How to Spot a Scam Crypto Platform: Warning Signs and Confirmation Tips

The emergence of cryptocurrency has ushered in a new world of economic possibility, but also a deluge of crypto scams, ranging from professionally presented websites to purely fraudulent crypto schemes.

There are so many new platforms coming out that sometimes it is hard to tell the difference between a real opportunity versus a digital scam.

Here, you will learn what a spam crypto platform is, what to pay attention to recognize it, and what to verify to ensure that such platforms are legal in practice.

Key Takeaways

- Scam crypto platforms often employ tactics such as urgency, false promises, and professionally designed fraudulent websites to deceive users.

- Verify regulation, team transparency, community reputation, and audit history before investing.

- Knowing the red flags helps you avoid falling victim to crypto fraud and protect your crypto wallet and assets.

What Is a Scam Crypto Platform?

A crypto scam is a counterfeit site or app that pretends to be a real crypto service. It could appear and function just like a reputable exchange, a wallet provider, investment opportunity, or trading platform—but behind the glossy interface is a single-minded aim: to cheat users and relieve them of their money.

These web pages capitalise on growing excitement regarding digital currencies by promoting high returns, exclusive offers, or “too-good-to-be-true” features, only to disappear with members’ funds or personal information.

What makes these cryptocurrency scams so dangerous is that they often appear to be legitimate. They’re loaded with fancy graphics, business-like logos, fake user reviews, and sometimes even false government badges to help put you more at ease.

They mimic the look and shape of reputable crypto brands so that new users struggle to distinguish them. Some also have ad campaigns going on their social media, including fraudulent influencer sponsorship, to first create credibility.

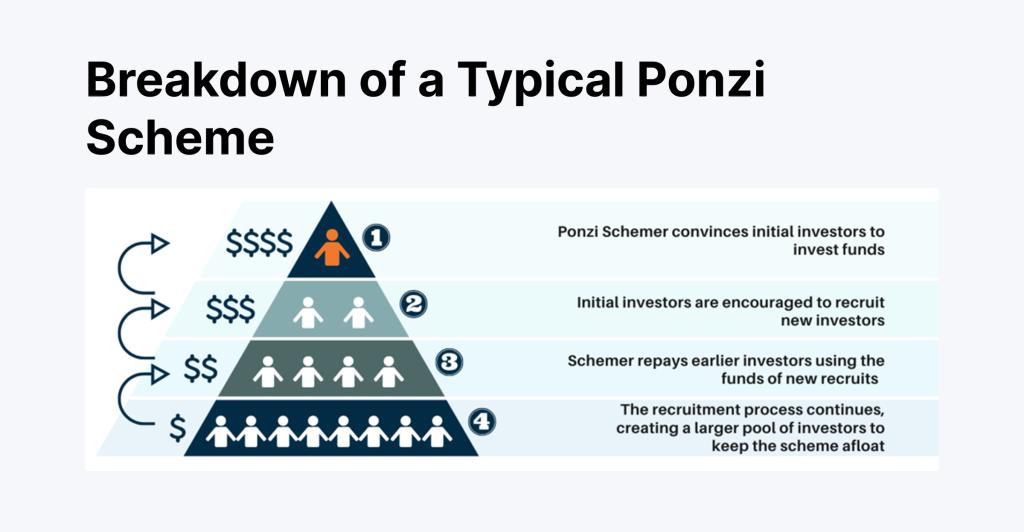

Ponzi crypto schemes often make use of emotion. Urgency and euphoria are brought to bear to cloud judgment—be it with a deadline timer to a “limited offer,” assurances of guaranteed income, or stories of astronomical returns by so-called pioneers.

These are tactics that aim to make individuals take immediate action without proper research. After deposits are made, the victims realize that their withdrawals are disabled, customer care is nowhere to be found, or the whole site is down.

