Cryptocurrency Transaction Monitoring: Why Does It Matter?

Cryptocurrencies have offered a wide range of new opportunities to millions of users around the globe. However, they have also introduced new challenges for regulators and financial institutions when it comes to combating financial crimes, money laundering and terrorism financing. According to blockchain security firm CertiK, $363 million was stolen by crypto thieves in November of 2023.

To address rising concerns, crypto service providers started to introduce monitoring and compliance measures for virtual assets. In this article, we will explore what transaction monitoring is, why it is essential, and what challenges it presents.

Key Takeaways:

- Cryptocurrency transaction monitoring is vital to ensure compliance with regulations and to help prevent financial crimes in the crypto space.

- According to FATF, suspicious cryptocurrency transactions are characterized by structuring, geographical risks, anonymity, using money mules, and some other indicators.

- Blockchain analysis firms and tools also play their role in fighting financial crime in crypto.

What is Transaction Monitoring?

Transaction monitoring is a technology-driven process that detects and analyzes unusual transactions in real-time or daily. It is a part of crucial anti-money laundering (AML) regulations.

The primary goal of transaction monitoring is to identify any unusual or suspicious activities that may be indicative of illegal funds being transferred. This could include significant and frequent transactions, transactions involving high-risk nations or individuals, or patterns of activity that deviate from the customer’s normal behavior.

While transaction monitoring is primarily applied to fiat currency transactions (such as USD, EUR, and so on), it has also become increasingly important for cryptocurrency transactions. This is due to the increasing use of cryptocurrencies as a tool for illicit activities and the need for businesses to comply with AML laws and regulations.

It’s important to note that transaction monitoring is not the same as AML monitoring, although they are often used interchangeably. AML monitoring refers specifically to screening processes for adverse media, blocklists, and sanctions. Transaction monitoring, on the other hand, focuses on identifying potential money laundering risks through the analysis of financial transactions.

Why Crypto Transaction Monitoring Is Needed

With the rise of cryptocurrency usage, it has become increasingly important to have proper monitoring systems in place. The alarming rate at which cybercrime related to cryptocurrencies is occurring highlights the need for proactive measures. From thefts and hacks to money laundering, these illegal activities can cause significant financial losses and damage to user funds and companies’ reputations.

