Crypto Trading Strategies That Work in 2024

To become a successful trader requires lots of hard work and dedication. This daily routine is not for everyone. If we take a closer look at the stats, roughly 40% of day traders give up within a month, and 80% are estimated to give up within the first two years. Only 13% are left after three years. A good strategy has to do a lot to stay in the industry.

A clearly defined trading strategy is essential for managing market volatility and optimizing profits. Successful trading techniques are advantageous and also necessary for risk management and improving decision-making. A strong trading strategy offers a framework for deciding with knowledge, reducing risks, and taking advantage of market opportunities.

In this article, we will demonstrate some of the best crypto trading strategies, identify trends, and explain what impacts coin prices and affects market sentiments.

Key Takeaways:

- Ensuring optimal profitability and minimizing market volatility requires a well-defined trading strategy. Effective trading strategies are essential for reducing risk and enhancing judgment.

- Keeping up with news and market developments is essential to successful trading. Provide crucial information on geopolitical and economic trends by using credible sources.

- Price movements in the market are driven by market sentiment, which is impacted by news, social media trends, and trading volumes.

- Because every trading method has pros and cons, traders must use risk management strategies that work for them, such as diversification, stop-loss orders, and limited leverage.

How to Identify Trends for Effective Trading

One of the main aspects of success in trading is the knowledge and information you possess. To trade effectively, it is essential to be up to date on news and market trends. This involves maintaining an eye on sources that offer real-time market and economic development updates. Keeping up with the newest changes requires visiting financial news websites and platforms devoted to crypto news. These resources provide information on geopolitical events, economic statistics, and market conditions that may impact price changes. CoinDesk, CNBC, Bloomberg, and other financial news services are trustworthy sources from which you can read all the necessary information.

Analysing Authoritative Sources

The following important aspects are charts and instruments for technical analysis, which are essential for spotting market trends. Let’s break down some of the most essential ones:

- Drawing trend lines on price charts helps identify a trend’s strength and direction. Connecting higher lows creates an uptrend line; connecting lower highs creates a downtrend line. Horizontal lines joining flat price changes indicate sideways tendencies.

- Price data is smoothed out by moving averages to show the underlying trend. SMA and EMA are two examples of types. Possible purchase or sell signals might be inferred from the relationship between various moving averages, such as the short-term vs. long-term ones.

- The Relative Strength Index (RSI) and other price momentum indicators may point to overbought or oversold situations. The ADX and MACD are also helpful for determining trend strength and possible reversals.

- Understanding patterns like head and shoulders, double tops, and flags can help predict future price changes. These patterns show possible shifts in trends and the psychology of the market.

