Top 15 Crypto Exchanges for 2024

As the crypto market gears up for a new bull run, with investors eagerly anticipating Bitcoin halving and expecting significant price surges in altcoins and projects, more and more new traders join this market in search of profitable opportunities. But what exchange is the best for crypto trading? It all depends on your preferences and goals, but among the rich exchange market, there are a number of platforms that can be considered the best.

In this guide, we will explore the top 15 crypto exchanges for 2024, their fees, features and capabilities to give you an overall impression and help you choose the right one for your certain requirements.

Key Takeaways:

- The crypto market offers a wide range of exchanges, each with its unique features and offerings.

- Some of the most liquid crypto trading platforms include Binance, Coinbase, ByBit, Gate.IO and KuCoin.

- Most exchanges offer spot, derivatives and bot trading, while some also provide NFT marketplaces, web3 features, and passive income opportunities.

- User-friendliness, security, fees, leverage and KYC verification are key points to take into account.

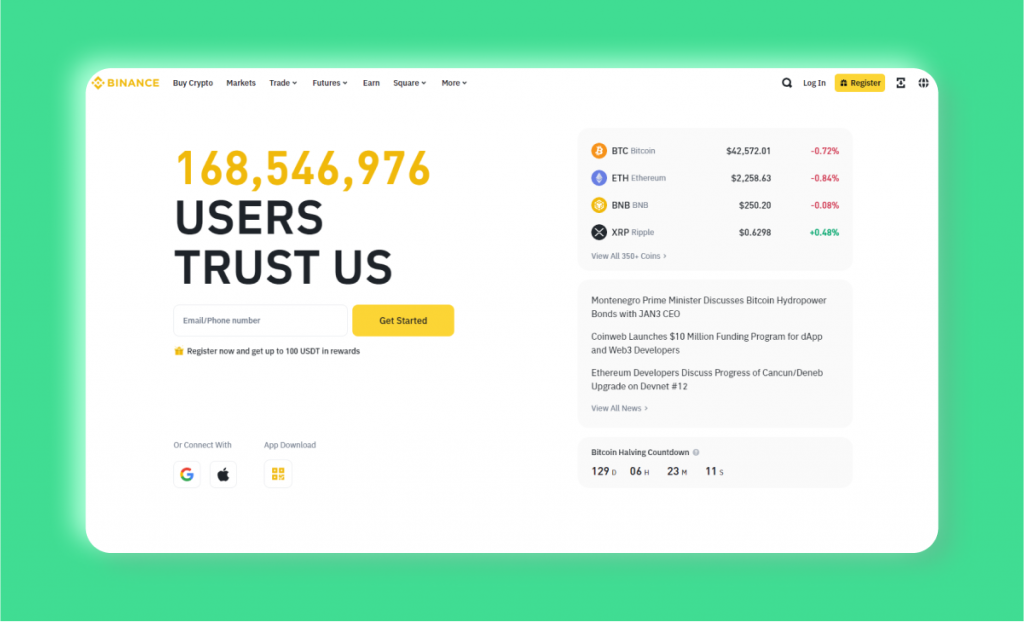

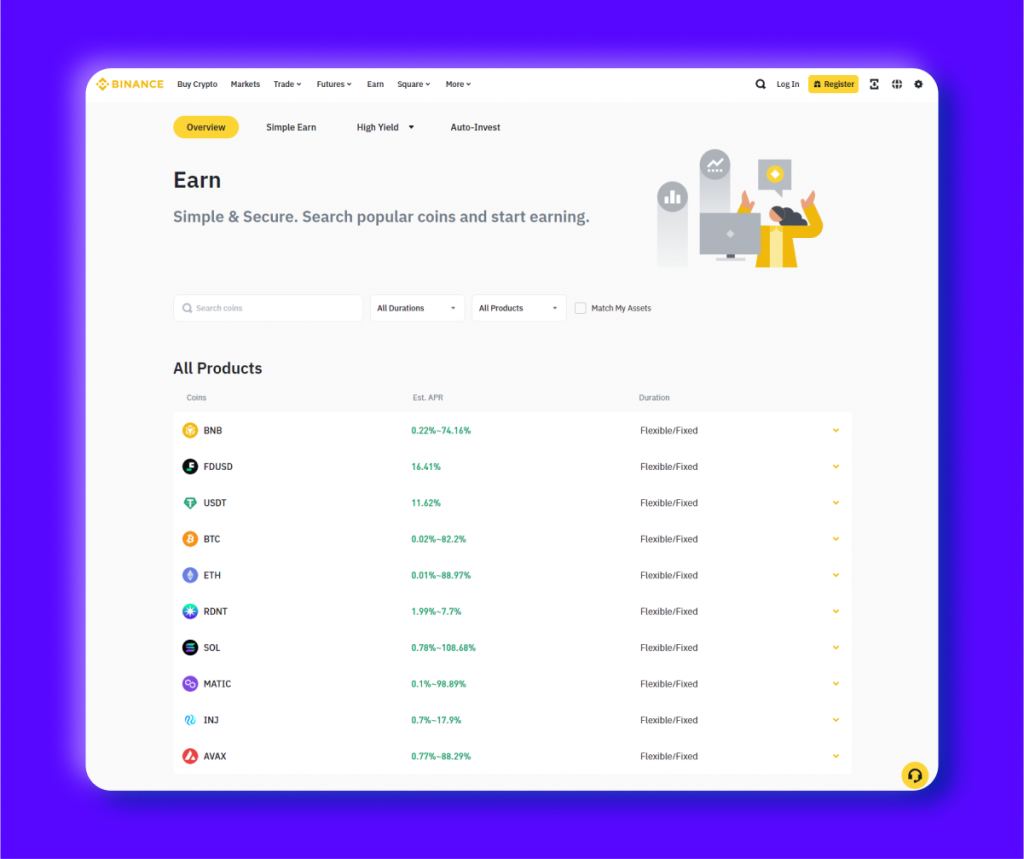

1. Binance: The Largest Crypto Exchange

Binance is the largest digital asset exchange platform in the world. It offers some of the lowest trading fees in the industry and more than 390 cryptocurrencies to trade. However, its availability and features are more limited in the United States, with only 150 tokens available for US users.

One of the major strengths of Binance is its robust selection of trading and investing opportunities. The platform offers:

- spot, margin and derivative trading,

- NFT marketplace (unavailable in the U.S.),

- launchpad with more than 78 projects already launched,

- trading bots and copy trading capabilities,

- Binance Earn program for passive income, which includes staking, dual investments and more,

- cloud mining services.

All of this makes Binance a preferred choice among experienced cryptocurrency investors. However, this also means that the platform may not be as user-friendly for those who are new to digital currency trading since the number of possibilities for making money may be overwhelming. As a result, users may experience a steep learning curve when using Binance.

It is important to note that Binance has faced major regulatory issues in the U.S. In November 2023, both the platform and its CEO, Changpeng Zhao, were found guilty of money laundering charges and agreed to pay a settlement of $4.3 billion, with Zhao stepping down as CEO. However, the new CEO of Binance, Richard Teng, stated that the platform will focus on restoring the confidence of the exchange’s 150 million users.

So, in 2024, Binance will remain a go-to platform for many traders due to the highest spot liquidity on the market, as well as a wide array of trading options and features.

Key Figures:

- Coins to trade: 394 (150+ in the U.S.)

- Daily trading volume (spot): $14.7 billion

- Daily trading volume (derivatives): $57.8 billion

- User base: 168.5 million

- Weekly visits: 13.2 million

- Fees: from 0.00% to 0.60% for trading

- Max leverage: 125x

- KYC verification: required

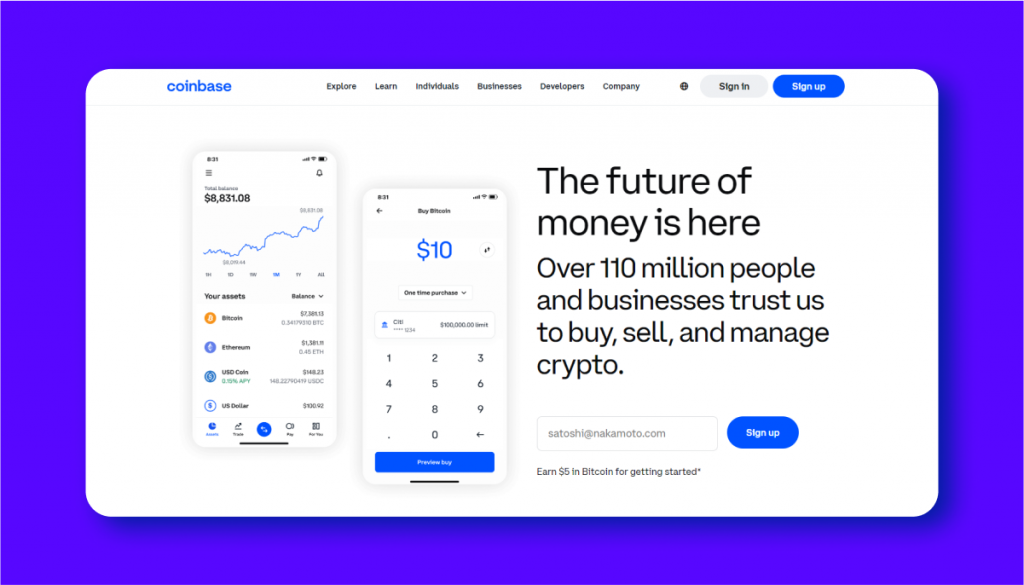

2. Coinbase: The Beginner-Friendly Exchange

With the increasing popularity of cryptocurrencies, newcomers today are looking for a user-friendly platform to start their trading journey. This is where Coinbase comes in – it is widely recognized as one of the most beginner-friendly cryptocurrency exchanges on the market. The platform is U.S. compliant, making it one of the most popular options for U.S. citizens.

Coinbase offers over 35 products for individuals, developers, and businesses. Each product caters to a specific audience, providing tailored solutions for their needs. For example, Coinbase Wallet is a non-custodial wallet with extra security features, while Coinbase Pro and Advanced Trade are trading environments for experienced users.

In terms of supported services and investing opportunities, the exchange gives its users:

- spot and derivative (for international users) trading,

- web3 and DeFi apps support,

- NFT trading platform,

- self-hosted crypto wallet and physical crypto debit card,

- Coinbase Earn program for passive income, which includes staking, dual investments and more,

- liquidity services and crypto payment solutions for businesses.

The company behind the exchange has also launched their international version of the platform specifically for derivatives trading of BTC, ETH and other assets – Coinbase International Exchange. The service is not available for U.S. users, and the futures trading volumes are not as high as those on concurrent exchanges, however.

In terms of security, Coinbase is well-regarded in the industry with its strict security measures, such as 2-factor authentication and cold storage for funds. The platform also offers insurance protection for digital assets held on their exchange.

However, one downside of using Coinbase is its fees. Compared to other exchanges like Binance, the platform charges higher transaction fees, around 0.50%, for purchasing and trading cryptocurrencies.