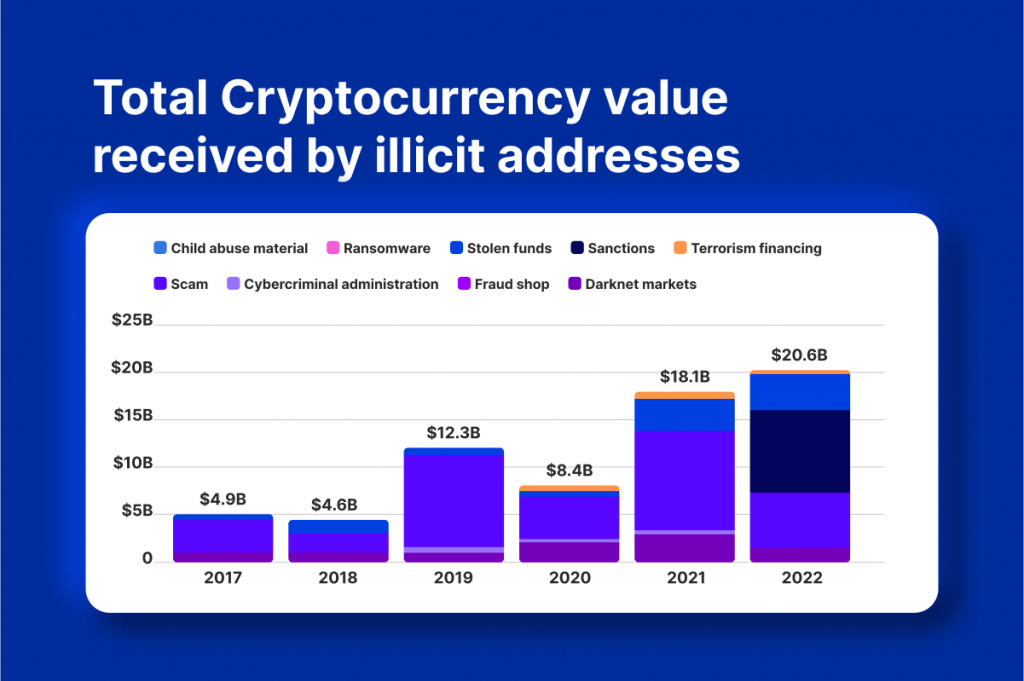

In 2022, the amount of crypto crime reached an all-time high, with $20.6 billion worth of blockchain transactions being crime-related, according to Chainalysis. It is evident that the risks associated with digital currencies are significant, and the rates of crimes are only growing.

One of the most pressing concerns is the use of coins and tokens for money laundering. In 2021, criminals successfully laundered $8.6 billion worth of cryptocurrency, representing a nearly 30% increase from the previous year. This shows that criminals are actively taking advantage of the anonymity and decentralization offered by cryptocurrencies to engage in illegal activities.

In response to these threats, regulators worldwide have implemented strict rules and guidelines for crypto transaction monitoring, which ensure that companies dealing with virtual assets have the necessary mechanisms in place to detect and prevent illicit activities. Non-compliance with these regulations not only puts companies at risk of facing substantial fines but also damages their reputation.

Challenges of Cryptocurrency Transaction Monitoring

While traditional financial institutions have long been subject to strict regulations and monitoring measures, the emergence of cryptocurrencies has introduced a whole new set of challenges for effective monitoring of transactions:

1. Anonymity

The pseudonymous nature of cryptocurrency transactions allows for a level of privacy and security that is appealing to many users. However, this same anonymity also makes it challenging to identify the individuals behind suspicious activities. The use of privacy coins, decentralized exchanges (DEXes), and other tactics can further complicate efforts to trace illicit funds.

2. Creative Ways to Evade Detection

Breaking down larger transactions into multiple smaller ones is a common tactic used by money launderers to avoid triggering reporting thresholds or AML monitoring alerts. With cryptocurrencies’ decentralized and unregulated nature, it becomes even harder to identify these suspicious activities.

3. Adaptability to Changing Circumstances

In the world of crypto, transactions can happen in a matter of seconds, making it challenging for traditional monitoring systems to keep up. Criminals can take advantage of this speed to move large volumes of illegal funds quickly without attracting attention. This puts pressure on financial institutions to have real-time monitoring capabilities.

What FATF Guidelines Say About Suspicious Crypto Transactions?

In 2020, the FATF (The Financial Action Task Force) released guidance for companies dealing with cryptocurrencies on how to effectively monitor transactions to prevent money laundering and other illicit activities. The recommendations were developed based on the increasing use of virtual assets as a means for criminal activity.

Fast Fact:

FATF is an international organization that sets standards and promotes the implementation of legal, regulatory and operational measures to combat money laundering, terrorist financing and other related threats to the integrity of the international financial system. The FATF Recommendations are recognized as the global anti-money laundering standard.

So, according to the FATF, there are several indicators of suspicious cryptocurrency transactions, which include:

- Size and intensity of transactions: Transactions involving large amounts of cryptocurrency or frequent transactions over a short period of time.

- Uncommon patterns of crypto transactions: Transactions that do not fit the typical patterns of legitimate transactions, such as high volume transactions followed by immediate withdrawals and so on, structured transactions, and so on.

- Geographical risks: Transactions from or to high-risk countries or jurisdictions, as identified by the FATF. These countries may have weak AML/CFT (Anti-Money Laundering/Combating the Financing of Terrorism) systems, making them more susceptible to illicit activities.

- Use of anonymous cryptocurrencies: Transactions conducted with private coins make it difficult to identify the parties involved.

- Use of unregulated middlemen: Transactions through unlicensed or unregistered cryptocurrency exchanges that do not comply with AML/CFT regulations.

- Lack of customer due diligence (CDD): Incomplete or insufficient information about the customers involved in the transaction. This may include failure to obtain customer identification, address, or other personal information.

