternative way for active community participants to be compensated even before tokens are in existence, and therefore, they are very popular for early-stage DeFi applications that lack their own coin.

In this paradigm, contributors meaningfully contributing to a protocol—in asset holding, staking, or special tasks—are rewarded points after some time. The points are often non-transferable and can’t be traded on exchanges, but they oftentimes serve as a proxy for value.

For example, most Web3 reward programs reward the largest point holders after the fact with governance tokens or special access to new functionality.

As such, crypto points farming is becoming a successful strategy for skilled DeFi users to position themselves for future crypto rewards in exchange for facilitating early-stage project growth.

Fast Fact

Some LayerZero users reportedly earned tens of thousands of dollars worth of tokens through points farming—before a token ever existed.

How It Works — The Mechanism Behind Points Farming

Points farming in the crypto space is an innovation on the traditional yield farming paradigm, which is revolutionizing how participants interact in decentralized finance protocols.

Instead of being awarded actual tokens or yields in the form of monetary value, participants are awarded points based on their user engagement, interactions, as well as loyalty on multiple platforms.

The point mechanisms are parts of a broader program for tracking and rewarding active participation in the crypto economy.

Liquidity Provision

Among the most significant methods for attaining points is acting as liquidity providers in liquidity pools. Similar to classic yield farming, participants deposit assets in pools on an automated market maker exchange and help facilitate trading.

As a reward, they stand to gain points concerning the liquidity provided, volume traded, or total value locked (TVL). Points most often reflect a user’s long-term participation and not short-term high-stakes plays. Thus, the reward is consistent with sustainable growth, not short-term profits.

Bridging Assets

Points farming further encourages participants to interact with third-party sites or cross-chain bridges through the movement of assets across different blockchains.

Projects typically reward participants with points for moving assets into their systems, stimulating an inflow of aggregate value and liquidity on new networks.

The strategy not only expands the coverage for the platform but also strengthens user loyalty as a core component in reward frameworks, possibly awarding potential value through future token distribution or governance tokens.

Participating in Governance or Staking

Protocols also let users farm points by staking their local tokens or voting on governance proposals. Unlike old-school yield farming strategies that strongly relied on high percentage yields on an annual basis, crypto points mechanisms value frequent participation in community building

Users participating in governance on an active basis help determine the future of the protocol and receive points that can potentially be exchanged for passive income or early access to tokens in the future.

Holding NFTs or Unique Wallets

Points programs reward members for owning some NFTs or for making transactions on verified wallet types. The strategies are geared towards promoting user engagement and brand awareness on most applications.

Points accrued through such can be linked to wallet age, NFT rarity, or engagement history––triggering loyalty drives and extending the project’s coverage throughout the crypto arena.

Rewarding Regular User Engagement

As opposed to traditional yield farming, which is often skewed in favor of larger capital, crypto points farming is all about consistent engagement and time-based participation.

Through activities like daily login, use of dApps, or referral of peers, the protocols allow both users, small and large holders, to earn rewards in the long term.

This allows for a broader pool of contributors, reduces transaction fees and market volatility’s impact, and fosters long-term passive rewards while minimizing risk.

Why Is It Trending Now?

The rise of crypto points farming is no accident—it’s the result of several converging trends across the DeFi landscape. As protocols shift their user acquisition and retention strategies, points systems have become the go-to method for fueling activity, growing communities, and preparing for future token launches.

Here’s why this new Web3 rewards model is gaining traction right now:

Airdrop Anticipation: The Core Incentive

One of the biggest drivers behind the popularity of points farming is the growing expectation of airdrops. Users are highly motivated to participate in protocols that track engagement through rewards, especially when there’s a strong belief that those points will eventually convert into actual tokens or governance tokens.

This anticipation creates a “farm now, profit later” mentality—users earn points without immediate monetary gain, hoping for future token distribution with substantial future value.

Projects like LayerZero, zkSync, and EigenLayer have fueled this trend by dropping hints—or outright confirming—that point holders may receive tokens down the line.

In this way, crypto points farming has become a speculative strategy and a form of yield farming based not on annual percentage rate, but on long-term payoff potential.

Tokenless Launches Are Becoming the Norm

Given the current crypto climate, a too-early token launch can be premature. The uncertainty surrounding regulations, sentiment, and speculative demand for trading prompted many new protocols to delay token launches in favour of building active user bases using points programs.

Such tokenless launches allow projects to test their products, retain users, gather feedback, and expand activity without directly experiencing price volatility or listing theatrics.

Points act in place of future tokens so that teams can reward use without inciting compliance issues or near-term liquidity for the end user, which equates to a chance to engage early—with the potential for big payoffs later on.