Key Figures:

- Coins to trade: 241

- Daily trading volume (spot): $2.7 billion

- Daily trading volume (derivatives): $306 million (international platform)

- User base: 108 million

- Weekly visits: 82,200

- Fees: from 0.05% to 0.60% for takers

- Max leverage: 10x (on international platform)

- KYC verification: required

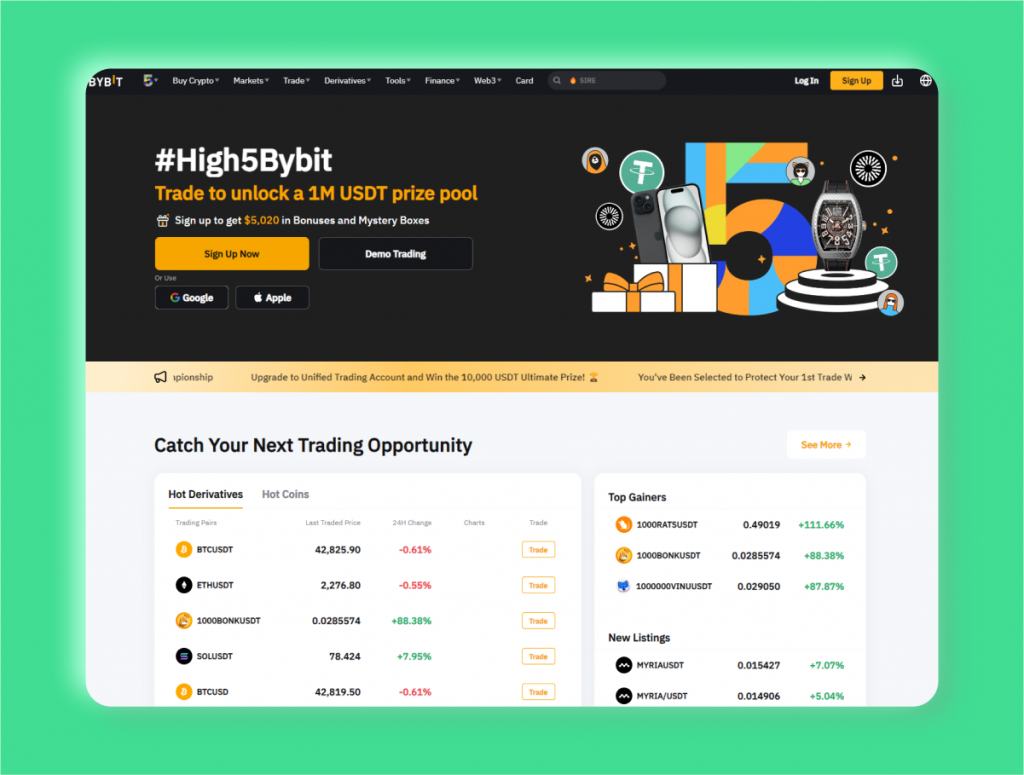

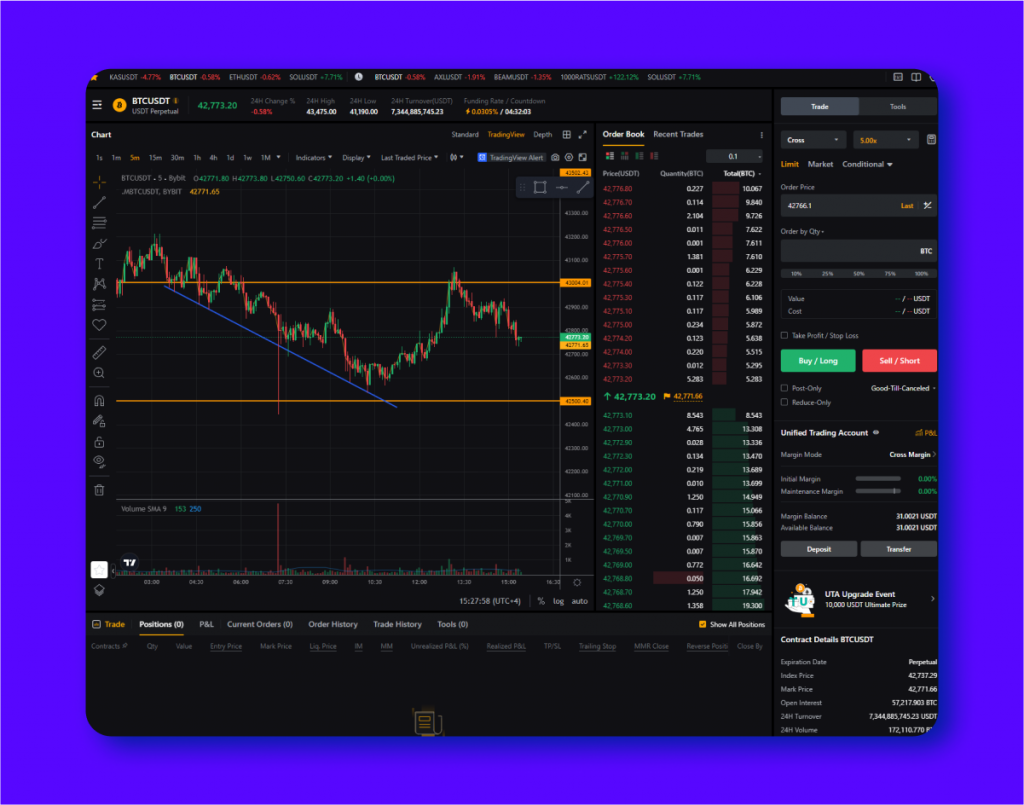

3. ByBit: Best for Derivatives Trading

ByBit is a relatively new player in the cryptocurrency market. However, it has quickly gained popularity among professional traders due to its advanced and sophisticated features and tools for spot and derivatives trading.

ByBit has plenty of investing and trading services available. Some of them include:

- spot, margin and derivative trading,

- NFT marketplace,

- launchpad with more than 25 projects already launched, launchpool and other ways to make money on new projects,

- spot and feature trading bots and copy trading capabilities,

- demo platform,

- ByBit Earn for passive income, including staking, dual investments, and liquidity mining,

- lending,

- debit crypto card for users in certain jurisdictions.

Currently, ByBit is one of the largest derivatives exchanges in terms of volume. Moreover, ByBit offers a greater selection of crypto assets to trade compared to Binance. With its rapid growth and focus on derivatives trading, it could become a major competitor to Binance in the future.

Aside from that, ByBit also offers a unique feature in the form of an NFT marketplace and web3 opportunities, providing users with additional options for trading and investing.

Key Figures:

- Coins to trade: 491

- Daily trading volume (spot): $3 billion

- Daily trading volume (derivatives): $20.3 billion

- User base: 15 million

- Weekly visits: 4.5 million

- Fees: from 0.055% to 0.60% for takers

- Max leverage: 100x

- KYC verification: required

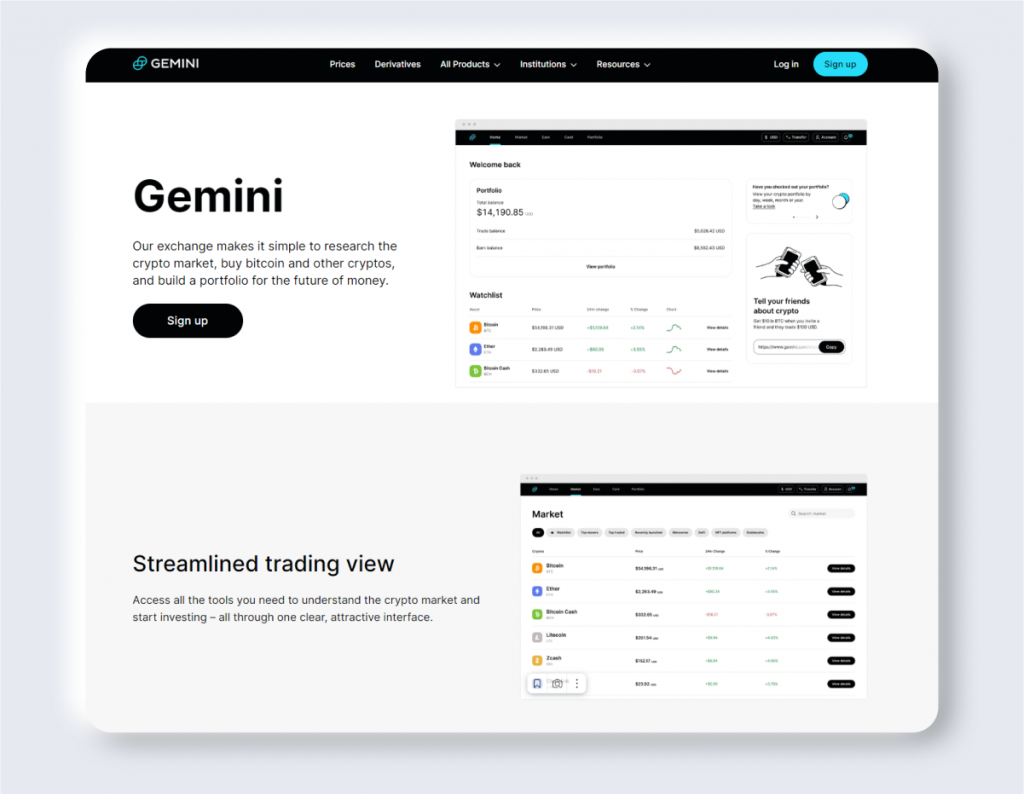

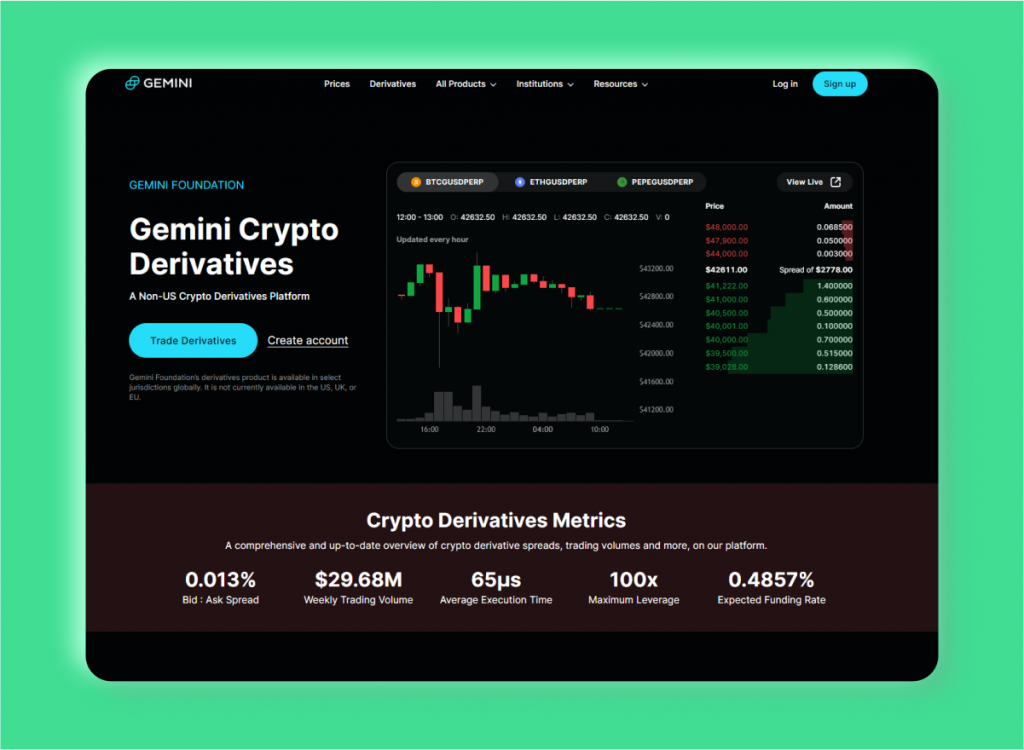

4. Gemini: Security-First Approach

Gemini is a cryptocurrency exchange founded by the Winklevoss twins, Tyler and Cameron, in 2014. The platform is built on four major pillars: product, security, licensing, and compliance. This focus on security sets Gemini apart from its competitors.

