What is EigenLayer? Restaking ETH for Modular Blockchain Security

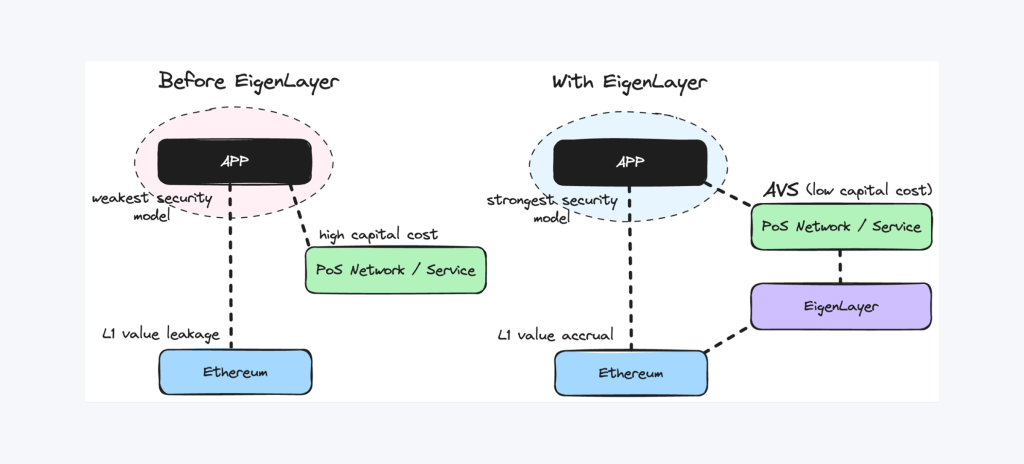

Historically, every new decentralized application or service—whether an oracle, a data layer, or a cross-chain bridge—had to establish its own set of validators and its own economic security from scratch. This approach leads to a fragmented ecosystem where security is siloed, costly to maintain, and slow to scale.

EigenLayer introduces a radical solution to this problem. Instead of forcing new protocols to build their own trust networks, it allows them to effectively “rent” security directly from Ethereum’s existing, highly secure validator set.

This platform transforms staked ETH from a passive asset into a dynamic, programmable resource that can be extended across the entire Web3 landscape.

Key Takeaways

- EigenLayer enables Ethereum validators to reuse staked ETH or LSTs to secure additional services and earn more yield.

- The protocol introduces pooled, programmable security via AVSs, increasing capital efficiency and decentralization.

- EigenLayer enhances Ethereum’s modular architecture, supporting innovation without compromising crypto-economic security.

What is EigenLayer?

