Safeguarding Your Crypto: What You Need to Know about Cryptocurrency Scams.

Cryptocurrency has revolutionised the way we view money, but with that also comes a set of risks associated with the industry. As crypto continues to rise in popularity, it is becoming increasingly important for users to understand how to protect themselves from crypto scams and rug pulls.

Recent data released by Comparitech shows that fraudsters have stolen more than $20 billion in total through different schemes as of August 2023, illustrating the growing threat of crypto-related fraud. In order to keep their funds safe, users must be aware of the different techniques employed by scammers and know how to recognise red flags that could indicate a potential scam.

In this article, we will be discussing some of the common scams in cryptocurrency, as well as providing helpful tips on how you can safeguard your crypto assets from malicious actors.

Key Takeaways:

- Cryptocurrency scams are a serious problem that users need to be aware of and take precautions against, as they can result in significant financial losses.

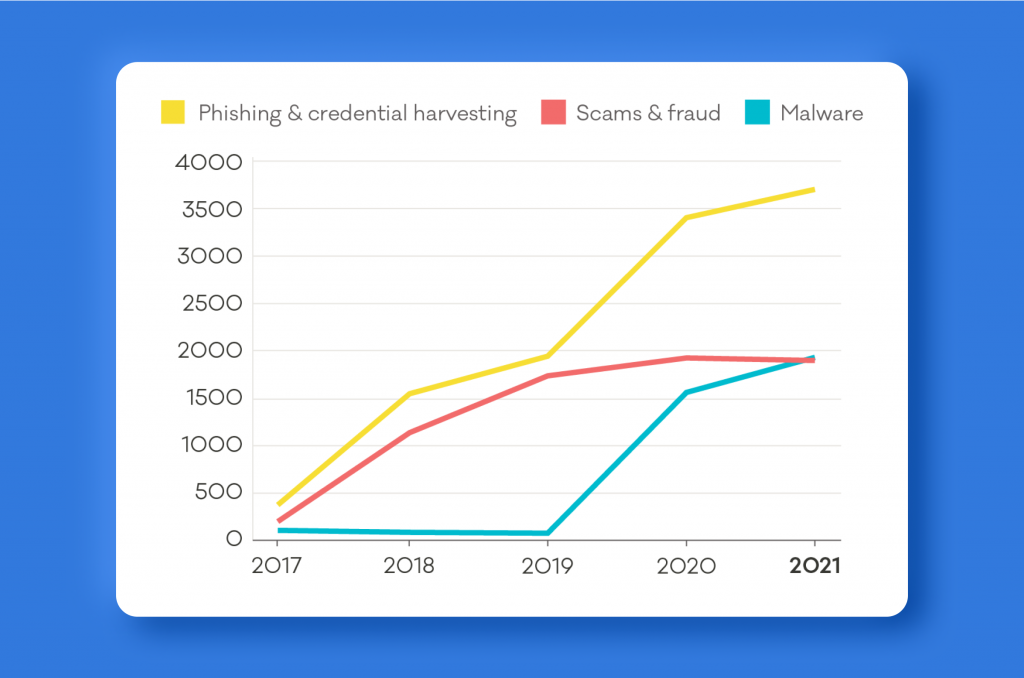

- Crypto scams come in many forms, from phishing, employee impersonation and malware & ransomware to phoney job offers and giveaway scams.

- Stay alert and take proactive measures to protect yourself from cryptocurrency scams by never sharing your private keys or passwords, using two-factor authentication, and installing antivirus software.

Why Do You Need to Be Aware of Crypto Scams?

A cryptocurrency scam is a fraudulent scheme orchestrated by individuals or entities with the intention to deceive and exploit users. These scams can take various forms, including phishing attempts to obtain users’ sensitive information, such as security codes, or manipulating individuals into transferring cryptocurrency to compromised wallets.

How Serious Is The Problem of Crypto Scams?

