How to Find Dash Payment Gateway to Start Accepting Dash

The global financial landscape has been renovated by cryptocurrencies, offering decentralized and secure alternatives to traditional fiat currencies. Among these digital assets, Dash has drawn significant attention for its innovative features and growing adoption. Dash materializes as a frontrunner, offering unparalleled speed, security, and privacy.

Key Takeaways

- Dash offers enhanced privacy and rapid transactions through its PrivateSend and InstantSend features, making it a standout choice among cryptocurrencies.

- Adopting Dash payments reduces fees and accelerates transactions, widening global market access and potentially boosting customer satisfaction.

- To enable Dash payments, businesses should partner with trusted payment processors, streamline their checkout processes, and ensure their setup is secure and customer-friendly through detailed testing and customization.

Understanding Dash

Dash, an abbreviation for “Digital Cash,” was launched in 2014 by Evan Duffield. Initially known as Darkcoin, it was later rebranded as Dash to emphasize its focus on becoming a digital equivalent of cash. Built upon the Bitcoin protocol, Dash introduced several key innovations to address perceived limitations of Bitcoin, including privacy, speed, and governance.

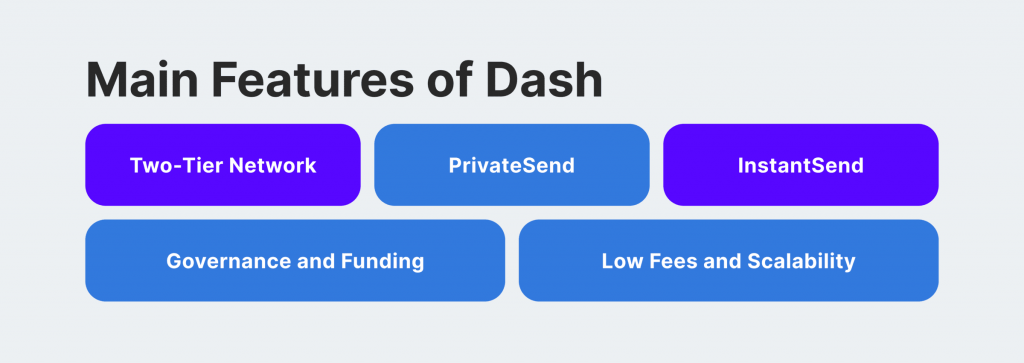

Dash incorporates several features that distinguish it from other cryptocurrencies.

Two-Tier Network

Dash operates on a two-tier network consisting of miners who secure the Dash network and master nodes that facilitate advanced functionalities such as PrivateSend and InstantSend.

PrivateSend

Dash offers enhanced privacy features through its PrivateSend feature, which utilizes a coin-mixing mechanism to blur transaction histories, providing users with greater anonymity.

InstantSend

InstantSend enables near-instantaneous transactions using master nodes to lock transaction inputs, ensuring swift confirmation within seconds.

Governance and Funding

Dash implements a decentralized governance system known as the Treasury, where a portion of block rewards is allocated to fund development projects, marketing initiatives, and community proposals, enhancing the ecosystem’s sustainability and growth.

Low Fees and Scalability

Dash transactions typically incur lower fees than traditional payment methods and, due to their network architecture, have the potential to scale more efficiently.

Compared to other cryptocurrencies like Bitcoin and Litecoin, Dash offers distinct advantages:

- Privacy: While Bitcoin transactions are pseudonymous and Litecoin transactions are transparent, Dash provides optional privacy features through PrivateSend, offering users greater confidentiality.

- Speed: Dash’s InstantSend feature enables rapid transaction confirmation, providing a competitive advantage over Bitcoin’s relatively slower confirmation times.

- Governance: Unlike Bitcoin and Litecoin, Dash implements a decentralized governance system that allows stakeholders to vote on proposals and allocate resources, fostering community-driven development and innovation.