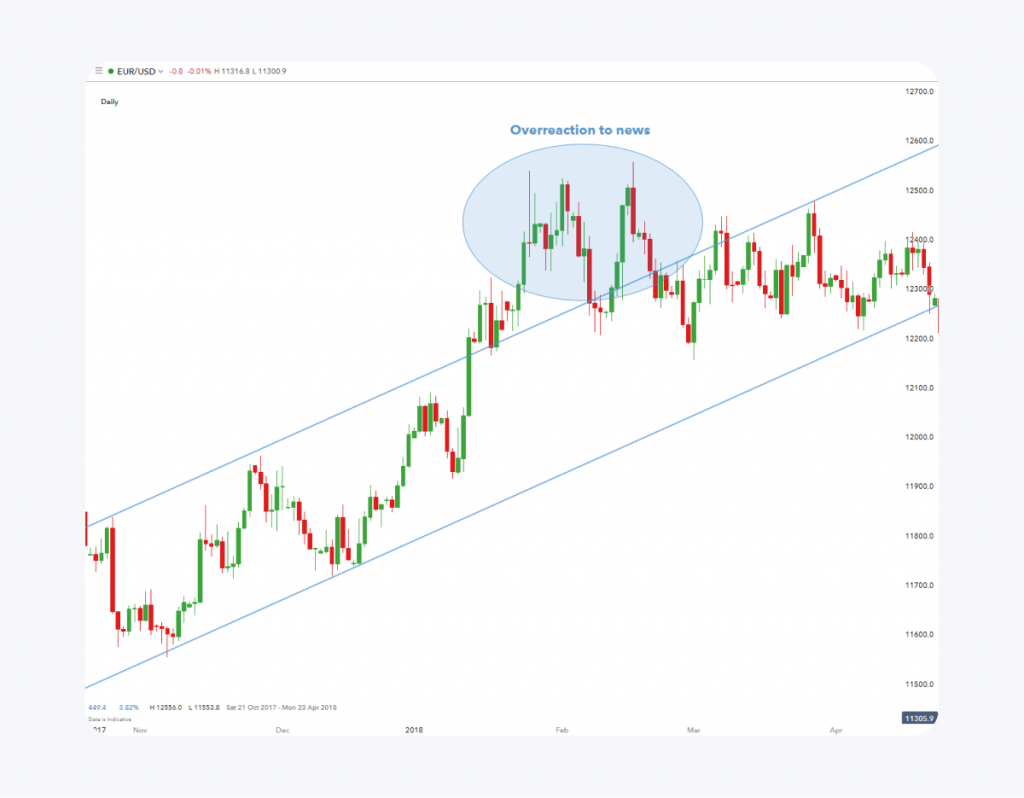

Understanding Market Sentiment

The general attitude of market participants is reflected in market sentiment, which drives price changes. Sentiment analysis, which can be measured by news sentiment, social media trends, and trading volumes, involves analyzing the aggregate behavior of traders and investors. Prices usually rise when public opinion is positive; prices may fall when public sentiment is negative.

These techniques and resources will improve your capacity to recognize patterns and execute well-informed trades. Whether you use automated trading systems, swing trading, or day trading, developing successful trading strategies depends on accurately detecting trends.

Beyond the Charts: What Impacts Crypto Trading?

The general perception that investors have of a particular cryptocurrency or the market at large is known as market sentiment. News, events, and general market perceptions contribute to this collective feeling. A positive attitude can cause a spike in demand for cryptocurrencies, raising their price. On the other hand, pessimism may lead to a decline in demand and a price drop. Investor emotions largely shape this mood, as market movements can be driven either way by optimism or pessimism.

Psychological Triggers

Investor psychology has a significant influence on crypto values. The two main factors that affect trading behavior are fear and greed. Fear of losing may cause people to sell during downturns, whereas fear of missing out (FOMO) may encourage them to invest in a rising market. Price volatility is also influenced by the herd mentality of traders, who copy the moves of others. Due to traders’ impulsive reactions to news and market movements, these psychological elements have the potential to cause significant market fluctuations.

Global Regulatory Trends

Global regulatory developments differ and, depending on the location, can have distinct effects. New regulations have been implemented to improve market security and transparency, and regulatory oversight has intensified recently. For example, nations may enact laws to prevent fraud or mandate more stringent exchange compliance. Comprehending these patterns enables traders to predict prospective market responses and modify their approaches correspondingly.

Technological Developments

Blockchain technology developments could significantly impact the cryptocurrency industry. Innovations like new consensus processes or better scaling solutions can make blockchain networks more efficient and secure, making them more appealing to investors. As a result of these changes, the value of cryptocurrencies that benefit from technological advancements may increase.

Economic Factors

Cryptocurrency markets can be impacted by economic variables such as interest rates, inflation rates, and economic growth. For instance, rising inflation could encourage investors to look for alternative assets like cryptocurrencies to protect against fiat money depreciation. Similarly, interest rate fluctuations can influence investment choices; lower rates may encourage people to pursue riskier assets like crypto.

Fiat Currency Volatility

The value of fiat money might fluctuate, which can affect the price of cryptocurrencies. When a significant fiat currency, like the US dollar, declines, investors may transfer their assets into cryptocurrencies, increasing their value. On the other hand, if fiat currencies gain strength, there may be less of a market for cryptocurrencies, which would lower their value.

Events in Geopolitics

Geopolitical developments and political stability can influence investor sentiment and market stability. Uncertainty brought on by political upheaval or changes in governmental regulations might cause market volatility. For instance, the revelation of new rules or disputes may affect market confidence and influence cryptocurrency price movements.