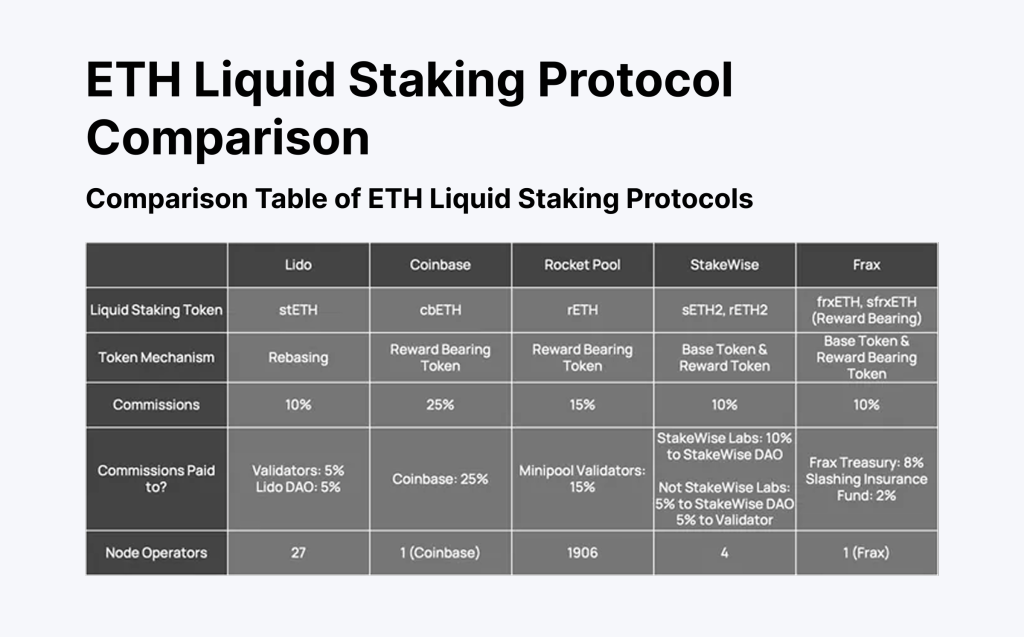

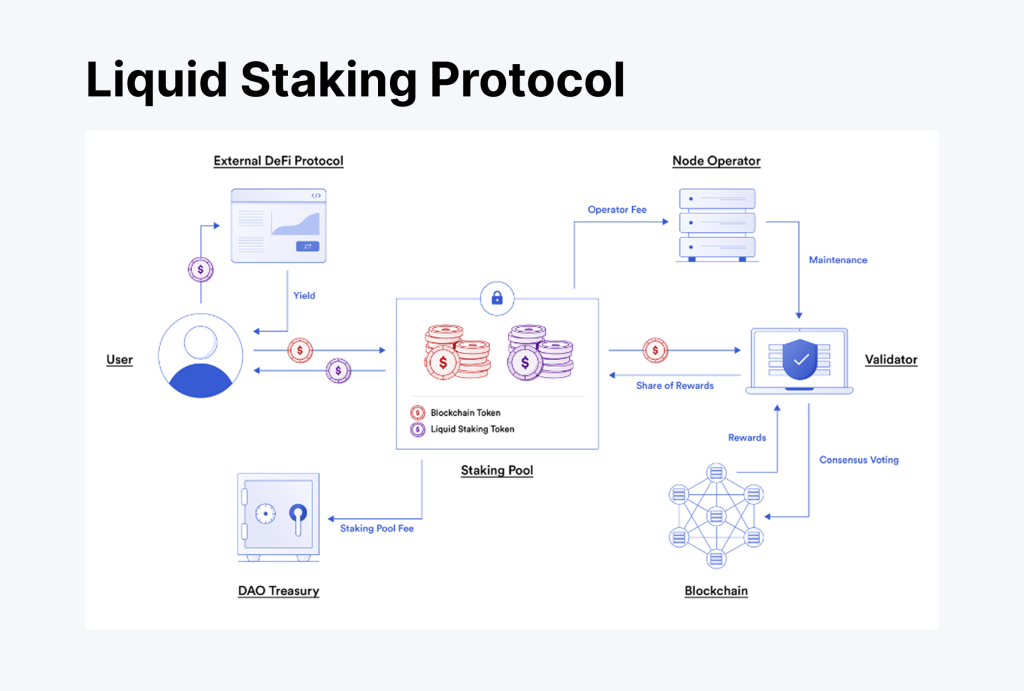

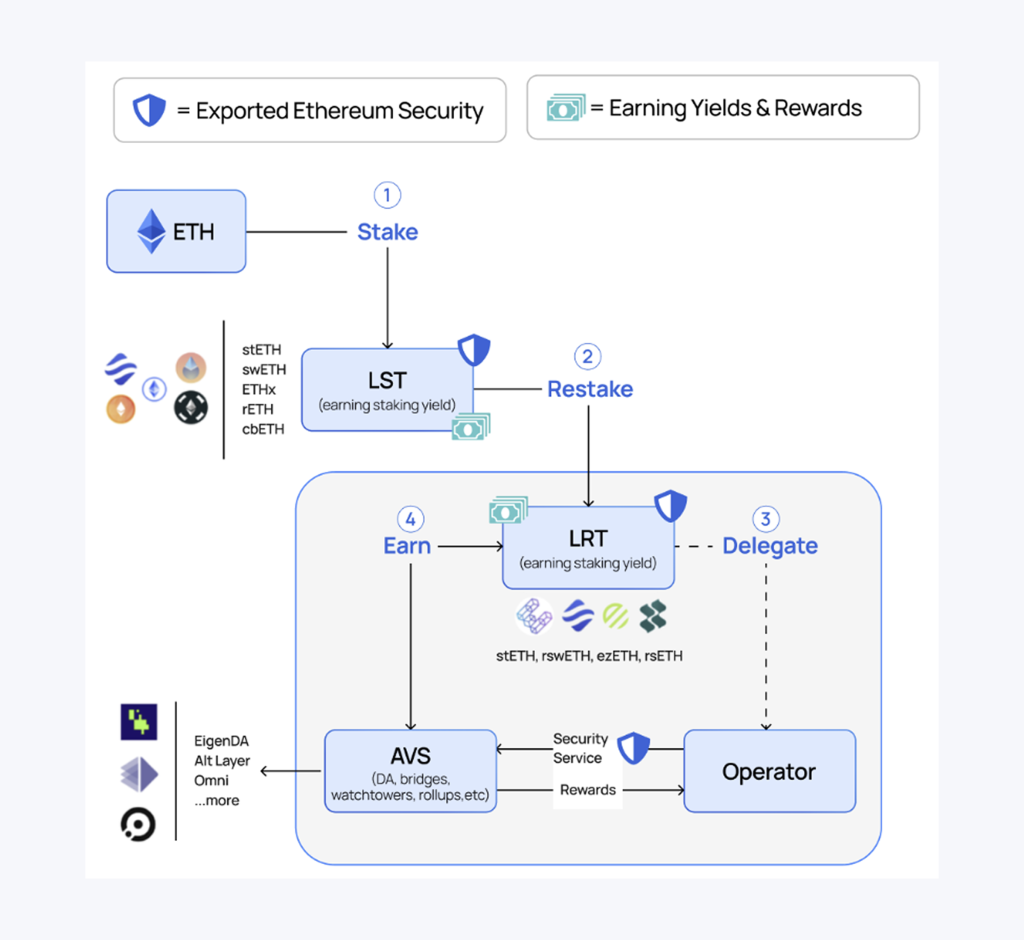

EigenLayer is a protocol built on Ethereum that introduces restaking, a novel concept in crypto-economic security. At its core, restaking allows validators and token holders who have already staked ETH (either directly or through liquid staking tokens like stETH or rETH) to repurpose that same stake to secure other applications on the network.

Think of it as leveraging an existing asset. Normally, your staked ETH has one job: securing the Ethereum mainnet. With EigenLayer, you can give that same staked ETH a second job: securing oracles, data availability layers, bridges, or rollups. In return for taking on this additional validation work—and the associated slashing risks—you earn additional rewards.

