Cryptocurrency Flipping: What Does it Mean and How Can You Flip Coins?

Since people started thinking about generating income, a good bargain has always been in their minds. Flipping cryptocurrency is another form of a good deal, an investing technique in which individuals purchase digital assets to resell them for a higher price promptly. This method has grown in popularity because of the market’s changing nature, which frequently causes notable price jumps.

This article will explain what crypto flipping refers to and review the essential procedures for turning cryptocurrency into income. We’ll also talk about the potential risks, such as losing money because of how unpredictable the market is and the difficulties brought on by market manipulation.

Key Takeaways:

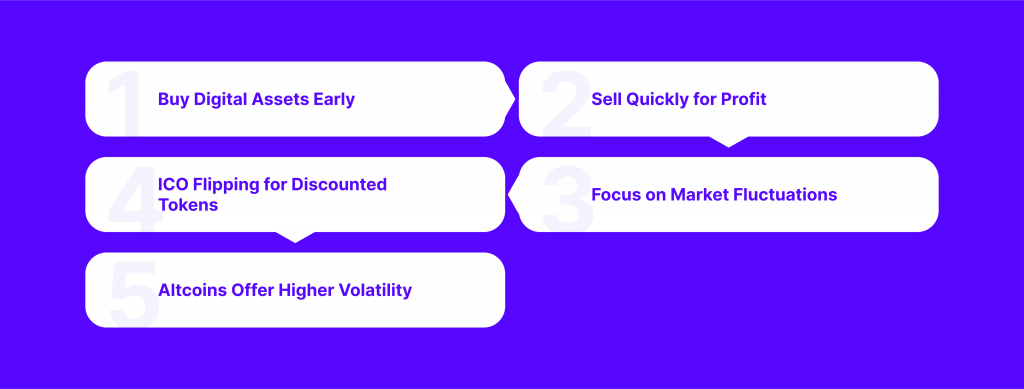

- Buying digital assets and swiftly reselling them for a profit is known as crypto flipping.

- In an ICO, investors buy tokens at a discount to sell for more money once they are listed on exchanges.

- There are a lot of dangers associated with flipping, including high market volatility, problems with liquidity, and possible regulatory issues.

What is a Cryptocurrency Flip?

While flipping, an investor buys digital assets, like altcoins, intending to sell them rapidly and for a profit. Usually, this procedure takes place following the assets’ listing on a cryptocurrency market. The technique relies on the notion that cryptocurrency values frequently see large jumps, especially when a new coin enters the market. The objective is to take advantage of these price spikes so that the trader can quickly turn a profit. Flipping cryptocurrency, in contrast to long-term investing, is concentrated on profiting from temporary market fluctuations.

ICO Flipping

One type of cryptocurrency flipping that takes place around Initial Coin Offerings (ICOs) is called “ICO flipping.” A new cryptocurrency is made available to early investors during an ICO before it is listed on exchanges. During this ICO, investors buy these tokens at a discount and plan to sell them soon after the coin begins trading on a secondary market.

The initial listing frequently increases other traders’ trust, which raises the token’s price. As a result, individuals who took part in the initial coin offering can sell their holdings quickly when trading starts for a profit.

Let’s now see how to flip cryptocurrency. During an ICO, a new crypto is issued for $0.10 per token. You buy tokens worth of $1,000. This crypto is then listed on a cryptocurrency exchange. Anticipation and heightened demand instantly cause the price per token to rise to $0.25. Now, you can earn $1,500 ($2,500 – $1,000) by selling your tokens for $2,500. This is how to make money flipping cryptocurrency.

Altcoin and Bitcoin Flipping

Although altcoin and Bitcoin flipping follow similar basic ideas, their methods vary because of the traded asset type. Bitcoin flip refers to purchasing a specific amount of Bitcoin and selling it at times of extreme volatility.

In contrast to altcoins, which are frequently more volatile, the market behavior of Bitcoin is relatively stable. There are more prospects for flipping because of the volatility of altcoins. Because smaller, less-established cryptocurrencies can see huge price volatility, flipping altcoins can be riskier but have more significant potential profits.

