Restaking Is the New Yield Farming — Should You Trust It?

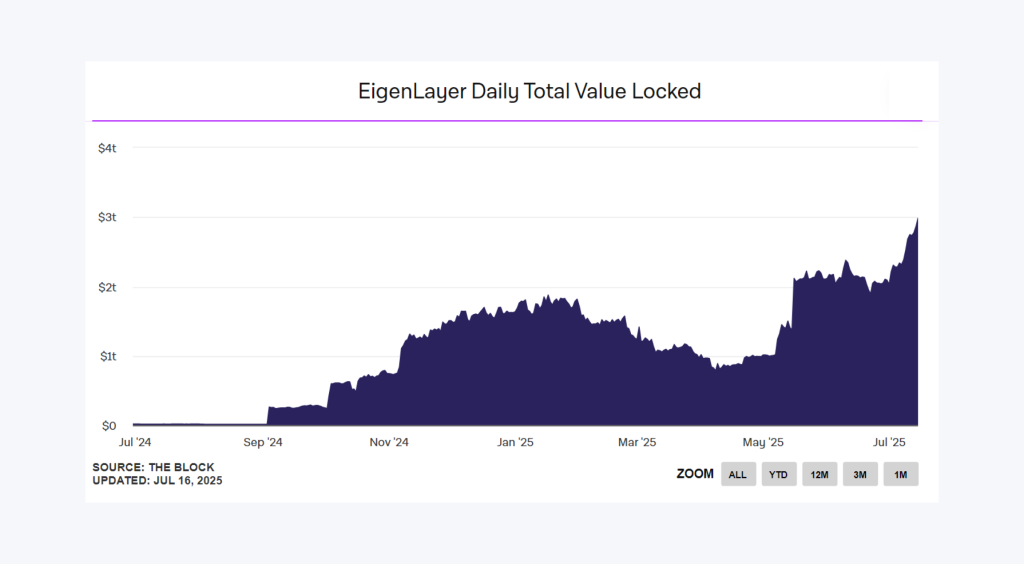

As of June 2025, a single protocol has attracted over $15 billion worth of staked ETH into its smart contracts. This protocol, called EigenLayer, is the center of a new, explosive trend in the crypto world: restaking.

This massive rush of capital into a new, complex system is drawing strong comparisons to the “yield farming” craze of past market cycles. Traders are once again on the hunt for the next major source of crypto passive income.

The question is whether restaking is a sustainable evolution in crypto-economic security or simply a more complex bubble.

Key Takeaways:

- Restaking uses already-staked ETH to secure new crypto networks in exchange for extra rewards.

- Restaking provides network security, while traditional yield farming provides market liquidity.

- The entire restaking ecosystem was pioneered by and is currently centered around a single protocol: EigenLayer.

- It is a high-risk, high-reward strategy best suited for advanced users who understand the complex, layered risks involved.

What Is Staking?

The entire concept of restaking is built upon the foundation of Proof-of-Stake (PoS). This is the consensus mechanism that now secures major blockchains like Ethereum, following its historic “Merge” event in September 2022. PoS systems replaced the energy-intensive process of mining.

In a PoS system, network security is not maintained by miners solving puzzles. Instead, it is provided by validators who lock up, or “stake,” the network’s native currency as collateral. This staked capital acts as a financial guarantee of their honest behavior.

These validators are then responsible for processing transactions and creating new blocks. If they act maliciously, a portion of their staked cryptocurrencies is destroyed in a process known as “slashing.”

Earning Yield Through Staking

In exchange for providing this crucial security service, validators receive a yield. This crypto passive income is generated from a combination of new token issuance and a portion of the network’s transaction fees.

As of mid-2025, the base staking yield for an asset like Ethereum consistently hovers around 3-4% APR. This is the baseline, risk-adjusted return for participating in the network’s security.

The Rise of Liquid Staking

The main drawback of traditional staking and restaking is that the staked assets are locked and illiquid. Liquid Staking Tokens (LSTs) were created to solve this problem.

Protocols like Lido Finance allow users to stake their assets and receive a liquid, tradable token in return, such as stETH. This LST represents a claim on the underlying staked asset but can be freely used across the DeFi ecosystem.

This innovation has been immensely successful. Today, liquid staking protocols secure tens of billions of dollars worth of assets, making LSTs a core, foundational component of the entire crypto economy.

What Is Restaking?