Gemini also offers a range of products and services, including:

- high-performance tools for spot and derivative trading,

- crypto credit card to earn rewards in BTC and other cryptocurrencies,

- NFT marketplace,

- staking features.

One of Gemini’s notable achievements is becoming the first SOC 2-certified crypto exchange in the industry. This certification, given by third-party auditors, assesses the platform’s security and compliance levels, which solidifies the platform’s reputation as a secure place for trading and storing digital assets.

However, one potential drawback of Gemini is its limited cryptocurrency offerings and low liquidity. This may not be ideal for those looking to trade more niche or lesser-known crypto assets. Also, derivatives trading is not available in the US, UK, or EU.

Key Figures:

- Coins to trade: 77+

- Daily trading volume (spot): $58 million

- Daily trading volume (derivatives): $11.5 million

- User base: 13.6 million

- Weekly visits: 375,272

- Fees: from 0.03% to 0.40% for takers

- Max leverage: 100x

- KYC verification: required

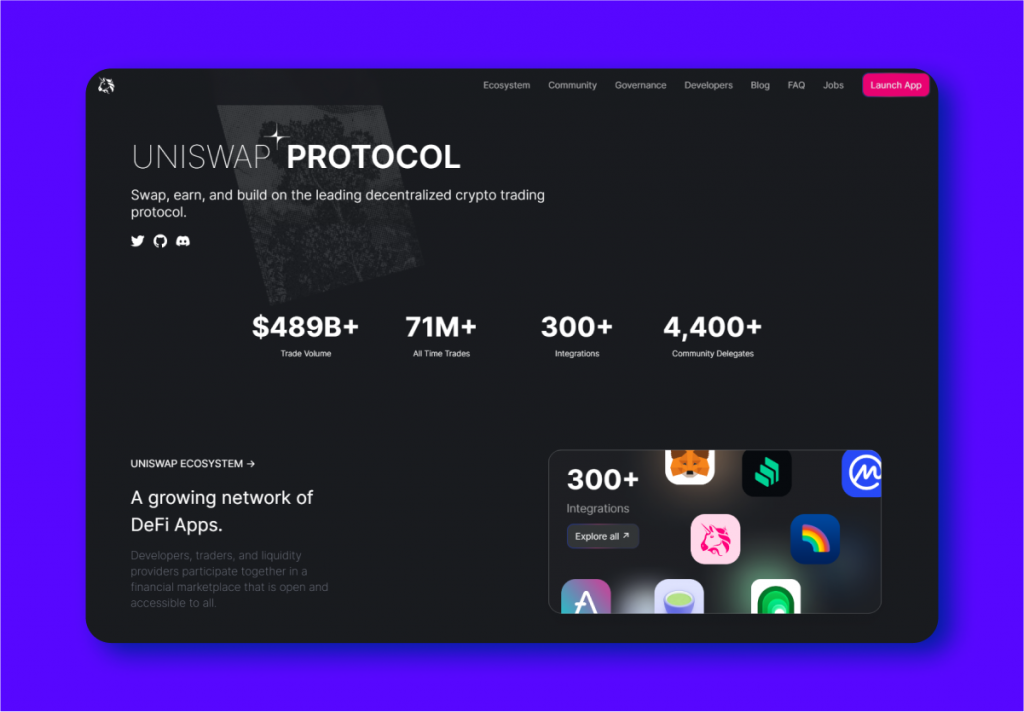

5. Uniswap: The Leading Decentralized Exchange

Uniswap is recognized as one of the top decentralized exchanges (DEXs) and a popular choice among DeFi enthusiasts. It offers a wide range of features and integrations that allow users to earn, buy, and sell various assets and NFTs without third-party intervention.

The platform offers several opportunities for participation in DeFi activities:

- token swaps on Ethereum, Arbitrum, Optimism, Polygon, Base, BNB, Avalanche, Celo blockchains,

- NFT trading,

- participation in liquidity pools,

- building dApps on ETH.

One of the main strengths of Uniswap is its integration with various DeFi apps and tools, including Boardroom, Rotki, Unbound Finance, Future Swap, Ondo Finance, and MetaMask. This makes it a one-stop shop for all things DeFi-related. Additionally, Uniswap also has a strong focus on community governance, allowing users to actively participate in shaping the platform’s future through various governance apps such as the governance portal, forum, and snapshot.

However, Uniswap does have some limitations. Since it is a decentralized exchange, there is no customer support available for users. Additionally, with its focus on DeFi, the platform may be less attractive to traditional crypto traders who are looking for advanced trading features and tools, like different types of orders, risk management features, etc.

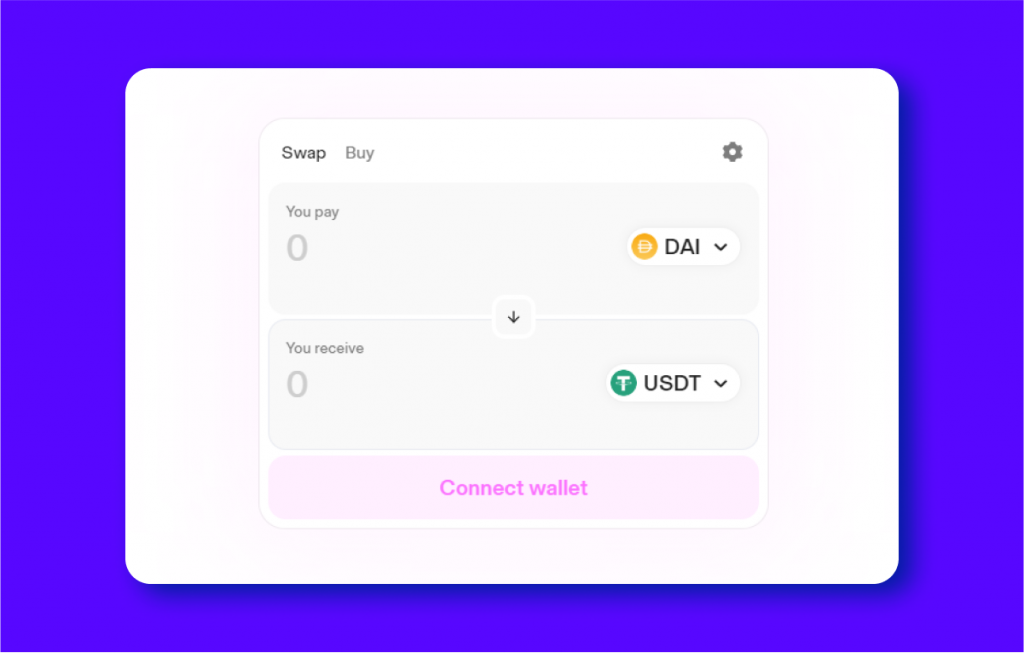

To start swapping tokens on Uniswap (or any other DEX), users must first connect their digital wallet.

Key Figures:

- Tokens to swap: any token that adheres to ERC-20 standard

- Daily trading volume: $881.6 million

- Total Value Locked (TVL): $3.41 billion

- Fees: dependent on ETH transaction processing fees

- Max leverage: –

- KYC verification: not required

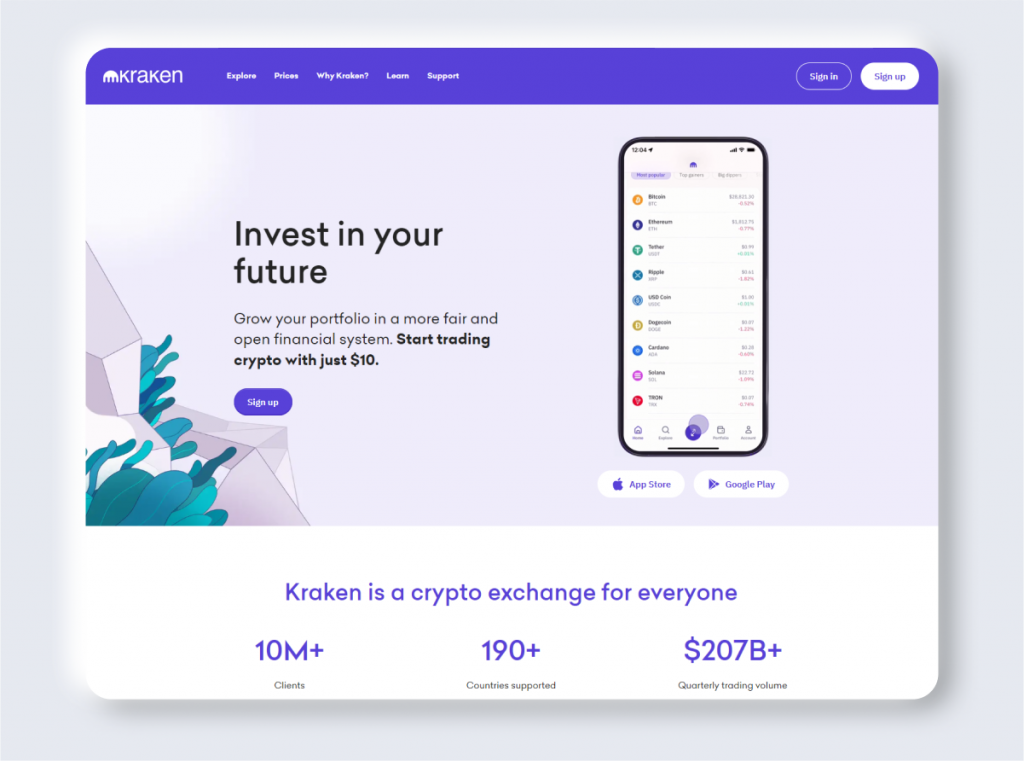

6. Kraken: A Platform for Both Beginners and Professionals

Kraken is a well-established cryptocurrency exchange that offers a wide range of services for all types of traders. Whether you are a beginner or an experienced investor, Kraken has something to offer.

The exchange offers a wide range of services and investment opportunities, including:

- spot, margin and derivative trading,

- NFT marketplace,

- staking options (not in the U.S.).

One of the main advantages of Kraken is its simple and user-friendly interface on the central platform, making it a popular choice for new crypto investors. With a verified account, users can quickly and easily make transactions using a linked bank account.

