Payment Gateway vs Virtual Terminal: Understanding the Differences

Our century stands out in terms of the ability to modernize and digitize everything. The fiscal environment is no exception. Several years ago, gold was changed by money banknotes; currently, cash is going to be replaced by digital money.

To circulate digital money smoothly, we need several mechanisms, including payment gateways and virtual terminals. While these terms are often used interchangeably, they represent distinct elements of the online payment ecosystem. Let’s explore the disparities between the two.

Key Takeaways:

- A payment gateway is a customer-facing platform for online transactions, while virtual terminals empower merchants with manual entry capabilities.

- Implementing the proper payment processing solution enhances efficiency, security, and client satisfaction.

- Use payment gateway and virtual terminal to streamline transactions and drive business growth in the digital landscape.

What Is a Payment Gateway?

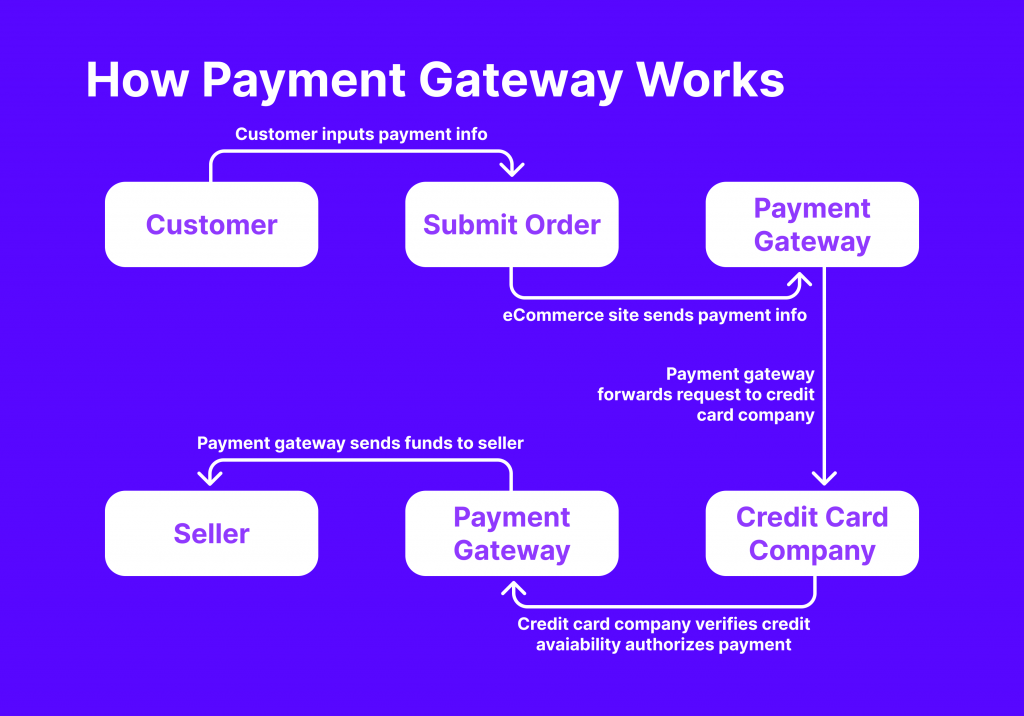

A digital platform that streamlines online transactions by acting as an intermediary between merchants and customers is a payment gateway. Their direct role is to securely confirm and process payments for goods and services purchased online.

It acts as the virtual counterpart of a traditional checkout counter, allowing clients to input their payment details on a website or through direct links provided by merchants. Once entered, the gateway encrypts this sensitive data into tokens for transmission to the payment processor, guaranteeing security throughout the transaction process.

Key Characteristics

A payment gateway is a software application that securely connects a merchant’s website or app to the bank or financial institution that processes payments. It authorizes clients to enter their payment details (such as credit card details or bank account information) during checkout.

The gateway then safely transfers this information to the payment processor, which verifies the operation with the customer’s bank. Once the transaction is authorized, the payment gateway sends a confirmation to the merchant, allowing the order to be fulfilled.

Payment gateway streamlines the payment process for both merchants and customers, making it convenient to buy and sell goods and services online. They support various payment methods, including credit/debit cards, digital wallets, bank transfers, and alternative payment options like PayPal or Apple Pay.

By offering multiple payment options, the payment gateway caters to a wide range of customers, increasing the likelihood of completing a transaction.

Security Features and Encryption Protocols

Security is paramount for payment gateways to protect sensitive financial information and prevent fraud. They employ encryption techniques such as SSL (Secure Socket Layer) or TLS (Transport Layer Security) to encrypt data transmitted between the customer’s device and the gateway.

