Meet Paul Atkins, The New SEC Chairman

Crypto exchanges and online brokerages dealing with digital assets have been subjected to the tight grip of the US finance regulator in recent years.

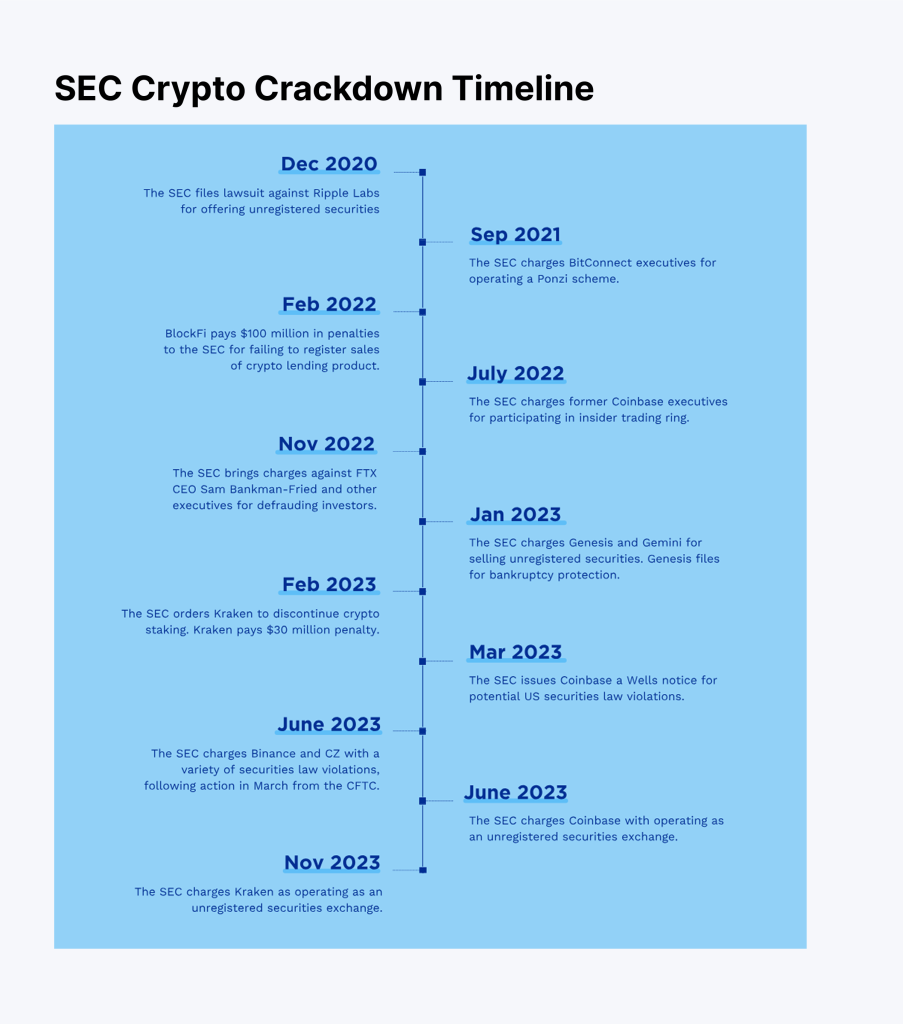

During Gary Gensler’s tenure, the Securities and Exchange Commission was targeting cryptocurrencies, labeling them as hazardous assets to the domestic economy as well as to domestic investors.

But with the new presidential administration in Washington, Trump has appointed a new SEC cabinet, led by Paul Atkins, whose appointment was met with positive reaction.

Who is Paul Atkins? What is on his agenda? Let’s explore.

Key Takeaways:

- President Trump appointed Paul Atkins as the SEC’s new Chairman, confirmed by the Senate committee on April 9th.

- The new leadership is expected to take a pro-crypto approach, easing regulations and prioritizing dialogue over punishment.

