What is a Crypto Liquidity Bridge – Do You Need One?

Activating your brokerage firm requires connectivity with liquidity pools and trading venues, from which you can source financial instruments, prices, and matching orders.

You can either partner with a liquidity provider that supplies trading capabilities or integrate a bridge that routes orders according to specific conditions. For example, you can adjust the crypto liquidity bridge to access liquidity for specific currency pairs, risk limits, execution type, and other parameters.

This flexible tool expands your liquidity practices and enables you to scale and control trading operations in your brokerage firm. Let’s dive deeper into this concept and how this technology works.

Key Takeaways

- Crypto liquidity bridges connect exchanges and brokers to multiple providers, offering enhanced pricing and execution quality.

- Trading platforms use this technology to minimize the need to build and maintain relationships with many liquidity providers and pools.

- Bridges aggregate and distribute trading assets, quotes, and order books from multiple sources and combine them in a single hub.

Understanding Crypto Liquidity Bridge Technology

The crypto liquidity bridge is a technology that connects trading platforms to multiple liquidity providers. They facilitate the free flow of assets and prices between LPs, market makers, and crypto liquidity pools on the one hand and brokerage firms, online trading software, and DEXs on the other.

The bridge serves as an intermediary solution, enabling seamless access to aggregated pricing and market depth, thereby allowing users to benefit from a broader liquidity pool.

This infrastructure plays a crucial role in improving execution quality and market efficiency, making trading faster, more flexible, and personalized.

It allows brokers and trading platforms to offer tighter spreads, deeper order books, and more competitive trading conditions. The technology utilizes (financial information exchange) FIX APIs, WebSocket connections, and intelligent routing protocols to ensure real-time, stable connectivity across various sources.

These solutions are especially valuable in crypto, where volatility, low liquidity on certain pairs, and exchange fragmentation can compromise trading performance.

Liquidity bridges solve these challenges by controlling access and routing flows based on real-time pricing, latency limits, and counterparty conditions. Additionally, some bridge providers enable brokers to customize their conditions, supporting tailored liquidity services.

As more traders and brokers enter the market, this technology has become essential for a professional, scalable infrastructure, equipping operators with a competitive advantage.

Liquidity Aggregation and Distribution

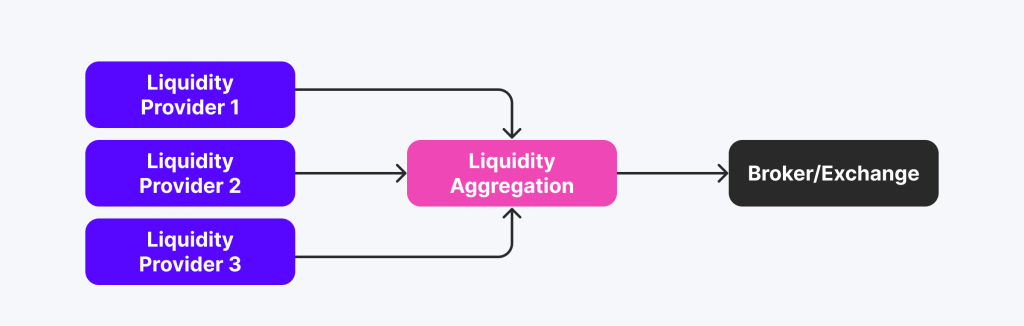

Aggregation and distribution are the main notions of a crypto liquidity bridge.

Aggregation involves collecting and consolidating prices and volumes from multiple sources, centralized exchanges, OTC desks, and crypto pools, into a single, unified feed.

Distribution delivers consolidated liquidity to end-users, including brokers, white-label trading platforms, and institutional investors, to ensure minimal slippage and optimized spreads.

This two-way structure ensures that offered assets are liquid regardless of where they originate from. It not only pulls data in but also selectively distributes it based on user preferences, trading behavior, and predefined risk parameters.

Liquidity Bridges vs Crypto Bridging

It is worth noting that ‘bridge technology’ in cryptocurrency can refer to two distinct things serving different purposes.