DeFi Recovery and Fierce Competition Among Protocols

Coming out of an extended bear market, the DeFi market is experiencing a gradual turnaround, and with it, a new rush of protocols all fighting for liquidity and members.

Cryptopoints are proving to be a useful tool in the attention war, giving projects a way to incentivize active participation without inflating their native coin supplies.

Under this new configuration, yield farming on its own can no longer attract attention. Today’s users require tiered benefits—are rewards accrued through liquidity pools, long-term farm points, and priming for airdrops or governance slots.

The tiered model is facilitating an arms race among DeFi platforms to deliver new and intriguing reward structures.

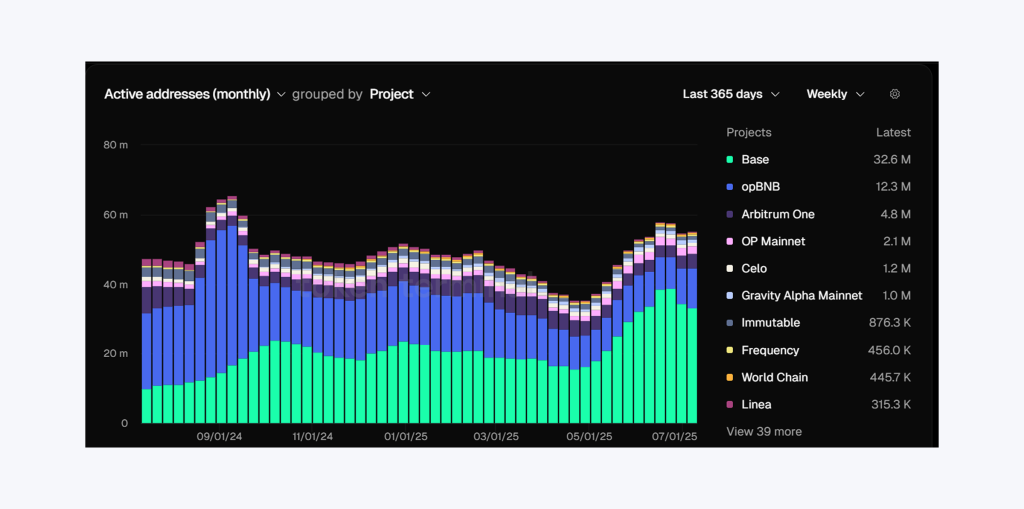

Layer 2 Networks and Modular Blockchains Unlock New Incentives

More applications for Layer 2 products like Arbitrum, Optimism, and Base, as well as modular blockchains like Celestia and Fuel, are opening new, scalable avenues for crypto rewards.

They reduce trading fees and enable many users to engage in micro-financing activities (such as everyday farming or staking) to explore sustainable and cost-effective opportunities.

By raising the cost threshold, such networks support richer loyalty campaigns in DeFi and point accumulation mechanics. Subsequently, protocols can reward not only wallet login but also cross-chain transfers, facilitating more subtle and inclusive ways for end-users to earn passive income and increase end-user loyalty across ecosystems.

Points vs. Tokens: Key Differences

As crypto points farming grows in popularity, it’s important to understand the fundamental differences between points and tokens. While both are used as reward mechanisms in the DeFi space, they serve very different purposes in terms of design, utility, and legal implications.

Let’s explore the key distinctions:

Fungibility

Tokens are generally fungible, meaning each unit is interchangeable with another. For example, one ETH or one USDC is always equal in value to another of the same kind. This makes tokens easy to use in trading, DeFi protocols, or payment systems.

In contrast, points in crypto points farming systems are usually non-fungible or semi-fungible. While users may receive points for similar actions (e.g., providing liquidity or staking), these points are often tied to specific accounts, non-transferable, and may not have a uniform value.

They’re intended to track individual user engagement, behavior, or loyalty—not function as currency.

Market Tradability

Tokens are designed to be traded. They are listed on decentralized and centralized exchanges, enabling price discovery, speculation, and liquidity. Their value fluctuates based on market volatility, supply and demand, and overall network utility.

Points, however, are not typically tradable. They exist within closed systems or reward programs managed by individual protocols. Users accumulate points through active participation but cannot sell, transfer, or exchange them on the open market.

This makes points accumulation more of a strategic investment in future value rather than immediate financial gain.

Transparency and Value Speculation

With tokens, value is usually transparent—market charts, tokenomics, and circulating supply data are publicly available. Users can analyze a token’s performance, compare it to similar assets, and make informed decisions based on real-time data.