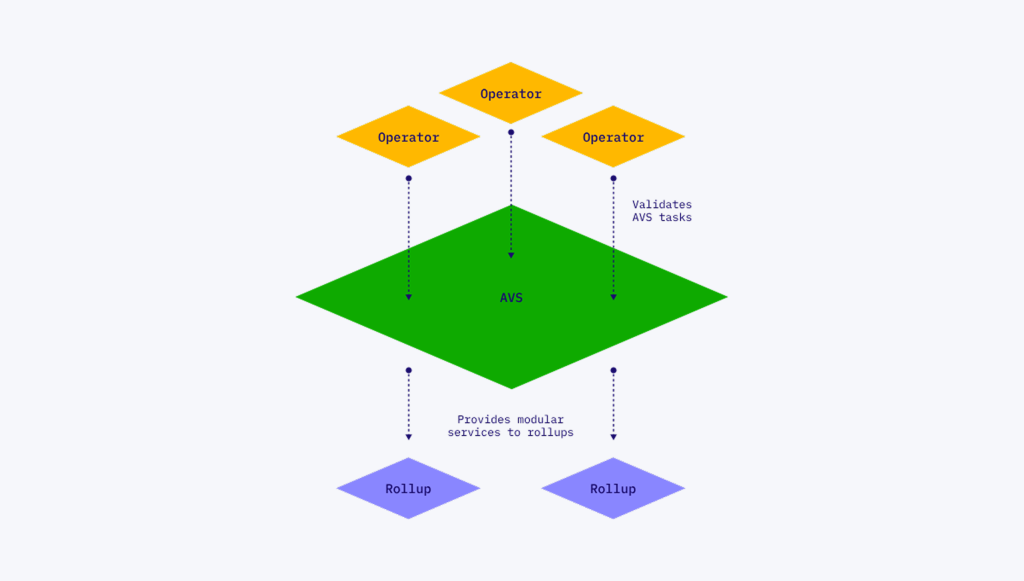

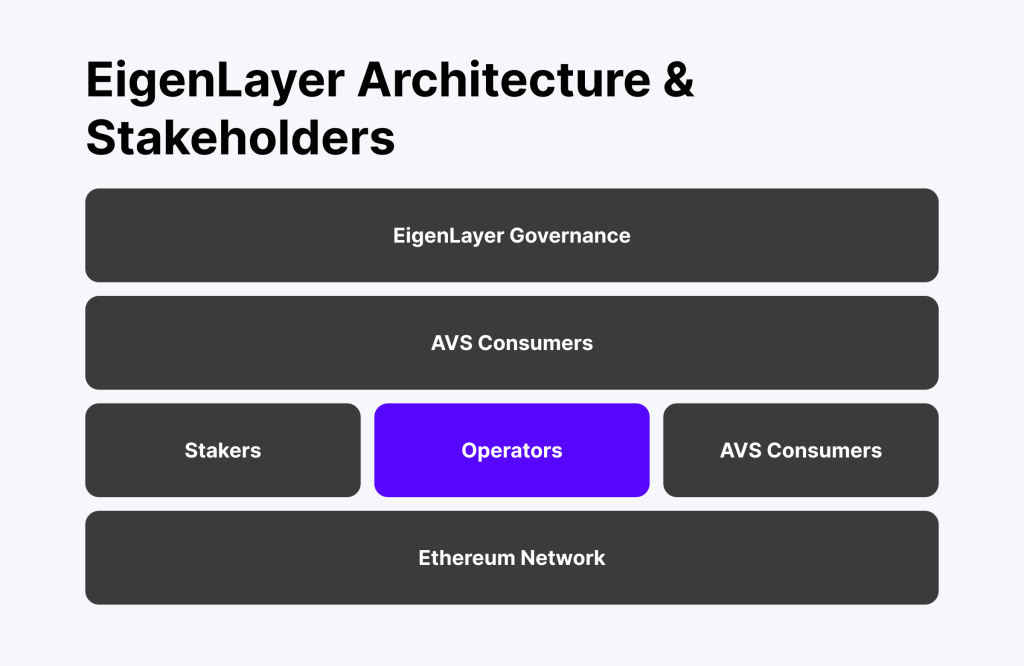

This creates a marketplace for decentralized trust. Projects that need security (Actively Validated Services or AVSs) can essentially “buy” it from the most secure source available—Ethereum’s own validator set. This solves a major bottleneck for innovation, as new projects no longer need to undergo the costly and time-consuming process of bootstrapping their own validator network.

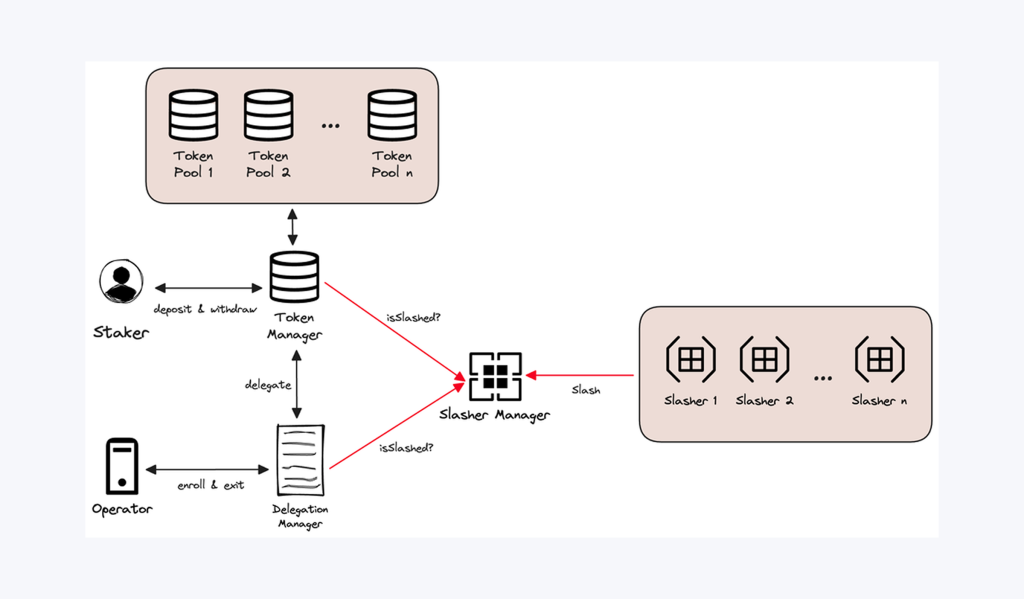

The entire system is managed by a set of smart contracts on Ethereum. These contracts handle the delegation of staked assets to AVSs and, crucially, enforce the rules. If a restaker acts maliciously on an AVS they’ve agreed to secure (for example, by providing bad data from an oracle), the EigenLayer smart contracts can slash their original staked ETH on the mainnet. This powerful enforcement mechanism is what makes the “borrowed” security real and trustworthy.