A crypto liquidity bridge focuses on aggregating and distributing pricing and execution across multiple trading venues, helping brokers and platforms access deeper markets. They work as an integrable software that enables brokers to customize their liquidity management and practices.

Crypto bridges, on the other hand, are blockchain protocols designed to transfer tokens between separate blockchain networks. They facilitate sending a cryptocurrency (e.g., ETH) from the Ethereum blockchain to the Polygon chain, for example, without requiring a swap into another coin.

Key Components of a Liquidity Bridge

This system combines complex technicalities that interact with multiple market players and derive real-time data, each contributing to the liquidity network. These form the core structure of any effective crypto liquidity bridge, ensuring efficient aggregation and fast execution.

Liquidity Providers

Institutional investing firms, asset managers, financial corporations, and OTC platforms play a key role in feeding bid-ask quotes into the bridge.

These crypto liquidity providers ensure competitive pricing and sufficient volume across trading pairs. The more suppliers connected, the better the depth and quality of the aggregated order book.

Market Makers

Market makers are middlemen and operators who continuously buy and sell assets to make them more available, ensuring price efficiency, tightening spreads, and boosting liquidity.

In bridge setups, they serve as stabilizing agents, especially during periods of low volume or high volatility. Some act algorithmically, such as automated MMs, reacting to real-time flow and adjusting quotes dynamically without manual intervention.

Brokerages

Brokerage firms leverage bridges to access institutional-grade liquidity without maintaining direct relationships with exchanges or LPs.

This allows them to offer tighter spreads and better execution to clients while also controlling markups and risk exposure through the bridge’s built-in tools.

Exchanges

Crypto exchange platforms use bridges to enhance their order execution practices with Tier-1 order books, especially when launching new trading pairs or expanding into less-traded assets.

Liquidity bridges enable them to match client orders against external pools and providers, improving execution quality and attracting higher trading volumes.

Who Uses Crypto Liquidity Aggregation Bridges?

These systems are prevalent in B2B settings. As such, end-users and retail traders do not have access to them. However, they benefit from their existence on the trading platform they deal with.

Financial entities and brokerages utilize this technology to enhance their liquidity access, particularly when scaling up their businesses, introducing new assets, or expanding into new financial markets.

This also includes institutional brokers, white-label crypto exchange/trading platforms, hedge funds, and proprietary trading desks that want to improve their digital asset liquidity and order execution.

Many brokers and startups use bridges to avoid the operational overhead of directly integrating with multiple LPs or managing fragmented order books. Even established exchanges often rely on aggregation technology to expand pair offerings and improve execution metrics.

For brokers, bridges allow them to customize pricing feeds and risk limits, offering high flexibility to serve different client types while maintaining full control over trade execution and market exposure.

How an Aggregation Bridge Works?

When a client trades, the bridge simultaneously pulls pricing data from all connected LPs and venues. It uses smart routing logic to identify the best price available and executes the trade accordingly.

Order execution may be filled fully from one venue (A-Book model or B-Book model) or split the order across several sources for best execution and minimal delay.

The system consists of several components:

- A pricing engine to aggregate and rank quotes.

- A smart order router (SOR) to execute trades optimally.

- Connectivity protocols to ensure real-time performance.

Bridges use different connectivity protocols (FIX API, REST, or WebSocket), while some include a risk management layer to apply exposure limits, markups, or filters based on client type or trading pair.

The infrastructure minimizes latency and supports high-frequency trading, especially at major exchanges that serve thousands of users and process millions of orders per second.

This technology simplifies the complexity of managing multiple liquidity connections, allowing clients to focus on service delivery and growth while ensuring tight spreads, reduced slippage, and top-notch execution.

Key Features

Digital assets liquidity bridges enhance performance, execution, and customization. These features make this technology not only essential for execution but also a powerful tool for scalability and compliance in the decentralized ecosystem. Some of the most critical features include:

Multi-Source Aggregation

Crypto liquidity bridges connect with centralized exchanges, institutional LPs, ECNs (electronic communication networks), and interbank market sources to compile a unified stream of prices and volumes.