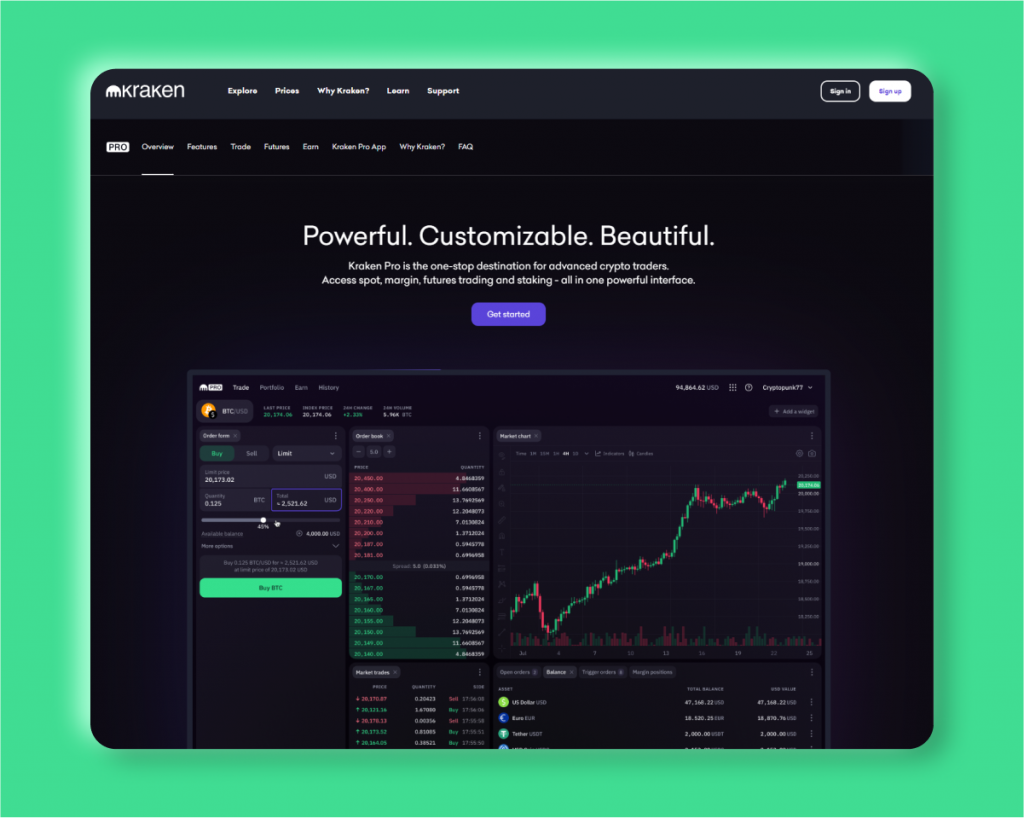

For more experienced traders, the Kraken Pro platform, margin accounts, and futures trading are available. These riskier products are useful for advanced trading strategies and allow traders to diversify their investments.

However, Kraken has faced legal issues in the past. In November 2023, the Securities and Exchange Commission (SEC) sued Kraken for multiple infractions, including commingling customer funds with company funds and operating an unregistered securities exchange. To settle this lawsuit, Kraken agreed to pay a fine of $30 million and closed its staking operation. However, it is still allowed to continue its staking activities through a subsidiary for non-U.S. clients.

Despite these legal issues, Kraken has maintained its reputation as a trusted and comprehensive cryptocurrency exchange platform.

Key Figures:

- Coins to trade: 242

- Daily trading volume (spot): $1.1 billion

- Daily trading volume (derivatives): $83.5 million

- User base: 9 million

- Weekly visits: 1.33 million

- Fees: from 0.10% to 0.26% for takers

- Max leverage: 50x

- KYC verification: required

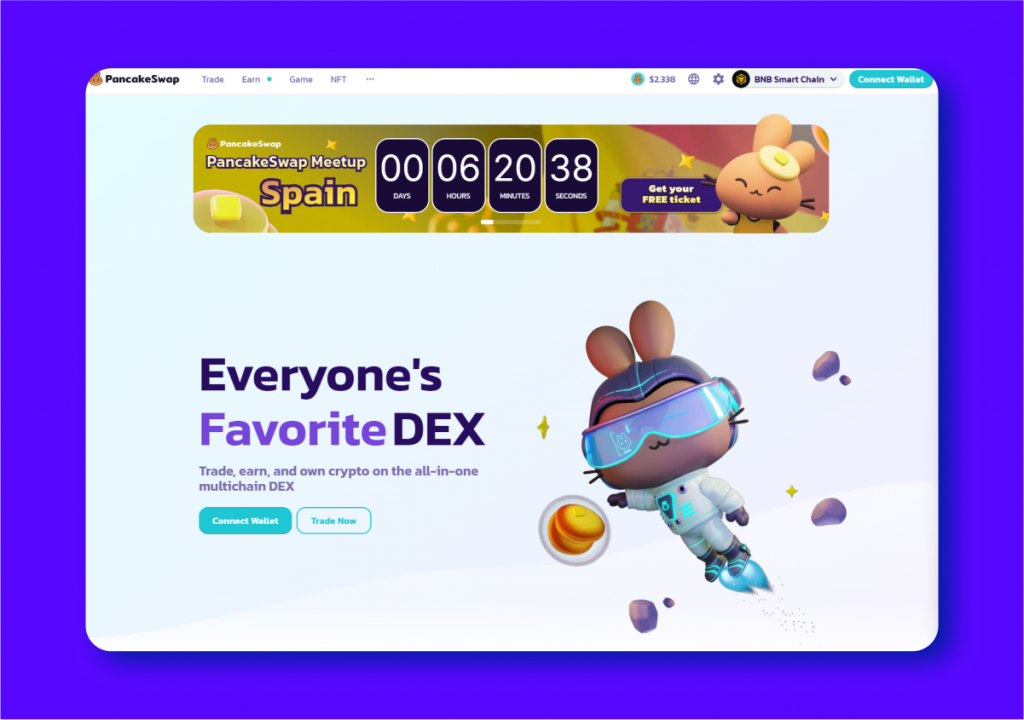

7. PancakeSwap: The Best DEX on BNB Smart Chain

PancakeSwap is another popular decentralized exchange that will be relevant in 2024. Currently, the platform is the most popular exchange built for the BNB Smart Chain.

One of the key benefits of PancakeSwap is its compatibility with various crypto wallets, allowing it to be used by a wide range of users. Additionally, the platform is user-friendly and offers low trading fees (0.2%) compared to other DEXs on the market. The platform also offers a native coin, CAKE, which users can earn by providing liquidity to the pool.

PancakeSwap also has many unique features that attract investors:

- token swaps on Ethereum, Arbitrum, Polygon, and BNB,

- NFT trading,

- staking and liquidity farming,

- trading competitions,

- lotteries and games where users can win digital assets.

However, PancakeSwap is limited to the BNB Smart Chain, Polygon, Ethereum, and some other blockchains at the moment, which may be a disadvantage for those looking to trade on other chains. Additionally, compared to centralized cryptocurrency exchanges, DEXs may have less liquidity and fewer trading options.

Key Figures:

- Tokens to swap: any token that adheres to ERC-20 standard

- Daily trading volume: $227.6 million

- Total Value Locked (TVL): $264.5 million

- Fees: dependent on transaction processing fees

- Max leverage: –

- KYC verification: not required

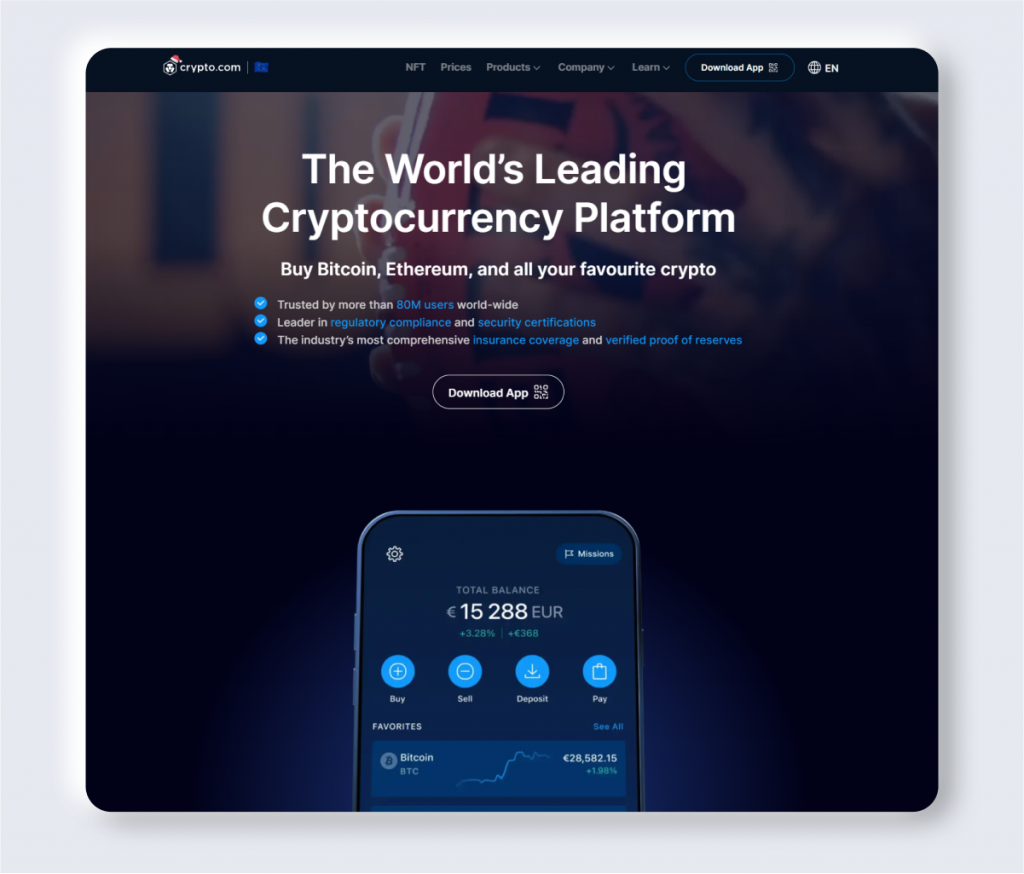

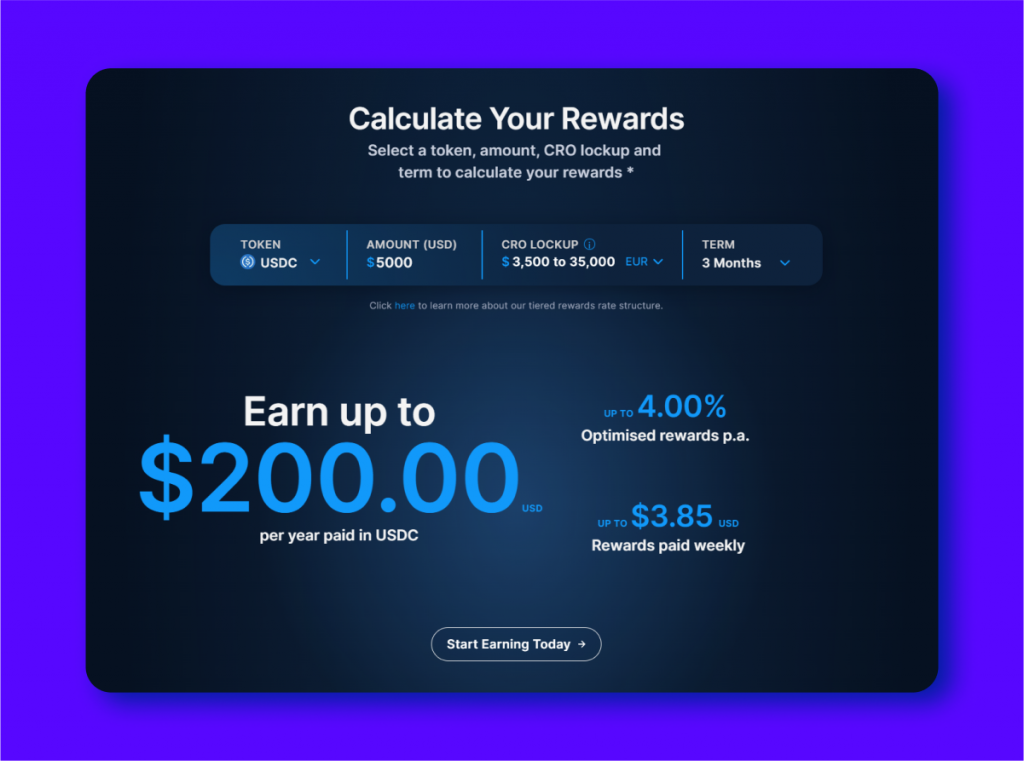

8. Crypto.com: Perfect for Mobile Trading

Crypto.com is a well-established cryptocurrency exchange with a strong focus on mobile trading. It offers nearly 300 cryptocurrencies to trade, as well as other blockchain-related products such as credit cards and a decentralized exchange.