Fast Fact

EigenLayer is the first protocol to transform Ethereum’s validator set into a programmable trust marketplace, enabling ETH to secure multiple services simultaneously.

Core Features of EigenLayer

EigenLayer introduces several new mechanisms to the Ethereum ecosystem. Its value proposition is built on a few key features that work together to create a flexible and efficient security model.

Restaking by Smart Contracts

At its foundation is the EigenLayer restaking mechanism. Instead of generating new validator sets or prompting users to unstake and redeploy assets, EigenLayer allows all Ethereum validators and LST token holders (e.g., holders of stETH, rETH, or cbETH) to opt into restaking assets through EigenLayer smart contracts.

The system extends the security utility of their capital to many services, increasing overall capital efficiency with zero loss in adherence to the Ethereum security model.

The restaking system enables stakeholders to be involved in securing more protocols, along with the rewards of staking Ethereum. In return for the additional trust they provide to services, restakers earn Eigenlayer restaking rewards, which can be in the form of ETH, AVS-native tokens, or Eigen tokens in the future.

Support for Multiple Services (AVSs)

EigenLayer is designed to support the entire spectrum of Actively Validated Services, including decentralized applications such as data availability layers, oracles, bridges, and fast finality layers.

Every AVS has its own terms, logic, and slashing conditions, and EigenLayer is the security framework that enforces these terms in the form of smart contracts on Ethereum.

By attaching to several services, validators increase the utilization of the assets they stake, transforming those assets into reusable security tools. The architecture creates a pooled security model, where a single validator set can secure multiple different protocols — greatly reducing capital expenditures and bootstrapping protocol security for greenfield protocols by eliminating the need to build self-contained trust networks.

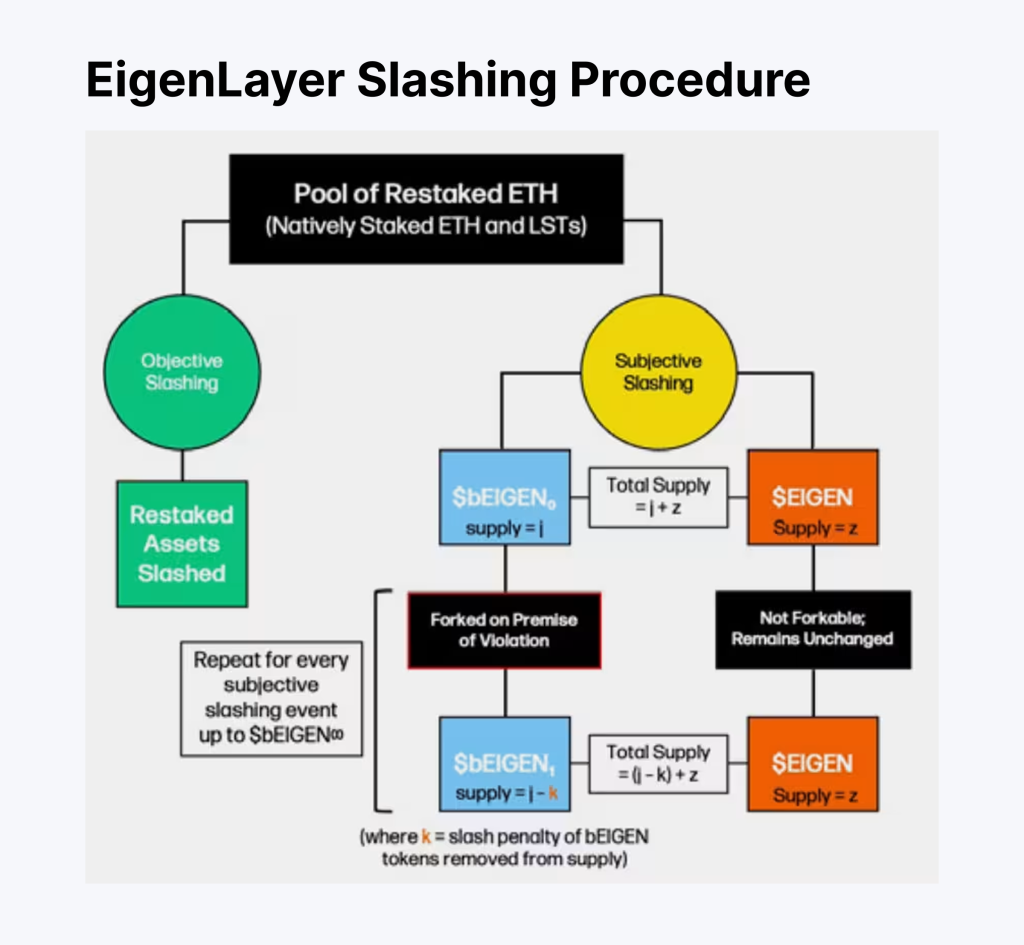

Cutting and Enforcing Security Measures

To guarantee integrity, EigenLayer incorporates a robust slashing mechanism to enforce security obligations in the entire system. Should one of the restaking validators violate the rules of one of the linked AVSs — i.e., signing fraudulent data or returning inconsistent messages — the restaked ETHs or LSTs shall be entitled to be slashed. Slashing is implemented by EigenLayer smart contracts to ensure intersubjectively attributable faults are treated prominently and justifiably.

