What is Slippage in Crypto Trading?

Slippage is a normal part of the dynamic world of crypto trading. However, it can have a significant impact on your results.

Historically, the size of slippage tended to be greater when the market reversed its direction, as the research from Hyblock Capital indicates. Today, when the crypto is once again turning its course, with investors actively pouring money into coins and tokens in anticipation of BlackRock’s Bitcoin ETF approval by SEC, potentially starting a new crypto bull run, the factor of slippage cannot be ignored.

On November 9th, 2023, the price of BTC jumped to nearly $38,000 from the $36,910 mark in just two hours before tumbling back to lower than $36,000 three hours later. These wild swings in prices are usually followed by massive slippage, causing investors to lose (or sometimes gain) huge sums of capital. Thus, knowing the concept of slippage is vital not only for experienced traders but also for regular HODLers as well.

But what is slippage exactly? How can we calculate it? In this guide, we will explore in detail how slippage affects your trading and what you can do to lower its negative effect.

Key Takeaways:

- Slippage is a natural part of cryptocurrency trading which can be either a benefit or a disadvantage.

- It can be affected by many factors, like volatility, low liquidity, and others.

- To prevent losing money from slippage, traders use a variety of strategies, including limit order, trading on liquid platforms, and some others.

Slippage Explained

Slippage, in the context of buying and selling assets on the market, refers to the discrepancy between the intended price and the executed trade price.

Slippage can occur in any type of market, especially in highly volatile markets like cryptocurrencies. Due to the nature of these markets, prices can change rapidly and significantly, resulting in slippage. Usually, these differences are small, typically occurring between 0.05% and 0.10% of a price.

How to Calculate Slippage

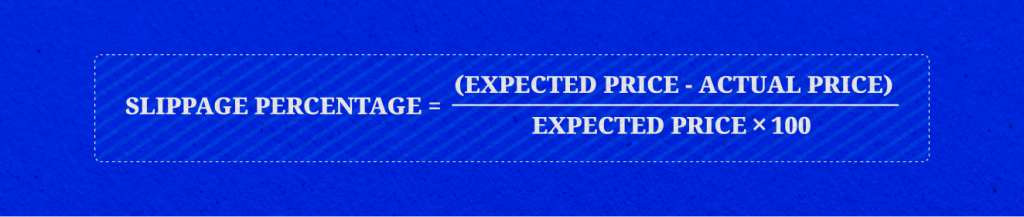

The formula to calculate slippage is simple:

For example, if a trader expects to buy a certain cryptocurrency at $100 per token but ends up buying it at $105 per token, the slippage would be $5. Slippage can occur in any market, but it is particularly common in crypto markets due to their inherent characteristics.

Another method for calculating it is through slippage percentage. This percentage is determined by taking the difference between the actual price and the expected price, dividing it by the expected price, and then multiplying by 100.

Using the same example as before, if the expected price is $3,000 per ETH and the actual executed price is $3,050 per ETH, the slippage percentage would be ($3,000 – $3,050) / $3,000 * 100 = -1.67%. Again, this indicates negative slippage.

Slippage in Action

To understand how slippage actually affects trades, let’s consider an example. You want to sell 10 Bitcoins at the current market value of $35,000 per BTC. You place a market order and expect all coins to be sold at that price.

However, due to slippage, your order may get partially executed at different prices. The first 5 coins are sold at $35,000 per BTC, but the remaining 5 are filled at a slightly cheaper rate of $35,100 per BTC.

As a result, the total executed price for the 10 BTC is (5 BTC * $35,000) + (5 BTC * $35,100) = $175,000 + $175,500 = $350,500. The expected total cost is $350,000 (10 BTC * $35,000), and the actual executed cost is $350,500, which means that the slippage in this example would be $350,500 – $350,000 = $500.

In this scenario, there would be negative slippage, where the executed price is worse than the expected price. You paid an additional $500 more than initially anticipated for the purchase of 10 BTC.