- As a key requirement before taking his new role, Atkins had to sell his holdings and shares in businesses due to a conflict of interest.

- Supporters are optimistic about the return of many crypto firms to the US, while critics worry about the outcomes of deregulation.

Paul Atkins Background: Education and Career

Paul Atkins commenced his legal career at an exclusive law firm in New York, Davis Polk, after obtaining an undergraduate degree from Wofford College in South Carolina, followed by a Juris Doctor from Vanderbilt University Law School.

He counseled financial institutions on compliance, regulatory matters, state and private company transactions, securities, public offerings, acquisitions, and mergers.

After that, Paul moved to working in the public sector as Chief of Staff to SEC Chairman Richard C. Breeden in the early 1990s. During that time, he gained valuable knowledge on Federal government securities rules and regulations as well as the inner workings of the SEC.

After a brief tenure in private practice, Atkins was named an SEC Commissioner in 2002 by President George W. Bush, serving until 2008. In office, he developed a reputation for resisting overly stringent enforcement powers and for promoting limited intervention by government in capital markets.

Outside of the SEC, he co-founded and is an investor in several financial services companies, consulting, and compliance. He is cited as a thought leader on regulatory and compliance approaches, marrying private and public sector experience, to become an authoritative presence in the world of financial regulation.

Rising Role at The SEC

Atkins’s short tenure at the SEC made him an outspoken critic of overregulation, earning him recognition for having incisive views amid high-profile enforcement proceedings.

His repeated championing of cost-benefit analysis in rulemaking and resistance to broad SEC interpretations earned him the role of a principle-based regulator.

While in service at the SEC from 2002 to 2008, Atkins was instrumental in designing post-Enron regulations, emphasizing overregulation’s pitfalls.

These considerations enhanced his profile and positioned him as an in-demand candidate after the departure on January 20th, 2025, of former SEC commissioner Gary Gensler.

Chairman Appointment

After Trump’s arrival at the White House, he selected the acting chairman Uyeda. Many expected dramatic changes in the SEC’s cabinet, especially given Trump’s pro-crypto stance, which opposed the then-current regulators.

In fact, many reported that as soon as Trump won the elections in late 2024, Atkins was the favorite choice, given their previous collaborations and shared views.

On April 9th, 2025, the Senate confirmed Paul Atkins as the new Chairman of the SEC after passing the congressional vote.

Known for his market-friendly philosophy and support for regulatory reforms, Atkins now steps into the role as a strong advocate for innovation, especially within the crypto industry. Many believe that Atkins’ residence will spur openness and a collaborative framework.

Portfolio and Personal Businesses

Besides public work in regulatory and compliance agencies, Paul built a successful career in the private sector.

- Patomak Global Partners: Patomak is a regulatory and compliance consultancy founded by Atkins in Washington D.C. It advises financial firms on SEC compliance, risk management, and market strategy.

- BATS Global Markets (Board Member): Atkins served on the board of BATS, a global stock exchange operator. He was involved in advising on regulatory policy and market structure.

- National Association of Corporate Directors: He has been affiliated with NACD, a governance-focused organization that provides boardroom education and resources.

- American Enterprise Institute: Atkins has contributed as an advisor at AEI, a research institute known for advocating free-market policies and deregulatory financial reforms.

- Private Clients: Atkins directly worked with many major banks, hedge funds, and FinTech startups. He advised many of them on navigating the US regulatory environment.

His entrepreneurial ventures indicate a persistent ideological approach: support for limited state intervention and encouraging self-regulation across the financial sector.

During Paul Atkins’ confirmation hearing, he was questioned by critics over possible conflicts of interest, most notably in terms of Patomak’s clients. Yet, Atkins vowed to divest himself of any holdings that could pose ethical issues.

But his knowledge about market participants is regarded as an asset that will bridge the gap between regulators and entrepreneurs.

Also, his broad private-sector background makes him best suited to appreciate the needs of businesses and entrepreneurs, particularly those handling digital assets and decentralized finances.