What does Crypto.com offer its users? Some of the services include:

- spot and derivatives trading,

- on-chain staking, lending

- crypto debit card service,

- grid bots,

- passive income opportunities with the Earn program.

The central hub for Crypto.com is its mobile app, which is available for both Android and iOS devices. Users who are familiar with trading stocks on mobile will find the experience to be intuitive and user-friendly. The app offers a streamlined view of your portfolio, popular assets, and all the tools you need to trade, stake crypto, or make payments.

One of the unique features of Crypto.com is its cryptocurrency credit card. The card allows users to spend their cryptocurrencies at over 60 million merchants worldwide, offering up to 8% cashback on purchases.

Crypto.com has recently obtained Electronic Money Institution (EMI) status from the UK’s Financial Conduct Authority (FCA). This allows for a more robust regulatory framework and the introduction of new e-money products specifically tailored to the UK market, enhancing Crypto.com’s position as a reputable and compliant exchange.

Key Figures:

- Coins to trade: 297

- Daily trading volume (spot): $1.1 billion

- Daily trading volume (derivatives): $1.1 billion

- User base: 80 million

- Weekly visits: 835,690

- Fees: from 0.00% to 0.40% for takers

- Max leverage: 100x

- KYC verification: required

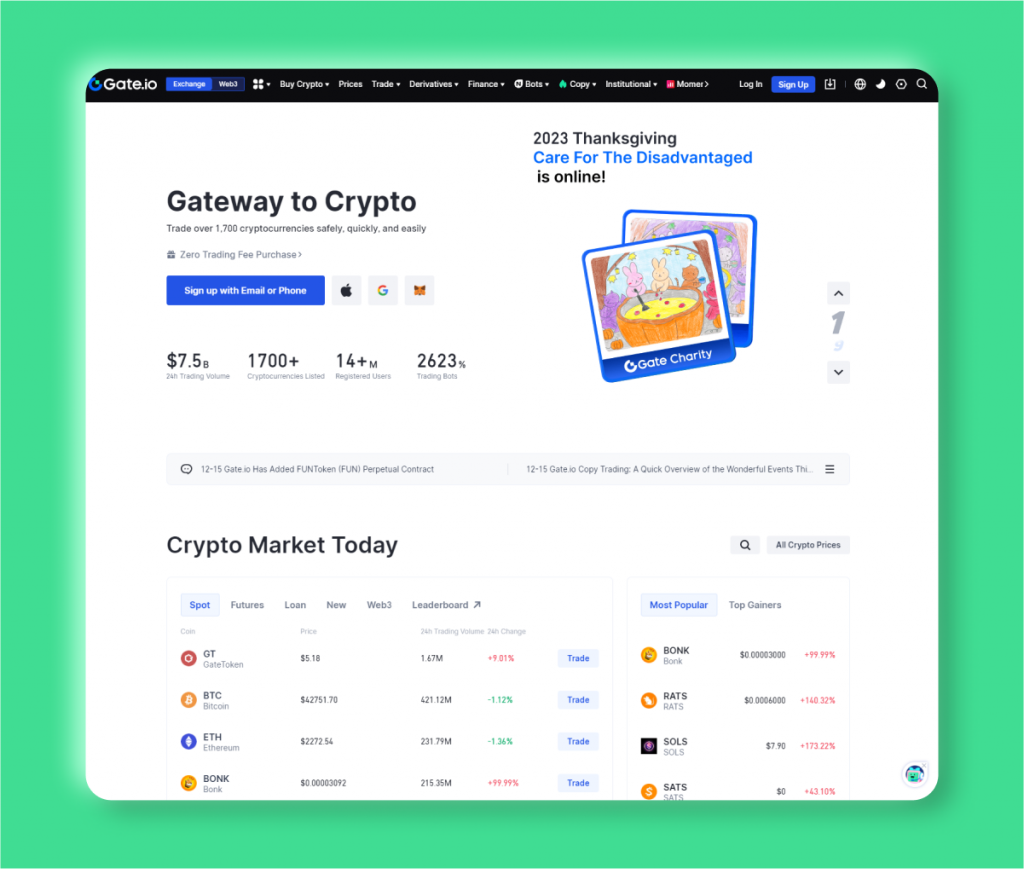

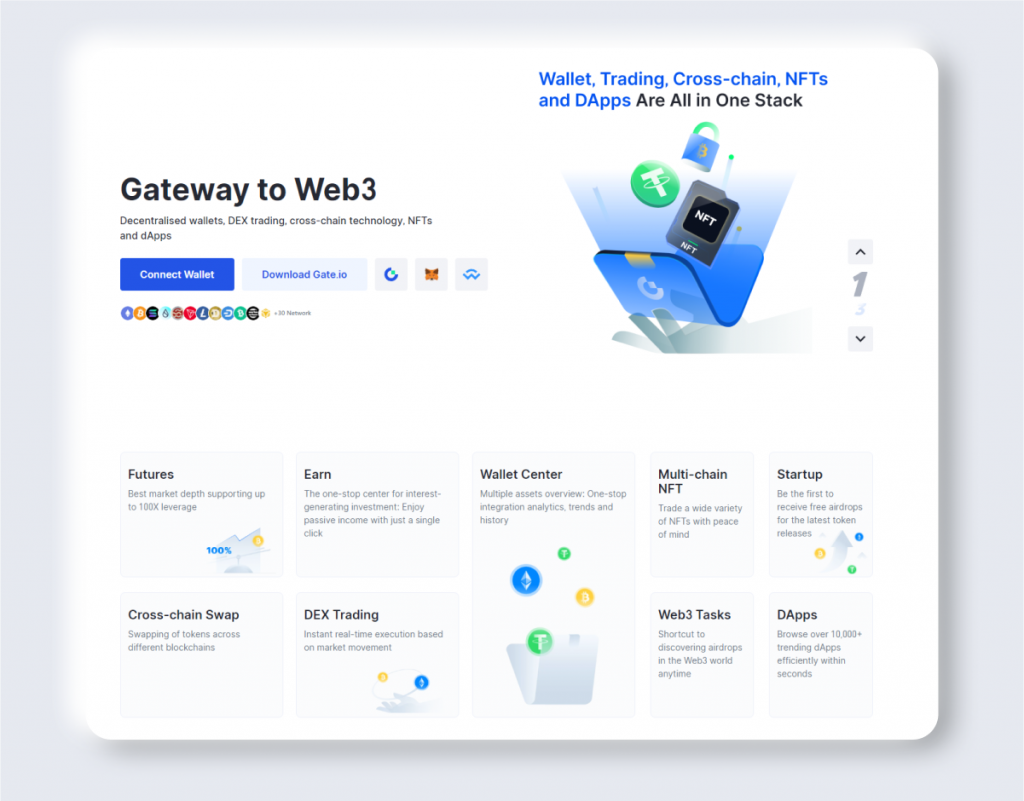

9. Gate.IO: The Diverse Selection of Crypto Assets

Gate.io is a leading cryptocurrency exchange that offers one of the most diverse selections of coins and markets in the industry. Established in China by founder and CEO Lin Han, Gate.io was originally launched as Bter or Bter.com in 2013 with a focus on Bitcoin trading. In 2017, the exchange was acquired by Gate Technology Inc. and rebranded as Gate.io.

The exchange offers a wide variety of prospects for traders and investors to explore:

- spot, margin and derivatives trading,

- launchpad for new projects,

- crypto debit card service,

- a wide selection of bot and copy trading options,

- passive income opportunities, such as lending, cloud mining, liquidity mining, dual investments, staking, and more,

- web3 features, including NFT, cross-chain swaps, and dApps.

As of today, Gate.io boasts an impressive selection of 1,800+ tokens for trade, catering to a diverse user base with its offerings and functionalities. Similar to other alternative coin exchanges, Gate.io has relatively low trading fees at around 0.2% per trade.

One notable strength of Gate.io is its extensive array of features and services. For traders looking to expand their portfolio beyond spot trading, Gate.io offers margin trading, futures contracts, as well as staking and lending options through the “HODL & Earn” program. The platform also has a launchpad for new projects and offers cloud mining services.