Points lack that level of transparency. The algorithms behind reward point systems are often proprietary or vaguely defined. Users may not know how many total points exist, how they rank among others, or how points will convert into actual tokens, if at all.

This introduces speculation, but without the ability to verify or hedge against outcomes. Users trust that their points’ accumulation will pay off, but there’s no certainty or liquid market to test that belief.

Regulatory Implications

The most critical difference lies in regulatory treatment. Tokens—especially those with monetary value or governance utility—often fall under securities laws in many jurisdictions. Issuing them prematurely can lead to legal consequences, especially if they are sold or promoted as investments.

Points, by design, offer a more compliant alternative during the early stages of a project. Since they are not directly redeemable for cash and lack inherent monetary value, they are less likely to trigger regulatory scrutiny.

This is one reason why tokenless launches have become common: protocols use crypto points to build and reward communities first, then introduce tokens later once legal clarity is established.

Why Platforms Use Point Farming

Point farming has become a go-to strategy for many Web3 and DeFi projects. Rather than relying solely on tokens to drive participation, platforms are increasingly adopting point systems to reward users, build momentum, and create sustainable ecosystems.

Here’s a breakdown of why this model is proving so effective:

Bootstrapping Early-Stage Growth Without Tokens

It is potentially risky to launch a token too soon, particularly for new initiatives that yet lack product-market fit or regulatory understanding. Point farming gives platforms a means to reward user activity and develop traction prior to the existence of a token.

This tactic facilitates bootstrapping liquidity, boosts trading volume on a daily basis, and improves community feedback while establishing and iterating on the product as the team progresses.

By crypto points farming, we are referring to exchanges rewarding their members with non-transferable points for engaging in activities such as providing liquidity, staking, or using the protocol.

The points can be redeemed for crypto rewards like airdrops, early access, or special features—a good reason for joining early.

Driving Long-Term User Engagement and Loyalty

One of the most significant advantages of point farming is that it can foster consistent user engagement rather than quick, capital-based farming activity.

As opposed to normal yield farming, which others typically perform for APR maximized and leaving tokens behind later, point systems reward long-term active participation.

By tracking and rewarding, such as daily use, referrals, voting for governance, and liquidity, platforms forge increased user loyalty. Such promotes a loyal user base and induces healthier network effects that translate to sustainable growth.

Flexible and Gamified Incentive Design

Platforms can design point programs to align with their specific goals—whether it’s onboarding new users, deepening usage, or attracting liquidity.

Points can be awarded in dynamic, gamified ways: leaderboards, badges, NFT-based bonuses, and time-based multipliers are just a few examples. This flexibility allows platforms to create personalized and engaging experiences that go beyond generic token rewards.

Gamification not only keeps users interested but also adds an emotional element to point accumulation. When users feel like they’re progressing or earning status, they’re more likely to stay involved—even without immediate financial payoff.

Reduced Regulatory Risk

Tokens—especially those with financial utility—can easily trigger regulatory scrutiny. By contrast, points are usually not classified as securities, since they aren’t tradeable or redeemable for cash.

This gives platforms more freedom to experiment with incentives while avoiding legal complications.

For teams operating in uncertain jurisdictions or without formal token plans, crypto points farming is a safer, legally conservative way to distribute rewards, build communities, and maintain momentum ahead of future token distribution.

Building a Qualified Airdrop Audience

Platforms that eventually launch a token want those tokens to land in the hands of their most loyal, engaged users—not just speculators. Point farming helps identify and filter those participants.

By analyzing points accumulation across a wide range of actions, teams can build a high-quality airdrop list made up of real contributors—not bots or short-term mercenaries.

This ensures that when tokens do launch, they’re distributed fairly and efficiently, strengthening the community and giving the project a better chance at long-term success.

Conclusion

Crypto points farming is more than just a trend—it’s a smarter, community-driven approach to bootstrapping Web3 ecosystems. Rewarding consistent user engagement over quick gains creates fairer opportunities for users and more sustainable growth for protocols.

Whether you’re staking digital assets, bridging tokens, or simply logging in daily, your loyalty could pay off in future rewards. The future of crypto points lies in its ability to bridge user engagement with decentralised finance more consistently and in the long term.

FAQ

Can I sell my crypto points on an exchange?

No. Points are typically non-tradable and tied to your activity within the platform.

Will I definitely get an airdrop from farming points?

It’s not guaranteed—but many platforms reward top point holders with tokens or perks later.

How is this different from yield farming?

Yield farming rewards you with tokens directly. Points farming rewards user behavior with future incentives.

Is points farming safe?

It carries fewer regulatory risks than token farming, but still involves smart contract and project risks. Always DYOR.