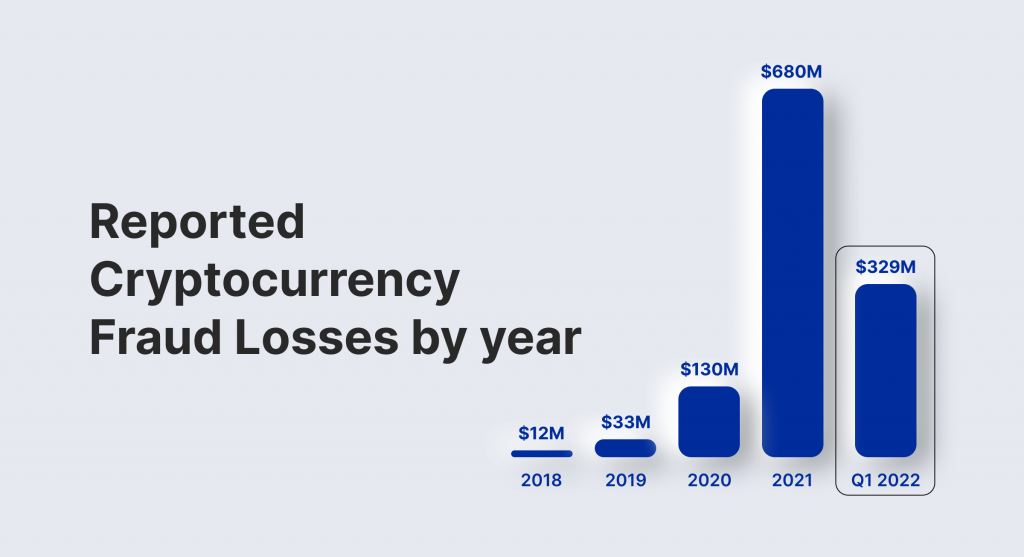

The rise in cryptocurrency usage has unfortunately resulted in a surge of scams associated with it. As blockchain security company De.Fi reports, users have lost about $55 million from crypto rug pulls in May 2023 alone.

Nevertheless, although the total amount of stolen funds continues to increase, 2023 remains lower compared to the year 2022, which saw an unprecedented surge in crypto heists. Still, users need to remain vigilant and take the necessary precautions when dealing with their digital assets as the threat of cybercrime continues to evolve at a rapid pace.

Why Do Cryptocurrency Scams Happen?

Studies indicate that criminals are increasingly employing cryptocurrency as a means of payment, with more than 25% of fraudulent transactions today occurring using crypto coins and tokens.

It’s not a surprise due to the nature of cryptocurrencies and blockchain technology. Since blockchains are decentralised and transactions irreversible, victims of scams cannot recover their funds, and there are fewer chances to trace the criminals.

Crypto scams pose a dual challenge. They not only result in significant financial losses but also undermine trust in the industry. This creates a barrier for individuals to feel secure about investing in cryptocurrencies, potentially impeding the growth of the sector.