This security enforcement provides EigenLayer with a foundation for future decentralized services, enabling them to offload crypto-economic security to the proven validator set of Ethereum without compromising decentralization or trust.

Opt-In Flexibility and Customization

EigenLayer is opt-in and extremely customizable. Validators decide to support whatever AVSs they wish to, and AVSs get to specify their own slashing logic and performance evaluation metrics.

This makes participants more responsible for the risks they expose themselves to during restaking, as well as differentiates the security models of the various AVSs according to the needs of the services they provide.

In addition, stakeholders can stake Eigen tokens (if active) or LSTs selectively, being members of only those AVSs they trust. This is a modular but permissionless architecture that encourages a large variety of validators and services to collaborate in a trust-aligned manner at scale.

Yield Aggregation and Alignment of Incentives

EigenLayer presents a groundbreaking incentive structure where LST holders and validators receive the opportunity to receive additional rewards in addition to the rewards they already obtain from Ethereum staking.

This encompasses EigenLayer restaking APY, whose value changes according to the security demand by the AVSs, along with the services the user wants to restake into.

These incremental rewards enhance capital efficiency across the board and make it economically desirable for validators to be part of the EigenLayer ecosystem.

In the long term, this would lead to the establishment of an active market for trust, where blockchain capital is optimized and utilized according to security needs.

Modular, Programmable Security Layer

EigenLayer is the evolution from siloed blockchain security methodologies to a programmable, composable security layer. By decoupling validator services from the base consensus of Ethereum in a manner that preserves security assurances, it opens the door to new financial applications, new data availability stacks, and even tokenless protocols previously cost-impossible or even risky to deploy.

The ultimate result is a composable system bringing world-class security to the masses, all without fragmenting the Ethereum network. That vision makes EigenLayer the infrastructure foundation for next-generation Web3 services.

Use Cases and Applications of EigenLayer

EigenLayer is changing the model of how blockchain protocols think about security, capital efficiency, and decentralization. The following represent the most compelling and transformational use cases in which EigenLayer is already making an impact.

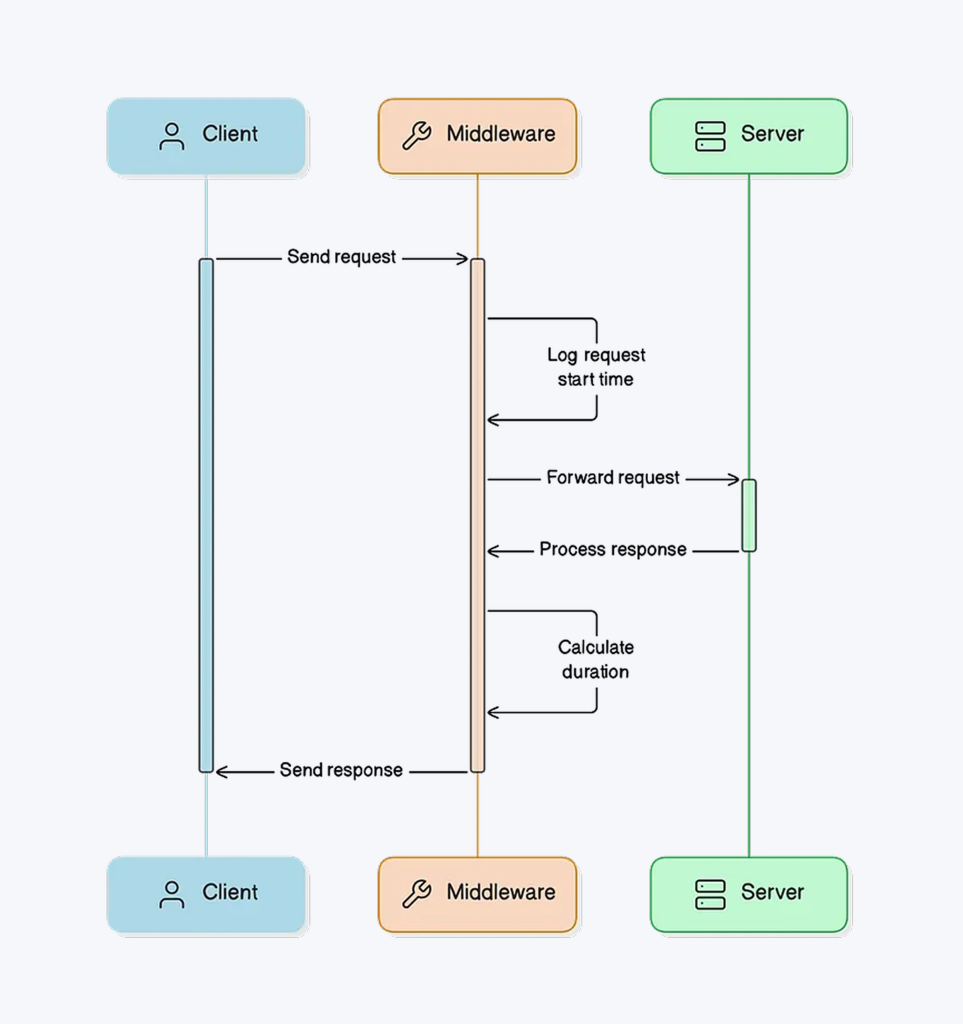

Middleware Security: Oracles, Bridges, and Beyond

Building blocks of middleware — such as oracles, cross-chain bridges, and relayers — enable numerous decentralized applications and money systems, but they’re typically hindered by weak or fractured security assurances. The building blocks typically have to create their own trust networks, which turn out to be expensive, fractured, or slow to mature.

EigenLayer enables these services to access the pooled security of Ethereum through EigenLayer restaking. Oracle providers, for example, may use restaked ETH to ensure the correct delivery of the right data, and cross-chain bridges may punish slashing of restakers for spreading malicious or erroneous messages.