Fast Fact:

By 2024, an average of $1.3 will be made per user in the cryptocurrency sector. The United States is predicted to have the most significant revenue in the world, coming in at $23,220.00 million.

Advanced Crypto Trading Strategies in 2024

After identifying trends and comprehending the external factors affecting crypto prices, we will discuss the best trading strategies for crypto below.

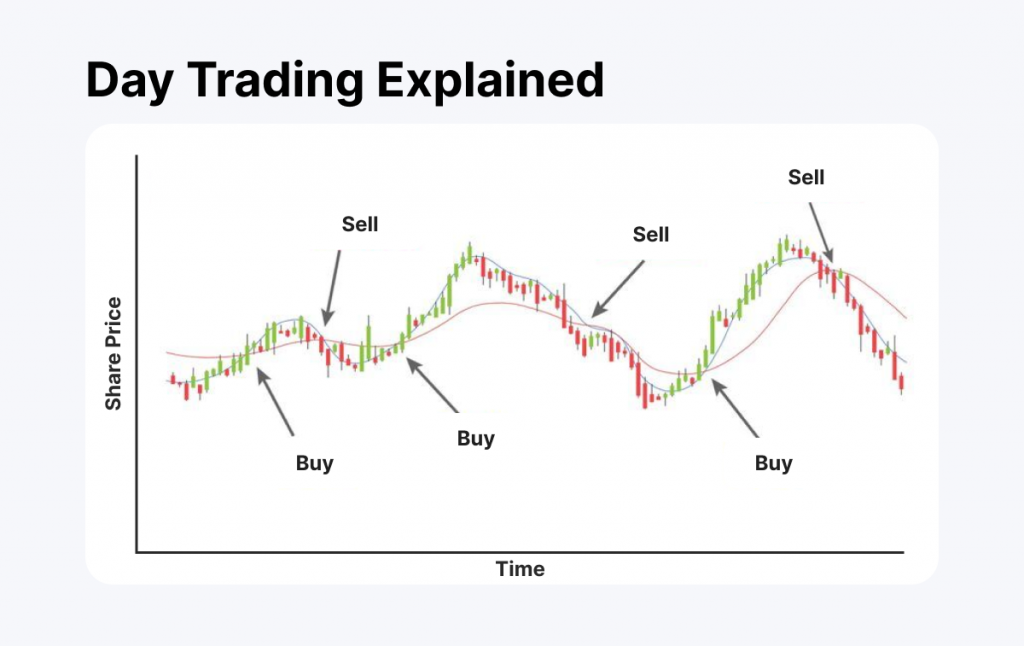

Day Trading

Working inside a single trading day is known as a crypto day trading strategy. The goal is to make money off of brief changes in pricing. Day traders commonly employ technical analysis and other tactics to profit from intraday price movements.

Technical indicators, complex trading platforms, and real-time market data are just a few of the instruments that day traders use. Typical strategies include range trading, which concentrates on buying at support levels and selling at resistance levels, and momentum trading, which aims to take advantage of quick price swings.

Although day trading crypto strategies have the potential to yield rapid returns, there are substantial risks involved. Day trading is a fast-paced activity that requires continual market monitoring and quick decision-making. High volatility can result in significant gains or losses, and transaction expenses can mount up quickly.

For example, a day trader can use moving averages to determine possible entry and exit locations. The 50-day moving average is a popular moving average. A trader may view a cryptocurrency price decline as a buying opportunity if it regularly trades above and then slightly below the 50-day moving average (provided other technical indicators also support this). Later in the day, if the crypto price rises over the 50-day moving average once more, they want to sell it for a profit.