Factors Affecting Slippage

There are many reasons why slippage happens, including volatility, liquidity, and time of execution. Let’s take a closer look at each of these factors:

1. Market Volatility

One of the primary causes is market volatility. Cryptocurrency markets are known for being highly volatile, with prices often experiencing significant fluctuations in short periods of time. This volatility can result in sudden price movements, making it more difficult to trade at the desired price.

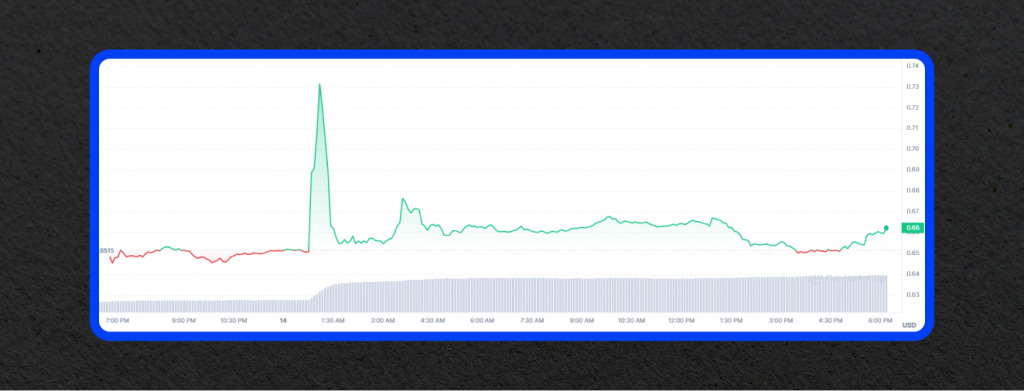

A notable example of market volatility can be XRP’s price swing on November 14th, 2023, when the false report on the token’s ETF listing caused the massive price surge. In just one hour, XRP increased by about 10% and then returned to its usual levels, leaving thousands of market participants out of pocket.

When market conditions are highly volatile, the price of an instrument can change rapidly during the execution process. This can lead to potential slippage, with the executed price deviating from the expected price. Traders need to be cautious when engaging in trading during volatile periods in order to keep slippage to a minimum.

2. Low Liquidity

Another factor that can contribute to slippage in crypto markets is low liquidity in the market or an asset. Liquidity refers to the ease of buying and selling an asset without causing major price movements. In markets with low liquidity, there may not be enough buy or sell orders to fulfill a trade at the desired price.

If a trader places a large market order on an exchange with low liquidity, the order may not be fully executed at the desired price. Instead, the order may be filled at different price levels, resulting in slippage. This is particularly common when trading large volumes of cryptocurrencies, as the market may not have sufficient liquidity to support such trades.