Fast Fact

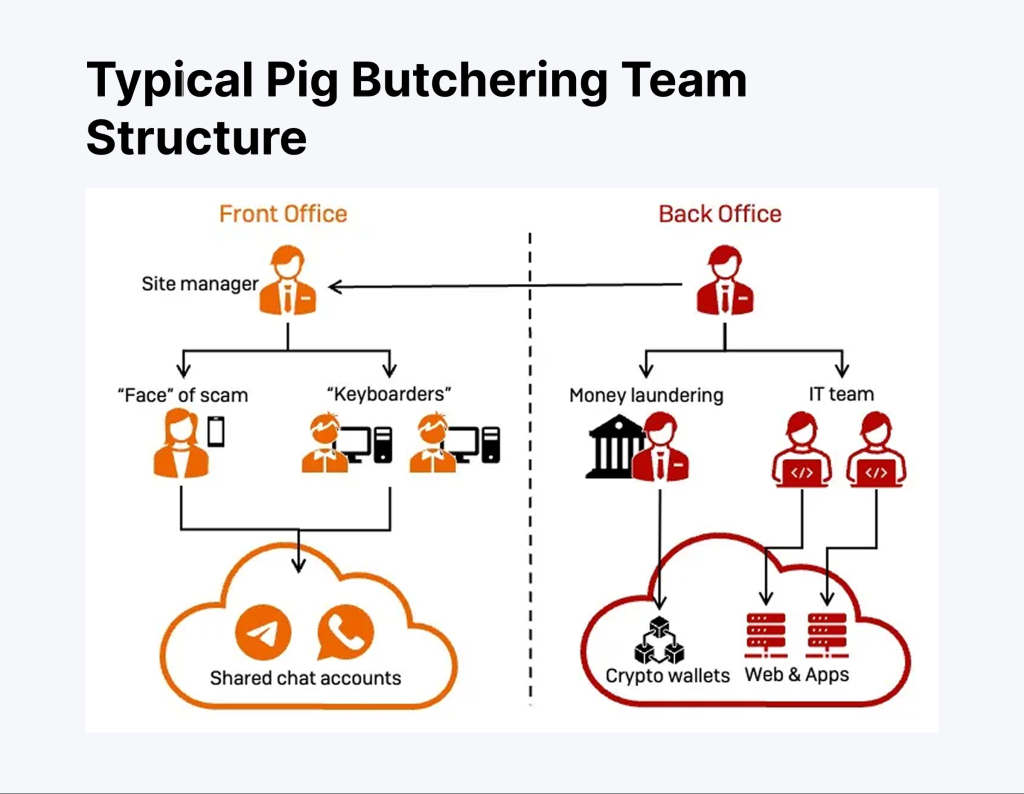

Pig butchering scams are among the fastest-growing crypto fraud tactics, blending romance scams with long-term investment traps.

How to Spot a Crypto Scam?

Today, with the rapid pace at which the cryptocurrency space is evolving, the distinction between a legitimate business and a scam is a thin line. While the technology underlying cryptocurrency is a game-changer, the deluge of spam crypto exchanges, spam crypto projects, and other crypto scams has rendered caution more necessary now than ever.

Learning to recognize a crypto scam is essential to safeguard your crypto holdings, your cryptocurrency purse, and your sense of calm.

Let’s examine the most common red flags so that you don’t end up a victim of such schemes.

Guaranteed Returns That Defy Logic

Nothing should make an eyebrow rise more quickly than a crypto investment site that offers “risk-free” returns or “guaranteed returns.” If it’s a bogus crypto marketplace, an “automatic” bitcoin mining package, or a phenomenally profitable investment opportunity, the reality is this: the crypto space is volatile by nature.

Real companies can’t give defined outcomes. If you’re assured steady daily returns irrespective of what’s going on within the market, you’re likely dealing with a crypto scam that wants to take you in with unrealistic promises.

No Licensing or Fabricated Regulation

Most of the fake exchanges go out of their way to appear to be in compliance. They will display false badges of regulation or claim affiliation with financial regulators. Some create fake websites to pretend to be exchanges or licensing authorities.

However, if you take a closer look, nothing backs it. Cross-check all claimed licenses with the regulator itself, invariably. Such scams thrive where regulation is poor or non-existent.

Anonymous Teams and Unverifiable Backgrounds

One of the telltale signs of a fraudulent trading platform is that it’s not transparent. If you’re not aware of who the founders, developers, and advisors of a platform are, that’s a red flag.

The majority of the pseudo crypto projects are established on busy-sounding social media platforms that have nothing much to offer. In some other cases, the images are duplicated or generated with the aid of AI. In the worst scenarios, scammers entirely make up identities to hide their footprints.

Pressure to Act Fast or Miss Out

Pressure is also used by thieves to intimidate individuals into making uninformed decisions. Pig butchering scams—one of the new crypto scams—involve emotionally exploiting individuals in the long run before persuading them to “seize” a last-minute money opportunity.

A countdown timer, a sense of “exclusive deal,” or a fabricated peril of lost revenues are all efforts to suppress thought and hasten you to mail money or invest more.

