Crypto Staking Guide 2023: Earn Passive Income with Your Crypto.

Key Takeaways:

- Staking cryptocurrency is an excellent approach to produce passive income and obtain exposure to the cryptocurrency market without actively managing assets.

- Download the correct wallet to store your coins, identify the hardware required to stake properly, and start staking.

- Crypto staking may be done in two ways: through a cryptocurrency exchange or by joining a staking pool.

- AQRU, eToro, Crypto.com, Binance, and Coinbase are among the greatest crypto-staking platforms.

- Before you start your own crypto-staking journey, you should think about all of the hazards connected with staking, such as price volatility and lock-up periods.

Crypto staking is the process of “staking” your digital assets in order to earn a fixed income stream. This process can be thought of as similar to investing in stocks or bonds, but with crypto assets instead. The concept behind it is simple – users put their coins into a specialised wallet and keep them there for a specified amount of time. In return, they are rewarded with interest payments.

Pluses of Crypto Staking

Crypto staking has become increasingly popular due to the numerous benefits it presents:

- Stable income stream – crypto staking offers a reliable source of passive income compared to traditional investments such as stocks and bonds which may have higher potential returns but are also subject to market volatility;

- Low Capital Investment – due to the low cost of entry, crypto staking requires a much lower capital investment than traditional investments for passive income. This makes it highly accessible for those who don’t have large amounts of money at their disposal;

- No need to actively manage investments – once coins have been staked, there is no need to actively monitor or manage them. This makes it an ideal option for those who don’t have the time or inclination to actively manage their investments for passive income.

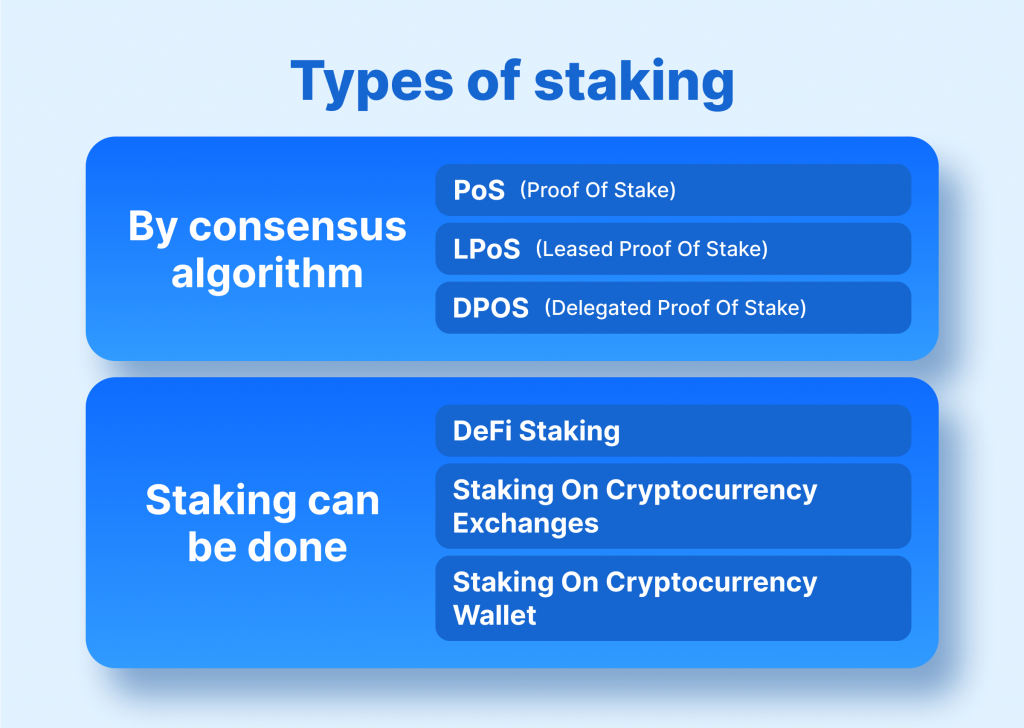

Types of Crypto Staking

Crypto staking can be broadly divided into two main categories: proof-of-stake and delegated proof-of-stake.

- Proof-of-Stake (PoS) is an alternative consensus algorithm to the traditionally used proof-of-work system for verifying and processing transactions on a blockchain. In the proof-of-stake model, nodes or validators commit some of their holdings as stake and are then semi-randomly chosen to create new blocks in the chain.

The validator is rewarded for creating the block in the form of native coins. This system requires far less computing power and electricity than proof-of-work systems, as validators do not need to race to solve complex mathematical problems. To determine who gets selected next, PoS algorithms take into account factors such as how long the validator has held their stake, its size and a random element. This way the system ensures fairness and secure verification of transactions without wasting large amounts of energy.

To ensure stable performance, PoS networks can impose penalties for malicious behaviour by slashing funds from misbehaving validators or even expelling them from the network. This makes PoS a highly secure alternative to proof-of-work consensus algorithms, as it creates strong incentives for honest participation. Moreover, since staking coins does not require specialised hardware, it can be a great way for users to earn passive income by supporting the network and validating transactions. In recent years, PoS has become the consensus of choice for many popular blockchain projects, including Cardano, Ethereum 2.0 and Polkadot.