Additionally, they often implement tokenization, which replaces sensitive card data with unique identifiers (tokens) to prevent unauthorized access to cardholder information. The payment gateway also adheres to PCI DSS (Payment Card Industry Data Security Standard) compliance standards, ensuring that it maintains a secure environment for processing payment data.

Fast Fact:

A payment gateway is an interface used to collect consumer payment information. In physical stores, payment gateways consist of point-of-sale (POS) terminals that accept credit card information by card or smartphone.

What Is a Virtual Terminal?

Virtual terminals are online interfaces provided by payment gateways or merchant service providers that enable businesses to enter and process credit card payments manually.

Unlike traditional physical terminals, online virtual terminals are accessed through a web browser, allowing merchants to accept payments without needing specialized hardware. Their direct objective is to facilitate card-not-present transactions, where the cardholder and the merchant are not physically present during the transaction.

A virtual terminal is a merchant-facing interface functioning as a dashboard within a virtual terminal merchant account. It allows merchant service providers to input credit card details for transactions conducted over the phone, via email, or through digital invoices. Unlike a payment gateway, which is customer-facing, a virtual terminal provides merchants with backend access to manage transactions efficiently.

Key Features

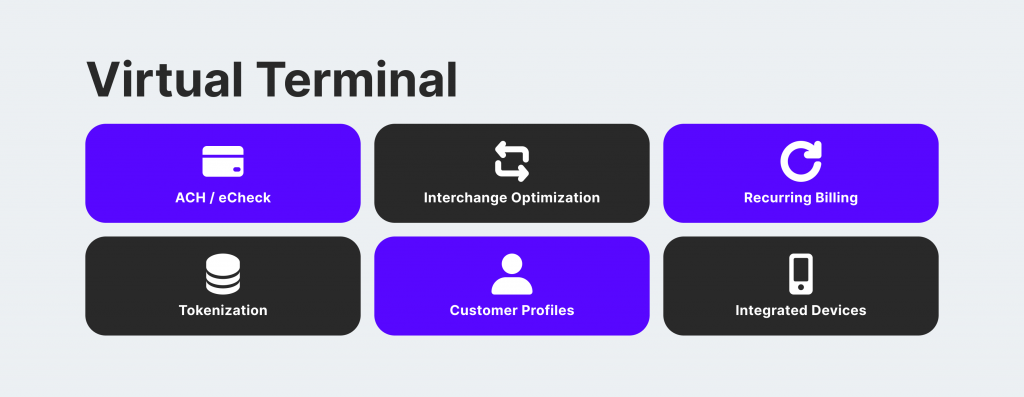

Virtual terminals can be accessed from any device with an internet connection, providing businesses with the flexibility to accept payments anywhere. They typically feature user-friendly interfaces that simplify the process of entering payment information, making it quick and efficient for merchants to process transactions.

Many virtual terminals support multiple currencies, allowing businesses to accept customer payments worldwide. They often include features for managing transactions, such as viewing transaction history, generating reports, and issuing refunds.

Some virtual terminals offer functionality for setting up recurring payments, making them suitable for subscription-based businesses.

Security Considerations and Compliance

Virtual terminals use encryption protocols such as SSL/TLS to secure the transmission of sensitive payment data over the internet, protecting it from interception by unauthorized parties.

Businesses using virtual terminals must adhere to the Payment Card Industry Data Security Standard (PCI DSS) to ensure the secure handling and storage of cardholder data. Many virtual terminals employ tokenization to replace sensitive card data with unique identifiers (tokens), reducing the risk associated with storing payment information.

Virtual terminals often include built-in fraud detection and prevention tools, such as address verification and velocity checks, to mitigate the risk of fraudulent transactions.

In summary, virtual terminals provide businesses with a convenient and secure way to accept card-not-present transactions. They offer key features such as accessibility, ease of use, multi-currency support, and robust security measures.

By complying with security standards such as PCI DSS and utilizing encryption and tokenization technologies, businesses can minimize the risk of data breaches and fraud while providing a seamless payment experience for their customers.