3. Order Book Depth

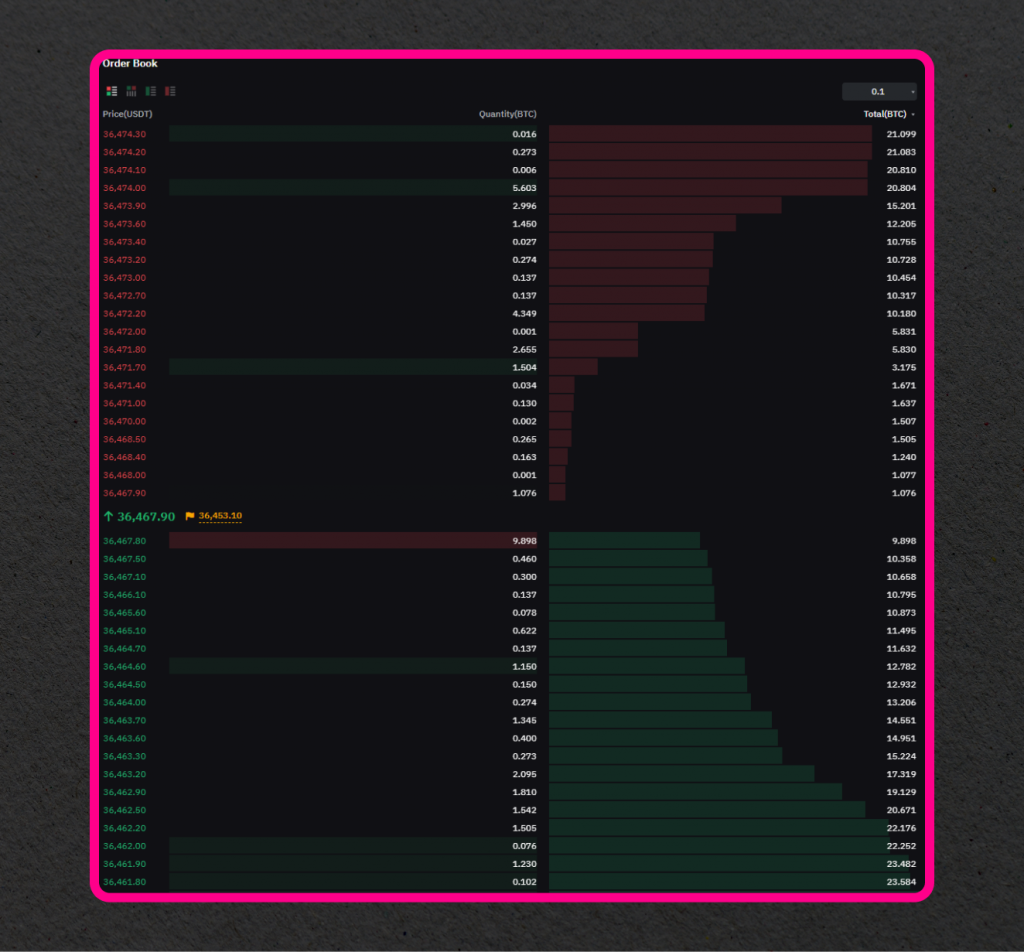

An order book is a list of all the buy and sell orders for a particular asset or security. It displays the cumulative volume of orders at various price levels, providing traders with an overview of market sentiment and liquidity.

The depth of the order book refers to the total available quantity of buy and sell orders at different price levels. The greater the depth, the more liquid the market is, and this can significantly impact slippage.

When the order book has limited depth, a large market order can quickly deplete the available liquidity at the prevailing price. This can result in significant slippage as traders end up paying a higher or lower price than anticipated for their trades.

On the other hand, if the order book has ample depth, a large market order may not significantly impact the available liquidity. In such cases, tradersmore likely to experience minimal slippage as their trades can be executed at or near their expected price.

For example, when a trader purchases a large volume of cryptocurrency, and there are only a few sell orders at the desired price, the order may be partially filled at higher prices. This can result in slippage, with the executed price deviating from the expected price. Traders should consider the depth of the order book when making trades to minimize slippage.

4. Time of Execution

The timing of a trade can make a significant difference on slippage. Market conditions constantly change throughout the day, with certain times experiencing higher liquidity and lower slippage compared to others.

On November 15th, 2023, Bitcoin experienced a drastic drop in price to levels around $35,000, causing a massive liquidation across the crypto market within 24 hours. This sudden crash came just after the digital currency had rallied to $37,000 in anticipation of an ETF approval.

The turbulence in the market triggered a massive $367 million in liquidations within just 24 hours, with over $200 million occurring in the span of one hour alone.

This event serves as a cautionary tale for all traders – timing is everything in the volatile world of cryptocurrency. This serves as a prime example of the potential consequences of making trades in times of market volatility. In situations like these, slippage can be particularly severe.

How to Prevent Slippage

While slippage is an inherent risk in crypto trading, there are several ways traders can mitigate its effects. Here are some strategies to consider:

1. Utilize limit orders

To minimize the risk of slippage, one effective strategy is to use limit orders. This type of order allows you to set a specific price at which you are willing to buy or sell an asset.