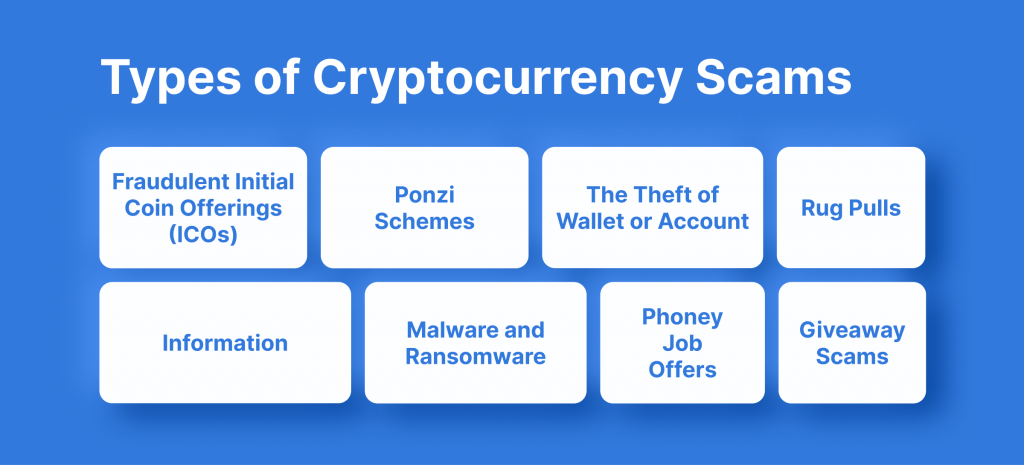

Types of Cryptocurrency Scams

Cryptocurrency scams are a growing threat to users of all experience levels. Learning what to look out for can help you protect yourself from malicious actors attempting to take advantage of you.

1. Fraudulent Initial Coin Offerings (ICOs)

Initial Coin Offerings (ICOs) are a form of crowdfunding model that has been used to facilitate the launch of new cryptocurrency projects. In an ICO, investors exchange their fiat currency for tokens that will be issued by the organisation running the ICO. The tokens may have utility value within the company’s network or, in some cases, can also be traded on exchanges outside of the ICO platform.

However, there have been many instances of malicious actors taking advantage of unsuspecting investors by creating fraudulent ICOs that are designed to take individuals’ money and disappear without delivering any products or services. In some cases, these deceptive practices are hidden behind exaggerated promises about potential returns or information that is not backed up with evidence.

How to Identify Such Scam?