Benefits of Accepting Dash Payments

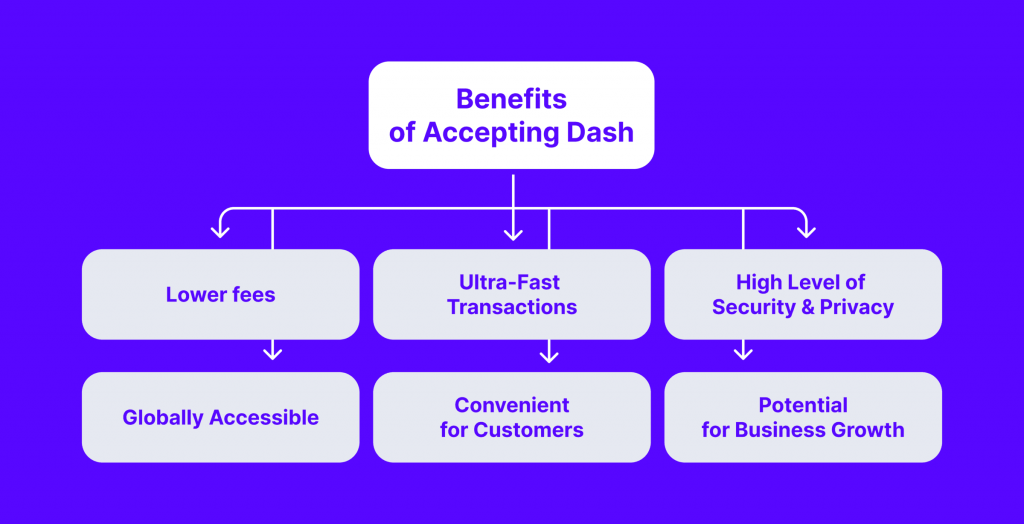

Accepting Dash payments offers numerous advantages for businesses, ranging from cost savings to enhanced security and global accessibility.

Lower Transaction Fees

Dash transactions typically incur lower fees than traditional payment methods and other cryptocurrencies. This can result in significant cost savings for businesses, particularly those engaged in frequent or high-value transactions.

Faster Transactions

Dash’s InstantSend feature confirms transactions within seconds, providing near-instantaneous settlement. This rapid transaction speed enhances the overall payment processing efficiency, reducing waiting times and improving customer satisfaction.

Enhanced Security and Privacy

Dash’s privacy features, such as PrivateSend, offer enhanced confidentiality by blurring transaction histories. This ensures that sensitive financial information remains protected, reducing the risk of fraudulent activities and improving customer trust.

Global Accessibility and Inclusivity

Dash transactions are borderless, enabling businesses to reach customers worldwide without the limitations imposed by traditional financial systems. This global accessibility fosters inclusivity by providing individuals in underserved regions with access to financial services, empowering economic participation and growth.

Potential for Business Growth and Expansion

By accepting Dash payments, businesses can tap into a growing community of Dash users and enthusiasts. This expands their customer base, opening up new revenue streams and opportunities for growth. Additionally, adding innovative payment solutions like Dash demonstrates a forward-thinking approach, enhancing the business’s reputation and competitive edge in the market.

The benefits of accepting Dash payments extend beyond mere transaction processing, offering businesses a strategic advantage in today’s booming digital economy. From cost efficiency to global reach, Dash presents a compelling proposition for companies seeking to optimize their payment infrastructure and drive sustainable growth.

How to Accept Dash Payments

Whether you’re a seasoned online retailer or a budding entrepreneur, integrating Dash payments into your business is simpler than ever. Accepting Dash payments involves setting up a secure infrastructure and integrating payment processors to facilitate seamless transactions.

Setting up a Dash Wallet

- Choosing the right wallet for businesses – Select a Dash wallet that meets the specific needs and preferences of your business. Consider factors such as platform compatibility, ease of use, and security features. Options include hardware wallets for enhanced security, desktop wallets for convenience, and mobile wallets for flexibility.

- Security considerations – Prioritise security when setting up a Dash wallet address for your business. Implement robust password protection, enable two-factor authentication, and regularly update the wallet software to mitigate security risks. Additionally, offline storage options such as hardware wallets should be considered to safeguard against online threats.