This significantly enhances the security of their protocol without the issuance of new tokenomics or validator sets. It also creates the potential for restakers to earn additional rewards for securing these types of protocols while gaining access to their eigenlayer restaking APY.

Fast Finality Layers

Finality is necessary for certain real-time use cases, such as high-frequency trading, inter-chain communications, and gaming. Traditional Ethereum finality (through Casper FFG) takes minutes to happen, which is unfavourable for latency-aware applications.

EigenLayer achieves the construction of fast finality layers by utilizing restaked ETH to confirm protocols with near-instant transaction confirmation.

The layers incorporate AVSs that run on consensus or verification protocols off the Ethereum chain but utilize eigenlayer smart contracts for enforcement. If restakers confirm invalid or inconsistent finality, they can be slashed — ensuring cryptoeconomic security even at low latency.

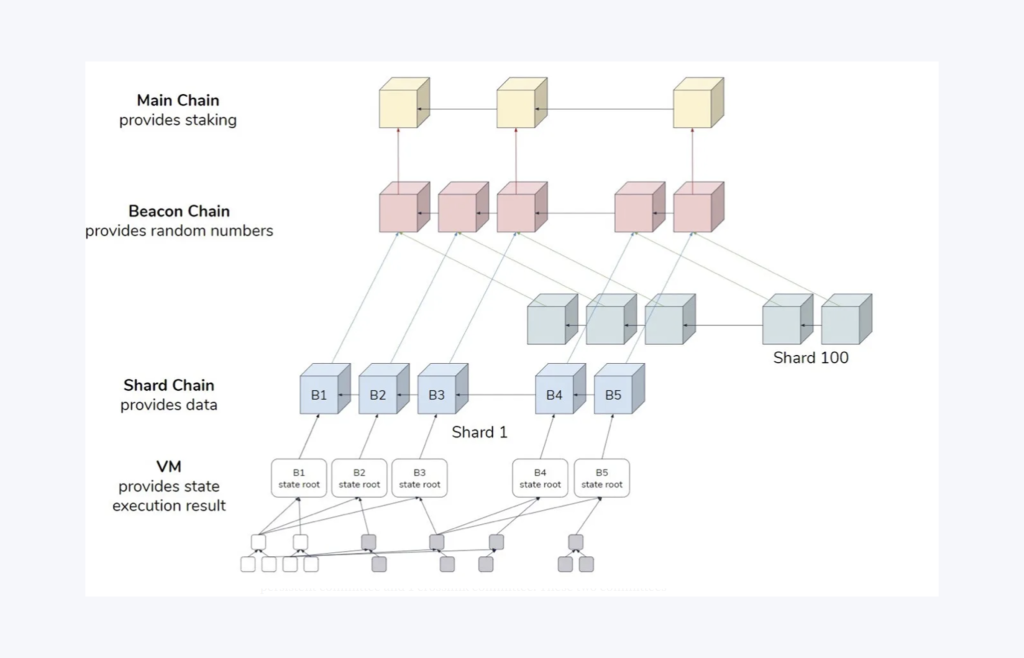

Data Availability Layers

Scaleable data availability underlies rollup-centered Ethereum scaling. The transaction information for the rollups is posted off-chain but requires the capacity to access the same information for proof and fraud verification. Without accessible data, the rollups cease to operate.

New availability layers for EigenLayer can be built and secured by restaking assets. The resultant AVSs store and retrieve rollup data with guarantees enforced by slashing mechanisms in EigenLayer smart contracts.

With the capital-efficient protocol design, authors do not need to bootstrap validator sets one by one or inflate token creation. Builders tap the economic substrate of Ethereum and pay additional rewards to stakers for assured data retrieval.

As Ethereum scales to a composible architecture, EigenLayer-backed data layers offer access to decentralized, resilient, and inexpensive data availability infrastructure.

Rising Decentralized Services

The EigenLayer’s flexibility allows it to support the full range of emerging decentralized services outside the boundaries of the traditional middleware. Some examples include:

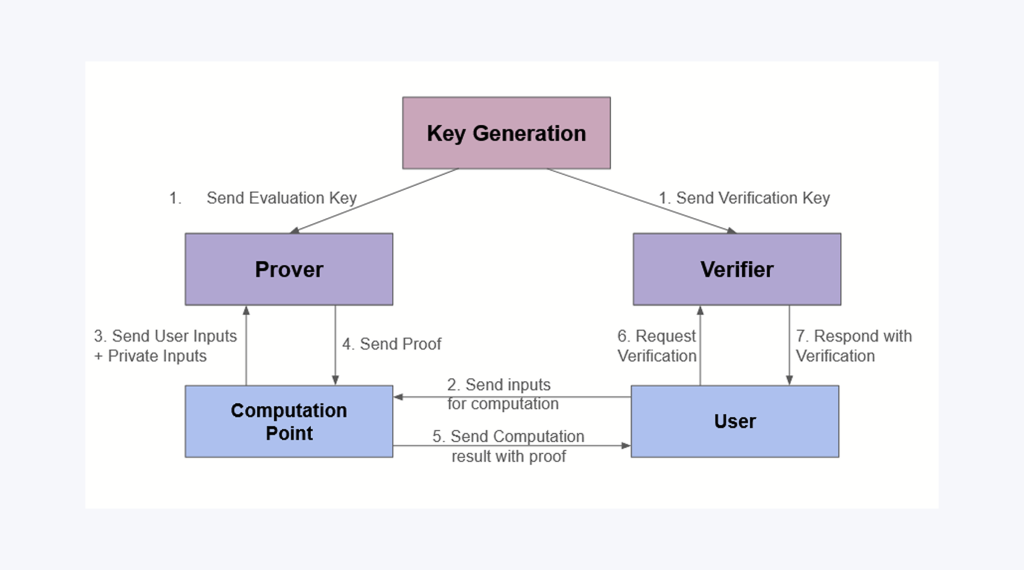

- Machine learning inference networks: The AVSs whose verifiable model of AI output is protected by slashing conditions and restaking risks.