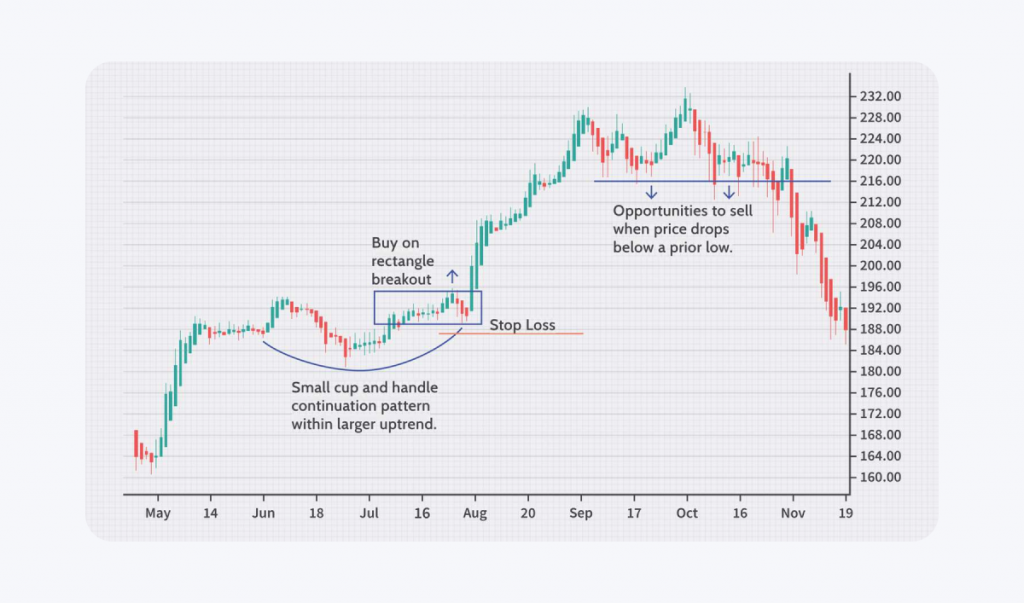

Swing Trading

To profit from price swings, swing traders hold their holdings for a few days or weeks. Technical analysis is a tool swing traders use to find trends and possible entry and exit locations. They could also use basic analysis to support their judgment.

Swing traders use indicators like stochastic oscillators, RSI, and moving averages. These indicators assist in locating possible reversal points and overbought or oversold situations. The RSI is a tool that measures the momentum of price movements and indicates when an asset might be oversold (below 30) or overbought (above 70). A swing trader might see this as a buying opportunity if a cryptocurrency experiences a significant price drop, pushing the RSI below 30.

Swing trading is a good option for people who cannot consistently monitor the markets because it takes less time than day trading. However, it exposes traders to risks during the night and weekend, when news or events can cause prices to move considerably. Swing trading can profit from more considerable price changes, but it also needs persistence and self-control to maintain positions over extended periods of time.

Scalping

A scalping trading approach aims to profit from slight price fluctuations. Scalpers seek to frequently catch modest gains by making many daily transactions, necessitating quick and intense decision-making.

Tight spreads, direct access to trading platforms, and real-time market data are all necessary for successful scalping. Trading breakouts, taking advantage of bid-ask spreads, and utilizing high-frequency trading algorithms are common tactics scalpers use. The secret is to minimize market risk and execute deals rapidly.

The possibility of regular, modest income is the main advantage of scalping. Scalpers can reduce the impact of unfavorable market changes by shortening the duration of their exposure. On the other hand, a high trading frequency may result in significant transaction expenses. In addition, scalping takes a lot of effort and commitment, as well as the capacity for stress management and quick decision-making.

Effective risk management strategies are essential in any crypto trading strategy. It includes setting stop-loss orders to restrict possible losses, diversifying the investment portfolio, and refraining from overleveraging. Traders should establish a strong cryptocurrency trading plan by considering their own risk tolerance, technical and fundamental analysis, and crypto market dynamics.