Traders may move from Bitcoin to altcoins for more consistent gains, but they may also do so for more important but riskier returns.

Fast Fact:

When Ethereum reached its all-time high compared to Bitcoin during the 2017 bull run, the phrase “flipping” was first used. The market placed its bets on Ethereum’s increased adaptability because of its capacity to create smart contract-based applications.

How to Flip Coins: A Step-by-Step Guide

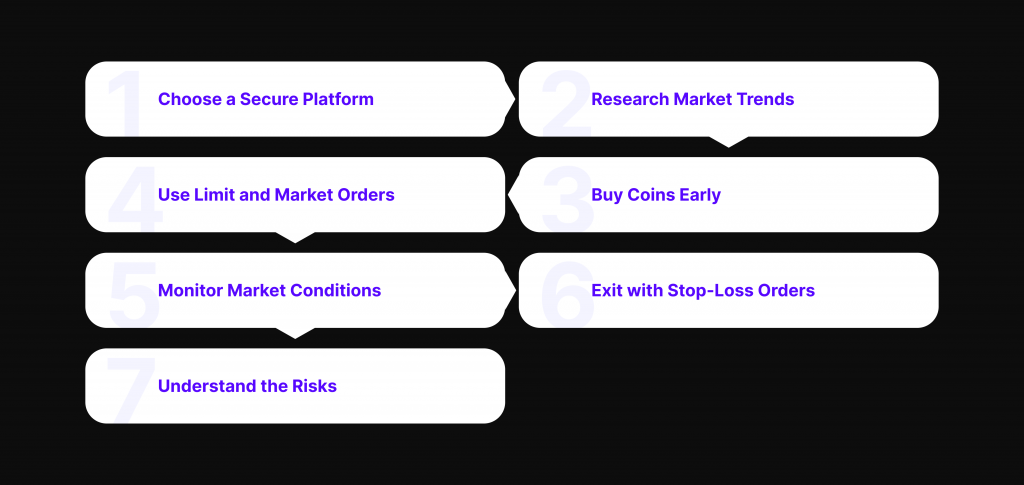

Selecting a reputable trading platform is essential when investing in coin flipping, and this is the first step. You may want to consider platforms that provide a large selection of trading pairings, robust security, and an easy-to-use user interface.

When choosing an exchange, look for features like cold storage for funds and 2FA. The availability of a wide range of trading pairs is crucial because it increases the number of flipping possibilities. A user-friendly interface can expedite the procedure and facilitate speedy trade execution.

Research and Market Analysis

Doing extensive research is necessary before investing. To start, look for possible price moves by analyzing market trends. Understanding the currency’s foundations, such as its team, goal, and roadmap, can help determine its long-term worth. Stay informed about industry news because announcements or changes may increase crypto prices. For example, if a specific currency is rumored to be listed on a large exchange, and the listing is confirmed, the price may increase quickly.

Executing the Flip

Buy coins during an ICO or before they are launched on significant exchanges to optimize your gains. To position themselves to sell coins at a greater price once they reach the secondary market, market participant purchases coins at a lower price during these stages. To prevent keeping a depreciating asset, this strategy requires careful timing and market awareness.

Types of Orders

Flipping cryptocurrency requires an understanding of the several trade orders. So, let’s discuss them.

- Limit orders – These let you specify the price you wish to purchase or sell a coin. For instance, you might create a limit order at $0.30 to sell the coin at that price. This strategy helps to generate profits by selling at your desired price.

- Market orders – They are executed right away at the going rate. Use market orders when you need to purchase or sell quickly, especially in very volatile markets. However, due to market volatility, the actual execution price may differ somewhat from the last traded price.

- Stop-Limit Orders – This is a limit order combined with a stop order. When the stop price is reached, it becomes a limit order. For example, you may set a limit price of $0.18 and a stop-limit order to sell your coins if the price drops to $0.20. This lessens the chance of losing money during unexpected price declines.

