What Is Raydium (RAY)? What Should You Know About It?

Multiple aspects create DeFi as a dynamic and sufficient system, and Raydium is one of the puzzle pieces. It is an automated market maker that runs on the Solana blockchain. It promotes decentralized trading by allowing users to trade digital assets straight from liquidity pools rather than via a conventional centralized exchange. Thanks to its connection with the Serum DEX, it is now an important force in the Solana ecosystem, improving its liquidity and trading capabilities.

This article emphasizes Raydium’s capabilities as an AMM, seeking to give readers a thorough grasp of the currency.

Key Takeaways

- With its incorporation into the Serum, RAY improves trading by providing liquidity and transaction efficiency.

- Due to the token’s considerable volatility, investors in RAY tokens need to exercise caution and strategically plan to manage risks appropriately.

- With its quick transactions, cheap fees, and strong liquidity, Raydium might be a good choice for those interested in decentralized finance.

Overview of Raydium

In February 2021, a group headed by Alpharay, who remained unidentified, launched Raydium. It swiftly gained popularity as an AMM on the Solana blockchain because of its unique approach to supplying liquidity and promoting decentralized trade.

With the help of the Serum DEX, Raydium may use its order books to turn its liquidity into limit orders. Because of this integration, Raydium stands out from other AMMs, which usually offer liquidity pools. Using Serum’s central limit order book, Raydium offers improved trading efficiency and liquidity throughout the Solana ecosystem.

The RAY token functions as a utility and a governance token. Protocol costs, staking rewards, and access to Initial DEX Offerings (IDOs) are all advantageous to RAY holders. An additional layer of utility is that Dropzone NFT tickets can be obtained with RAY tokens. This multifunctional tool encourages users and liquidity providers to interact with the platform, supporting Raydium’s ecosystem.

How Raydium Works

Raydium assesses liquidity using the Serum order book and its own liquidity pool. This twin source of initial liquidity makes algorithmic trading more effective. When a transaction is made, Raydium evaluates its ideal execution path based on the liquidity available in its pools and the Serum orderbook. Raydium improves the trading depth and price discovery on Serum’s order books by transforming liquidity into limit orders.

Key Components

To properly understand Raydium’s components, let’s examine some of its critical characteristics.

- Raydium’s launchpad platform, AcceleRaytor, was created to assist new enterprises in obtaining early funding and distributing their tokens. This feature allows initiatives to take off and become more visible within the Solana Raydium ecosystem.

- By locking up their Raydium token, customers can earn rewards through staking opportunities provided by Raydium. Staking contributes to the network’s stability and security and generates passive income.

- By supplying liquidity to several pools, users can earn extra incentives through yield farming on Raydium. Because of these advantages, Raydium is a desirable choice for liquidity providers when generating RAY tokens and other incentives.

- Raydium’s platform for releasing NFTs is called Dropzone (NFT Launchpad). Authors can mint and distribute their NFTs with the help of Raydium users and liquidity.

- Thanks to Raydium’s integration with Magic Eden, an NFT marketplace is now available. This marketplace increases the usefulness of the Raydium platform by giving users a venue to exchange and gather NFTs.

Liquidity Provision

LPs play a crucial role in the Raydium crypto ecosystem. They provide assets to Raydium’s liquidity pools to make trades more accessible. In exchange, they receive a % of the trading fees that customers pay. These transaction fees encourage LPs to keep supplying benefits. LPs can increase their profits and produce RAY tokens by participating in liquidity mining.

Using smart contracts to automate market creation and trading, Raydium’s protocol is built to guarantee on-chain liquidity and decentralized trade. This strategy benefits all parties involved in maintaining a solid and active trade environment.

Fast Fact

Three anonymous blockchain entrepreneurs, AlphaRay, XRay, and GammaRay, are in charge of Raydium. AlphaRay, who has experience in algorithmic trading, used his abilities and expertise to develop Raydium.