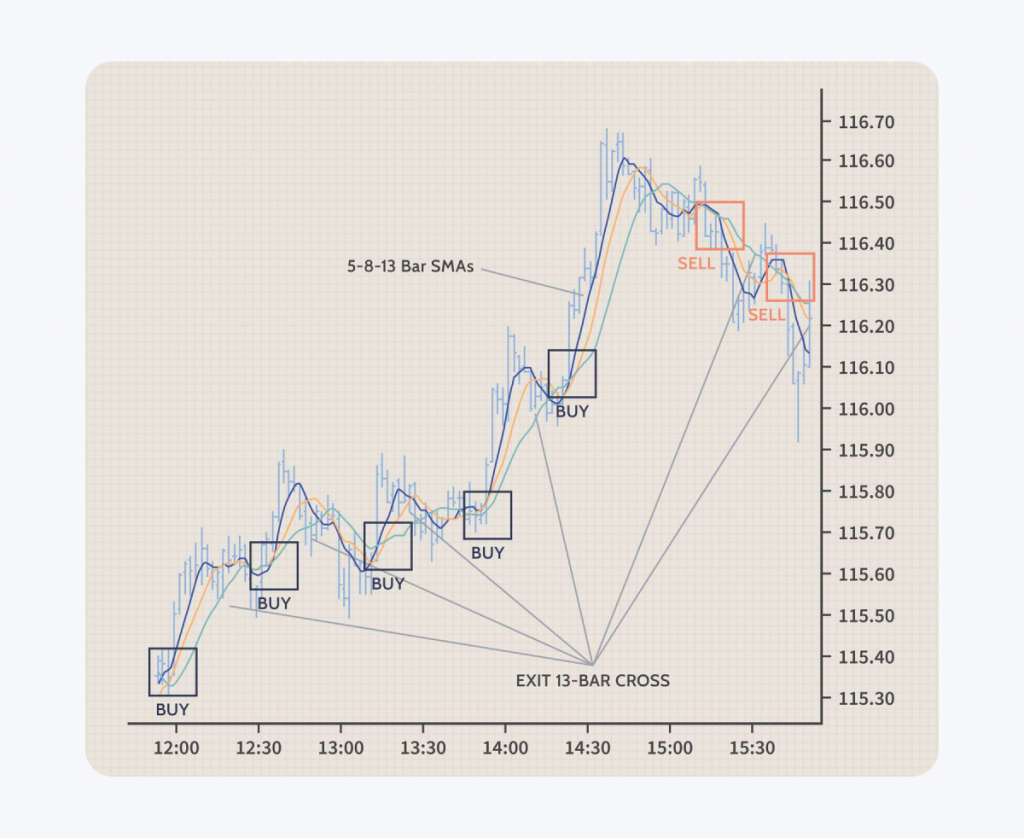

Trend Following

To optimise profits, trend following includes spotting and seizing market trends. This approach is essential in cryptocurrency trading because of the market’s volatility. To identify trends, traders employ momentum indicators, trendlines, and moving averages. The 200-day moving average, for example, might be used by a trader to spot possible trends.

A trader may consider a long entry opportunity if the price of a cryptocurrency regularly trades above the 200-day moving average and begins to trend upward. After that, their goal would be to take a long position and profit if the rise holds. On the other hand, to profit from the price drop, a trader may start a short position (borrowing and selling the asset) if the price regularly drops below the 200-day moving average and exhibits a downward trend.

Trades are made by the ones who enter long positions during uptrends and short positions during downtrends when the price of a coin swings consistently in one direction. Accurate trend identification and risk management using stop-loss orders are critical success criteria.

The tricky part is figuring out which price swings are transitory and which are actual patterns. The trend following necessitates constant market monitoring to modify trading decisions based on the most recent facts.

Range Trading

Another well-liked tactic is range trading. A predetermined price range is traded within this strategy using support and resistance levels as guidelines. Cryptocurrency assets are purchased by traders at the support level and sold at the resistance level. Analyzing past price data and applying indicators such as RSI to validate overbought or oversold circumstances are necessary to identify range-bound markets. Range trading’s primary advantages are its ease of use and propensity to forecast price changes within a predetermined range. The vulnerability, though, is the possibility of huge losses if the price unexpectedly moves outside the defined range.

Arbitrage

Arbitrage trading allows one to take advantage of price variations for the same asset in other marketplaces. Purchasing a cryptocurrency at a discount on one exchange and selling it at a higher price on another is known as arbitrage. This approach requires prompt implementation and cautious assessment of transaction expenses to guarantee profitability.

Though relatively low-risk, arbitrage trading involves quick deal execution and ongoing exchange monitoring. Potential earnings may be eroded by risks such as abrupt price fluctuations and differences in exchange liquidity. Two ways to reduce these risks are using high-frequency trading (HFT) methods and automated crypto trading systems to complete trades quickly and effectively.

