Top 10 Altcoins Of 2023 — Biggest Tokens of the Year

2023 has become a landmark year for the cryptocurrency industry, with major changes and developments occurring. Active addresses continue to hit all-time highs, and more people engage with blockchain technology through DeFi and NFTs. Meanwhile, BTC started gaining momentum in the second half of 2023, with its price reaching new highs and sparking renewed interest in the market.

But while Bitcoin remains a dominant player, there are altcoins that are making waves in the crypto market. In this article, we will explore the biggest altcoins of 2023 and their unique features that position them for success in the future of the digital currency industry.

Key Takeaways:

- Altcoins, or alternative cryptocurrencies, offer unique features and use cases that set them apart from traditional coins like Bitcoin.

- Ethereum is the second-largest cryptocurrency by market cap, known for its smart contract capabilities.

- Other notable altcoins include Binance Coin, Solana, XRP, Cardano, Dogecoin, Tron, Polkadot, Avalanche and Chainlink.

What Is An Altcoin?

The term “altcoin” is derived from two words – “alternative” and “cryptocurrency”. Simply put, altcoins refer to all coins that are not Bitcoin. These alternative cryptocurrencies were created in an attempt to address the technical and practical challenges faced by Bitcoin.

Altcoins vary greatly in terms of their technology, purpose, and value. Some of the more well-known altcoins include Ethereum, Solana, and Ripple. While Bitcoin is most commonly priced in fiat currencies such as dollars or euros, altcoins are typically priced in Bitcoin.

The birth of altcoins can be traced back to the introduction of blockchain technology by Bitcoin after the global financial crisis of 2008. As BTC gained popularity and established itself as the leading cryptocurrency, it also opened up opportunities for other cryptocurrencies to emerge.

Second and third-generation cryptocurrencies like Litecoin and Ether were created as alternatives to Bitcoin, offering improved features and functionalities. These altcoins have gained a significant following and continue to grow in popularity.

Now, let’s take a look at the top 10 altcoins of 2023:

1. Ethereum (ETH)

Unlike traditional cryptocurrencies like Bitcoin, which primarily serve as a store of value, Ethereum offers much more than just a digital currency. It serves as a playground for developers and enterprises to build and deploy smart contracts and decentralized applications (dApps).

Smart contracts are self-executing contracts coded on the blockchain and are designed to perform a specific set of actions automatically when certain conditions are met. With the support of smart contracts, Ethereum is a go-to platform for building dApps today. From decentralized finance (DeFi) to supply chain management, dApps disrupt traditional industries and pave the way for a more decentralized future.

Recently, Ethereum has undergone an upgrade known as “Ethereum 2.0”. This upgrade aims to improve the network’s scalability, security, and decentralization by transferring it from a Proof of Work to a Proof of Stake consensus algorithm. It officially kicked off with the launch of the Beacon Chain in December 2020 and continues to roll out gradually.

Fast Fact

Proof of Stake is a consensus mechanism that relies on validators to stake their tokens as a form of collateral in order to reach a consensus. PoS is more energy efficient than PoW as it does not require miners to compete for block rewards using computing power.

With a market capitalization of $265.5 billion, Ethereum holds the title of the largest altcoin by market cap. Its robust infrastructure, advanced smart contract capabilities, and a vast array of dApps have solidified its position as a powerhouse in the crypto world.