With limit orders, the market will only execute your trade at the specified price – no more, no less. This helps to avoid unexpected price fluctuations and limits the risk of slippage. However, it’s important to note that using limit orders does not guarantee that your order will be 100% executed.

2. Divide your orders

Splitting large orders into smaller ones can help mitigate slippage risks. By breaking down your order into multiple smaller trades, you can reduce the impact of your trades on the market and avoid depleting the desired price level’s liquidity.

For example, if you want to buy 100 BTC, consider splitting the order into several smaller orders of 10 BTC each. This allows you to execute the trades gradually and increases the chances of finding liquidity at the desired price levels.

Splitting orders can also help in taking advantage of different liquidity pools across various exchanges. By diversifying your trading across multiple platforms, you can access different order books and potentially find more favorable prices.

3. Use high-liquidity trading platforms

Trading on platforms with high liquidity can help prevent slippage. Exchanges with deep order books and high trading volumes are more likely to have sufficient liquidity to fill your orders at the desired price.

There is a list of exchanges that have the highest liquidity on the market (highest volumes in both spot and derivatives trading):

- Binance

- ByBit

- OKX

- Coinbase

- KuCoin

Before trading on an exchange, make sure it has a good amount of liquidity, a deep order book, and high trading volumes for the specific cryptocurrencies you intend to trade. Slippage can vary between crypto trading platforms for the same crypto assets due to differences in liquidity and trading infrastructure.

4. Trade with high-liquid assets

These are digital assets that have high trading volumes and market capitalization, making them easier to buy or sell without causing significant price fluctuations.

Some of the most liquid cryptocurrencies include:

- Bitcoin (BTC) – $715 billion* in market cap

- Ethereum (ETH) – $246 billion* in market cap

- Binance Coin (BNB) – $37 billion* in market cap

- XRP (XRP) – $35 billion* in market cap

- Solana (SOL) – $24 billion* in market cap

If an asset has a low market cap and low daily trading turnovers, it means that there are fewer buyers and sellers on the market, resulting in a higher slippage probability.