Monitoring Market Conditions

It’s vital to remain aware of market conditions when flipping, particularly during extreme volatility. The price of cryptocurrency marketplaces can fluctuate quickly—often in minutes. Monitoring tools like price alerts and real-time charts can help you respond swiftly to changes by reducing the chance of losing money. For example, a sharp rise in buying activity may portend an impending price jump and be an excellent moment to sell.

Exiting the Trade

Choosing when to close a trade is essential to profiting from flipping. Determine your target pricing by analyzing the market and using your investment strategy. Sell right away to protect your gains if the price hits your target. Use stop-loss orders to hedge against unexpected declines. For instance, you may place a stop-loss order at $0.20 if you purchased a coin at $0.10 and it increases to $0.25. This guarantees that you will still make a profit if the price drops.

Risks and Challenges of Flipping

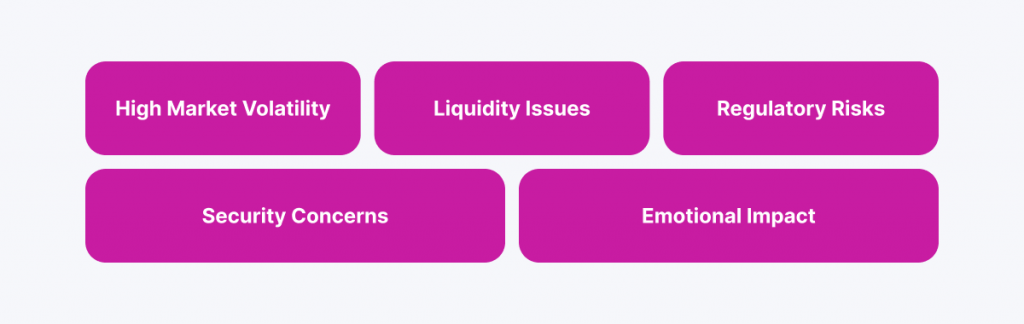

As we know, the crypto world is renowned for its extreme volatility, which can result in quick profits or losses. Price fluctuations are frequent and can be caused by news, significant trades, or changes in market sentiment.

For instance, A coin worth $1 in the morning might only be worth $0.50 in the afternoon. Because of this uncertainty, prudence is needed. There is a significant chance of losing money while flipping cryptocurrency in a highly volatile market, but there is also a chance of making money.

Liquidity Issues

Liquidity is the ease with which an asset can be purchased or sold without reducing its price. It can be a significant problem, particularly for lesser-known altcoins. When it comes time to sell, a market participant who buys a particular amount of these cryptocurrencies might not have enough buyers, making it impossible to sell at the intended price or in the recommended amount of time. This may compel traders to sell for less than planned, reducing profits or resulting in losses.

Regulatory and Security Concerns

Because the cryptocurrency markets are still primarily unregulated, fraud, market manipulation, and exchange hacking are all possible risks. For example, in the absence of regulatory monitoring, some coins may be the target of price manipulation, in which one entity inflates the price to draw in unwary investors. Furthermore, due to the lack of regulation, exchanges may not have the same security precautions as conventional financial institutions. As has occurred to traders in the past, a hack might cause you to lose all of your assets that are kept on an exchange.

Emotional and Psychological Factors

Trading cryptocurrency puts your emotional and psychological fortitude to the test in addition to your market expertise. In a highly volatile market, the urge to make judgments quickly might result in rash decisions motivated by greed or fear.

For instance, a rapid fall in prices may cause you to sell before you should out of fear of losing more, or a sudden increase may cause you to hold onto your investments longer out of greed and expose you to a downturn. Even when emotions are running high, it’s critical to maintain discipline by establishing clear investment strategies and sticking to them.

Conclusion

You should approach flipping with caution and knowledge. Conducting an in-depth study and using efficient risk management techniques is critical. Although there are financial opportunities in this volatile market, only well-prepared and disciplined people can successfully handle the obstacles that lie ahead. Remain informed at all times, keep an eye on the state of the market, and be prepared to modify your investment plan as necessary.