Market cap of ETH: $265.5 billion

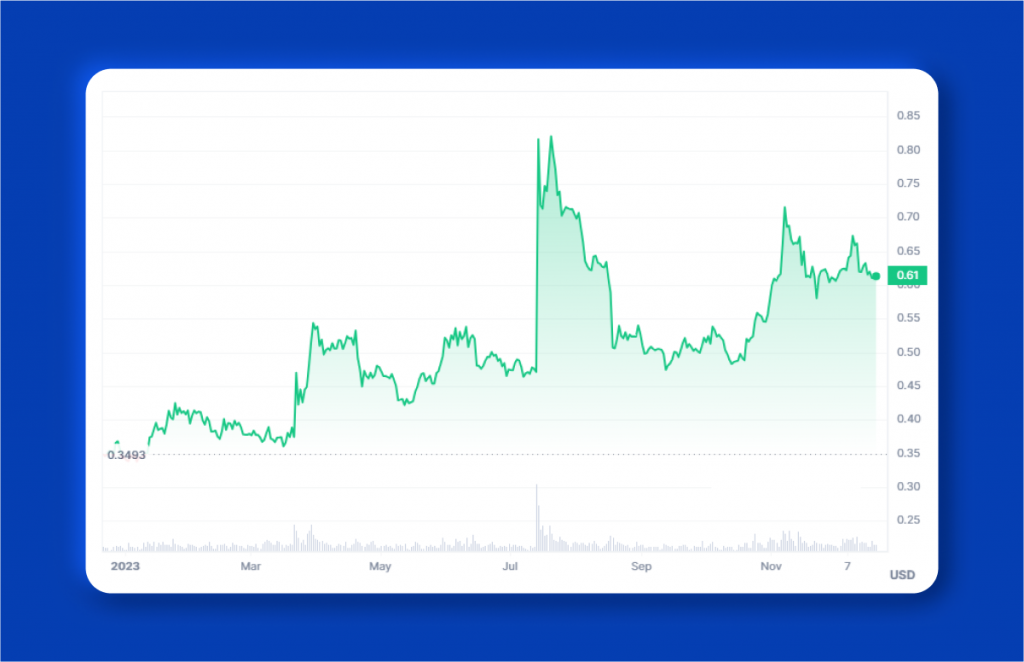

The price action of ETH throughout the year:

2. Binance Coin (BNB)

Binance Coin (BNB) is the native cryptocurrency of one of the world’s largest cryptocurrency exchanges, Binance. Launched in 2017 as an ERC-20 token on the Ethereum blockchain, BNB later migrated to its own blockchain, Binance Chain.

With a market capitalization of $37.4 billion, Binance Coin holds the position of second largest altcoin by market cap, right after Ethereum.

But BNB is more than just a digital currency. It holds significant utility within the Binance ecosystem, allowing users to pay transaction fees, participate in token sales, and access various services. Its liquidity, integration with multiple applications, and popularity among traders have contributed to its rapid growth.

Aside from its use cases within the Binance platform, BNB also has staking and governance capabilities through its BNB Smart Chain (BSC). This allows holders of BNB to participate in network governance and earn rewards for staking their coins.

Binance’s launch of the BNB Smart Chain has expanded the use cases for BNB even further. With its compatibility with Ethereum Virtual Machine and low transaction fees, BSC has become a popular platform for DeFi applications.

Market cap of BNB: $38.9 billion

The price action of BNB throughout the year:

3. Solana (SOL)

While Ethereum undoubtedly holds its position as the leading platform for decentralized applications, Solana has emerged as a strong contender in the blockchain industry.

Solana boasts a third-generation architecture that is designed to be highly performant and scalable, making it an attractive option for developers looking to build complex dApps. Its unique consensus mechanism combines Proof of Stake and Proof of History (PoH) to increase speed and efficiency while still maintaining a level of decentralization.

Solana also offers support for a wide range of use cases, from DeFi platforms to NFT marketplaces. Its capabilities are constantly expanding as more projects and developers flock to the platform.

Currently ranked within the top ten crypto assets by market capitalization at $33.5 billion, Solana has made a significant impact in the crypto space since its launch in 2020 through the Initial Coin Offering (ICO). It is definitely a project to keep an eye on in 2024 and beyond.