- Exploitation of third-party individuals: The use of elderly or financially vulnerable individuals as money mules to carry out cryptocurrency transactions on behalf of money launderers.

These challenges highlight the need for robust and innovative solutions to monitor cryptocurrency transactions effectively and mitigate the risks associated with digital currencies.

Updated Guidance for Crypto Transactions

In 2021, FATF released updated guidance on implementing a risk-based approach in the cryptocurrency industry.

According to the document, companies operating in the crypto industry are responsible for implementing cryptocurrency transaction monitoring measures. This means that they must have systems in place that can effectively detect and prevent potential money laundering risks posed by their clients. Factors that must be considered:

Customer Due Diligence

One of the key components of this risk-based approach is implementing due diligence measures for transactions above 1000$/€. This includes collecting accurate customer data, such as digital credentials and biometric identifiers, to build risk profiles and ensure compliance with AML regulations.

Screening and Monitoring

In addition to due diligence, companies should also enhance their transaction monitoring procedures by screening and monitoring key risk data. This includes identifying customers who are politically exposed persons (PEPs), involved in adverse media, or listed on relevant international sanctions or watch lists.

Smart Technology

To effectively manage the large amounts of data involved in crypto transactions, companies should leverage smart technology and implement a range of automated AML monitoring software. These technologies can help detect suspicious activity in real time, allowing companies to report it to the authorities promptly.

The Role of Blockchain Analysis in Crypto Transaction Monitoring

Blockchain analysis is the process of investigating, categorizing and monitoring blockchain transactions in order to understand the activities of various participants. It utilizes blockchain technology to detect fraudulent acts and suspicious behavior, making it a vital tool for maintaining trust and transparency in the world of cryptocurrencies.

Fast Fact

One notable use case of blockchain analysis is its role in uncovering the theft of Bitcoin by two rogue FBI agents during an investigation into the Silk Road darknet market. This incident, which made headlines in 2015, was brought to light by a blockchain analysis platform, Chainalysis.

Blockchain analysis is performed with special monitoring and analyzing tools and solutions, which serve multiple functions, including address classification, investigation, transaction monitoring, and risk analysis. One of the primary uses of blockchain analysis software is to link blockchain addresses to real-world identities.

To achieve this, these tools employ various techniques, such as web scraping and clustering algorithms. Clustering algorithms are commonly used to identify entities like exchanges, payment processors, and wallets. On the other hand, web scraping is used to track price changes in the cryptocurrency market for effective decision-making.

Another essential feature of blockchain analysis tools is their ability to provide visualization tools for investigating crypto risks. These tools use transaction graphs to understand the connection between multiple transactions and assess potential risks. Moreover, compliance solutions offered by blockchain analysis tools track all transactions involving a company and assess risk based on factors such as fund origins, money flow history, and wallet activity.

Crypto Transaction Monitoring Today: EU’s Funds Transfer Rules

As the world continues to grapple with the rapidly growing cryptocurrency industry, Europe has taken a proactive stance in regulating this new form of currency. In April 2023, lawmakers in the European Union voted overwhelmingly in favor of two major laws that will set a global standard for crypto regulation.

The first law, known as Markets in Crypto-Assets (MiCA), received a resounding 517-38 vote in favor, with 18 abstentions. This legislation will introduce a comprehensive crypto licensing regime, making the EU the first major jurisdiction to do so.

In addition to MiCA, the European Parliament also voted 529-29 in support of the Transfer of Funds Regulation (TFR). This law requires crypto operators to identify their customers in order to combat money laundering and terrorist financing. This legislation is another significant step towards regulating the crypto industry.

While it will not come into effect until mid-2024 or early 2025, MiCA lays the foundation for a regulated environment that will help protect investors and combat financial crime.

What Does It Mean for the Industry?

The introduction of MiCA in the European Union marks a significant milestone for the crypto industry worldwide. Through the establishment of comprehensive regulatory guidelines, MiCA brings much-needed clarity and legal certainty to the often uncertain world of digital assets.