- Zero-Knowledge Proof Attestation Layers: Efficient Validation of zk-Proofs with High Cryptoeconomic Security.

- Consensus overlays: L2s/sidechains running on top of the validator set of Ethereum, other L2/sidechains’ alternative

- Tokenless protocols: New uses for whom it’s not needed to deploy a native token to secure their protocol — they simply use stake Eigen functionality by way of EigenLayer.

The EigenLayer ecosystem enables efficient experimentation, with security assured by the validator base of the Ethereum network.

EigenLayer vs. Other Security Models

EigenLayer presents us with blockchain security in a new way—that of being modular, programmable, and restaking-powered. To fully appreciate its advantages, we must compare EigenLayer to traditional solutions, such as shared security in Polkadot and rollup-centric architectures in Ethereum’s Layer-2 configuration.

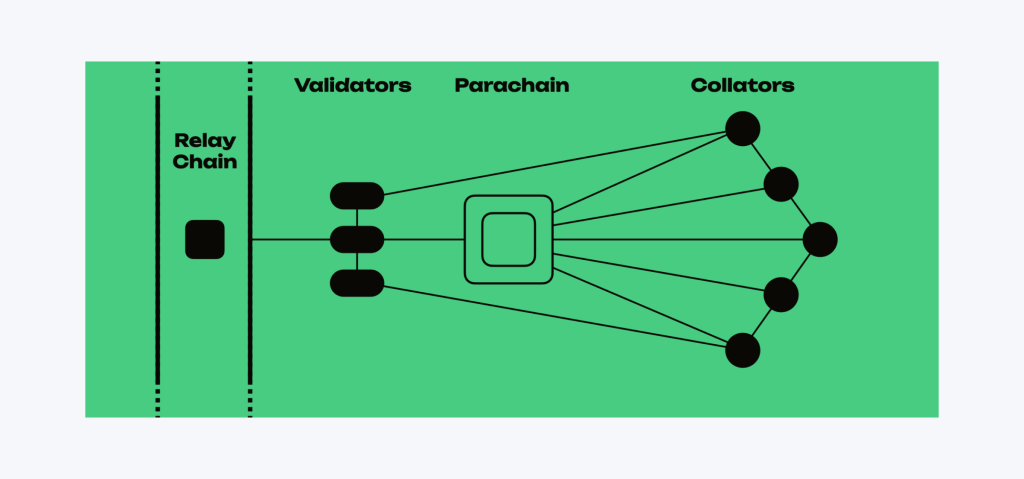

Comparison with Traditional Shared Security

Polkadot was the first blockchain network to provide a native shared security model. All parachains in Polkadot are anchored to a core relay chain and, in turn, rely on a unified validator set for security.

This configuration enables the same security guarantees to be consistently enforced on all parachains, representing a significant advancement over fully sovereign blockchains, which have only one option for initial security: bootstrapping their own validators.

However, the model is rigid and tightly coupled. The parachains must conform to strict technical specifications to integrate with the relay chain, and they compete for limited slots by auctions, where the expense might be capital-intensive and discouraging to innovation.

EigenLayer offers a more inclusive alternative. Instead of requiring protocols to be parachains or to win auctions, any dev can launch a service on Ethereum and opt in to pooled security using restaked ETH or liquid staking tokens.

This opt-in, permissionless model enables greater heterogeneity in protocol design and lowers barriers to entry, particularly for experimental, tokenless protocols. It is also more decentralized in how trust allocation is managed, as AVSs will appeal to restakers dynamically rather than through a central governance mechanism.

EigenLayer vs. Rollup-Centric Models

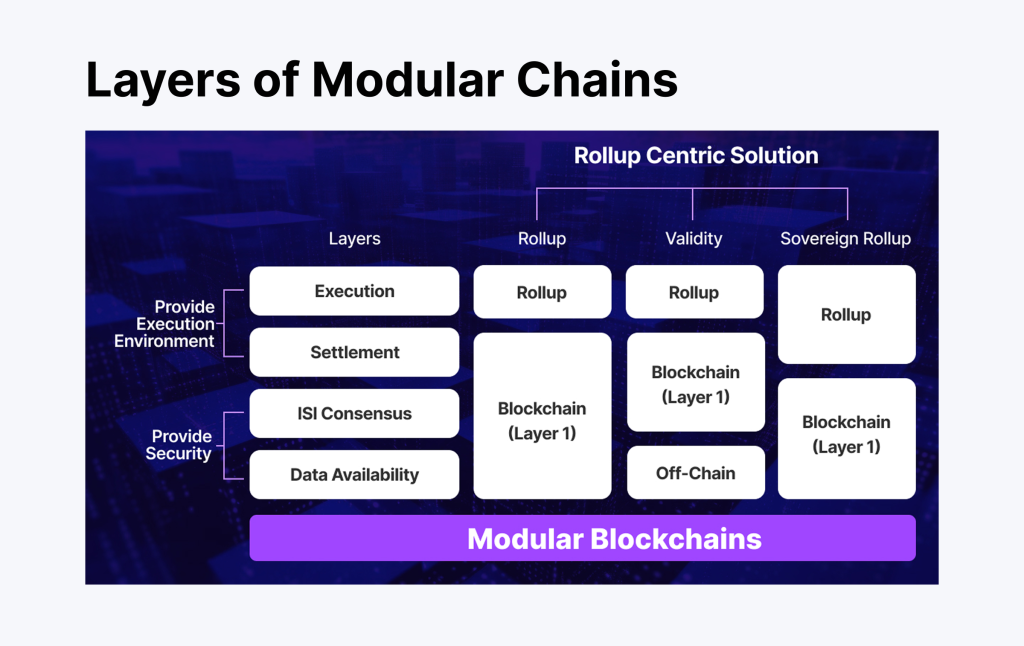

In the current Ethereum roadmap, rollups are the primary solution for scalability. Every rollup is its own independent chain with off-chain execution, but it relies on Ethereum for the availability of data and state commitments, ultimately facilitating the final settlement.