Market cap of SOL: $33,5 billion

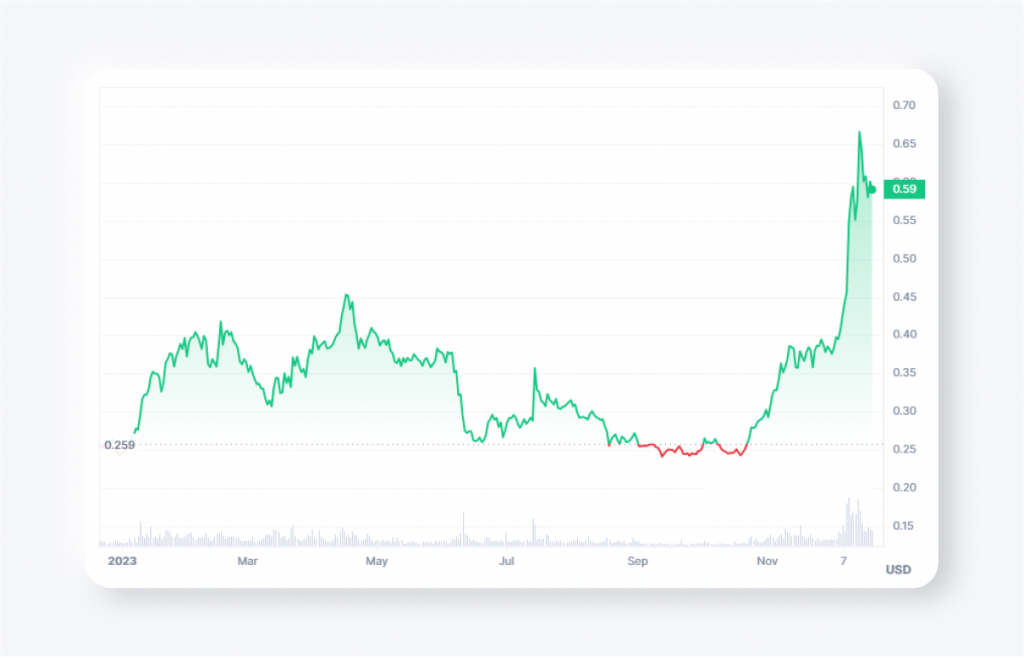

The price action of SOL throughout the year:

4. XRP (XRP)

XRP, the digital currency and native token of the Ripple network may seem like just another cryptocurrency at first glance. However, it offers unique qualities that set it apart from other cryptocurrencies like Bitcoin and Ethereum.

While many refer to XRP as “Ripple”, it’s important to note that XRP is an independent open-source digital asset while Ripple is a technology company. XRP is used to facilitate fast and cost-effective international money transfers, making it an essential component of Ripple’s solutions.

Powered by its decentralized, open-source blockchain called the XRP Ledger (XRPL) and the Ripple Transaction Protocol (RTXP), XRP specializes in secure cross-border transactions. Its carbon-neutral and efficient nature has gained favor from financial institutions worldwide.

Despite its success, XRP has faced challenges from regulatory bodies throughout the years. One notable event was the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC). However, in 2023, after a series of victories for Ripple, including XRP being deemed not security by the SEC, there is growing confidence in the crypto community about the future of XRP. XRP’s Chief Legal Officer, Stuart Alderoty, predicts further victories and a diminishing role of “regulation by enforcement” in 2024.

With a market capitalization of $33.2 billion, XRP continues to hold its position as a dominant player in the crypto asset market. Its unique features and effectiveness in real-time gross settlement systems, currency exchange, and remittance services have solidified its place as a valuable asset in the digital economy.

Market cap of XRP: $33.1 billion

The price action of XRP throughout the year:

5. Cardano (ADA)

Cardano aims to provide a more refined and scientifically driven alternative to Ethereum. As a third-generation blockchain platform, Cardano seeks to address many of the issues faced by previous generations.

One of the key features that sets Cardano apart is its unique proof-of-stake algorithm, Ouroboros. Developed through peer-reviewed research, Ouroboros offers a more energy-efficient alternative to the resource-intensive proof-of-work mechanism used by Bitcoin and other coins.

In addition, Cardano also places a strong emphasis on compliance and governance. The project involves stakeholders who hold ADA cryptocurrency in the decision-making process, aiming to create a more democratic and sustainable ecosystem.

In addition to its focus on sustainability, Cardano also offers a layered architecture that allows for flexibility and seamless interoperability with other systems. This opens up opportunities for developers to build dApps and use cases beyond just financial everyday transactions.