Realising the Distinctions: Payment Gateway vs Virtual Terminal

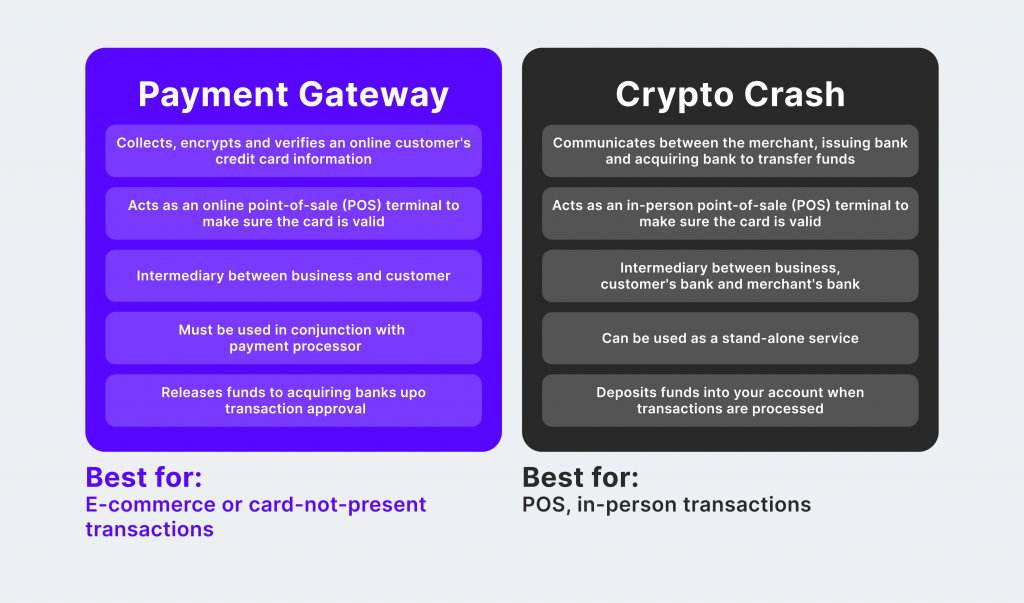

The primary distinction between a payment gateway and a virtual terminal lies in their intended users and functionality. While a payment gateway caters to customers by facilitating online transactions, a virtual terminal empowers merchants to process payments manually.

Let’s compare the virtual terminal and payment gateway across the specified aspects:

Cost Implications

Virtual terminals typically have lower upfront costs, with minimal or no setup fees and often no monthly charges. The payment gateway may have higher setup fees, ranging from a few hundred to several thousand dollars, depending on the provider and the level of customization required.

Transaction fees for virtual terminals are usually slightly higher than those for payment gateways, ranging from around 2.5% to 3.5% per transaction, plus a fixed fee. For payment gateways, fees often start at around 1.5% to 2.9% per transaction, plus a fixed fee.

Flexibility

Virtual terminals are suitable for businesses with lower transaction volumes, service-based industries, and companies primarily operating online or remotely. They offer basic features like invoicing, recurring billing, and customer management, making them adaptable to various business models.

A payment gateway is more suitable for businesses with higher transaction volumes, e-commerce stores, and businesses that require more advanced features like inventory management and shopping cart integration. It offers a wide range of features and customization options tailored to specific industries and business needs.

User Experience

Virtual terminals typically offer simple and user-friendly interfaces, with easy setup processes and intuitive navigation. Customization options may be somewhat limited compared to payment gateways, but primary branding and configuration are usually available.

Payment gateways often provide more advanced user interfaces, with extensive customization options and integrations with e-commerce platforms. Setup processes may be more involved, especially for businesses integrating with existing systems, but they offer more flexibility and scalability in the long run.

Use Cases and Suitability: Virtual Terminal vs Payment Gateway

Virtual terminal and payment gateway each have advantages and are suitable for different types of businesses. Virtual terminals are more cost-effective and user-friendly for smaller companies with more straightforward needs. At the same time, payment gateways offer greater flexibility, scalability, and security for larger businesses with higher transaction volumes and more complex requirements.

Let’s delve into the advantages of payment gateway for e-commerce businesses, virtual terminals for service-based companies, and considerations for businesses with both online and offline transactions:

E-commerce Businesses (Payment Gateway)

- Payment gateways offer a seamless checkout experience for e-commerce businesses, allowing customers to securely pay for goods and services online using various payment methods.

- The payment gateway integrates smoothly with popular e-commerce platforms like Shopify, WooCommerce, Magento, etc., enabling businesses to manage their online storefronts and payment processing in one centralized location.

- International payment gateways support multiple currencies and international transactions, facilitating sales to customers worldwide and expanding the reach of e-commerce businesses.

Service-Based Businesses (Virtual Terminal)

- Virtual terminals enable service-based businesses, such as consultants, freelancers, and professional services, to accept payments from clients without the need for physical card terminals.

- Service-based businesses can access virtual terminals from any location with an internet connection, allowing them to accept virtual terminal payments while on the go or working remotely.

- Virtual terminals often include invoicing features, allowing service-based businesses to generate and send invoices to clients easily, track payments, and manage billing cycles.

