ABCs of USDT Stablecoin: What’s Its Role In The Crypto Market?

With nearly 5 million distinct users and counting, Tether’s USDT stablecoin is commanding an increasing presence in the crypto industry. As a haven in the otherwise unsteady crypto market, USDT is rapidly gaining widespread acceptance and use.

But what exactly is USDT, and what role does it play in shaping the future of the global crypto industry?

Key Takeaways

- USDT, or Tether, is a stablecoin pegged to a fiat currency, such as the US dollar, providing stability to the crypto market.

- USDT boasts a substantial market presence, with a market cap and circulation of approximately $83 billion.

- USDT finds extensive use in international transactions, trading, liquidity provision, and dApp development.

- Regulatory developments pose potential challenges for USDT. If labelled an “unregistered security” or subjected to increased scrutiny, it could impact its position in the market and have broader implications for the industry.

Fundamentals of Tether – USDT Stablecoin

Simply put, a stablecoin is a type of cryptocurrency less subject to price swings than others, including Bitcoin and Ethereum. The value of a stablecoin is stabilized by being pegged to a predetermined reserve of assets, often a fiat currency like the US dollar or Euro or a basket of products.

Despite the volatility of the cryptocurrency markets, this process ensures that each coin will always be worth the same and may be used as a means of trade.

One well-known stablecoin is USDT. Since 2014, Tether has maintained a 1:1 peg between USDT and the US dollar. This means that for every USDT that enters circulation, $1 is kept in reserve. By being pegged to the US dollar, USDT can avoid the wild price swings plaguing conventional cryptocurrencies.

In addition, USDT can be traded for over four thousand different currencies on centralized exchanges and possibly even more on DEXs, some of which may not always accept traditional dollars.

Because of its extensive exchangeability, investors dealing in cryptocurrencies will almost certainly come into contact with USDT at some time.

How is USDT Backed?

As a stablecoin, USDT maintains its value by being backed 100% by US dollars. Tether Ltd., the corporation behind the stablecoin, has US dollars in reserve equal to the value of each Tether token created. The fact that this reserve may be exchanged at any moment for US dollars guarantees that USDT will always be worth the same.

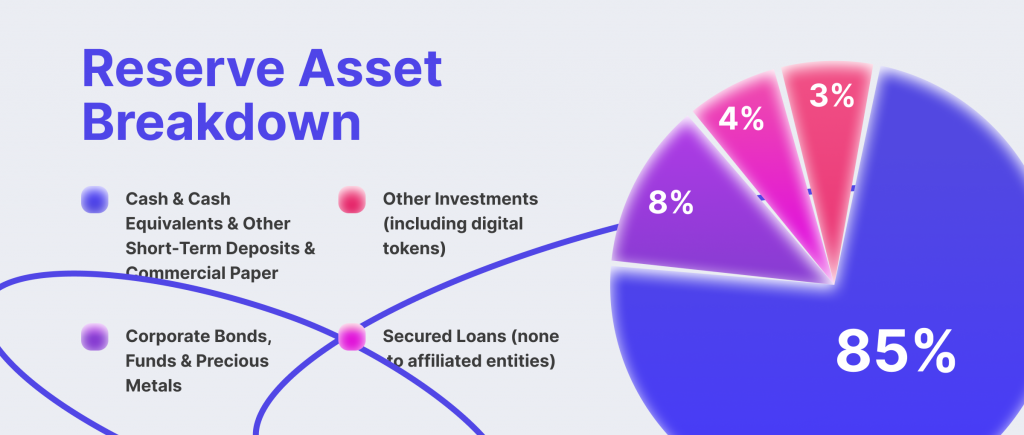

The USDT backing, however, is more complex than it first appears. The reserves consist of various assets, including cash and other cash equivalents and short-term securities. Tether’s underlying diverse portfolio is subject to regular audits to guarantee compliance and transparency.

This support is crucial because it assures Tether’s consumers that their token’s value will be unaffected by fluctuations in the larger cryptocurrency market. Without this guarantee, USDT would be far less helpful as a means of trade in the cryptocurrency industry. This support is built into Tether’s architecture and is essential to keeping it as a leading stablecoin.

A Brief History Of USDT

USDT may be traced back to a whitepaper from 2012 that advocated a stablecoin dubbed “Realcoin.” In 2014, software engineer Craig Sellars, businessman Reeve Collins, and investor Brock Pierce established Tether Ltd., rebranding “Realcoin” as “Tether.”

The basic motivation was to combine the adaptability and decentralization of cryptocurrencies with the reliability of traditional currencies through a digital token pegged to the value of a fiat currency.