Overall, proof-of-stake is an attractive consensus algorithm that offers a secure and energy efficient way of validating transactions in a blockchain. It provides users with the opportunity to conveniently earn passive income by staking their coins, while also helping to support the network and protect it from malicious attacks. As such, PoS has become an increasingly popular alternative to proof-of-work systems in the blockchain space.

Which Cryptocurrencies are based on proof-of-stake?

There are many popular cryptocurrencies that use proof-of-stake consensus for passive income, including:

1. SOL (Solana)

2. AVAX (Avalanche)

3. Polkadot (DOT)

4. Cardano (ADA)

5. Ethereum (ETH)

- Delegated Proof-of-Stake (DPoS) – DPoS is a consensus mechanism used by many cryptocurrencies such as Lisk, Bitshares, and Steem. It is based on the concept of “voting” for delegates to receive rewards. The user receives a reward when their delegate produces a valid block on the blockchain.

- Liquid proof of stake (LPoS) is a blockchain consensus technique that enables token holders to lend their validation rights to other users without giving up ownership of their tokens.

Delegation is optional with LPoS. As a token holder, you can transfer your validation powers to other holders without having possession. That is, the tokens will stay in the delegators’ cryptocurrency wallets.

Furthermore, only validators are punished in the event of a security flaw.

Arthur Breitman and Kathleen Breitman first introduced the LPoS algorithm as part of the Tezos project a few years ago.

The Tezos Foundation raised about $232 million in an initial coin offering (ICO) in 2017. It has subsequently been known as one of the biggest ICOs in internet history. Tezos started online in 2018 and has since become a successful challenger to the Ethereum network.

There are also certain restrictions to liquid proof of stake. For starters, it lacks the decentralised consensus of proof of work (PoW). This is due to the fact that a tiny number of people still control the majority of the coins.

Second, LPoS is more vulnerable to assaults than PoW since attackers only require a tiny portion of the overall supply to command 51% of the network. Furthermore, there are a few fundamental distinctions between proof of stake (PoS) and LPoS. Users of LPoS are not required to have their money staked at all times. Instead, users may withdraw their money at any moment and continue to get incentives.

Furthermore, LPoS does not require users to have a huge quantity of coins to bet for passive income.

Main Ways to Stake:

There are many ways to stake cryptos that are much easier than setting up as a validator yourself. These include staking on a cryptocurrency exchange or joining a staking pool.

1. Staking on a crypto exchange

Staking your crypto in an exchange allows you to make money from your assets without having to do the complex work yourself. The exchange takes care of the technical details and finds a node for you to join, providing an easy way to monetize your cryptocurrency holdings through passive income.

2. Participating in a staking pool

A staking pool is a platform that enables users to collectively share resources and earn block rewards. This two-tier system is managed by an administrator, who divides the rewards among the pool operator and delegators. Some pools may also charge entry or membership fees for access to their services.

The Hazards of Cryptocurrency Staking

With every sort of investment, there is always some danger, and staking is no exception. The following are the primary risks of staking cryptos:

1. You may see unstable prices

Volatility is one of the most significant hazards associated with crypto staking. If you get 20% in incentives for staking an asset but it loses 50% in value over the course of the year, you will still lose money. If you wish to stake, be sure to select the appropriate coin for passive income.

2. You may have difficulty selling your staked assets

There is no assurance that you will be able to change your crypto assets back into cash or other decentralised finance because it is dependent on demand and availability.

3. Lock-up times

Some stakable assets have locked periods during which they cannot be accessed. If the price of your staked asset falls significantly during the locked period and you are unable to unstake it, your holdings will suffer.

4. The time it takes to receive profit

Some staking assets, like lockup periods, do not pay out staking benefits on a daily basis. It implies that investors would have to wait for their benefits. Return rates on staking rewards are not always fixed and may alter over time.

5. Failure of the project

Before you invest money in a project, be sure you understand it and the dangers involved. If the network you chose fails and goes out of business, you will most likely lose all of the coins you have invested for potential passive income. In other words, don’t just look at projects with the biggest salary, but also look into the basics and technologies.

6. Required minimum holdings

Most initiatives demand you to set aside a minimum amount of your assets in order to reap the benefits. That is why it is critical to read the terms and conditions before signing up. It’s also crucial not to lock away more than you can afford, regardless of the minimal holding, because you risk losing it all.

7. Theft or loss

Finally, there is always the possibility that you may lose your cash if you do not pay close attention, such as through scams. To avoid it, never give personal information to strangers. It’s also a good idea to encrypt your online wallet with a strong, one-time password.

When the staking time is up, users may take their rewards from the wallet and trade them for other cryptocurrencies or fiat cash.

How to Get Started with Crypto Staking

1. Research the ROI and fees associated with each type of cryptocurrency you’re interested in staking. Understand the risks involved with investing, as well as the potential rewards that come with it.

2. Identify a platform or network where you can stake your cryptocurrency. Consider whether exchanges offer an efficient way to do this, or if another third-party provider might be more suitable.