Market cap of ADA: $20,9 billion

Price action of ADA throughout the year:

6. Avalanche (AVAX)

Avalanche is another competitor to Ethereum in the world of smart contracts and dApps. Launched in 2020, Avalanche aims to offer a faster, more affordable, and more versatile alternative to the ETH blockchain.

One of the key features that sets Avalanche apart is its consensus protocol. Unlike Ethereum’s proof-of-work algorithm, which requires extensive computational power, Avalanche uses a unique “Snow” consensus protocol that allows for high transaction speeds and low fees.

Additionally, Avalanche offers its own set of tools and services for developers to build and deploy dApps easily. These include the Avalanche-Ethereum Bridge, which allows for seamless interoperability between the two platforms.

Overall, Avalanche’s combination of speed, affordability, versatility, and accessibility make it a strong contender in the world of blockchain platforms.

Market cap of AVAX: $15,4 billion

The price action of AVAX throughout the year:

7. Dogecoin (DOGE)

Dogecoin is often referred to as the “meme” cryptocurrency, but it also has its own unique features and use cases. Created in 2013 by software engineers Billy Markus and Jackson Palmer, Dogecoin was initially intended as a lighthearted parody of the growing number of altcoins at the time.

However, what started off as a joke quickly gained traction and became a legitimate cryptocurrency with its own passionate community. One of the key features that sets Dogecoin apart from other cryptocurrencies is its low price and unlimited supply.

But perhaps the most notable use of Dogecoin is its online tipping system. The community has a reputation for being friendly and generous, often “tipping” each other in DOGE as a way to show appreciation for content or contributions within the community.

Despite its initial origins as a joke, Dogecoin has proven to have staying power and continues to gain mainstream adoption. In fact, billionaire entrepreneur Elon Musk even declared Dogecoin as his favorite cryptocurrency.

While it may not have the advanced capabilities of other cryptocurrencies like Ethereum or Solana, Dogecoin’s strong and supportive community, along with its growing adoption, make it a force to be reckoned with in the crypto world.

Market cap of DOGE: $12,9 billion

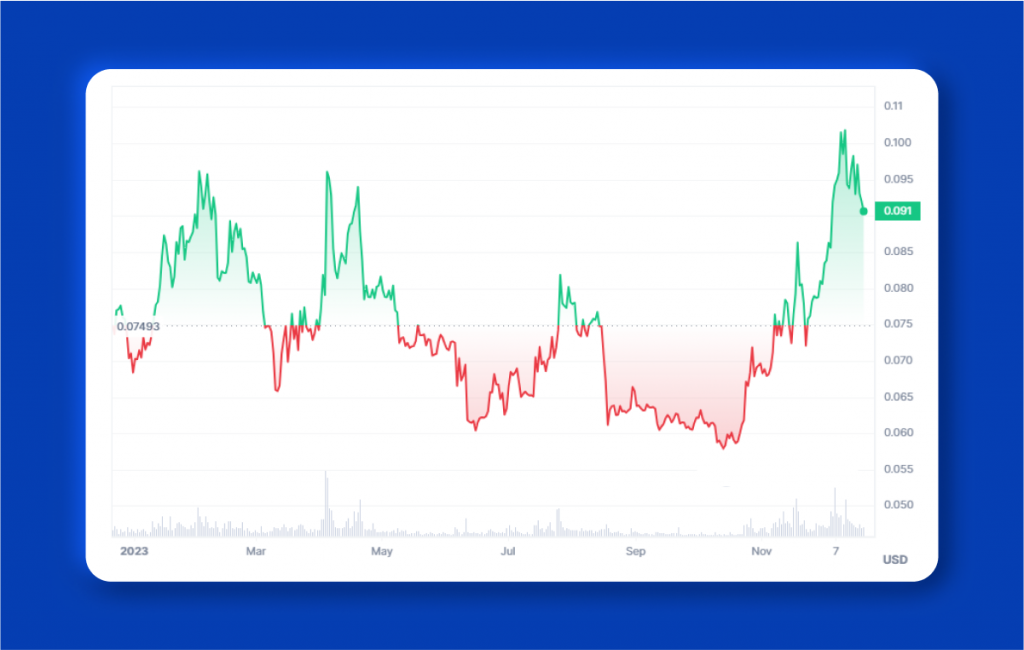

The price action of DOGE throughout the year:

8. Tron (TRX)

Tron is a blockchain platform designed for building and deploying decentralized applications. However, Tron takes it one step further by focusing on the decentralization of the media and entertainment industries. With its slogan “Decentralize the Web”, Tron aims to remove corporate middlemen and allow content creators to directly connect with their audience.