Tether Ltd. launched its USDT tokens in 2015 with the help of the Omni Layer Protocol and Bitcoin’s network. Not long after that, one of the most prominent cryptocurrency exchanges, Bitfinex, began actively trading Tether.

In 2017, Tether was able to integrate with some other blockchains, including Ethereum, allowing it to make use of Ethereum’s ERC-20 standard for faster, cheaper transactions. Tether has grown to support many blockchains, including Tron and EOS, to meet the demands of a wide range of customers.

Tether has faced several problems, most prominently about its reserve backing and level of openness. Nonetheless, USDT has expanded to become a vital part of the global crypto ecosystem and still dominates the stablecoin market share.

USDT Use Cases: Why Is It So Popular?

USDT has become an influential force in crypto, providing real-world utility to its users. Its use cases include:

Cross-Border Transfers

In the modern banking system, international payments can be expensive and complex, often involving multiple intermediaries, wire fees, and currency conversion costs. Even small payments can attract significant fees and take days to complete. Tether (USDT) disrupts this process by offering an efficient, cost-effective solution.

Using USDT, users can eliminate currency conversion fees, minimize settlement times, and substantially reduce transaction costs.

Importantly, USDT transactions are final – once tokens have been received, the transfer cannot be reversed, nor can a financial institution restrict immediate access to the funds.

Consequently, USDT is a practical solution for businesses and individuals operating across borders, evidenced by its significant growth as an international payment medium.

Remittances

For people working overseas and seeking to send money home to their families, remittances are an essential service. Traditional remittance channels, however, charge excessive fees, significantly reducing the amount of money that eventually reaches the recipient.

USDT offers an alternative path. It eliminates the need to engage with a third-party business or to incur unnecessary fees, requiring only a transparent transaction fee.

Moreover, USDT eradicates the need to convert between two currencies and allows users to hold the tokens even without a bank account – a significant advantage for those without access to traditional banking facilities.

Banking the Unbanked

Billions of people worldwide lack access to banking infrastructure, leaving them vulnerable to inflation, physical security threats related to cash storage, and corrupt financial service providers. USDT presents an innovative solution to these issues.

For individuals living under the high inflation, USDT offers a stable currency accessible via an internet connection, in which they can save their funds securely. In areas where physical cash dominates, USDT allows value to be stored digitally, eliminating the risks associated with cash storage.

Furthermore, by removing reliance on central intermediaries, USDT ensures users are not susceptible to unscrupulous financial service providers.

Trading and Liquidity Provision

One of the significant use cases of USDT that deserves explicit mention is its role in crypto trading. It is an essential tool in the world of digital asset exchanges. Due to its stability, USDT is frequently used as a trading pair with other cryptocurrencies.

Traders often convert their assets to USDT to avoid market volatility, effectively providing a digital “safe haven.” This property allows them to stay within the cryptocurrency ecosystem without converting back to fiat currencies.

Additionally, USDT is crucial for maintaining liquidity in crypto exchanges, enabling traders to buy or sell large quantities of digital assets without causing significant price changes.

Store of Value and Hedge Against Volatility

Another important use case for USDT is its function as a store of value and a hedge against market volatility. Cryptocurrencies are notoriously volatile, with prices that fluctuate wildly in short periods. For investors looking to protect their assets from such volatility, USDT offers a viable solution.

By converting their volatile crypto assets into USDT, investors can essentially “park” their value in a stable digital asset, avoiding potential losses during periods of market turbulence. This makes USDT an invaluable tool for risk management in cryptocurrency portfolios.

Facilitating DeFi Activities

In recent years, the DeFi sector has seen an explosion of growth, and USDT has played a significant role in this development. DeFi platforms often utilize stablecoins like USDT for lending and borrowing services, yield farming, liquidity mining, and other financial operations.

Given its stability and widespread acceptance, USDT is a reliable form of collateral and a medium of exchange in these DeFi protocols, thus contributing to the growth and diversification of DeFi services.

Risks Surrounding USDT Stablecoin

Like all financial assets, Tether’s USDT stablecoin carries certain inherent risks that are important for users to understand. These risks primarily revolve around concerns about the token’s underlying reserves, the details of which are critical to maintaining its peg to the US dollar.

Transparency and Trust

Questions about Tether’s financial integrity have been prevalent since its inception in 2014. Doubts primarily stem from the company’s historical lack of transparent, audited financial statements, a standard requirement for traditional banks. Tether began releasing attestations of its reserves in 2017, conducted by external accounting firm BDO Italia to address these concerns.

However, it’s worth noting that these attestations aren’t full audits. While Tether’s reports assert that approximately 82% of its reserves are in cash and cash equivalents, specifics about the nature and location of these assets, which could indicate the risk level of the collateral, remain undisclosed.