Raydium Price Analysis

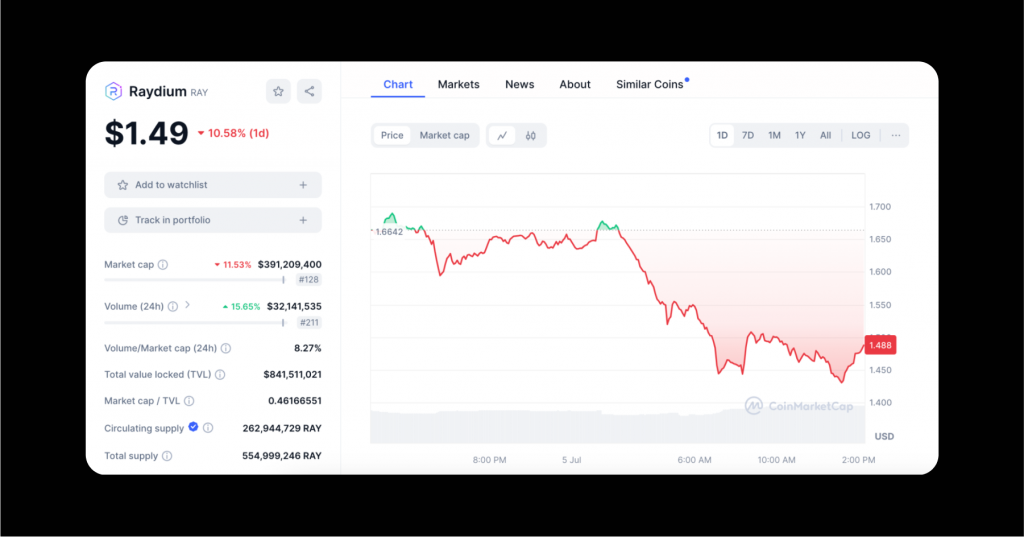

As of August 5th, RAY is currently trading at about $1.49. There are 555 million tokens in circulation, which corresponds to the total supply of Ray crypto. Variations in trade volumes have been observed on the Raydium exchange, which can be attributed to general market patterns. Its recent performance demonstrates a mixture of growth spikes and corrections, which are characteristic of DeFi tokens.

Short-Term Predictions

Evaluating technical indications and the state of the market are important aspects of analyzing short-term price forecasts. The price of Raydium may vary slightly during the next few days; a range of $1.60 to $1.70 is anticipated. Based on a one-month projection, RAY might hit $1.80, presuming a favorable market trend. Forecasts for the next three months indicate that, depending on continued interest and trading volume in the Raydium DEX, prices may increase to $2.00.

Long-Term Forecasts

The long-term projections for Raydium indicate that cryptocurrency investments carry risks. The projection for 2025 is between $0.42 and $3.62. WalletInvestor analysts predict a sharp rise, possibly as high as $3.62. More cautious forecasts, however, center the price around $2.28. Optimistic projections indicate that RAY may reach $12.24 by 2030. On the other hand, some forecasts are less optimistic and place the price closer to $2.13.

Technical Indicators

Critical technical indicators shed light on the behavior of the Raydium market. Moving averages (MAs) can be used to discover patterns by displaying the average price over a given period of time. While the 200-day MA is utilized for long-term trends, the 50-day MA is frequently used as a short-term indicator. The 200-day MA for Raydium currently points to a stable long-term outlook, while the 50-day MA implies a possible higher rise.

The pace and variation of price fluctuations are gauged by the Relative Strength Index (RSI). When the RSI is over 70, it is overbought; it is oversold when it is below 30. Currently, Raydium’s RSI is neutral, indicating a balanced market.

Understanding possible price floors and ceilings requires an awareness of support and resistance levels. Raydium has essential support levels at about $1.50 and resistance levels at about $1.80 and $2.00. These levels help traders decide whether to purchase or sell, which increases the volume and liquidity of trading overall.

Investment Considerations

The excessive volatility of RAY tokens poses significant risks for investors. Rapid and erratic price swings can have a short-term effect on the value of investments. Due to this volatility, close observation and being prepared to react to changes in the market are necessary.

To look on the brighter side, it has many advantages, like swift transactions, reduced expenses, and strong liquidity. It is a desirable alternative for decentralized trading because of these properties.

Another risk is exchange manipulation by centralized parties, which could affect the market’s stability. Due to the tokens’ growing circulation, investors risk losing money on RAY tokens.

The market has differing opinions on investments in Ray coin at the moment. A method used to gauge investor emotions, the Fear & Greed Index, shows varying degrees of confidence. Understanding these attitudes might help an investor make educated selections.

Investors need to understand the risks of investing in cryptocurrencies like Raydium coin. Diversifying portfolios is crucial for reducing risk and avoiding making more significant investments than one can afford to lose.

Limit possible losses using stop-loss orders and periodically assess and modify investing plans in light of market developments. Making informed decisions about regulations and market trends can also help with strategy.

Always remember that this information is not intended to be financial advice but for educational purposes only. Always do extensive research and speak with a financial expert before making any kind of investment.

Conclusion

RAY, which offers several benefits, integrates with the Serum order book to enable decentralized trading. Our demonstrated price analysis focuses on current patterns and forecasts, while the investing considerations discuss benefits, dangers, market volatility, and strategic insights.

Investing in Raydium has its share of advantages and disadvantages. Do your homework and speak with financial advisors before making decisions.