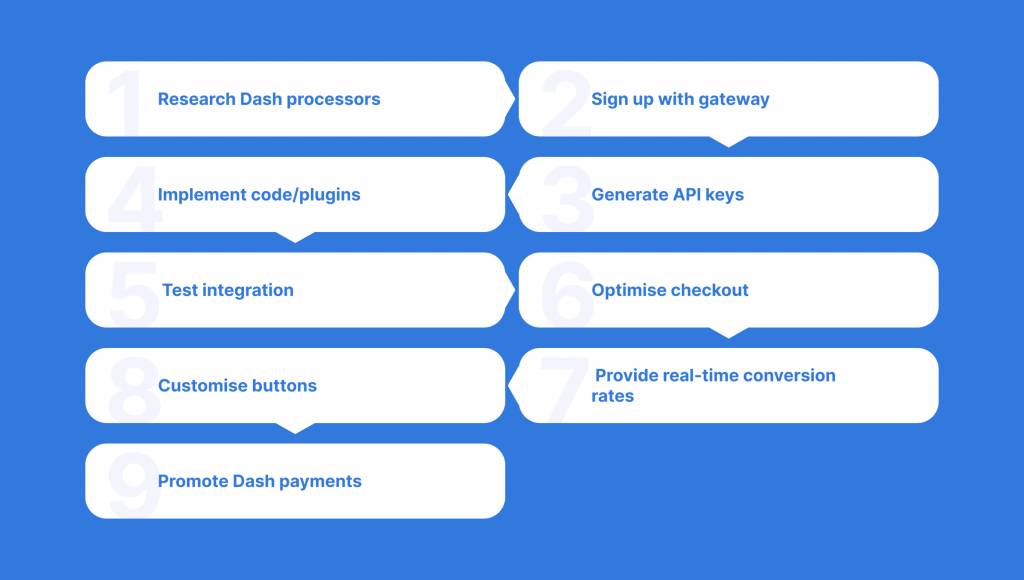

Integrating Dash Payment Gateway

- Research and identify reputable Dash payment processors that support Dash transactions.

- Sign up for an account with the chosen payment gateway.

- Generate Dash API keys or integration tokens to connect your business platform with the payment processor.

- Implement the necessary code snippets or plugins the payment processor provides to enable Dash payments on your website or point-of-sale system.

- Test the integration thoroughly to ensure functionality and compatibility with your business operations.

- Optimize the checkout process on your website to provide a seamless and intuitive experience for customers. Incorporate Dash payment buttons prominently within the checkout to streamline the payment process and encourage adoption.

- Provide real-time conversion rates and transaction status updates to enhance transparency and trust.

- Lastly, customize Dash payment buttons to align with your brand aesthetic and website design, and launch promotional campaigns!

By following these steps and best practices, businesses can effectively integrate Dash payments into their operations, offering customers a convenient and secure payment option while expanding their revenue streams.

Legal and Regulatory Considerations

Ensuring compliance with legal and regulatory requirements is essential when you decide to accept Dash payments. Restrictions may vary significantly from one region to another, impacting licensing requirements, consumer protection laws, and anti-money laundering (AML) regulations. Depending on your business activities and geographical location, you may be required to obtain specific licenses or permits to accept Dash coin payment legally.

Cryptocurrency transactions may be subject to income tax, capital gains tax, or value-added tax (VAT), depending on the jurisdiction and the nature of the instant transactions. Maintain detailed records of Dash transactions, including sales revenue, transaction dates, and counterparties.

Protect your business and customers against cyber threats and fraudulent activities by implementing robust security measures. Utilise encryption technologies, multi-factor authentication, and secure crypto payment gateway to safeguard sensitive information and prevent unauthorized access.

Promoting Dash Payments

Promoting Dash payments involves educating customers, incentivizing adoption, implementing marketing strategies, and fostering collaboration with the Dash community and influencers.

- Educate customers about the advantages of using Dash.

- Offer educational materials, such as blog posts, tutorials, and FAQs, to help customers understand how Dash works and how they can use it for transactions.

- Encourage Dash adoption by offering discounts or special promotions for customers who pay with Dash.

- Provide exclusive offers or incentives specifically for Dash users to attract new customers and retain existing ones.

- Create targeted advertising campaigns to reach Dash users and enthusiasts.

- Promote your business and its acceptance of Dash payments using online advertising platforms, social media channels, and cryptocurrency-related websites.

- Produce engaging content related to Dash and cryptocurrency to attract and educate potential customers.

- Participate in Dash community events, forums, and social media groups to connect with Dash users and enthusiasts. Share updates that your companies receive Dash payments.

- Collaborate with Dash influencers and thought leaders to promote your business and its acceptance of Dash payments.

Bottom Line

Dash sets itself apart with features like improved privacy and faster transactions, making it increasingly popular among businesses as a payment option. As the digital economy grows, integrating Dash can help your business keep pace and appeal to more customers.

Start by choosing a reliable crypto payment processor that supports Dash and follows the latest cryptocurrency trends that will broaden your customer base.