Mantra Token Price Drops 90% in 24 Hours – The First Token Crash of 2025?

Amidst the current market unpredictability and volatility, Mantra drew massive attention from crypto enthusiasts and digital asset traders; however, due to the bad news.

The token collapsed massively, losing most of its value in a few hours, depicting a steep drop in its price chart and reminiscing about the infamous LUNA crash in 2022.

The Mantra token price crash triggered a wave of accusations between project insiders and centralized exchanges, leaving investors and token holders confused about what happened and what will happen.

Let’s analyze the reasons for this drop and what the on-chain analysis tells us.

Mantra Token Price Collapse: What Happened?

On April 14th, Mantra, the native cryptocurrency of the Mantra blockchain, collapsed, losing 90% of its value and simulating what could be the largest crypto crash since TerraLuna.

The OM token was trading at $6.30 on April 13th before the drop. At 17:00 UTC of the same day, the cryptocurrency started a steep drop, losing 75% of its value in one hour and reaching less than $0.50 by 19:00.

This freefall erased more than $5.2 billion in market capitalization, sparking fears of insider manipulation and poor exchange oversight.

The sharp decline happened during low-liquidity hours, exacerbating the impact of mass sell-offs. This timing has led many to question whether the crash was triggered naturally or deliberately.

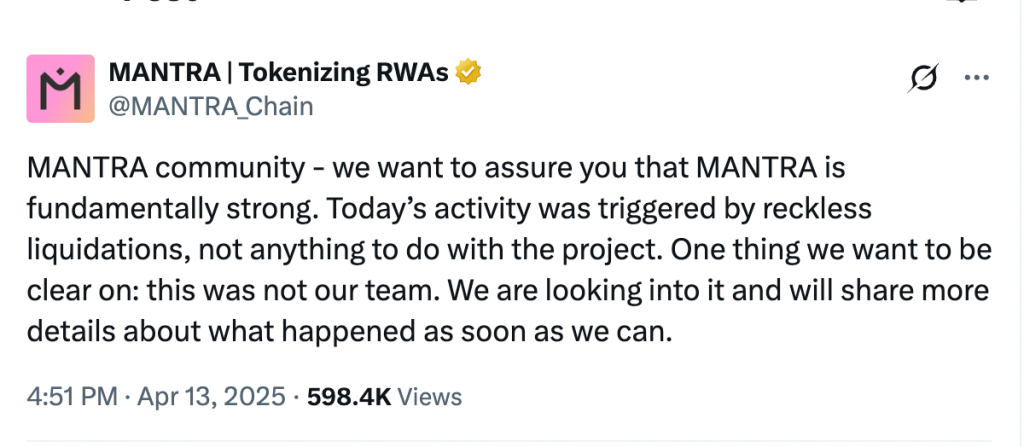

Swift Management’s Reaction

The co-founder, John Patrick Mullin, was quick to respond, assuring that the platform is still functioning and its Telegram groups are running uninterruptedly. John asserted that users’ holdings and money are safe, and no Mantra rug pull is involved in this incident.

In a post on X, Mullin stated that the sudden liquidations took place during illiquid periods of the market, which amplified the Mantra down trajectory and resulted in a price drop.

He emphasized that the core team still holds its token allocation and intends to continue building despite the setback.

Mantra’s Roadmap

Mantra was gaining momentum as a promising platform for real-world asset (RWA) tokenization. In January 2025, the company signed a $1 billion partnership with UAE-based DAMAC Group to tokenize real estate and digital infrastructure.

In February, it became the first DeFi project to receive a VASP license (Virtual Asset Service Provider) from Dubai’s Virtual Assets Regulatory Authority (VARA).

This milestone granted Mantra the legal right to operate in the UAE as a digital asset firm, positioning it as a rising player in the tokenized finance ecosystem.

However, the project’s future is now in jeopardy, with the community demanding answers to decide whether they shall or shall not trust the platform.

Insider Trading or CEX Liquidations

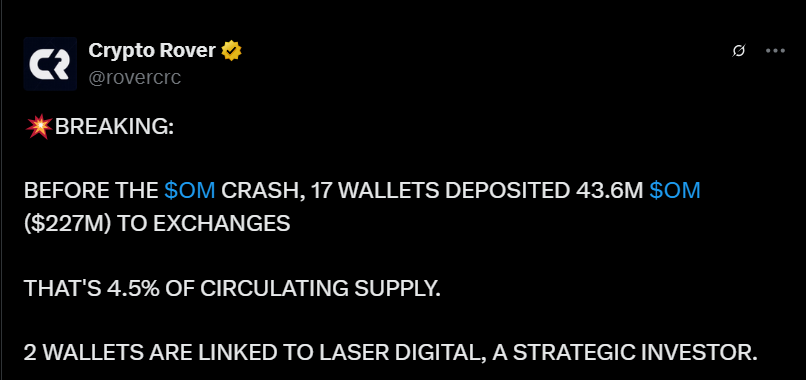

Blockchain analytics firm Arkham revealed that 17 wallets transferred roughly 43.6 million OM tokens (equivalent to $227 million) into exchanges just before the crash. This amounts to around 4.5% of the total circulation, which raises more doubts about this action.

What makes this more concerning is that two of these wallets were linked to Laser Digital, an early strategic investor in Mantra Chain. This revelation has intensified speculation about insider manipulation, questioning Mantra’s governance model and tokenomics.

However, the co-founder asserted that centralized exchanges were responsible for the crash. He criticized these platforms for initiating reckless, forced liquidations of large OM positions without sufficient notice or coordination, calling their actions a breach of trust.

While the exact motive is still unclear, centralized exchanges like OKX and Binance are now investigating what appears to be a coordinated insider dump.

Final Takeaways

The OM token’s crash created massive panic in the crypto market. While the overall market prices were not at their best, such a dramatic collapse was unexpected.

The Mantra token price quickly lost over 90% of its value within a few hours, triggering doubts about the company’s once-prosperous potential.

With insider team members and centralized exchanges blaming each other, will Mantra recover from this setback, as the co-founder suggests?