Rollups usually inherit the cryptographic economic security of Ethereum only in terms of finality, not in their everyday operations, such as middleware security, fast finality, or sequencing.

This makes rollups weak at points such as data withholding, central sequencing, or weak off-chain consensus. To fill these gaps, the rollups end up building their own communities of sequencers, validators, or governance mechanisms—rewriting bits of the security stack from the ground up.

EigenLayer supplements rollup architectures by incorporating a restaking-based security model for off-chain services. For example, you can deploy an AVS in a rollup to provide data availability layers, high-speed finality, or decentralized sequencing—all backed by EigenLayer smart contracts and enforced by slashing.

This not only reduces the capital requirements of rollup operators but also achieves maximum composability and capital efficiency within the Layer-2 ecosystem.

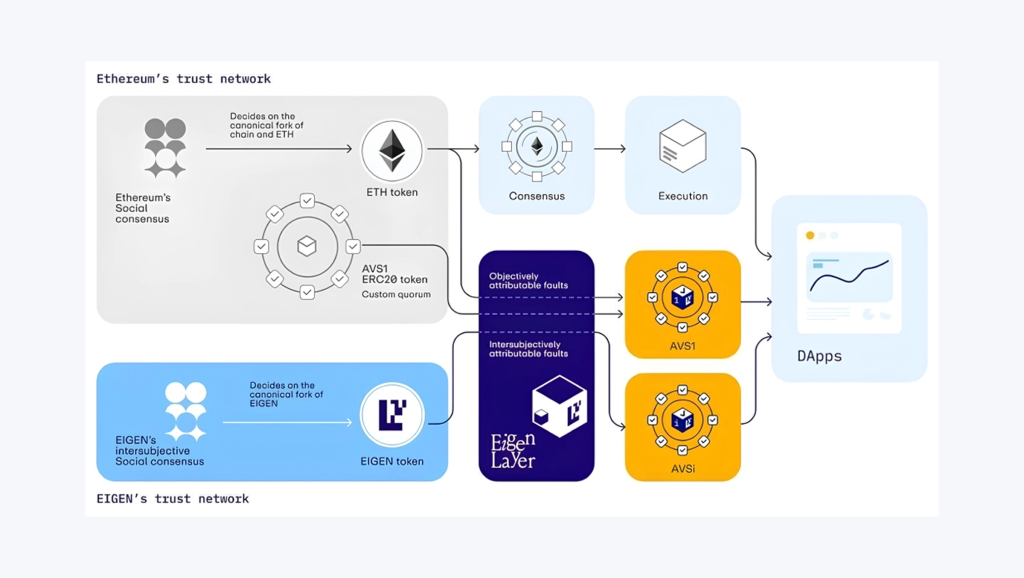

Role in Ethereum’s Modular Architecture

Ethereum is evolving into a plug-and-play blockchain architecture, where execution, consensus, data availability, and settlement each have specialized layers with corresponding areas of expertise. Separation of concerns enables scalability and fosters innovation by allowing each layer to evolve independently.

EigenLayer fits nicely in this non-monolithic future. By decoupling security from the world of consensus and serving as a programmable trust network, EigenLayer becomes the binding agent between services requiring security and the validator set of the Ethereum network.

It enables new protocols to integrate with the cryptoeconomic security of the Ethereum network in non-monolithic, non-vertically integrated modes.

In doing this, EigenLayer offers a security marketplace for the Ethereum stack at the modular level—allowing protocols to buy and customize security assurances on-demand and offering restakers new opportunities to monetize their staked assets.

This aligns incentives across the entire ecosystem, allowing for rapid experimentation and scalable infrastructure building in decentralized finance and beyond.

Conclusion

In the race to scale decentralized systems, EigenLayer doesn’t just follow—it redefines the rules. By turning staked ETH and LSTs into reusable security, it empowers validators to secure far more than Ethereum alone. The result is a pooled security model built for a modular future—where capital is efficient, trust is programmable, and innovation is frictionless.

Whether you’re building oracles, rollups, or simply seeking smarter yield, EigenLayer offers the foundation to scale securely and creatively. It’s not just a protocol—it’s a new way to think about blockchain security.

FAQ

What is restaking in EigenLayer?

Restaking is the process of using already-staked ETH or Liquid Staking Tokens (LSTs) to provide security for additional applications (AVSs) on the EigenLayer protocol in exchange for extra rewards.

What are AVSs in EigenLayer?

AVS stands for Actively Validated Service. It is any protocol, such as an oracle, bridge, or data layer, that uses EigenLayer to “rent” security from Ethereum’s restakers instead of building its own validator set.

Can I use liquid staking tokens with EigenLayer?

Yes. EigenLayer supports many popular LSTs, such as stETH (Lido), rETH (Rocket Pool), and cbETH (Coinbase), allowing holders to participate in restaking without running their own validator.

What rewards can I earn through EigenLayer?

In addition to standard Ethereum staking rewards, restakers can earn rewards from each AVS they help secure. These rewards may be paid in ETH, the AVS’s native token, or other forms, often calculated as a restaking APY.