Furthermore, past legal scrutiny adds to these concerns. In 2021, Tether and its affiliate, Bitfinex, were fined $18.5 million in a settlement with the New York Attorney General, who accused Tether of lying about its reserves. An additional penalty of $42.5 million was imposed by the Commodity Futures Trading Commission that same year. Investigations into Tether’s practices, including a U.S. Justice Department probe, continue.

Vulnerability in Times of Market Stress

Tether’s peg to the US dollar, implying that USDT is always worth $1, leads many crypto investors to treat it like a bank. However, unlike banks, Tether does not provide deposit insurance. This leaves USDT vulnerable to potential runs if confidence in its dollar peg wavers during periods of market stress.

The peg is crucial for regular trading and the financial stability of numerous crypto entities that treat USDT like a bank balance. Past instances like the Terra ecosystem collapse and the looming bankruptcy of FTX saw USDT lose its peg, indicating potential risks under stress conditions.

Regulatory Concerns

Regulators have raised alarms about stablecoins, particularly because they operate in the interface between the largely unregulated crypto world and traditional finance.

Experiences from the 2008 financial crisis, when US money-market funds couldn’t uphold their $1-per-share pledge and necessitated Federal Reserve intervention, have informed regulators’ apprehensions. There is a growing concern about the potential systemic impact if an unchecked USDT becomes significant in the traditional financial system.

Potential Regulatory Interventions

Global regulators, including the Financial Stability Board, have proposed treating stablecoins under the same regulations as firms conducting similar activities in the traditional finance sector. Lawmakers worldwide are considering rules that could transform the $150 billion stablecoin sector.

These measures could impose limitations on the assets stablecoin issuers can use as reserves and demand more detailed disclosures. This development could significantly impact Tether’s operations and the broader stability of the stablecoin market.

SEC and USDT: The Latest Developments

Over the past year, the SEC has undertaken enforcement actions against several notable crypto entities. Notable examples include crypto exchanges Kraken and Bittrex and the crypto lending platform Nexo. More recently, Binance and Coinbase, two of the world’s largest cryptocurrency exchanges, have come under the SEC’s spotlight.

The regulator alleges that these platforms operated as unregistered exchanges, provided unregistered securities, and misled customers, among other claims.

While confirming a systematic crackdown on crypto in the US is challenging, the pattern of recent events and labelling Binance’s stablecoin, BUSD, an “unregistered security” suggests that Tether could potentially be a future target. By targeting USDT, which comprises 76% of all stablecoins on exchanges, the SEC could significantly affect liquidity in crypto markets.

USDT’s Influence: Present and Future Outlook

As it stands, Tether’s USDT is the reigning stablecoin with a circulation nearing $85 billion, overshadowing its closest competitor, Circle’s USDC, which circulates about $30 billion. In fact, only Bitcoin and Ether surpass Tether in market value among all cryptocurrencies. The widespread use of USDT has made it easier for traders and investors to enter and exit the cryptocurrency market, fueling growth across the sector.

Additionally, USDT’s importance is emphasized in the DeFi sector, enabling users to lend and borrow cryptocurrencies without being exposed to market volatility. Because of this, many DeFi applications accept USDT for transactions and as loan collateral, securing its place as the top stablecoin in the DeFi market. However, it’s also worth noting that issues surrounding USDT have impacted the broader cryptocurrency market.

Looking ahead, while USDT’s role in the current cryptocurrency landscape is significant, its dominance could be challenged by aggressive regulatory decisions from authorities like the SEC. If USDT faced similar regulatory scrutiny as Binance’s stablecoin, BUSD, its standing within the market might diminish.

The Bottom Line

The USDT stablecoin has become the standard for stablecoin transactions, which profoundly affects the cryptocurrency industry. Its broad acceptance has given investors a safe and dependable choice despite the market’s volatility.

Additionally, USDT’s impact on the growth of DeFi apps is immense. Therefore, it’s safe to say that USDT will continue to be a major factor in the development of digital payments and the cryptocurrency market as a whole.

FAQs

- Is USDT the same as USD?

No, USDT is not the same as USD. USDT is a stablecoin designed to be approximately $1, while USD refers to the physical currency issued by the United States.

- Can I sell USDT for USD?

Yes, USDT can be sold for USD. Many cryptocurrency exchanges and platforms allow users to convert USDT into USD or other fiat currencies.

- Is money safe in USDT?

The safety of money in USDT depends on various factors. While USDT claims to be backed by reserves, there have been concerns about transparency and collateralization.

- Can USDT lose its value?

Although USDT aims to maintain a stable value, it is not immune to market fluctuations. Factors like regulatory actions, loss of trust, or changing market conditions can impact its value. However, compared to other cryptocurrencies, USDT is generally considered more stable.