ORDI Price Analysis: Will it Reach $88 During Bitcoin Halving?

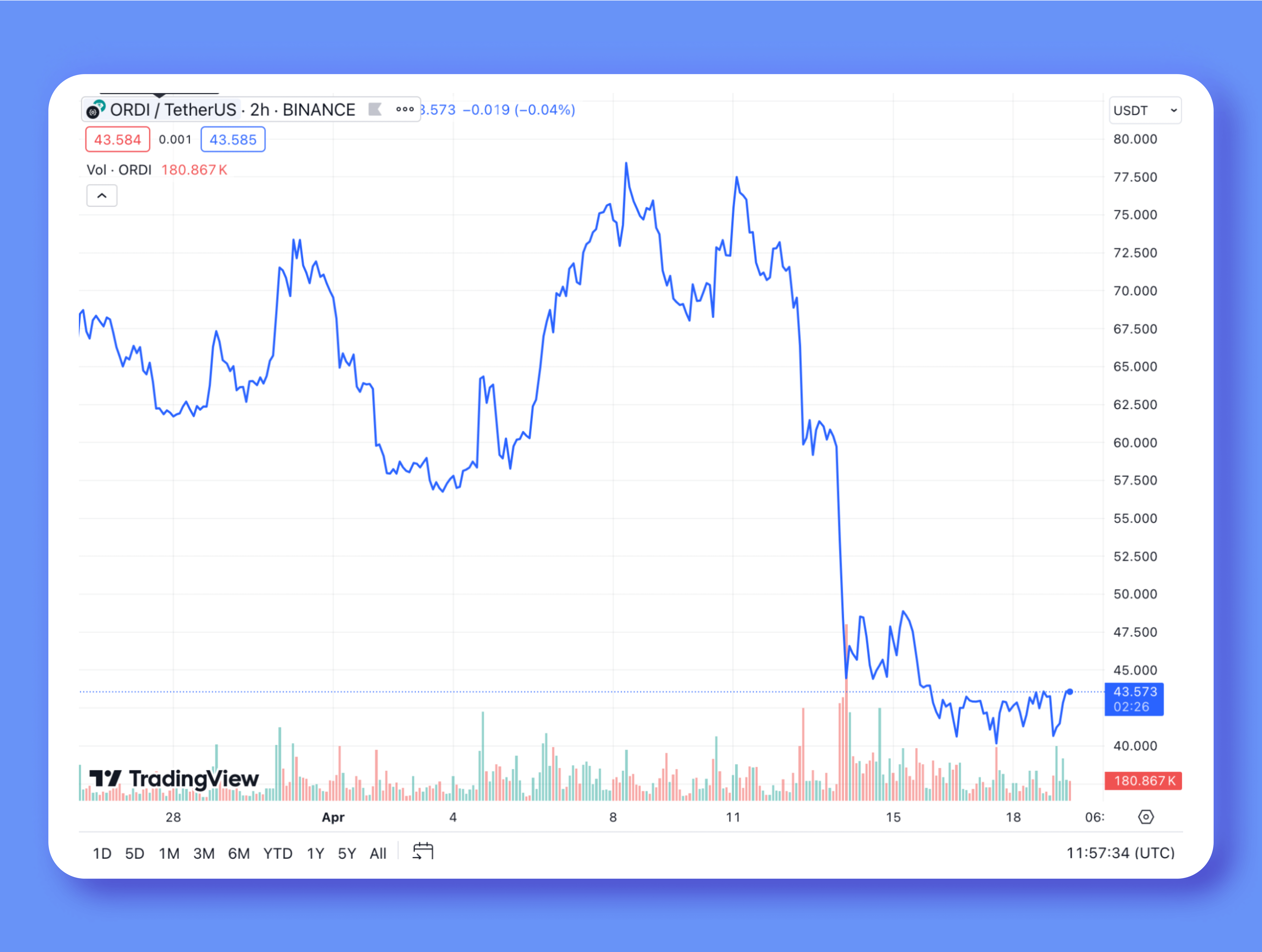

Since April 13th, the ORDI coin has been in an extended slump, failing to capitalize on its accumulated momentum in the previous months and reaching a low point of support at a $40 valuation. While the fall-off of ORDI is consistent with the faltering crypto market, the upcoming Bitcoin halving event could give ORDI the surge it requires to regain the momentum.

