Bitcoin Ranking Surpasses Google as The 5th Most Valuable Asset

With rising institutional adoption and governmental strategic inclusion, Bitcoin has proved itself as a globally critical instrument. The digital asset has gone beyond being a virtual payment method, reshaping traditional financial systems and institutions.

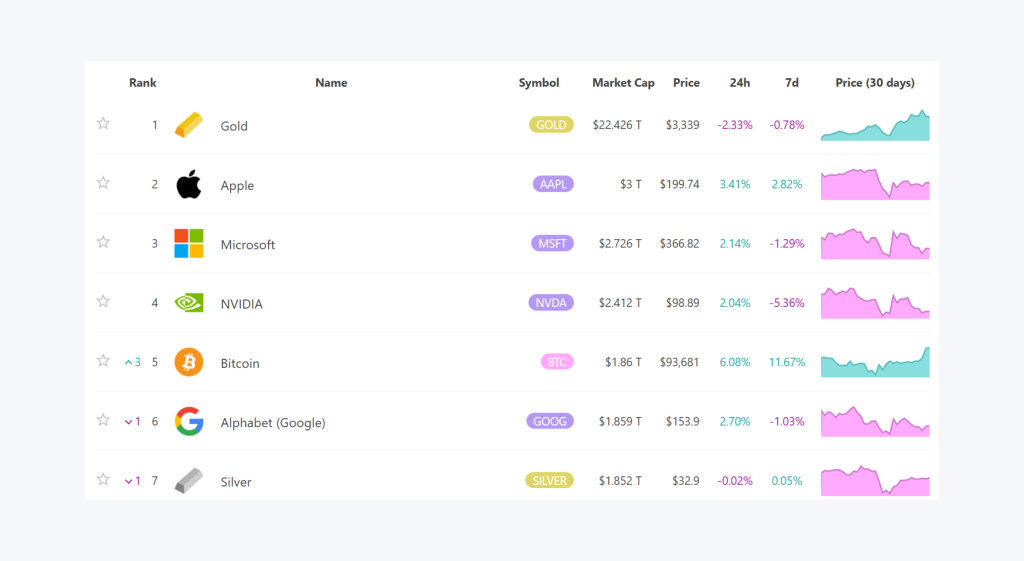

BTC has recently entered the top 5 list of the most valuable assets, overtaking Google after surpassing Meta and Silver a few months ago.

The new Bitcoin ranking of globally valued assets complements the series of good news accompanying the coin, triggering a positive market sentiment. Let’s review the reason for this growth and what the future looks like.

Growing Bitcoin Ranking

On 23 April, Bitcoin’s market capitalization surged significantly, triggered by regulatory news and ETF inflows, making it the fifth most valuable asset globally.

According to recent market data, BTC’s market cap surged past $1.86 trillion, outpacing Alphabet Inc.’s $1.85 trillion. However, it is worth noting that both assets have had their valuations fluctuate, with the Bitcoin asset ranking moving frequently between the fifth and sixth positions.

This milestone puts BTC just behind Nvidia, Microsoft, Apple, and the most valuable asset, Gold, sitting at north of $22 trillion in capitalization.

The climb comes amid renewed investor optimism, driven by increasing institutional adoption and regulatory clarity. The coin’s ability to re-enter the $90,000 zone boosted market confidence, even as macroeconomic uncertainties persist.

Analysts attribute this rally to strong on-chain fundamentals, potential economic reforms, and thriving capital inflow from traditional finance.

Bitcoin Price and Market Cap

After staying under the $85,000 mark for around two months, the news triggered a massive BTC price rally, taking the coin’s price to $93,000 in two days on 21-23 April. The rising Bitcoin market cap ranking spurred a return to the $90,000 level for the first time since March this year.

The coin’s valuation experienced a similar trajectory, seeing the crypto’s valuation spike from under $1.70 trillion to over $1.85 trillion in a couple of days. This pushed the market capitalization ranking of Bitcoin beyond Silver and Google very rapidly.

Institutional Adoption

On-chain data showed an increasing adoption by financial institutions, especially those dealing with BTC spot ETFs and crypto assets. Leading asset management firms, such as BlackRock, Fidelity, and Ark Invest, have reported substantial investments, signaling strong confidence in the asset’s long-term value.

According to recent data, BlackRock’s iShares Bitcoin Trust has seen consistent weekly inflows, further solidifying the coin’s role in traditional finance and boosting overall market momentum.

New SEC Chairman

Another optimistic news in the crypto space was the appointment of a new Securities and Exchange Commission chairman. Paul Atkins was sworn in as the new SEC leader on 22 April, adding another push to the ongoing domino effect.

This announcement led to increased optimism among investors and industry stakeholders, anticipating clearer guidelines and support for cryptocurrencies and DeFi exchanges.

BTC Price Analysis

If we analyze the BTC price chart using the exponential moving average indicator, we see how the 12-day and 24-day lines change their patterns.

After moving close to each other and along with the market price, the 12-day EMA line crossed over the 24-day EMA line on 21 April. This movement was accompanied by an increasing price line, crossing over both EMA indicators.

Additionally, the 12-day diverges significantly from the 24-day EMA and is just under the price line, signaling a continued bullish movement for the coming days. However, the correction at the end of the indicator’s slope suggests that a slight price recovery might happen, setting a new support level.

Concluding Thoughts

The growing valuation, price, and adoption rate boosted the Bitcoin ranking list, putting it above Google for the first time ever.

Looking ahead, analysts predict Bitcoin will re-enter the $100,000 zone again and probably revisit or exceed its previous record of $106,000.

Many factors have influenced this rally, including institutional adoption, regulatory clarity, and macroeconomic trends, pushing the coin’s price to new highs this year.

Disclaimer: This article is for informational purposes only. It is not financial advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.