Regulatory Divestment

The Federal ethics framework requires suspending and disposing of any shares, businesses, or positions that may pose a conflict of interest with the Chairman’s role.

Paul Atkins moved to divest from any business holdings to align with the Fed requirements. This includes stepping down from executive duties at Patomak Global Partners and renouncing board memberships.

The move is seen as a step to ensure objectivity and build public trust, especially amid scrutiny from unions. While some critics remain skeptical, this divestment reflects his awareness of the delicate balance between public and private sector entanglements and commitment to the new position.

Paul Atkins Crypto Stance

Paul Atkins is regarded as one of the most crypto-friendly voices to ever lead the SEC. Unlike his predecessor, Gary Gensler, who maintained a firm grip on digital assets, Atkins has long called for a forward-looking approach.

He believes the SEC’s role should be to provide clarity and not create obstacles, especially for industries that could boost the local economy and are of global importance, such as blockchain and cryptocurrencies.

Paul Atkins argued that most crypto projects are not inherently fraudulent and should not automatically be classified as securities.

Instead, he supports the development of a tailored consolidated audit trail, specifically for digital assets and associated businesses, rather than implementing outdated securities laws.

In interviews and public commentary, Atkins has expressed admiration for blockchain technology’s potential to enhance market transparency, reduce settlement times, and democratize access to capital. He supports sandbox environments where developers can test blockchain applications without fear of legal consequences.

What to Expect From The New SEC Administration?

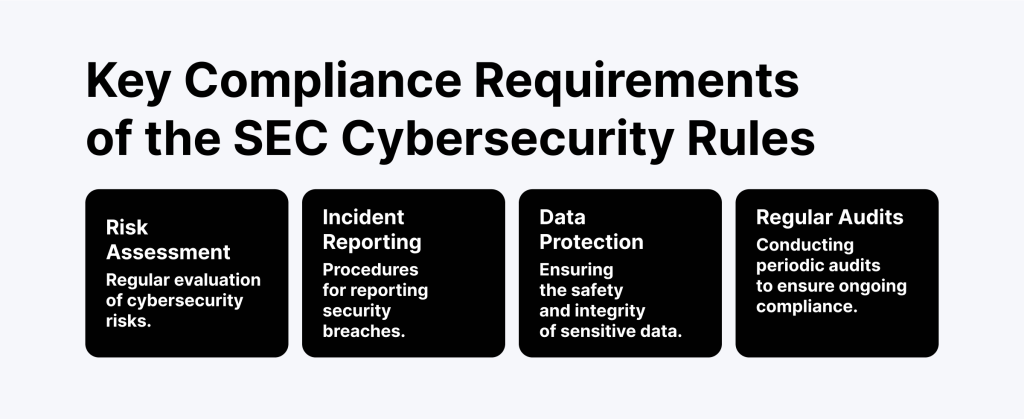

The SEC is expected to shift from an enforcement-first approach to one that emphasizes guidance, education, and collaboration with innovators.

This promise has been met with optimism across the crypto ecosystem, which has long called for regulatory clarity as opposed to the aggressive tone that characterized the Gensler era.

However, the Chairman must satisfy many proposed amendments.

Pro-Crypto Policy Reform

Atkins is expected to advocate for clearer, friendlier regulations for digital assets, which can motivate exchanges to re-enter the US after forcefully leaving due to burdensome regulations.