But what is ORDI exactly? And is it a good investment amidst the undervalued altcoins in early 2024? Let’s discuss.

The Vision Behind ORDI Project

It is no secret that the NFT revolution of the early 2020s was a failure, with numerous scammers and malicious individuals exploiting the market for their own benefit. Moreover, the NFT movement failed due to the lack of real utility and standardized value. In 2023, Bitcoin started to create a spiritual successor to NFTs, Bitcoin Ordinals, which aimed to increase the value of Bitcoin as well as establish a more utility-oriented variation on NFTs. As a result, many coins started to follow the inscription method, allowing users to inscribe valuable information or content within the coins.

ORDI was a novel coin that developed a mission to create a fully functioning marketplace around the Bitcoin ordinals protocol. The team behind ORDI designed the system that allows artists to create NFTs directly on the Bitcoin blockchain, offering a high level of security and immutability compared to other platforms. Artists can sell and transfer their digital artwork directly on the Bitcoin network, potentially reducing reliance on intermediaries.

As a result, ORDI quickly positioned itself as a go-to marketplace and currency for artists and users who wished to engage with the Bitcoin ordinals technology.

How ORDI Became a Powerful Force from the Get-Go

As a lesser-known entity, the ORDI project entered the early 2023 market with an impressive valuation of $25, which is hard to achieve without any backing or previous success. ORDI kickstarted last year’s altcoin season with impressive numbers and never looked back, going beyond even the most optimistic resistance points and accumulating a massive market capitalization.

This impressive surge was the result of a well-timed and expertly executed push to empower Bitcoin ordinal creators and users. ORDI’s ecosystem is by far the most intuitive and accessible for inscription purposes, allowing Bitcoin users to create inscriptions seamlessly.

As ORDI became the biggest proponent of Ordinals, it quickly became the leader of the altcoins to watch, gaining significant momentum in September of 2023 and reaching unprecedented price highs for such a young project.

ORDI’s use cases are tied to the actively expanding Ordinals market, making the best use of the BRC-20 protocol and capitalizing on the new movement. While moving strongly into 2024, ORDI has been unable to maintain momentum during the Bull run. Let’s discuss.

ORDI’s Uneven Progression in 2024

As analyzed above, ORDI managed to make the most out of its connection with the widely popular Ordinals technology. However, these circumstances work both in favor and against ORDI, as it lives and dies by the popularity of the Ordinals. In 2024, many Bitcoin users stepped forward to voice their complaints about Ordinals, highlighting the fact that they are unethical and possibly dangerous to the general public. This concern is because Ordinals aren’t supervised or regulated, allowing users to conduct harmful and illegal activities potentially.

As a result, ORDI’s success hinged on how well the adoption of Bitcoin Ordinals would spread across the market. Naturally, the value of Bitcoin itself played a huge role in ORDI’s valuation, allowing it to climb unprecedented highs of $88.

However, the last month has not been as kind to ORDI’s aspirations, as the market correction finally stepped into the cryptocurrency landscape, and the industry finally showed signs of a crypto bear market. As Bitcoin started to lose its hype, ORDI’s valuation experienced a heavy momentum toward a decline, going back to a $43 price at the beginning of April.

The reason behind the sharp decline can be attributed to a temporary bearish sentiment in the crypto field. Lately, the crypto fear and greed index went down to 56, which showcases that the crypto bullish trends are over for the current period. Another major reason is the dilemma of Bitcoin Ordinals, with the adoption rates not going as planned in the Bitcoin community.

ORDI and Bitcoin Halving 2024

Despite a bumpy road in the recent weeks, ORDI might receive a significant injection of momentum once again when the Bitcoin halving takes place. As the halving date approaches its critical point, the general public expects the Bitcoin to initiate the process in the following couple of days. Most probably, this event will stimulate themarket once again and nudge Bitcoin to go up in valuation.

If Bitcoin Ordinals manage pull through the market controversy and Bitcoin receives a much-awaited push from the halving event, it is safe to assume that ORDI will follow in its footsteps. However, the extent of ORDI’s rise is still in the question, as the currency has been devalued significantly and it is still not clear if ORDI will be able to recoup its previous price peaks.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in cryptocurrencies carries ingrained risks, and individuals should conduct their own research before making any investment decisions.