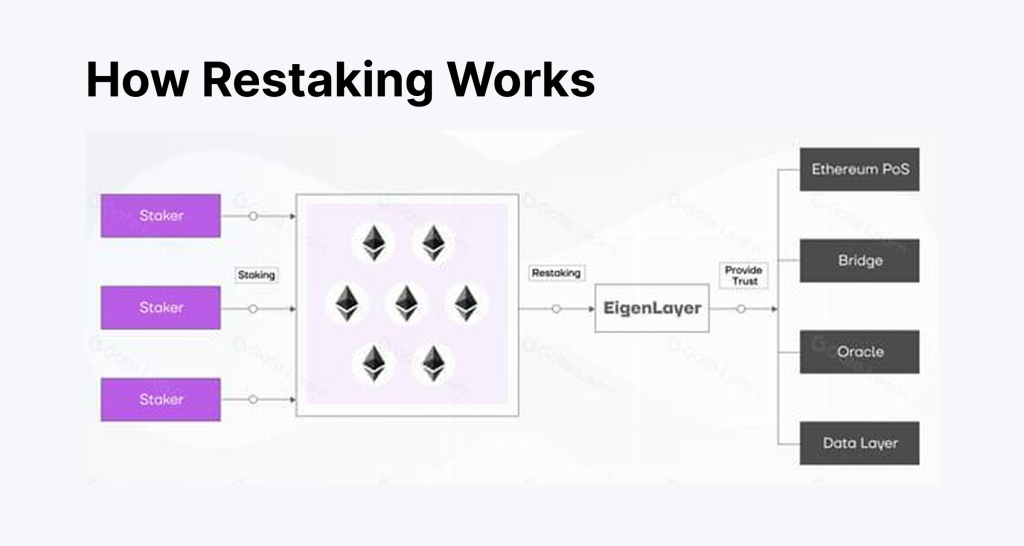

Restaking takes the concept of staking one step further. It is the process of using your already-staked assets to provide security for additional protocols beyond the main network itself.

About the EigenLayer Protocol

This entire category was pioneered and is currently dominated by a single protocol: EigenLayer. As of mid-2025, over 5 million ETH, representing more than $15 billion at current prices, have been “restaked” through its smart contracts.

EigenLayer’s core innovation is “pooled economic security.” It allows new protocols to essentially rent security from Ethereum’s massive staked capital base. This means they do not have to build their own expensive and time-consuming validator networks from scratch.

What are Actively Validated Services?

The protocols that use this rented security are known as Actively Validated Services, or AVSs. These are critical infrastructure projects like data availability layers (such as EigenDA), cross-chain bridges, oracle networks, and other systems that require their own distributed validation.

In exchange for helping to secure them, these AVSs pay a yield to the restakers. This creates a new source of crypto passive income on top of the base staking reward, which is the primary economic appeal of restaking.

Essentially, Eigenlayer restaking creates a marketplace for decentralized trust. Ethereum stakers can lease their capital’s security to new protocols, and new protocols can launch with robust security from day one. It is a powerful new primitive in the crypto economy.