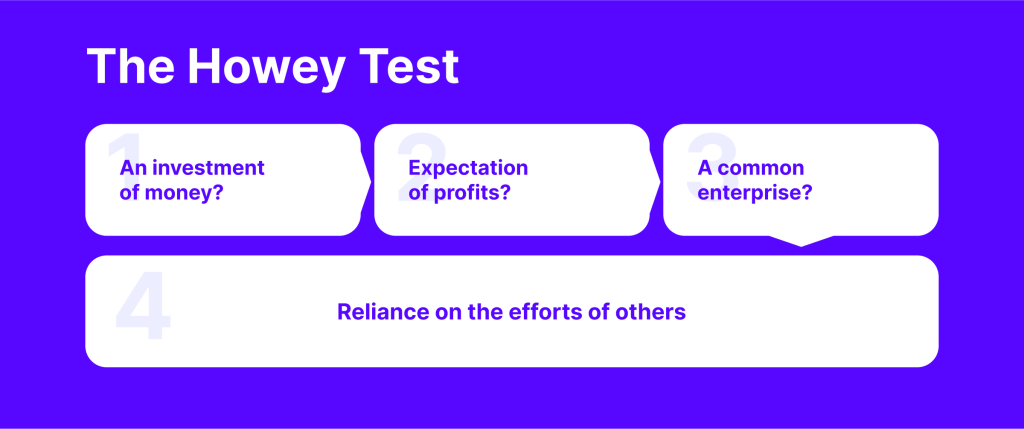

This could involve updating the Howey Test, improving the digital chamber’s token alliance, or introducing legislation that clearly identifies utility tokens and supports digital asset issuances.

Less Aggressive Enforcement

The SEC’s aggressive pursuit of crypto firms under Gensler drew criticism and deterred many DeFi businesses, fearing legal consequences. As such, the market expected Atkins to reduce litigation and prioritize formal rulemaking and dialogue.

Guidance over Enforcement

Across his years of open-market advocacy, Atkins stated that companies should not be blindsided by unclear rules and vague identifications. Therefore, his administration will likely issue more detailed guidelines to help startups and trading platforms navigate the legal landscape and avoid illegitimate operations.

Support for Capital Formation

The industry expects the new cabinet to set new, simple rules for crowdfunding and capital accumulation, especially for crypto startups and DeFi projects.

Many blockchain companies and token developers suffered the SEC’s penalties due to “illegal capital accumulation” by selling crypto assets.

Rebuilding Trust

The market expects more constructive conversation and a softer tone from the new SEC administration, which can boost financial growth and government efficiency in the long term.

Atkins aims to restore investor and entrepreneur confidence in the SEC as a fair, impartial regulator by implementing more predictable policies.

Tech Innovation Encouragement

The Chairman’s forward-looking approach may create new initiatives, like regulatory sandboxes and pilot programs, to encourage innovation and cooperation.

This will allow the SEC to engage in financial technology, aligning with the ambitions of the Trump administration to make the US the leader in tech and blockchain.

Global Regulatory Coordination

Chairman Atkins is more likely to bring US policies closer to international frameworks, which can minimize regulatory burdens and encourage institutional expansions while maintaining competitiveness.

This may require changes within the SEC itself, possibly including shifts in leadership, project leads, and initiatives.

Atkins vs Gensler: The Future of the SEC

The switch from Gary Gensler to Paul Atkins signals a fundamental shift.

Gensler is an MIT blockchain professor and a former Goldman Sachs partner. He was appointed by the Biden administration and approached his SEC Chairmanship with a focus on strict regulatory compliance, particularly financial products in the crypto space.

His term was marked by the lack of common-sense regulations and high-profile enforcement actions against key crypto businesses.

Atkins is a self-described “regulatory minimalist”. He prefers limited governmental interference and constructive dialogue over punishment.

Paul Atkins is expected to overhaul the SEC’s enforcement approach, placing greater emphasis on guidance and less on litigation. This could mean fewer lawsuits against crypto firms and more collaborative frameworks for compliance.

While Gensler focused heavily on investor protection and systemic risk, Atkins will likely ease the stifling capital formation rules to boost corporate governance and market efficiency.

Nevertheless, critics argue that relaxed regulations may open the door to fraud and manipulation, damaging the investor’s assets that Gensler was defending.

However, many entrepreneurs and market participants see hope in Atkins’ appointment to create a financial environment that supports growth and responsibility.