Key Figures:

- Coins to trade: 1,825

- Daily trading volume (spot): $2 billion

- Daily trading volume (derivatives): $2.5 billion

- User base: 12 million

- Weekly visits: 2.8 million

- Fees: 0.20%

- Max leverage: 100x

- KYC verification: required

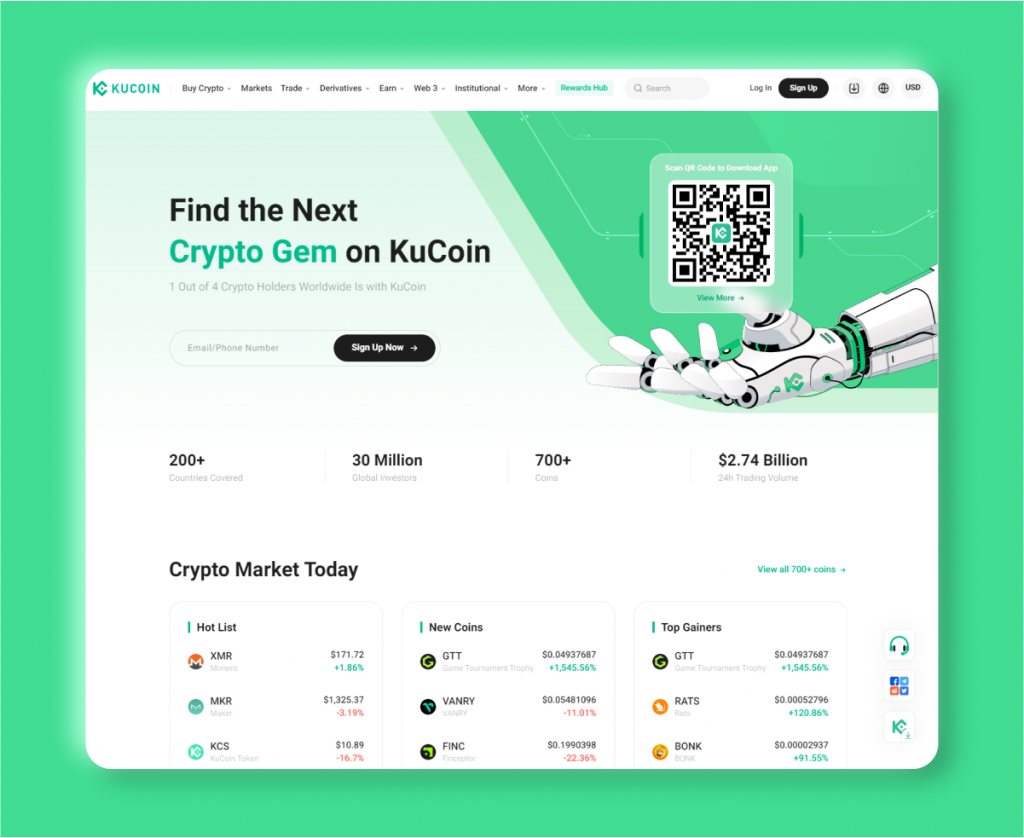

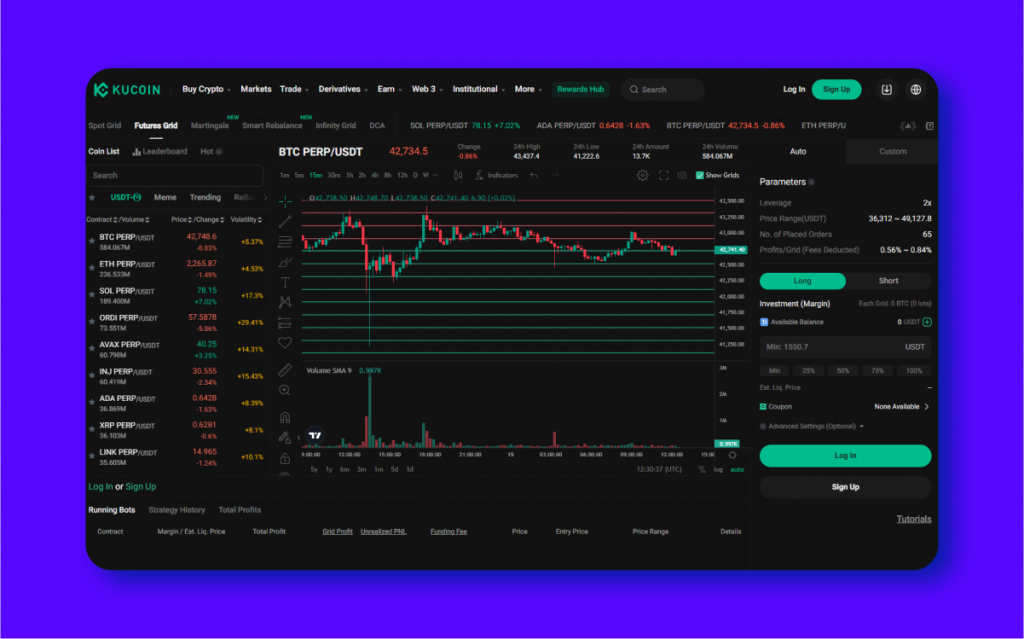

10. KuCoin: A Global Exchange Supporting Small-Cap Coins

KuCoin is a global cryptocurrency exchange that offers users access to over 700 cryptocurrencies. With low trading fees and a wide range of trading and investing options, KuCoin has become a popular choice for both beginner and experienced traders.

The platform can compete with big names like ByBit, Binance and Gate.io in terms of available services and features:

- spot, margin and derivatives trading,

- launchpad for new projects,

- a wide selection of bot and copy trading options,

- passive income opportunities with KuCoin Earn, including lending, dual investments, staking, and more,

- web3 capabilities, including NFT, DeFi, and dApps.

One of the key strengths of KuCoin is its support for small-cap coins. Unlike some exchanges that only list popular cryptocurrencies, KuCoin offers a diverse selection of tokens, including many that are still in their early stages. This allows traders to potentially find hidden gems and capitalize on early investing opportunities.

It is important to note that KuCoin has faced regulatory issues in certain countries, including The Netherlands and Canada. Additionally, while U.S. users can sign up for a KuCoin account, their access to features may be limited as the exchange is not licensed to operate in the United States. In addition, the interface and the amount of features can be overwhelming for newcomers to crypto trading.

Key Figures:

- Coins to trade: 1,825

- Daily trading volume (spot): $1.2 billion

- Daily trading volume (derivatives): $1.9 billion

- User base: 30 million

- Weekly visits: 2.2 million

- Fees: up to 0.50%

- Max leverage: 125x

- KYC verification: required

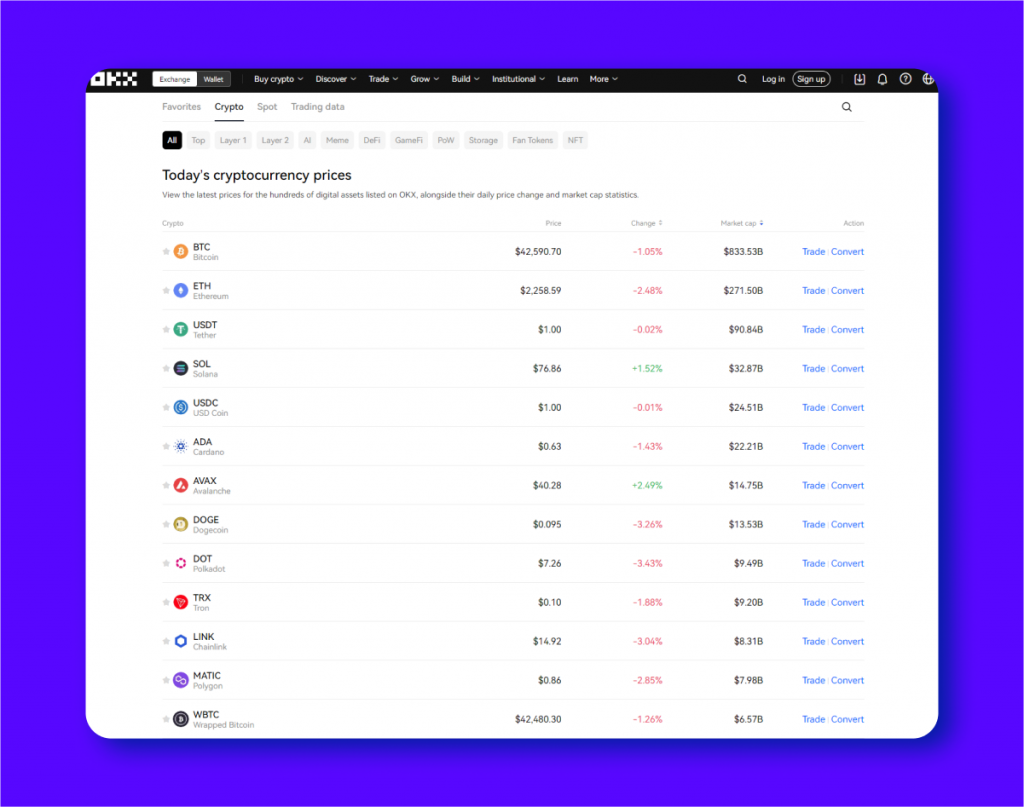

11. OKX: The All-In-One Crypto Exchange

OKX, a well-known name in the crypto trading world, is a platform that offers an impressive range of features for both advanced and new traders, on par with other major exchanges like Binance.

The platform offers many services and features, including:

- spot and derivatives trading,

- copy trading,

- vast DeFi features,

- passive income opportunities, including lending, dual investments, staking, and more,

- web3 capabilities.

One of the standout features of OKX is its low trading fees. With spot limit orders costing just 0.08% for USDT pairs, OKX beats out Binance and Coinbase in terms of affordability. And with select pairs offering even lower fees of 0.05% and 0.07%, OKX is a top choice for cost-conscious traders. In addition to its competitive fees, OKX also offers a feature-packed crypto wallet with support for 77 blockchains and easy access to DeFi apps.

But perhaps one of the biggest draws of OKX is its focus on education and skill-building. The platform offers copy trading and a generously funded demo account for newer traders to hone their skills.

Key Figures:

- Coins to trade: 1,825

- Daily trading volume (spot): $3.2 billion

- Daily trading volume (derivatives): $24.9 billion

- User base: 20 million

- Weekly visits: 6.4 million

- Fees: from 0.08% to 0.10%

- Max leverage: 125x

- KYC verification: required

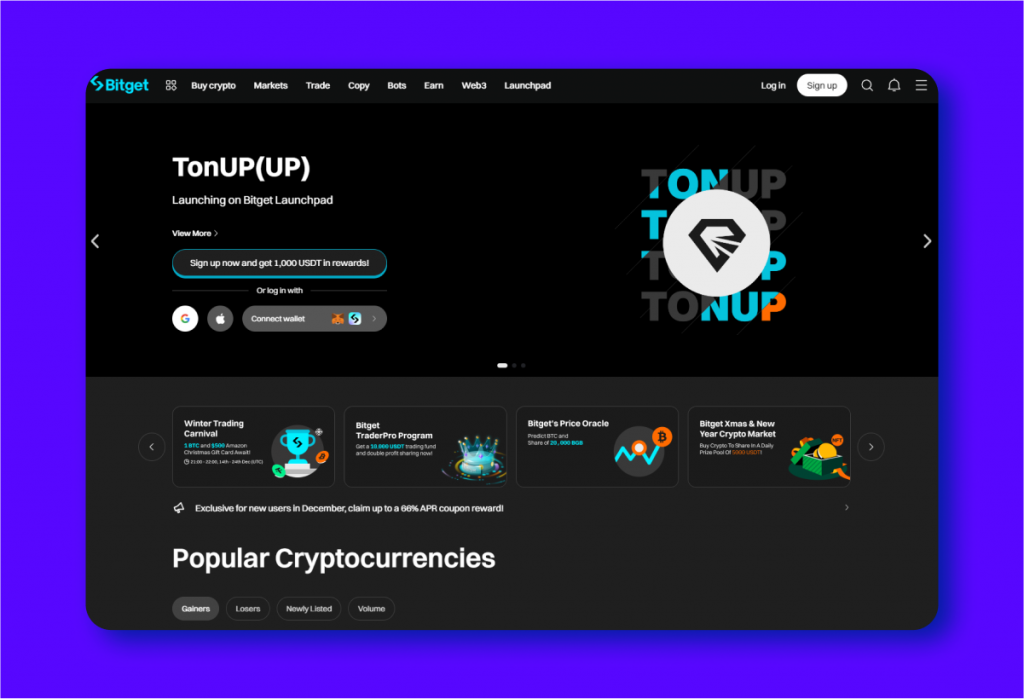

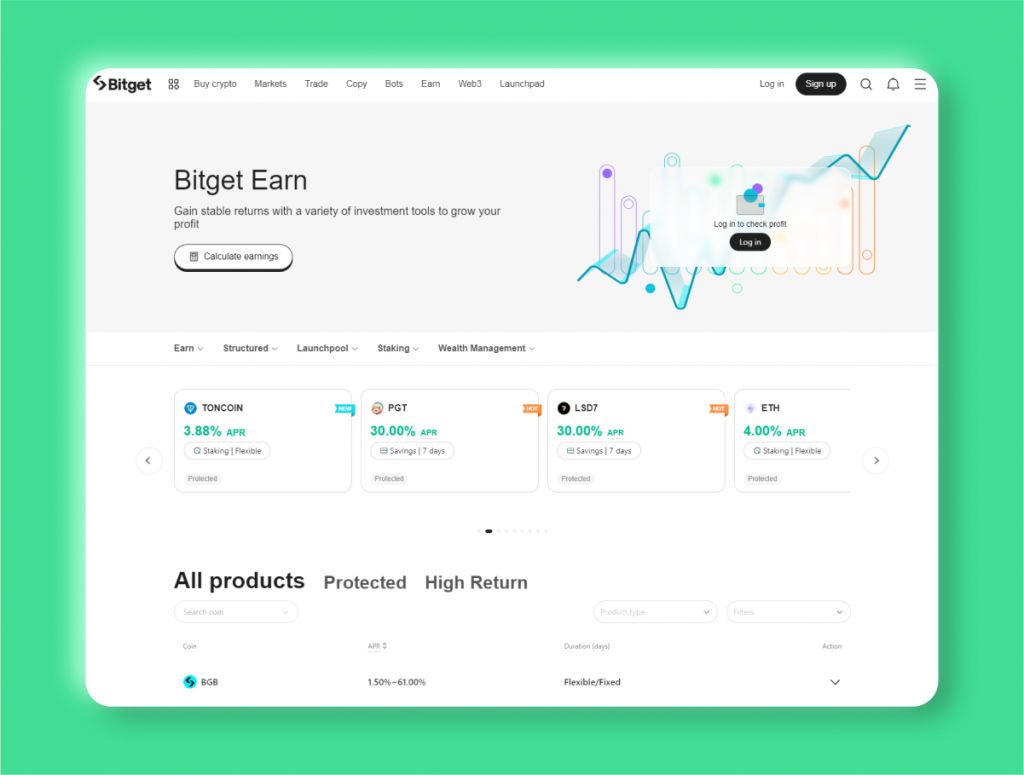

12. Bitget: Advanced Trading for Crypto Enthusiasts

Bitget is a popular Singapore-based cryptocurrency exchange that offers a wide selection of advanced trading tools for both beginners and experienced traders. With over 600 cryptocurrencies available for trading, Bitget stands out as one of the leading exchanges in terms of diversity.

One of the standout features of Bitget is its innovative offerings, such as:

- spot, margin and derivatives trading,

- copy trading and bot trading capabilities,

- ICO launchpad with a variety of projects already launched,

- Bitget Earn savings options with staking, dual investments, and more,

- dApps and other web3 features.

However, some users have noted that Bitget could improve in certain areas. For instance, the platform currently has limited withdrawal options, which can be inconvenient for some users.

Despite these minor shortcomings, Bitget remains a top choice among cryptocurrency enthusiasts, thanks to its competitive fees and a 20% fee discount for those who pay with BGB tokens.

Key Figures:

- Coins to trade: 619

- Daily trading volume (spot): $965 million

- Daily trading volume (derivatives): $12.1 billion

- User base: 20 million

- Weekly visits: 2.6 million

- Fees: from 0.00% to 0.60%

- Max leverage: 125x

- KYC verification: required

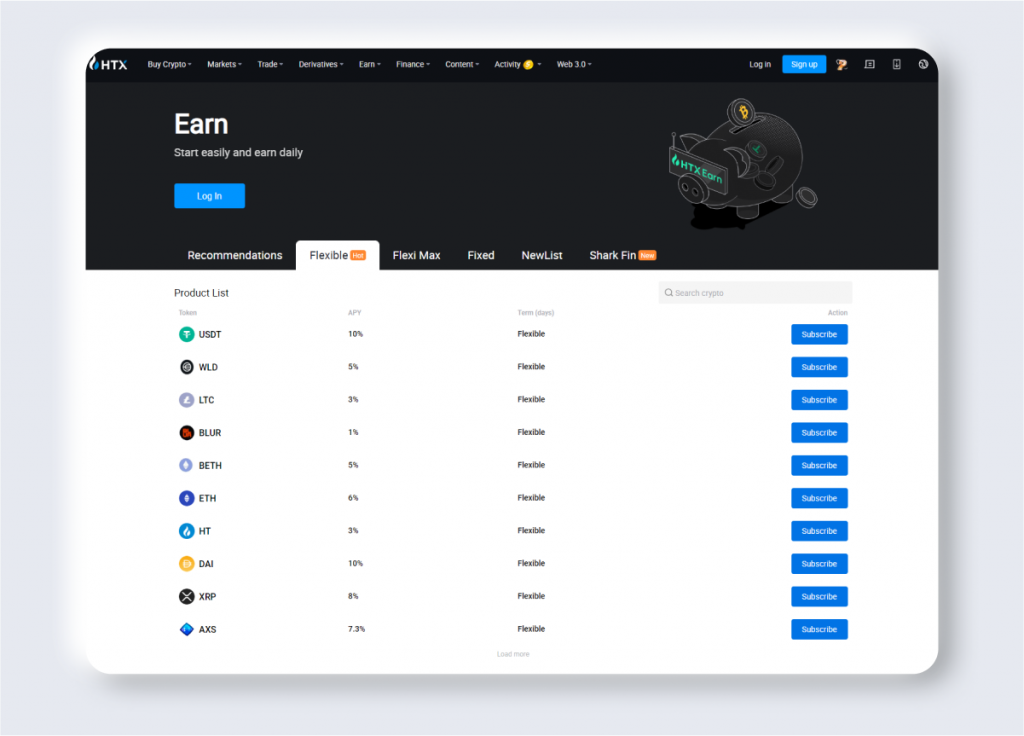

13. HTX: A Powerful Platform with a Decade of Experience

HTX (previously Huobi) is a well-established cryptocurrency exchange platform that has been operating since 2013. In September 2023, the platform celebrated its 10-year milestone by rebranding to HTX.

HTX may not hold the #1 spot in terms of daily trading volume, but it is still a powerhouse in the crypto world. The platform currently ranks #16 on CoinMarketCap and offers users a variety of trading options and services. These include:

- spot, margin and OTC trading,

- copy trading and bot trading services,

- launchpad for new projects,

- VIP account tiers based on Huobi Experience (EXP) points,

- savings options with staking, dual investments, and more,

- crypto loans,

- NFT trading platform (APENFT).

One unique aspect of HTX is its commitment to the Tron blockchain. The ‘T’ in HTX stands for TRON, showing their dedication to this particular network. However, this does not limit users from trading other cryptocurrencies on the platform.

In November 2023, HTX faced a security breach, which resulted in a temporary suspension of deposits and withdrawals. However, the platform quickly took action to restore affected hot wallets and ensure the safety of its users’ funds.

Key Figures:

- Coins to trade: 616

- Daily trading volume (spot): $1.7 billion

- Daily trading volume (derivatives): $1.6 billion

- User base: 10 million

- Weekly visits: 4.6 million

- Fees: 0.20%

- Max leverage: 125x

- KYC verification: required

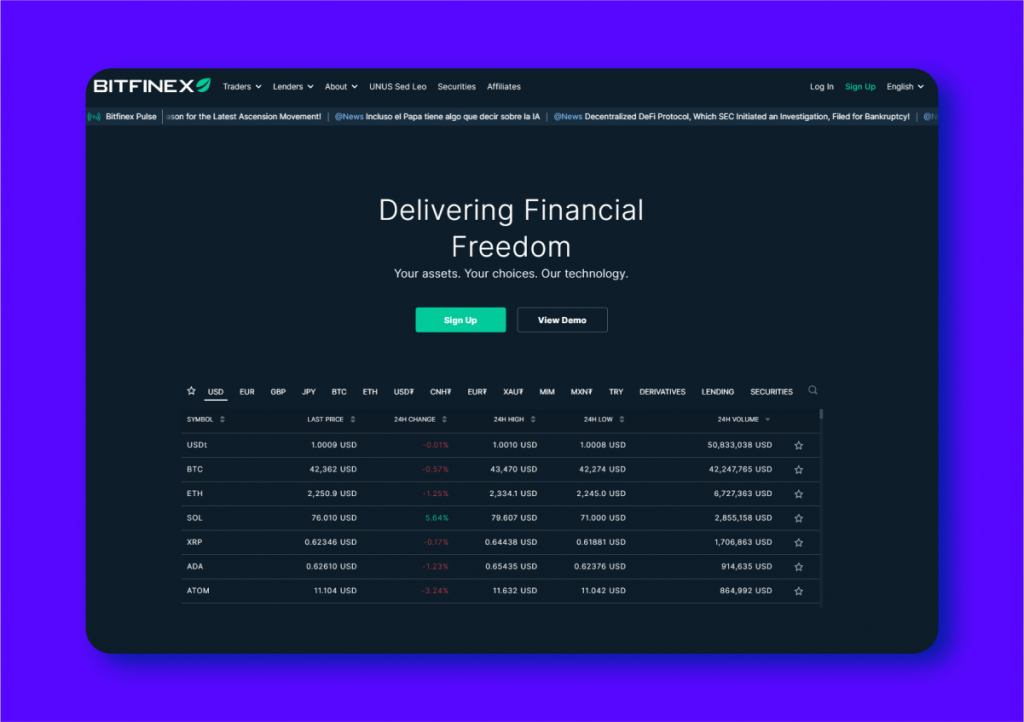

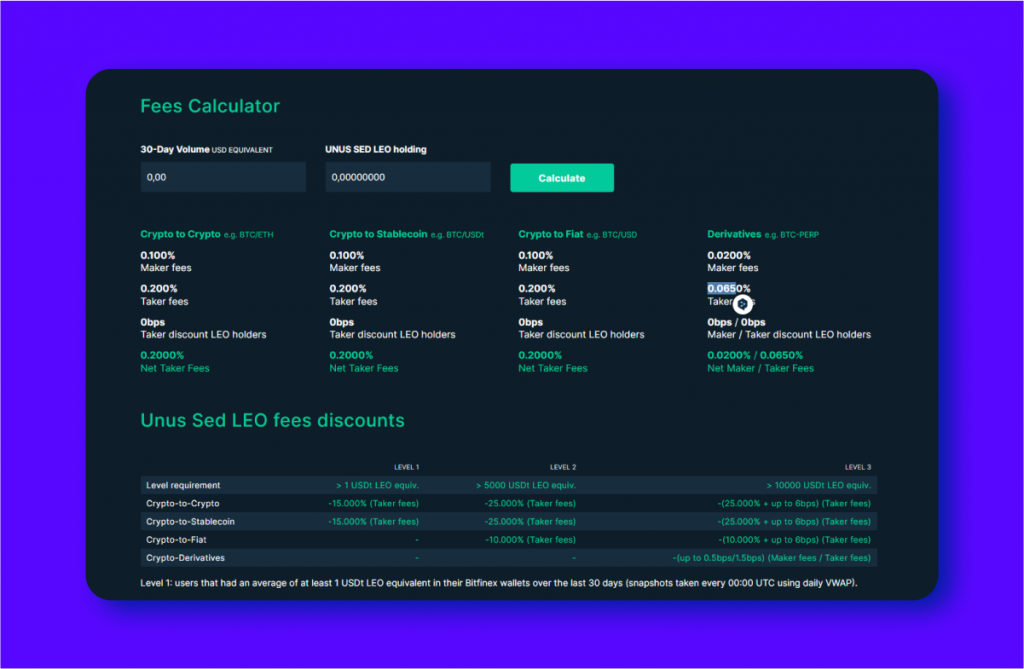

14. Bitfinex: Empowering Pro-Style Trading

Bitfinex is a well-established and reputable cryptocurrency exchange that caters to experienced traders. It is known for its advanced trading tools, such as margin trading and lending, which allow users to execute complex trading strategies.