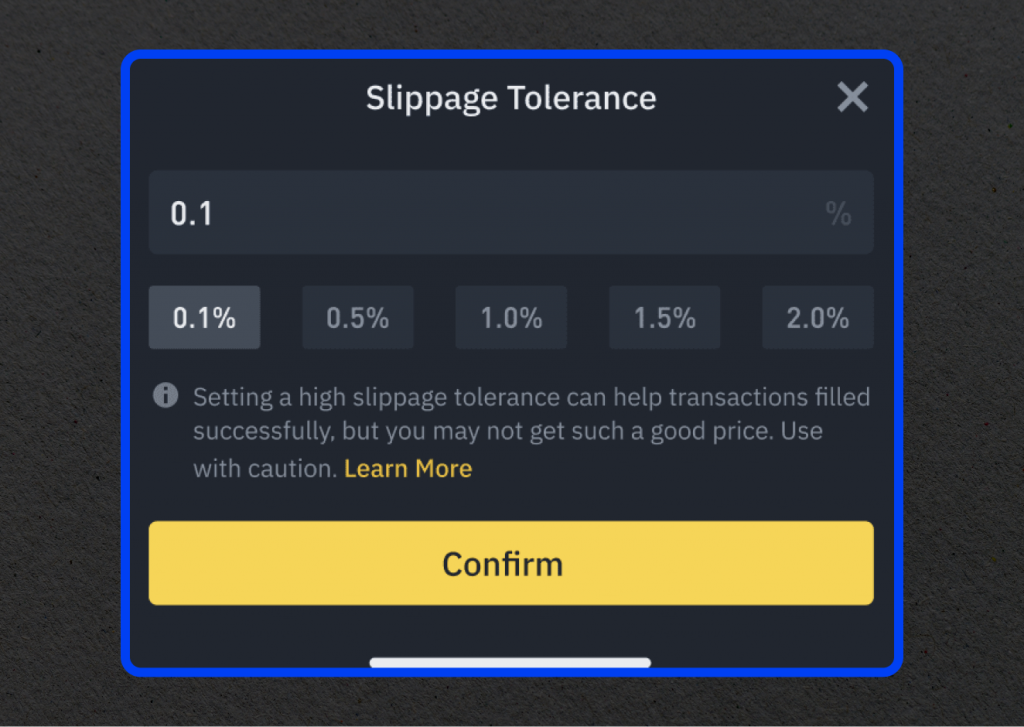

5. Adjust slippage tolerance

What is slippage tolerance in crypto? Slippage tolerance is a commonly used term in the world of crypto trading. It refers to the maximum price difference that a trader is willing to accept from the expected price of an asset. In simple terms, it is the “wiggle room” that traders allow for when making trades.

By adjusting your slippage tolerance, you can define the highest deviation from the desired price that you are comfortable with. A high tolerance allows for greater flexibility in execution, but it also increases the risk of higher slippage. Meanwhile, low tolerance may result in fewer filled orders but can help lessen slippage.

6. Keep track of market trends

Keeping a close eye on market conditions can help you make smart trades and avoid slippage. Stay updated on relevant news and important developments that can impact the cryptos you trade.

Even some of the fundamental data reports on inflation and consumer spending may affect crypto prices. For instance, a monthly CPI report showing a decline in inflation may trigger a price surge in cryptocurrencies. Not to mention crypto-related events, major announcements, and regulatory actions that can cause sudden spikes or dips in prices.

Such sudden price movements or market disruptions can increase slippage, which is why awareness is crucial.

Last Thoughts

Slippage is an inevitable part of the crypto trading process. However, by implementing the strategies discussed above, you can mitigate its impact and improve your overall trading experience. Remember to research and analyze market conditions, diversify your trades across multiple platforms, and adjust your trading parameters accordingly to prevent slippage.

*as of November, 2023

Disclaimer: The information provided in this article is for educational purposes only and does not constitute financial advice. Traders should do their own research and risk assessment before making any investment decisions. Always trade responsibly and consider the potential risks associated with crypto trading. There is no guarantee of profits or protection against losses when trading cryptocurrencies. Trading at your own discretion is advised.

FAQs

Is slippage always bad?

Depending on the situation, slippage can be either beneficial or detrimental. For example, it is advantageous when the trader buys a stock at a lower market price than anticipated (positive slippage). However, in most cases, slippage becomes a problem, resulting in lost profits when trades don’t go as planned.

What slippage can be considered normal?

The ideal slippage percentage is considered to be between 0.3% to 0.5%. However, this can vary between markets and asset types.

Do other markets experience slippage?

Yes, slippage takes place in all markets, particularly in those that are highly volatile. Examples of such markets include the crypto market, the foreign exchange market, and even commodities. Slippage also sometimes occurs in markets with high trading volumes, such as stocks.

Which crypto exchange shows the least slippage?

The best exchange for crypto trading without slippage is Binance. It has high daily trading volumes – $52 billion for derivatives as of November 2023, which is two times more than that of OKX ($21 billion), which holds the second position among exchanges in terms of derivatives trading volumes per day. It also has the deepest spot liquidity among other exchanges and offers advanced trading tools. Besides Binance, other popular exchanges known for low slippage include Coinbase Pro, Kraken, and ByBit.

How to start trading crypto?

You will first need to find a reliable and secure cryptocurrency exchange platform. Once you have chosen an exchange, you can create an account and deposit funds into it. Then, you can use the platform’s trading capabilities to exchange virtual currencies. Remember that cryptocurrencies are high-risk investments. Thus, always do your research and only invest what you can afford to lose.