This creates a deep and competitive order book with real-time updates, enhancing market coverage, reducing bid-ask spreads, and allowing you to offer more stable and efficient trading conditions.

Smart Order Routing (SOR)

It routes each trade to the most optimal liquidity venue based on real-time prices, available volume, latency, and trading fees. SOR may also accommodate custom parameters to align with your risk profile.

Orders may be split across multiple destinations to reduce slippage and maximize fill quality. This ensures best-execution compliance, improves order reliability, and boosts client retention.

Customizable Markups and Spreads

You can apply dynamic or fixed markups to the aggregated liquidity flow to align with your financial strategies. These parameters can be adjusted by client group, asset type, or trading behavior.

This flexibility and personalization allow you to streamline your revenue models while maintaining competitive spreads and adjusting pricing plans more effortlessly.

Real-Time Risk Management Tools

A robust liquidity bridge provider integrates built-in tools to control potential risks, set quoting limits per client or instrument, and trigger protective actions like trade throttling or hedging.

These instruments enable you to actively mitigate risks in volatile conditions, using real-time monitoring and automated responses to prevent losses and maintain service uptime.

Connectivity with FIX, REST, and WebSocket APIs

Bridges support standard API connectivity for seamless integration with trading software, CRMs, liquidity pools, and reporting tools. This multi-protocol support enables fast onboarding, cross-platform compatibility, and secure communication.

Institutional clients benefit from low-latency access, while brokers enjoy full control over order flow and trading patterns.

Aggregation Methods

With the growing role of technology in liquidity aggregation, you can access real-time market data, assets, and order books using different protocols.

Each employs different collection and distribution strategies based on architecture, use cases, and business demands. The most effective and commonly used methods in today’s crypto trading include the following:

Price-Level

Price-level aggregation merges multiple order A/B-books from different providers into a single order book. This unified pool offers real-time visibility and direct market access across various liquidity venues.

This practice is useful for exchanges and HFT platforms where transparency and depth are crucial. This way, orders are matched based on the best available prices across providers, reducing spreads and improving execution precision.

The price-level method might be more complex to implement. However, it delivers institutional-grade market coverage and is a preferred choice for advanced trading infrastructures seeking optimal liquidity across crypto, Forex pairs, and multi-asset classes.

Quote-Based

Quote-based aggregation relies on real-time or request-for-quote streams from LPs rather than pulling entire order books.

These quotes are compared and ranked to select the most suitable for a given market order at any moment. This method is faster and less resource-consuming than acquiring and scanning the full book, making it preferable to FX brokerages and crypto trading platforms.

It ensures traders access to rapid execution, quick price updates, and low slippage, especially during low liquidity or volumes.