How to Participate

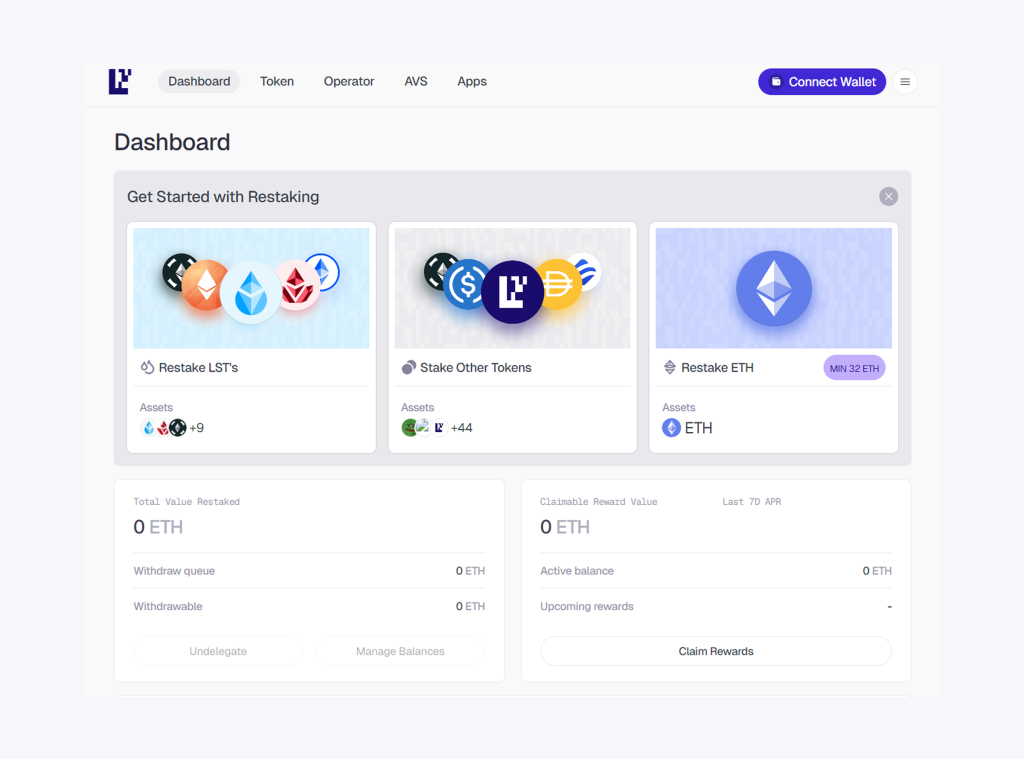

There are two distinct methods for participating in restaking. One is a high-commitment approach designed for technical professionals, while the other, known as liquid restaking, has opened the door to a much broader audience of crypto investors.

Direct Restaking

Directly restaking with EigenLayer requires running your own Ethereum validator node. This path comes with a significant barrier to entry: a required stake of 32 ETH (worth over $110,000 at mid-2025 prices) and the deep technical expertise to operate and maintain the node 24/7.

This approach offers the most control but is reserved for sophisticated, professional stakers who can manage the operational complexity.

Liquid Restaking

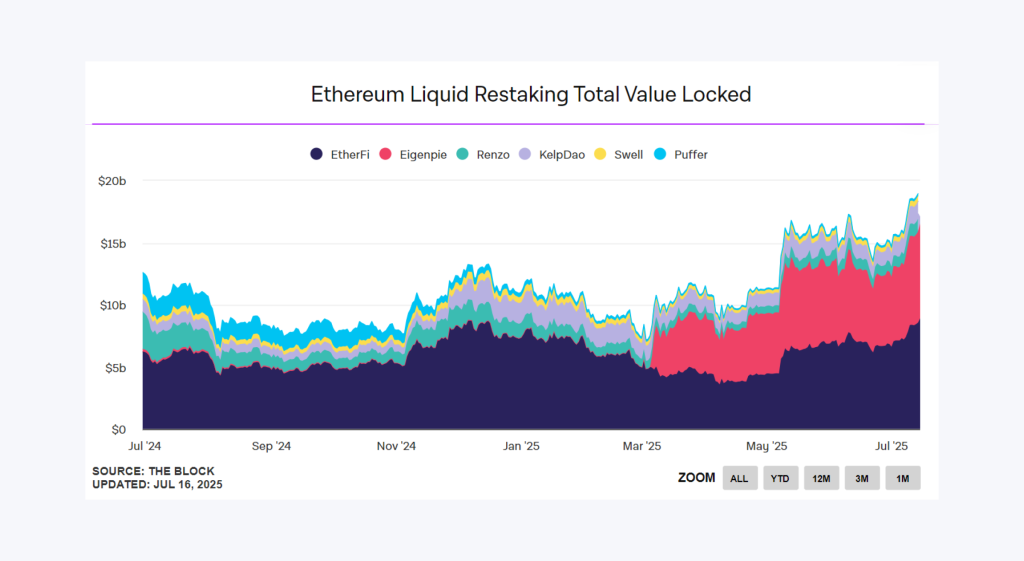

Liquid restaking is the dominant method for most users. It abstracts away all the technical complexity through third-party protocols. As of July 2025, this sector is led by platforms like Ether.fi and Puffer Finance, which together manage over $20 billion in restaked assets.

The process for a user is straightforward:

- Step 1: A user starts with an LST, such as stETH from Lido or rETH from Rocket Pool.

- Step 2: They deposit this LST into a liquid restaking protocol like Ether.fi.

- Step 3: In return, the protocol instantly mints and sends them a new token—a Liquid Restaking Token (LRT), such as Ether.fi’s eETH.

This new LRT is a fully liquid asset that represents the user’s claim on the underlying restaked position. It continues to accrue all the layered rewards—the base ETH staking yield, the AVS yields, and any protocol points—while remaining tradable and usable across the DeFi ecosystem.

These liquid protocols act as aggregators. They pool thousands of users’ assets and handle the complex backend work of delegating the stake to validator nodes and AVSs.

Why the Hype?

The intense excitement surrounding restaking is driven by the promise of layered rewards. The system is designed to offer multiple streams of yield from a single underlying asset, but the most significant driver of the current market hype is not the immediate yield itself, but the speculation on future token distributions.

The Two Layers of “Real” Yield

The foundational reward comes from combining two sources. First, there is the base staking yield from the underlying Ethereum network. Second, there are the additional fees paid by the Actively Validated Services that are being secured by the restaked capital.