But beyond its direct impact on companies operating within the EU, MiCA has the potential to drive positive change throughout the global crypto ecosystem. For countries that have yet to establish any form of crypto regulation, MiCA serves as a blueprint that can be localized and adapted according to their specific needs.

Moreover, MiCA’s emphasis on security does not come at the expense of innovation, as it can actually empower crypto industry players with greater confidence to grow and innovate within defined boundaries. It provides transparent rules for the operation of digital asset platforms, and regulators can foster industry growth while safeguarding the interests of users.

Closing Thoughts

Cryptocurrency transaction monitoring plays a crucial role in ensuring compliance with AML regulations and detecting financial crimes in the digital currency landscape. Financial institutions and crypto service providers should mitigate risks, protect consumers, and contribute to the integrity of the broader financial system. Fortunately, today there are many providers that offer transaction monitoring systems to businesses in both crypto and traditional space, which makes the work of financial compliance and risk management easy and effective.

FAQs

Can you track crypto transactions?

Yes, cryptocurrency transactions can be tracked. Blockchain networks usually allow anyone to view all transactions on their public ledger. However, only the sender and receiver addresses are visible, not the personal information of individuals involved in the transaction.

How to check crypto transactions on the blockchain?

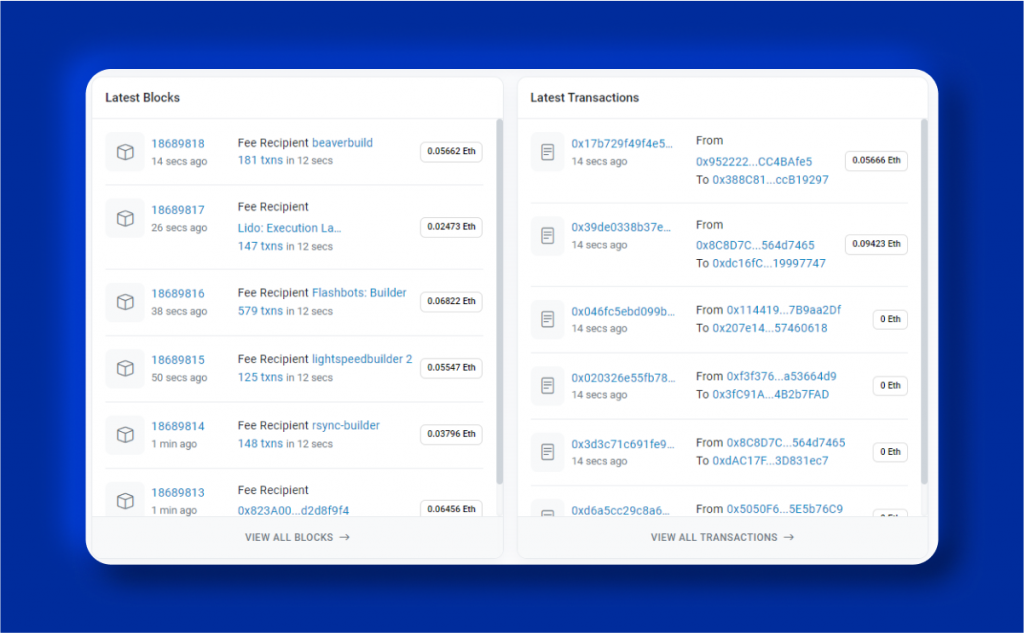

There are several ways to check crypto transactions on the blockchain, but one of the most user-friendly and accessible methods is by using a blockchain explorer. These tools allow users to search for specific transactions or addresses and view details such as the amount sent, transaction fees, and confirmation times. As an example, the best blockchain explorer for ETH transactions is Etherscan, and for BNB, it is Bscscan.

What fines can be imposed on crypto platforms if they violate AML rules?

The fines imposed on cryptocurrency trading platforms can vary depending on the severity of the violation and the jurisdiction in which it occurred. It is certain, however, that the measures taken against these platforms are becoming increasingly strict, with fines potentially reaching millions of dollars.

For example, in 2022, Robinhood Markets Inc.’s cryptocurrency arm was fined $30 million by New York’s financial regulator for violating AML and cybersecurity rules.