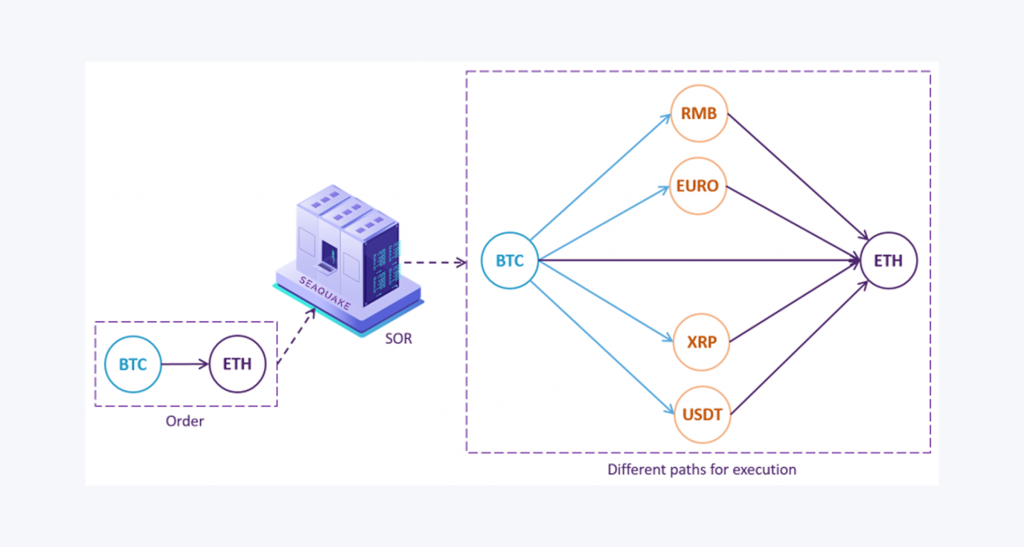

Smart Order Routing

SOR technology analyzes real-time market prices and volume across various liquidity pools, venues, and providers, then routes orders to the most favorable source for settlement.

As such, orders might be split between multiple sources to find better fills and execution parameters, reducing slippage, minimizing rejections, and enhancing the trading experience in volatile or fragmented markets.

This crypto liquidity aggregation method is increasingly common in modern STP liquidity bridges and servers, offering the best trading conditions and giving operators more control over routing logic.

Weighted/Preference-Based Aggregation

This approach enables brokers and platforms to assign weights or preferences to specific LPs to acquire streams based on business needs or user demand. These conditions may vary based on pricing, filling rules, or other terms.

The preference-based method supports strategic routing of flow toward preferred LPs while maintaining direct access to others as backups, making it highly useful for managing market exposure, reducing infrastructure costs, and maintaining institutional relationships.

Weighted aggregation can be dynamic, changing in real-time based on latency, quote quality, or trade success, or static, based on agreements with LPs.

Benefits and Risks

Crypto liquidity bridges must be carefully dealt with because they are highly technical and require deep market knowledge and understanding to adjust streams and ensure compliance with market trends.

Benefits

- Improved execution quality: Orders are routed using STP networks to the best-priced venues and providers.

- Deeper liquidity access: Aggregation from multiple LPs creates a consolidated order book with greater depth and better spreads.

- Reduced overhead: Platforms can avoid the technical burden of integrating multiple liquidity sources individually.

- Customizable conditions: Brokers can set their own exchange commission schemes, margin requirements, and markups.

- Scalability and flexibility: Enables brokers to support new asset pairs, markets, or institutional clients as the business grows.

Challenges

- Latency and technical risks: Poor connectivity or high latency can compromise execution quality or result in failed trades.

- Vendor dependency: Relying heavily on a single bridge provider may limit flexibility or present the risk of a single point of failure.

- Toxic flow exposure: Poor routing logic or overly aggressive trading may damage relationships with providers.

- Regulatory scrutiny: Platforms must ensure transparency in routing decisions and meet regulatory obligations.

- Infrastructure complexity: Bridges require consistent monitoring and configuration, especially in volatile market conditions.