This combined interest is the “real,” sustainable yield of the system. However, this is not what has attracted billions of dollars into the ecosystem in early 2025.

The Real Driver

The primary driver of the current restaking narrative is the speculation on future airdrops, tracked through a system of points. Both the core protocol, EigenLayer, and the liquid restaking platforms built on top of it (Ether.fi, Puffer, and Kelp) have their native restaking point systems.

Users accumulate these points based on the amount of capital they deposit and the duration for which it is held. The entire market is operating on the widely held assumption that these points will be converted into valuable governance tokens during future airdrop events.

This “points meta” turns staking and restaking into a large-scale speculative bet on the future value of these yet-to-be-launched tokens.

The potential for a massive, one-time airdrop payout is what defines this new form of crypto passive income, making it far more about future capital efficiency than immediate yield.

Restaking vs Yield Farming

The high yields and intense market excitement surrounding restaking have drawn many comparisons to the “DeFi Summer” yield farming craze.

While both offer pathways to generating significant returns, the underlying economic models and the services provided are fundamentally different.

Here is a direct comparison of restaking vs yield farming:

The Core Service Provided

- Yield Farming: A user provides liquidity to a protocol. They deposit a pair of tokens into a decentralized exchange (DEX) or lend out an asset on a lending platform, acting as a decentralized market maker or lender.

- Restaking: A user provides economic security. Their staked ETH acts as a form of insurance or collateral, guaranteeing the honest operation of other protocols (AVSs) built on top of the base layer.

The Source of the Yield

- Yield Farming: The yield often comes from inflationary token rewards. The protocol mints and distributes its own governance token as an incentive to attract initial liquidity, a model that is often unsustainable long-term.

- Restaking: The “real” yield comes from a share of the fees generated by the AVSs being secured. The current speculative yield comes from accumulating restaking points, which are expected to convert into valuable airdrops.

The Primary Financial Risk

- Yield Farming: The main risks are impermanent loss for liquidity providers and the risk of smart contract exploits or “rug pulls,” as many protocols are anonymous and unaudited.

- Restaking: The main risk is slashing. If the validator a user is delegated to misbehaves, their underlying staked ETH can be confiscated. Restaking compounds this risk across multiple services.

The Risks

The promise of layered yield from restaking comes with layered, complex risks. This is not a simple, low-risk strategy. The entire system is new, largely untested at scale, and introduces multiple potential points of failure that do not exist in traditional staking.

Compounded Slashing

The most significant and direct risk is slashing. In standard staking, a validator’s ETH is slashed if they act maliciously or fail to perform their duties. In restaking, that same staked ETH is used to secure multiple networks simultaneously.

This means a single failure event on one validator node could trigger slashing penalties across all the different services it helps to secure. This “compounded” slashing risk could lead to a far greater loss of the underlying capital compared to standard staking.

Centralization and Systemic Risk

As of mid-2025, the entire restaking ecosystem is heavily dependent on a single protocol: EigenLayer. This has created significant concerns within the crypto community about centralization. A critical bug or an economic failure in EigenLayer’s core contracts could have a catastrophic cascading effect on every AVS and liquid restaking protocol that relies on it.

This concentration of power and capital creates a potential systemic risk for the broader Ethereum ecosystem.

Smart Contract and Operational Risk

The staking and restaking activities involve multiple layers of complex smart contracts interacting with each other. A user’s capital moves from the base Ethereum layer, through a Liquid Staking Token protocol, into a Liquid Restaking protocol, and is then delegated by an operator to multiple AVSs.

A vulnerability or exploit in any one of these additional layers could result in a total loss of user funds. While the top protocols are heavily audited, the sheer complexity of this multi-layered system inherently increases the surface area for potential attacks.

Conclusion

Restaking is a powerful financial primitive. It introduces a new way to secure decentralized services by leveraging Ethereum’s existing trust layer, creating the potential for layered, real yield.

However, these higher potential rewards come with compounded risks. The dangers of slashing, smart contract vulnerabilities, and centralization are significant and complex.

For this reason, restaking should not be treated like the new yield farming. It is a sophisticated tool best suited for advanced, risk-tolerant users who fully understand the multi-layered risks they are taking on.

FAQ

What is the meaning of restaking?

Restaking is the process of using your already-staked assets (like ETH) to help secure other new protocols, such as data networks or bridges, in exchange for additional rewards.

What is the difference between staking and restaking?

In standard staking, your assets secure only one network. In restaking, those same assets are used to simultaneously secure multiple networks, which increases your potential yield but also your risk.

What are the restaking points?

Restaking points are loyalty scores given out by protocols like EigenLayer. Many users collect these points in the hope that they will be converted into a valuable token airdrop in the future.