Difficult or Blocked Withdrawals

If a platform is simple to invest money into but very hard to withdraw money from, you’re likely facing a scam site. You might enjoy phony profits on your dashboard—the type designed to convince you that it’s working—yet to withdraw the money, that’s where problems take place.

They will demand additional fees, taxes, or even a supplemental deposit before making a payout. This is a type of manipulation that is common with all cryptocurrency investment scams, and hundreds of thousands of investors have so far lost their invested funds.

Poor Technical Quality or Suspicious Behaviour

The second red flag is a site that doesn’t quite sit right with you. That might include suspicious design, broken links, missing legal pages, or uneasy language. Spam crypto sites are also likely to be poorly built using templates and filled with plagiarized content.

Elsewhere, the fraud could consist of fake applications that pretend to be crypto wallets or trading platforms and are developed solely to get users’ private keys and the deposits of their cryptocurrencies.

Shady Token Offerings and Empty Whitepapers

The majority of scams involve false initial coin offerings (ICOs) that comprise a new cryptocurrency with no use, no roadmap, and no team. Such fake crypto tokens typically have impressive whitepapers with technical jargon and hype terms, but no value in themselves.

A viable project will explicitly state its mission, tokenomics, and technical configuration—and chances are, it will be open-sourced and frequently audited. If that’s not present, you’re better off avoiding it.

Overreliance on Social Proof and Influencer Endorsements

Social media scams often feature fake influencers or sponsored posts that promise high returns on a specific cryptocurrency investment. But such recommendations are probably paid endorsements—or outright inventions. Be on the lookout for overly effusive descriptions with not much behind them.

Skip the comments and sensational postings and take a look at nonpartisan reviews, forum arguments, and transparency. A great number of crypto scams build their validity on nothing more substantial than smoke and mirrors.

Lack of Contact Information or Support

No support team, no phone number, and no address? That’s a giant red flag. Many fraudulent trading sites avoid direct interaction to hide their identity.

And just as soon as issues manifest—especially when you’re initiating a withdrawal—their deafening silence is ever-present. With some phishing attacks, so-called “support” personnel dupe customers into relinquishing private keys under the guise of assisting.

No Security Audits or Code Transparency

Especially within the decentralised community, transparency is at the forefront. A credible crypto trading platform or DeFi project will have its third-party audits carried out and its code accessible.

The lack of open documentation is also a red flag that something is probably being hidden—either some identity-theft backdoor or a cunning trap to drain a crypto wallet of a victim.

How to Verify a Legitimate Crypto Platform?

It’s a market that is prolific with innovation, quick profits, and, unfortunately, fraud. It’s a tough task to make a judgment call between a legitimate crypto platform and a cunningly disguised fraud. But with proper checks and balances, you’re able to venture into cryptocurrency with confidence.

The following are imperative steps that every investor has to undertake to verify a crypto platform before investing a pound.