Pros and Cons of Paul Atkins’ Appointment

It is impractical to say that Paul Atkins’ SEC appointment is absolutely perfect. This decision will definitely have positive and negative outcomes, though the advantages must outweigh the disadvantages. Let’s review some pros and cons.

Optimism

- Pro-innovation mindset: Atkins supports crypto and FinTech innovation, promising a more adaptive regulatory environment.

- Emphasis on clarity: Paul Atkins prioritizes clear and consistent guidelines over unpredictable actions and vague guidelines.

- Capital formation focus: Startups and small businesses may benefit from easier access to fundraising.

- Market experience: The Chairman’s background in private consulting and public service gives him a practical advantage.

- Collaborative tone: Atkins encourages dialogue between regulators and innovators, which could ease industry tensions.

Skepticism

- Weak investor protections: Critics argue that his deregulation may expose retail investors to higher risks.

- Conflict of Interest: Atkins’ ties to Wall Street and owned consulting firms raise red flags about regulatory capture concerns.

- Limited enforcement approach: Soft enforcement can encourage bad actors and illegitimate entities in crypto markets.

- Corporate favoritism: Critics fear his policies may unjustly benefit large financial institutions rather than retail operators.

The Crypto Future in the US

As Paul Atkins takes the lead at the SEC, the US crypto landscape could enter a new era of legitimacy and growth. The new leadership comes as the industry is in dire need of regulatory clarity and relief from unfair enforcement actions.

Prioritizing education, collaboration, and fair guidance is the central approach for Atkins’s agenda as the new chairman. This will give him the opportunity to transform the US into a global leader in digital finance innovation, blockchain developments, and decentralization.

Analysts predict crypto companies will return to the US markets and serve local customers after being forced outside the country due to a regulatory crackdown. We may see DeFi startups, exchanges, and even institutional companies venture into cryptocurrencies without massive changes in firm regulatory foundations.

However, there are critical challenges along the way:

- Firstly, the new Chairman must convince the opposition of his commitment to leading the financial landscape away from his ties to personal businesses and investments.

- Then, the agency must create a clear regulatory framework that distinguishes between decentralized platforms, centralized exchanges, and hybrid models.

- Finally, Atkins must be fairly just with enforcement against bad actors, prioritizing dialogue and guidance over retribution.

If successful, the US could reclaim its status as a hub for financial innovation, drawing talent and capital back. The future of the US crypto landscape relies heavily on Atkins’ ability to tackle these challenges and combine freedom with responsibility.

Conclusion

All eyes are on the newly appointed SEC Chairman, Paul Atkins, succeeding Gary Gensler, whose approach was overly politicized towards DeFi businesses.

As the United States struggles with rapid technological and regulatory changes, financial markets, and investor behavior, Paul Atkins promises a fresh, principled approach, especially toward crypto.

While supporters see this as a chance to nurture a new wave of growth, skeptics worry about deregulation and soft enforcement against illegitimate entities.

FAQ:

Is Paul Atkins pro-crypto?

Yes. Paul Atkins is widely considered a crypto supporter. He supports regulatory clarity for digital assets and opposes enforcement approaches. The new Chairman favors innovation-friendly policies that allow blockchain and crypto projects to grow under a clear framework.

Who is the new SEC leader?

The new Chairman is Paul Atkins, appointed on April 9th, 2025. He worked as an SEC commissioner and financial consultant with private and public companies. He brings a free-market approach with a strong emphasis on regulatory reform.

Is Paul Atkins better than Gary Gensler?

Atkins promotes innovation and lighter regulation, appealing to crypto advocates, while the prior administration used strict enforcement and litigation to protect inventors.

What are Atkins’ plans for cryptocurrencies?

Atkins plans to introduce clearer disclosure requirements for cryptocurrencies, moving away from regulation by enforcement to a more relaxed approach and guidance. He supports simple frameworks that distinguish crypto assets from traditional securities.