The exchange currently offers a range of trading services and options. These include:

- spot, margin and derivative trading,

- lending and borrowing services,

- professional trading features.

One of the key strengths of Bitfinex is its high level of security and privacy standards. In fact, the exchange has obtained a SOC 2 Type 1 Certification based on security, availability, and confidentiality. This certification demonstrates Bitfinex’s commitment to implementing rigorous policies and procedures in accordance with the AICPA Trust Services Criteria.

However, one area that Bitfinex can improve upon is its user-friendliness. The platform may be overwhelming for beginners due to its complex features and interface. As such, it may not be the best choice for those who are new to cryptocurrency trading.

In October 2023, the UK’s Financial Conduct Authority (FCA) issued a warning to investors about Bitfinex, stating that the platform may be promoting financial services without proper authorization. The FCA also warned that individuals engaging with Bitfinex will not have access to the Financial Ombudsman Service to resolve complaints.

Still, Bitfinex remains a popular choice among professional traders due to its reputation and advanced trading features.

Key Figures:

- Coins to trade: 174

- Daily trading volume (spot): $200 million

- Daily trading volume (derivatives): $72 million

- Weekly visits: 167,861

- Fees: from 0.065% to 0.20%

- Max leverage: 100x

- KYC verification: required

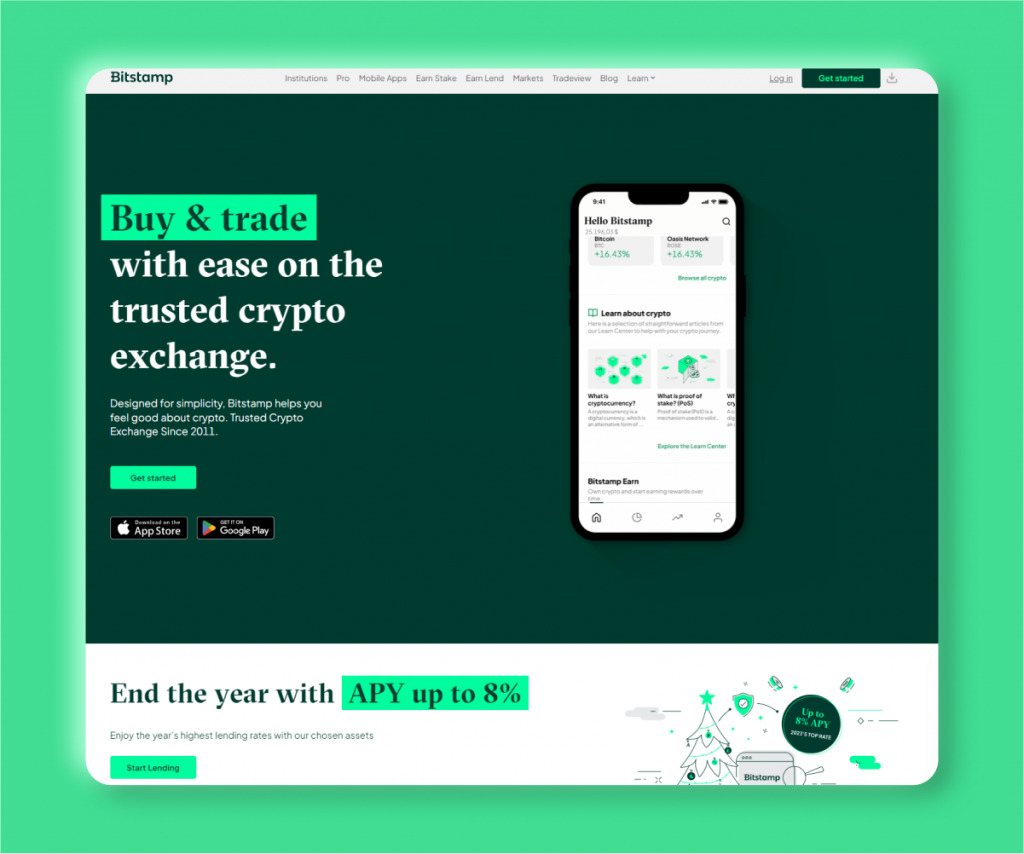

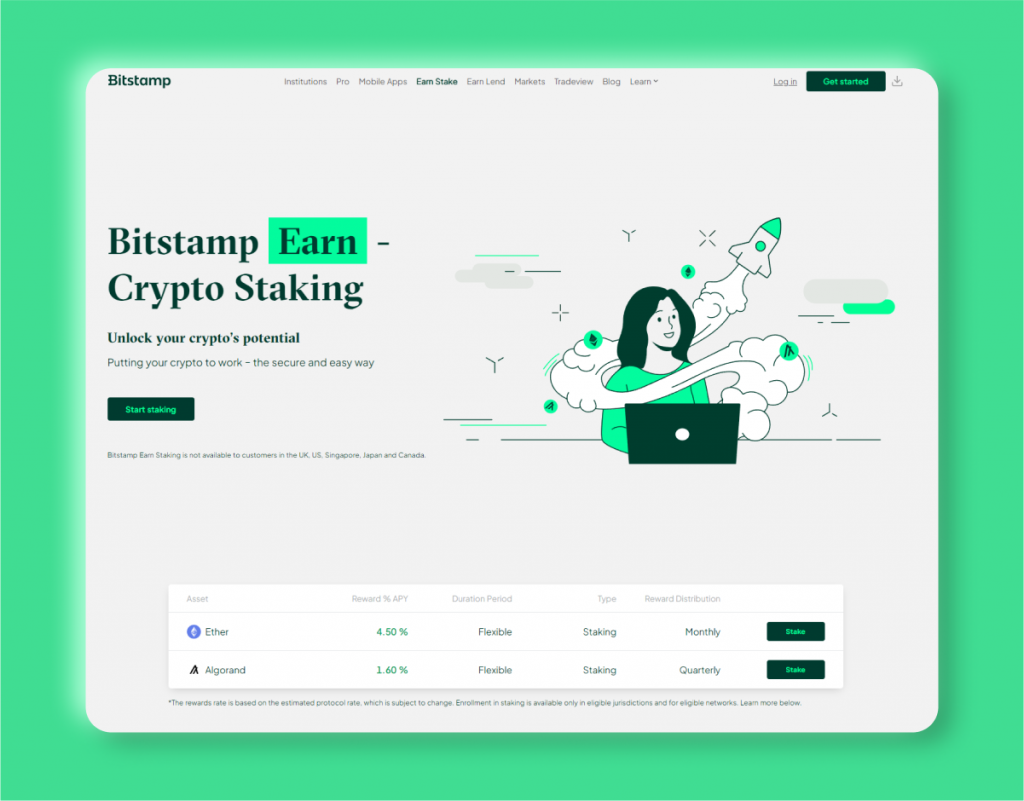

15. Bitstamp: Stable and Secure Option

Bitstamp is a trusted platform for cryptocurrency trading, known for its stability, security, and reliability. Established in 2011 in Luxembourg, it was the first nationally licensed Bitcoin exchange in the world. The exchange offices are located in Luxembourg, London, and New York.

The platform offers services and features, such as:

- spot, margin and derivatives trading,

- launchpad for new projects,

- crypto debit card service,

- a wide selection of bot and copy trading options,

- lending and staking,

- web3 capabilities, including NFT, DeFi, and dApps.

One of Bitstamp’s strengths lies in its simple yet effective online trading platform, as well as its mobile app. Traders can use Bitstamp through three different platforms: Bitstamp.net, Bitstamp Tradeview, and Bitstamp Mobile. The trading fees are the same across all platforms. This gives users the freedom to choose their preferred way of trading crypto. Currently, the exchange does not support derivatives trading, but it plans to launch it in the future.

While cryptocurrency trading is known for being risky and volatile, Bitstamp has a solid track record of keeping customer accounts secure. It also provides a straightforward user experience for both traders and investors.

Recently, Bitstamp announced that it would no longer offer stake rewards to its U.S. customers starting in September 2023 due to regulatory issues in the country. Additionally, the exchange also announced its withdrawal from the Canadian market in 2024.

Key Figures:

- Coins to trade: 79

- Daily trading volume (spot): $211 million

- Daily trading volume (derivatives): –

- User base: 4 million

- Weekly visits: 283,064

- Fees: up to 0.40%

- Max leverage: –

- KYC verification: required

FAQs

Which cryptocurrency exchange is the best for beginners?

While there are many options available, some popular exchanges known for their user-friendly interface and beginner-friendly features include Coinbase, Binance, and Kraken.

Can I use multiple cryptocurrency exchanges?

Yes, you can use multiple exchanges depending on your trading needs and preferences. It is recommended to diversify your portfolio by using different exchanges for different coins.

What is the difference between spot and derivative trading?

Spot trading involves buying and selling actual coins, where the price is determined by supply and demand. Derivative trading involves speculating on the future value of a cryptocurrency without owning it. This type of trading typically involves higher risk and leverage options.

What is KYC verification?

KYC stands for “Know Your Customer” and is a standard process used by financial institutions to verify the identity of their customers. Exchanges that comply with KYC regulations require users to provide personal information and identification documents before being allowed to trade on their platform. This helps prevent fraud, money laundering, and other illegal activities.

What should you look for when choosing a cryptocurrency exchange?

When choosing a cryptocurrency exchange, there are several factors to consider:

- Reputation and track record: Look for exchanges with a solid reputation in the market and a proven track record of security and reliability.

- Security measures: Make sure the platform has rigorous security protocols in place, such as two-factor authentication and cold storage for funds.

- Regulatory compliance: Check if the exchange is licensed and regulated by reputable financial authorities to ensure the safety of your funds.

- User interface: Consider the ease of use and user-friendly interface of the platform, especially if you are a beginner in cryptocurrency trading.

- Available coins and trading options: Look for exchanges that offer a wide variety of cryptocurrencies for trading, as well as spot, margin, and derivative trading options.

- Fees: Take into account the fees charged by exchanges for transactions and trades, as these can vary significantly between platforms.

Always make sure to carefully assess each platform’s features and strengths before entrusting them with your funds.