- Virtual terminals typically have lower setup costs and transaction fees than traditional payment terminals, making them a cost-effective solution for service-oriented businesses with lower transaction volumes.

Hybrid Models (Considerations for Businesses with Both Online and Offline Transactions)

- Businesses with online and offline transactions should consider payment solutions offering seamless integration between virtual terminals and payment gateways. This allows them to manage all payment channels from a single platform.

- Look for a payment service provider that offers omnichannel capabilities, enabling businesses to accept payments across multiple channels, including in-store, online, mobile, and over the phone, while maintaining a consistent and integrated customer experience.

- For businesses selling physical products both online and offline, integration between payment systems and inventory management software is essential to ensure accurate stock levels and streamline order fulfillment processes.

- Businesses should prioritize payment solutions that provide robust customer data management capabilities, allowing them to track customer interactions and purchase history across all channels to understand better and engage with their customer base.

Challenges and Limitations

Let’s explore the challenges and limitations associated with payment gateway and virtual terminal:

Technical Issues and Downtime

Payment Gateway – Technical glitches and system downtime can disrupt payment processing, leading to failed transactions and potential revenue loss for businesses. High transaction volumes or spikes in traffic during peak periods (e.g., holidays, sales events) can strain payment gateway systems, causing slowdowns or service interruptions.

Virtual Terminal – A virtual terminal relies on internet connectivity, so disruptions to internet service or server issues can impact transaction processing. Compatibility issues with browsers or devices may arise, affecting the functionality of the virtual terminal and hindering payment processing.

Regulatory Compliance and Legal Considerations

Payment Gateway – To ensure the security and privacy of customer data, payment processors must comply with various regulatory requirements, such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation). Changes in regulatory standards or new compliance mandates may require updates to payment gateway systems and processes, posing challenges for businesses to remain compliant.

Virtual Terminal – Similar to the payment gateway, the virtual terminal must adhere to regulatory standards for data security and privacy, particularly regarding handling sensitive payment information. Service-based businesses using virtual terminals may also need to consider industry-specific regulations and legal requirements related to billing practices, consumer protection, and financial transactions.

Customer Support and Troubleshooting

Payment Gateway – Timely and effective customer support is crucial for resolving technical issues and addressing concerns related to payment processing. Long response times or inadequate support can frustrate merchants and customers, impacting business operations and customer satisfaction.

Virtual Terminal – Service interruptions or usability issues with the virtual terminal may require prompt assistance from customer support to minimize disruptions to business activities. Service-based businesses relying on virtual terminals may require specialized support for billing inquiries, transaction disputes, and other payment-related issues unique to their industry.

Picking the Right Version for Your Company

Selecting between a payment gateway and a virtual terminal depends on your business model and requirements. While a payment gateway is essential for online transactions, a virtual terminal proves invaluable for merchants processing mail or phone orders. When deciding, consider factors such as transaction volume, customer preferences, and resource availability.

Payment Gateway – Ideal for e-commerce businesses, a payment gateway enables customers to make purchases online using various payment methods, including credit cards, debit cards, and digital wallets. It integrates seamlessly with websites and online platforms, offering convenience and security to both merchants and customers.

Virtual Terminal – Geared towards merchants, a virtual terminal simplifies the payment process for mail or phone orders, as well as in-person transactions at events. It eliminates the need for physical card readers and allows merchants to accept payments anywhere with an internet connection.

Final Remarks

To sum up, realizing the disparities between a payment gateway and a virtual terminal is crucial for optimizing your payment processing strategy. By using the right solution for your business needs, you can streamline transactions, enhance security, and provide a seamless payment experience for your customers. Whether you opt for a payment gateway, a virtual terminal, or both, prioritize efficiency and convenience to drive business growth.

FAQs:

Which one is the cheapest virtual terminal?

Square Virtual Terminal has no monthly fee or commitments. You only pay the remote processing fee of 3.5% + 15 cents or 2.6% + 10 cents for in-person payments.

What is a PayPal Virtual Terminal?

PayPal’s Virtual Terminal is a web-based application that processes credit and debit cards, replacing swipe machines. Merchants can accept credit or debit card payments by phone, fax, or mail.

What is the Sage Virtual Terminal?

Sage Virtual Terminal is a secure website that you can use to Review, process, or void current transactions.

Which is the best free payment gateway?

The Top Free Payment Gateways are PaySimple, Dwolla, Spreedly, PayLane, Sila, CSG Forte, Payrexx, and HighRadius.

Which one is the best payment gateway for small businesses?

PayPal is a popular payment gateway for overseas money transfers. It can process transactions in over 100 currencies. This application allows you to process debit and credit card payments.