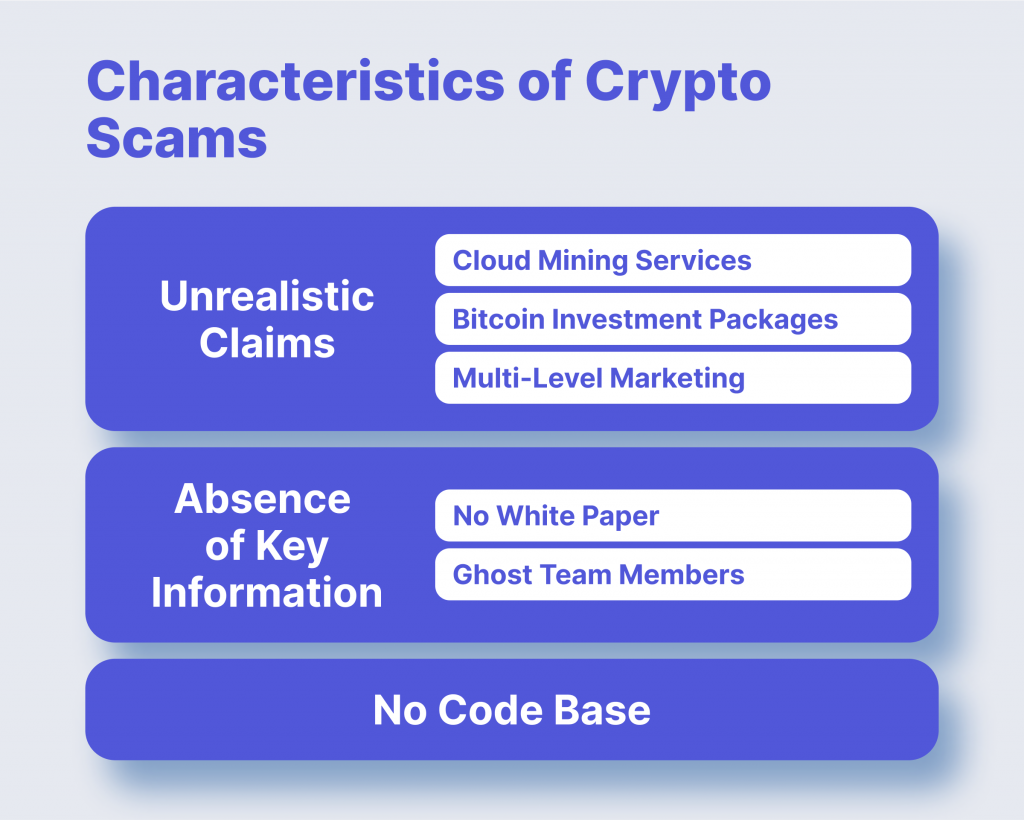

Identifying such fraudulent projects can be challenging, but there are several warning signs to watch out for. Exercise caution if you observe an abrupt and unexplained increase in the value of a digital asset.

The best and most effective approach to safeguarding yourself from falling victim to an ICO is to diligently conduct thorough research prior to making any investments. Take the time to delve into the project’s background, explore its team members’ credentials, and assess their reputations on social media platforms and other online outlets. If you encounter a lack of information or discover any inconsistencies, consider it a significant warning sign that the ICO may indeed be a scam. Remaining vigilant and meticulous in your investigative efforts will help ensure a safer investment experience.

In addition to that, it is highly recommended to take a look at the project’s whitepaper, which serves as the foundational document providing an extensive overview of the project. The whitepaper should encompass crucial information, including a comprehensive financial model, a thorough analysis of legal concerns, a detailed SWOT analysis, and a well-thought-out plan for future development.

2. Ponzi Schemes

Ponzi schemes are another form of crypto scam aimed at deceiving investors by offering them unrealistic returns on their investments. Such a financial scam operates by exploiting existing users to pay out incoming participants, giving the impression that high returns are achievable through investing in the scheme.

BitConnect was one of the most notorious Ponzi schemes in the cryptocurrency space, which lured investors with promises of up to 40% returns on their investments. However, it soon became evident that the platform had no real prospects and eventually collapsed due to a lack of funds and new investors. Many people lost money as a result, highlighting just how dangerous such fraudulent schemes can be.

How to Identify Such Scam?

It can be difficult to identify a Ponzi scheme, as they are often disguised under the guise of legitimate investment opportunities. However, while researching potential investments, always look out for warning signs such as unrealistic returns or promises of guaranteed profits, lack of transparency and an inability to provide proof of payment records.

3. Rug Pulls

A rug pull is a scam in which the creator of a project or token suddenly and unexpectedly withdraws the total supply of tokens from circulation, leaving investors without any profits. This kind of scam has become increasingly common in the digital currency space and can be especially damaging to unknowing investors.

Thodex, the Turkish crypto exchange, was at the centre of one of the most notorious crypto investment scams in history. The closure of Thodex, timed conveniently with the announcement of a “partner agreement,” led to the simultaneous shutdown of user accounts. This left customers unable to withdraw funds and involved the suspicious sale of DOGE at an unreasonably low rate.

Research by BeInCrypto uncovered a Bitcoin hot wallet connected to Thodex, with over 643 BTC transferred into it since the start of 2021 – worth $30.5 million at current rates. Analysis of outgoing transactions also revealed that the majority of these funds bypassed public crypto exchanges, with most being laundered through mixers. Only 35 BTC settled on an address belonging to an exchange.

How to Identify Such Scam?

Investors can protect themselves from falling victim to rug pulls by researching the project and creators thoroughly before investing. It is important to look into whether there are any red flags, such as a lack of information about the team or an unusually high concentration of tokens held by a single address.

Additionally, make sure that the trading volume on exchange platforms is realistic and not artificially inflated. Keeping up with the latest news in the crypto space is another way to identify potential scams and protect your assets.

Lastly, it is essential to diversify one’s investments across multiple projects and exchanges, as this will limit your exposure should something go wrong.

4. The Theft of Wallet or Account Information

Fraudsters can use different methods to trick people into revealing their crypto account or wallet information, allowing them to gain unauthorised access and steal the funds. These scammers may use phishing scams, social engineering tactics, or advanced hacking methods to manipulate individuals into unknowingly giving away their valuable digital assets.