Crypto trading strategies for beginners frequently center on straightforward, understandable techniques like trend following and range trading. Advanced trading techniques and a deeper understanding of market dynamics are required for tactics like arbitrage and scalping.

Fundamental Analysis

Fundamental analysis is the process of analyzing multiple underlying aspects to determine a cryptocurrency’s intrinsic value. These elements consist of the team, technology, market potential, and acceptance rate of the project. Analysts examine key reports and indicators like whitepapers, collaborations, development activities, and community involvement.

Determining the cryptocurrency’s long-term potential requires an understanding of these components. Fundamental analysis is not without its limitations, though. It can take a lot of time and cannot always correctly forecast changes in prices in the near future. Despite these shortcomings, it offers insightful information about the feasibility and potential of cryptocurrencies.

Technical Analysis

The main goal of technical analysis is to predict future price movements by utilising volume and past price data. Moving averages, levels of support and resistance, and momentum indicators are examples of important technical indicators. Additional crucial chart patterns are triangles, head and shoulders, and double tops. By determining entry and exit points based on market movements, traders use these indicators to make well-informed trading decisions. Technical analysis has limitations, even if it can be quite helpful for short-term trading. It makes extensive use of previous data, which might not always be an accurate indicator of future price changes. Furthermore, erroneous signals can occasionally result from market instability. Even with these drawbacks, technical analysis is still an essential resource for cryptocurrency traders.

Algorithmic Trading

Algorithmic trading, often known as algo-trading, is the practice of executing transactions based on preset criteria using computer programmes. Time, cost, and quantity are a few examples of these requirements. Several advantages come from automated techniques, which can execute transactions at rates and frequencies that are not possible for human traders. They can guarantee that trades are carried out at the best rates, cut down on emotional trading, and lower trading expenses.

Algorithmic trading is not without its problems, though. Trading can be affected by technical issues like software problems or network disruptions. In addition, relying just on historical data might not take unanticipated market developments into account. Despite these difficulties, crypto algo trading strategies are still an effective method for efficiently handling deals in the erratic cryptocurrency market.

Hedging in Crypto Trading

Hedging in the crypto context is similar to an insurance policy and is used to reduce the risk of unfavorable market price fluctuations. By hedging, traders can protect their capital from substantial losses in volatile market conditions. Trading to reduce the risk attached to other holdings in a trader’s portfolio is known as hedging. While not totally eliminating the risk, this tactic lessens its possible harmful effects.

Using derivatives like options and futures can be an effective hedging strategy in crypto trading. While crypto futures trading strategies require the trader to buy or sell the commodity at a future date and price, options provide the trader with the freedom to buy or sell a coin at a fixed price. To protect against a future decline in the price of a coin, a trader with substantial holdings of the cryptocurrency can, for example, buy put options. With this strategy, the gains in the put options will balance the losses on the holdings in the event of a price decline.

Another popular hedging tactic is using stop-loss orders, which automatically sell a cryptocurrency when its price drops to a specific threshold. This aids in limiting losses and shields the trader from more drops. ETFs that move against the direction of the crypto market are another tool that traders may employ. The entire portfolio’s performance is balanced when the market declines since the value of the inverse ETFs increases.

Conclusion

As the article has shown, selecting an appropriate trading strategy is essential and should be in line with personal objectives and risk tolerance. It is crucial to keep learning new things and changing tactics to comply with the market. Crypto trading is always changing, so traders need to be aware and updated. In this case, traders will be able to make more informed judgments and traverse the market’s complexity more effectively.

FAQs

1. Which trading method is the best?

Buy and Hold is the most often used trading strategy for cryptocurrencies. This means hanging onto your cryptocurrency assets for the long run and having faith in their potential and earnings.

2. Is it hard to trade crypto?

To trade well, one needs to be well-prepared, have a strong plan, have the appropriate attitude, use useful tools, and have emotional restraint.

3. What cryptocurrency is best for day trading?

If you plan to day trade cryptocurrencies, select those with high liquidity. Seek out traders with significant activity; this suggests active participation in the market and facilitates fast entry and exit from deals.