Case Study: B2CONNECT Liquidity Bridge

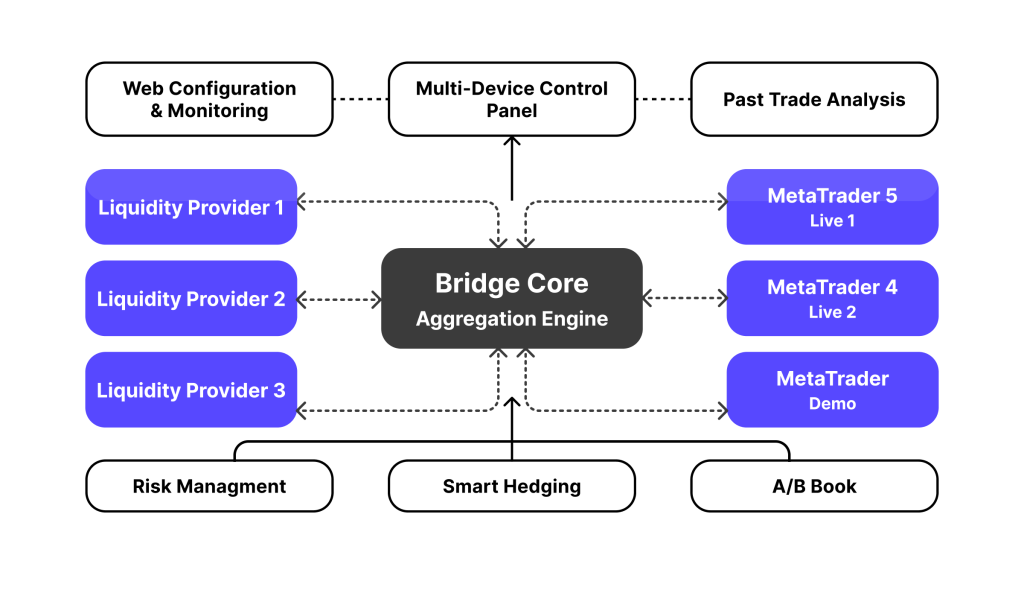

B2CONNECT stands out as a robust example of a liquidity bridge tailored for institutional crypto and multi-asset trading. The solution developed by B2BROKER complements the company’s comprehensive brokerage toolkit.

B2CONNECT is a crypto-native liquidity bridge that connects brokers, exchanges, Prime-of-Prime brokerages, and OTC trading desks with Tier-1 crypto pools and liquidity sources.

It provides clients with the flexibility to set their routing logic, create synthetic instruments, and control their market exposure. Crypto exchanges and brokerage platforms utilize B2CONNECT to establish their liquidity infrastructure, connecting with 20+ providers.

It integrates seamlessly with top platforms, such as MetaTrader and cTrader, to provide best-in-class market depth to all traders.

Designed to integrate seamlessly with platforms like MetaTrader 4/5, cTrader, and custom trading terminals, B2CONNECT offers aggregated liquidity from top-tier crypto exchanges, OTC desks, and Forex market LPs.

At its core, the system provides multi-asset aggregation, covering crypto, indices, commodities, CFDs, Forex trading, and many more, connecting clients to over 50+ LPs, and uses smart order routing to ensure best execution with minimal latency.

B2CONNECT also allows customized pricing feeds and enables clients to distribute liquidity to sub-brokers or white-label platforms, supporting brokerages to pursue their financial goals and profitability models.

Supported Platforms

B2CONNECT is compatible with a wide range of front-end trading platforms and back-end systems. This includes popular trading software, such as B2TRADER, MetaTrader 4/5, and cTrader.

Additionally, B2CONNECT supports multiple protocols, including FIX API and WebSocket, facilitating ultra-low-latency connectivity for institutional-grade performance.

B2CONNECT is one of the most versatile liquidity bridge solutions, integrating top-tier crypto providers, such as Binance, Kraken, Coinbase, Bitfinex, Gemini, Bitstamp, Bybit, OKX, and many more.

Concluding Thoughts

Liquidity bridges are foundational to any trading infrastructure. They enable access to deep liquidity, smart order routing, and tailored pricing distribution. These solutions empower brokers, exchanges, and OTC desks to offer competitive prices, diverse asset classes, and favorable trading conditions.

Modern crypto liquidity bridges enable you to customize your liquidity flows, sources, routing, and execution methods, facilitating more flexibility in a highly dynamic environment.

FAQ

Who needs crypto liquidity bridges?

Crypto liquidity bridges are essential for exchanges, brokers, and institutional trading platforms that require access to deep, multi-asset liquidity. They help streamline order execution, improve pricing, and enhance efficiency, especially in fragmented financial markets.

Are liquidity bridges expensive?

Costs vary depending on the provider and integrated features. While initial setup and monthly fees can be significant, crypto liquidity bridges often reduce operational burdens and execution costs compared to traditional practices.

Are bridges better than traditional liquidity providers?

Unlike single LPs, liquidity bridges aggregate multiple providers, offering better pricing, lower spreads, and greater depth. They also provide smart order routing and risk tools, making them more adaptable and scalable.

How do liquidity bridges acquire market prices and assets?

Bridges connect to centralized exchanges, OTC desks, and institutional LPs via APIs and FIX protocols. They receive real-time bid/ask quotes, depth-of-book data, and executable liquidity, which is then aggregated, classified, and redistributed to connected trading systems and clients.