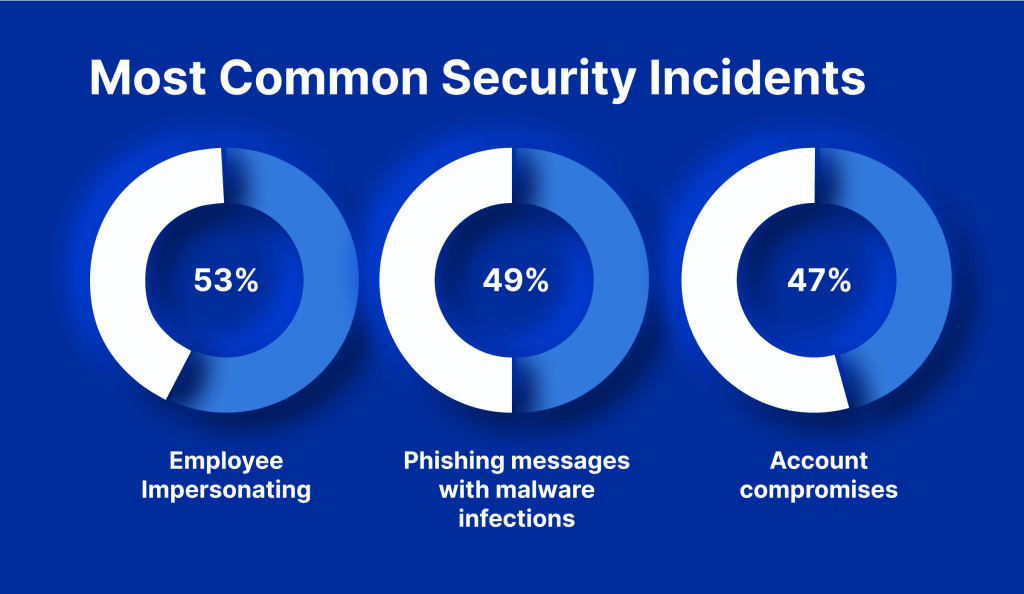

Phishing

Crypto scammers often target potential victims through social media or messenger apps, where they send deceptive emails that appear to be legitimate communication from reputable cryptocurrency wallets or exchanges.

When you receive an email notification about a problem with your exchange account, be careful and refrain from clicking any links in the email. These links might redirect you to a fake website that looks very similar to the genuine exchange platform. If you unknowingly log in to this fraudulent website, the attacker will obtain your credentials and potentially steal your cryptocurrencies. Stay alert and protect your valuable assets.

Employee Impersonating

Scammers sometimes impersonate customer support or official exchange accounts in order to fraudulently get users to transfer crypto. It is important to remember that company customer service representatives will never intervene in transactions conducted between users.

SIM Swapping

The occurrence of SIM swapping scams is increasing as cybercriminals seek alternative methods to circumvent 2FA security measures. In a SIM swap scam, a cybercriminal manipulates your mobile phone operator to gain control of your phone number. With possession of your phone number, scammers can bypass any implemented 2FA and gain unauthorised access to your cryptocurrency wallets and exchanges. This form of scam is progressively more prevalent and poses significant risks.

5. Malware and Ransomware

Malware and ransomware are types of malicious software specifically designed to infiltrate a system and manipulate it for criminal purposes. For example, scammers often use malware disguised as legitimate trading applications to steal users’ wallets and passwords.

Ransomware, on the other hand, is a type of malicious software that encrypts systems or networks in order to extort money from victims. Both of these malicious activities can be extremely damaging, and it is important to remain vigilant in protecting yourself from them.

6. Phoney Job Offers

In recent times, scammers have been resorting to increasingly sophisticated tactics to deceive innocent job seekers. These fraudsters are now impersonating recruiters and exploiting employment websites by posting fake job offers.