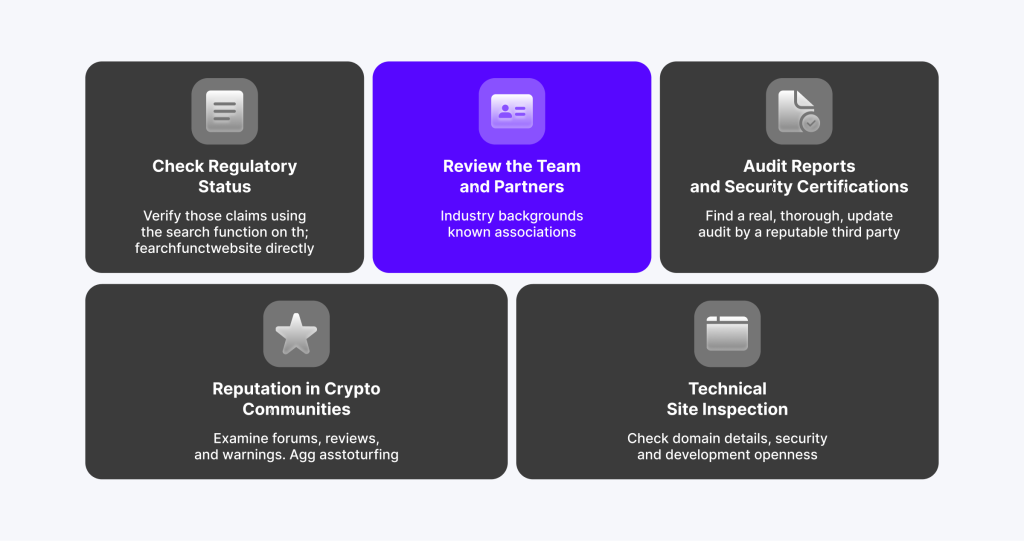

Check Regulatory Status

The very first and most important step to assessing a crypto platform is checking if it is regulated appropriately. A platform that’s worth its salt has a license that has been issued by a reputable financial regulator, such as the Financial Conduct Authority (FCA) of the United Kingdom, CySEC of Cyprus, or ASIC of Australia.

Don’t believe their hype—verify those claims yourself. Scammers have been known to create fake registration numbers and flaunt logos that they shouldn’t be displaying at all. Head to the legitimate regulator’s website directly and utilize their search functions to verify if the company is actually registered.

Unregulated is not automatically fraudulent, but it does enhance the risk a great amount, and most particularly if the platform is handling client funds or offering investment advice.

Review the Team and Partners

Trust in crypto is better built on the strength and transparency of individuals behind the initiative. A sustainable platform will not shy away from promoting its founders, developers, and business connections.

Look for extensive biographies, team pages, and, more relevant, LinkedIn profiles that reflect a genuine record of experience with the blockchain or financial worlds.

If the team is faceless, unrecognisable, or a stock photo, that’s a red flag. Try to drill a little deeper down—do the people who appear have relevant industry backgrounds, or ghosts with no online presence?

Trustworthy sites are also typically backed by known partners/investors, and they don’t mind putting those associations front and center.

Audit Reports and Security Certifications

For a code- and smart-contract-based industry, security audits are a given. You should ask yourself this question: Has the technology on this platform ever been vetted by an independent, reputable third party?

Companies such as CertiK, Hacken, and Quantstamp are experts at sifting through smart contracts and blockchain protocols to spot potential vulnerabilities.

There is a real audit report available—it’s somewhere on the platform’s site or on the auditor’s page. Ensure that the audit is thorough and up-to-date, and not a short summation on a page. If no third-party review or unauthorised “security seals” on the page, this should make you suspicious.

Reputation in Crypto Communities

One of the better things about the crypto universe is its vocal, enlightened online communities. Forums like Reddit, Bitcointalk, and Trustpilot are potential founts of truthful commentary, user reviews, and warnings.

A legitimate crypto platform will generally benefit from some healthy discussion and even some occasional criticism—nobody is flawless, sadly.

Or, those fraudulent sites are typically not familiar to the general public, or members are complaining that such sites do not make payouts, offering fake crypto projects tokens, or providing inadequate customer service.

Be cautious about fake comments or astroturfing—the real community comments are accurate, balanced, and informative.

Technical Site Inspection

It is sometimes worthwhile to take a peek under the bonnet. A series of technical tests is able to assess whether a platform is serious about safety or going through the motions.

Start with a WHOIS search to see who registered the domain, when the domain was registered, and where the domain is. Scams will, at times, use newly registered domain names that hide the ownership.

Check that the site has an SSL certificate (there should be a padlock in the browser) and that the site is using HTTPS—any connection that is not secure is a danger sign. Forward-thinking users also check their GitHub repository (if applicable, for blockchain-based services).

Active development, frequent updates, and open source code are all indicative of a genuine project. An unused codebase or a codebase that has not been touched in months is indicative of abandonment or a scam.

Conclusion

The crypto space holds great potential—but with that potential comes a sea of pitfalls laid down by crypto scammers eager to take advantage of the unsuspecting.

By familiarising yourself with the red flags of a dishonest trading platform, doing your due diligence with the proper questions, and doing some key verifications, you can avoid falling into their traps.

Remember that no get-rich-quick scheme is worth losing your crypto assets, your identity, or your sense of peace. Trust is earned, not assumed—not with crypto.

FAQ

What is the easiest way to spot a fake crypto platform?

Check for licensing, team transparency, and real user reviews—scammers often fake all three.

Can I trust social media endorsements for crypto projects?

Not always. Many are paid or fabricated. Always do your own due diligence.

Is it safe to invest in a platform that isn’t regulated?

Not necessarily. Lack of regulation increases risk and offers no legal recourse if you lose money.

What should I do if I am unable to withdraw my funds?

Stop depositing immediately, take screenshots, and report it to your local financial authority.