One notable feature of Tron is its support for smart contracts through its own virtual machine, known as the TRON Virtual Machine (TVM). This allows developers to build dApps on the network using solid and secure smart contract technology.

In addition to its focus on decentralization, Tron also boasts the largest global circulating supply of USDT stablecoins. These are tokens that maintain a stable value and are crucial for the DeFi sector in providing financial stability.

Since its launch in 2017, Tron has continuously improved and evolved. In December 2021, it became a fully community-governed decentralized organization, solidifying its commitment to decentralization.

Market cap of TRX: $9 billion

The price action of TRX throughout the year:

9. Polkadot (DOT)

Polkadot, created by Ethereum co-founder Dr Gavin Wood, is a next-generation blockchain platform that aims to solve the problem of scalability and interoperability in the cryptocurrency space.

At its core, Polkadot is a network of interconnected blockchain networks, known as parachains, which can communicate and transact with one another. This allows for increased scalability, as each parachain can handle its own transactions while still being able to communicate with the broader network. This “infrastructure for infrastructure” approach is essential for bringing Web3 to life.

The native cryptocurrency of Polkadot, DOT, fuels the network’s operations and governance. It also holds value as an investment asset, with a current market capitalization of $8,7 billion.

However, despite its potential, Polkadot’s progress has been slow, and its adoption is still lacking. The reason for this lies primarily in the lack of star applications for the ecosystem. However, the project is actively growing, so it’s worth watching in 2024.

Market cap of DOT: $8,7 billion

The price action of DOT throughout the year:

10. Chainlink (LINK)

Chainlink is often called the bridge between blockchain technology and real-world data. Its decentralized oracle network enables smart contracts to access reliable and tamper-proof data from external sources.

The main goal of Chainlink is to provide a secure and trustworthy connection between smart contracts and off-chain data. Network operators are incentivized to retrieve data from various sources, format it into usable formats, and perform necessary computations.

Chainlink’s capabilities extend to weather forecasts, sports outcomes, IoT sensor readings, and many other applications, opening up a new world of possibilities.

Furthermore, Chainlink’s open-source nature allows for collaboration and innovation within the community. Anyone can view and contribute to the project’s code, promoting transparency and decentralized development.

With an ever-growing list of use cases, Chainlink is proving to be a crucial component in unlocking the full potential of blockchain technology. While the demand for secure and reliable data increases, the value of LINK tokens is also growing, making it a strong contender in the cryptocurrency market.

Market cap of LINK: $8,2 billion

The price action of LINK throughout the year:

FAQs

Are stablecoins considered altcoins?

There is some debate whether stablecoins should be considered as altcoins. On one hand, stablecoins do not fit the traditional definition of altcoins as they are designed to maintain a stable value against another asset, such as the U.S. dollar.

On the other hand, some argue that stablecoins should still be considered altcoins because they are an alternative form of cryptocurrency to Bitcoin, the first and most well-known cryptocurrency.

What are the top 3 altcoins?

The top 3 altcoins by market capitalization as of December 2023 are Ethereum (ETH), Binance Coin (BNB), and Solana (SOL). These altcoins have different use cases and are distributed across various blockchains. It’s important to note that the ranking of altcoins is constantly changing.

Are altcoins a good investment?

As with any other investment, there are risks associated with investing in altcoins. The altcoin market is highly volatile and unpredictable, so it’s essential to research before investing in any altcoin.

However, some altcoins have shown promising growth and adoption, making them potentially profitable investments. Do not forget to have a diversified portfolio and only invest what you can afford to lose.