To carry out their scheme, scammers may request payment under the guise of initiation fees for job training. They might even provide an offer letter that appears legitimate, further adding to the illusion. Unfortunately, their deceitful tactics don’t stop there. They may also ask for confidential personal information, which can be used to carry out identity theft or commit other criminal activities.

Moreover, scammers have devised a new ploy where they cancel fiat cash transfers after receiving cryptocurrency from unsuspecting victims. This leaves individuals at a loss, both financially and in terms of trust.

How to Identify Such Scam?

To avoid falling prey to such fraudulent schemes, it is crucial to thoroughly examine the employer’s website and delve into detailed research regarding the background of the employee. Additionally, exercise caution if the employer insists on initial payment in cryptocurrency, as this could potentially be a red flag indicative of suspicious intentions.

7. Giveaway Scams

Giveaway scams are a type of fraud where scammers impersonate legitimate people in the industry, promising giveaways of large amounts of crypto assets. These schemes often require users to send small deposits to claim their rewards, and once they do, the money is gone forever, and there is no chance for them to receive their “prizes.”

Fraudsters use various tactics to deceive unsuspecting victims into sending cryptocurrency. One method is impersonating celebrities or hacking their Twitter accounts. Impostors promise to return funds with interest after victims send money to their crypto wallet address. In the first half of 2021, the FTC reported that users sent over $2 million in cryptocurrency to impersonators of Elon Musk.

Another scam involves creating fake streams on streaming platforms. Scammers overlay old video streams of cryptocurrency exchange CEOs with false information about giveaways. The video description often includes an “official” address or a link to a web page with a fake address.

How to Identify Such Scams?

Before sending any money, make sure to conduct thorough research if you come across a celebrity or crypto platform promoting a cryptocurrency giveaway. If it sounds too good to be true, it most likely is.

How to Protect Yourself from Cryptocurrency Scams

It is essential for all crypto users to be aware of the various cryptocurrency scams and take proactive measures to protect themselves from falling victim. Here are some tips to help you stay safe:

- Do not respond to phishing emails or click on suspicious links, even if they appear to be from legitimate sources.

- Be wary of messages claiming free money or giveaways with promises of exorbitant returns.

- Install and regularly update antivirus software on your devices.

- Use two-factor authentication (2FA) whenever possible.

- Do not share your private keys or passwords with anyone, especially strangers.

- Regularly review your accounts and transactions for any suspicious activity.

- Stay up to date on the latest security threats and scams in the crypto space.

The cryptocurrency community is full of potential scammers, so it’s important to protect yourself by keeping up with security best practices. By staying diligent, you can help protect your assets and minimise the risk of becoming a victim of any cryptocurrency scams.

FAQ

How can I identify a legitimate cryptocurrency exchange or wallet?

The most important step you can take to protect yourself from cryptocurrency scams is to make sure that the exchange or wallet you are using is legitimate. You should always do your due diligence by researching the company before depositing any funds. Check for reviews online and see if the platform has been independently verified to be secure. Additionally, look for exchanges and wallets that are insured against loss or hacking.

How can I protect my passwords and private keys against potential hacks?

It’s important to make sure that all of your accounts are secured with strong, unique passwords. Additionally, you should use 2FA whenever possible as an extra layer of protection. If you’re storing large amounts of cryptocurrency for long-term investments, consider storing your private keys in a secure offline storage device like a USB drive or paper wallet so that they’re not vulnerable to hackers.

Are there any security measures that can help me avoid falling victim to a scam?

One of the best ways to protect yourself from cryptocurrency scams is to stay informed about the industry. Research any investment opportunities thoroughly, and be sure to verify the legitimacy of the platform or service provider before you deposit any money. Additionally, be wary of ads and offers that seem too good to be true, as these are often scams. Finally, always read terms and conditions carefully before signing any contracts.