3. Securely transfer your crypto coins to a wallet that supports staking. You should also back up your private keys, so that you can protect and regain access to your crypto funds in case of an emergency.

4. Monitor the market for changes in value and activity related to the cryptocurrency you’re staking regularly, using news sources, technical analysis and social media.

5. Decide on which blockchains will be used for staking your coins, such as PoS or DPoS. Consider the rewards that come with each type of blockchain and whether they’re suitable for your needs.

6. Stay up to date with the latest security protocols and best practices when it comes to staking. Research new tools and technologies, such as smart contracts, that might make the process easier or more profitable for you.

Top Crypto Staking Coins

As we previously stated, proof-of-stake consensus is a more recent concept than proof-of-work consensus, which Bitcoin uses. The finest proof-of-stake coins are listed here, along with their yearly average return, which is stated as a percentage of the cryptocurrency pledged. Today, many crypto projects utilize proof of stake consensus, and several exchanges make it simple to earn cryptocurrency by staking their crypto assets.

1. ETH

Ethereum (ETH) is now the market’s second most popular cryptocurrency for passive income. Staking Ethereum has a restriction, and you must stake a minimum of 32 ETH Coins. Profit might vary, but the average annual rate of return on Ethereum staking is 5-17%.

2. Cosmos

Cosmos (ATOM) coins may also be used for staking for passive income on many sites. Currently, Coinbase, Binance, and Kraken allow ATOM staking. ATOM staking rewards may now be around 7% per year.

3. Cardano

Cardano, like Ethereum, is a platform for smart contracts. Cardano (ADA), one of the most popular cryptos, may also be staked on a variety of platforms. Binance offers ADA staking, with staking rewards of up to 24%.

4. EOS

EOS is another famous cryptocurrency that is comparable to Ethereum. EOS coins are native to the EOS blockchain, which is likewise proof-of-stake based. To gain incentives, EOS can be staked. EOS staking has a 3.2% projected rate of return.

5. Tezos

Tezos (XTZ) is an open-source blockchain network that uses the XTZ as its native currency. Tezos may be staked over a variety of platforms and networks. Tezos currently has a projected rate of return of roughly 6%.

6. Polkadot

Polkadot is a fast-growing cryptocurrency that uses proof-of-stake consensus and may be used for staking. Staking for DOT is supported via the Kraken cryptocurrency exchange. The DOT stake earns around 12% each year.

If you intend to stake your crypto assets, the aforementioned rewards may appear attractive when compared to regular investments, but the danger is also substantial. As the value of the currencies declines, so may the value of your staking coins.

Best Crypto Staking Platforms in 2023

If you’re new to crypto staking and want to know about the best staking platforms, this guide can be helpful for you. Here we are providing the list of some of the best crypto staking platforms:

1. AQRU – The best crypto staking platform with up to 12% interest rates.

2. eToro – Popular crypto staking platform with copy trading tools.

3. Crypto.com – One of the trusted crypto staking platforms with up to 14.5% pa rewards through crypto savings accounts.

4. Binance – One of the most high liquidity crypto staking platforms with validate transactions.

5. Coinbase – Beginner-friendly platform for staking crypto with crypto rewards.

Final Claiming

Crypto staking is a great way to generate passive income and gain exposure to the rapidly growing cryptocurrency market. With its low cost of entry, increased security, and no need to actively manage investments, it is an ideal option for those looking to earn a steady stream of income without having to put in too much effort. With the right amount of research and preparation, crypto staking can be a rewarding (and potentially profitable) venture for all involved.

So what are you waiting for? Get started today with your own crypto staking journey!

Further Resources

If you’re looking to learn more about crypto staking, check out some of these resources:

- Crypto Staking Guide by CoinMarketCap – an in-depth beginner’s guide to crypto staking;

- Liquidity-provider.com – a comprehensive news website covering the latest news and developments in the crypto world;

- Blockonomi – an online resource providing up to date information on various cryptocurrency topics, including staking.

FAQs

1. What other information should I consider when evaluating a crypto staking platform?

When evaluating a crypto staking platform, you should consider the quality of customer support, security protocols in place to protect your assets, fees associated with the service, and how regularly rewards are distributed.

2. Is it possible to stake multiple cryptocurrencies on the same platform?

Yes, many platforms will allow you to stake different types of crypto coins simultaneously. However, some platforms may limit the number of coins you can stake at once or require you to open multiple accounts.

3. Is crypto staking taxed?

Yes, crypto staking may be subject to taxation in some jurisdictions.

4. How long does it usually take to begin staking a cryptocurrency?

The time frame for beginning your crypto staking process will vary depending on the platform and the amount of cash you are planning to invest. Generally, you should be able to start staking within a few days after completing your registration and deposit process.

5. What is the minimum amount of cryptocurrency needed for staking?

The minimum amount of cryptocurrency required to begin staking varies depending on the coin. For example, Ethereum (ETH) requires a minimum of 32 ETH Coins, while Cosmos (ATOM) does not have any minimum requirements.

Additionally, some platforms may impose additional requirements or set a lower limit than the coin itself. It is therefore important to review platform requirements carefully before investing.