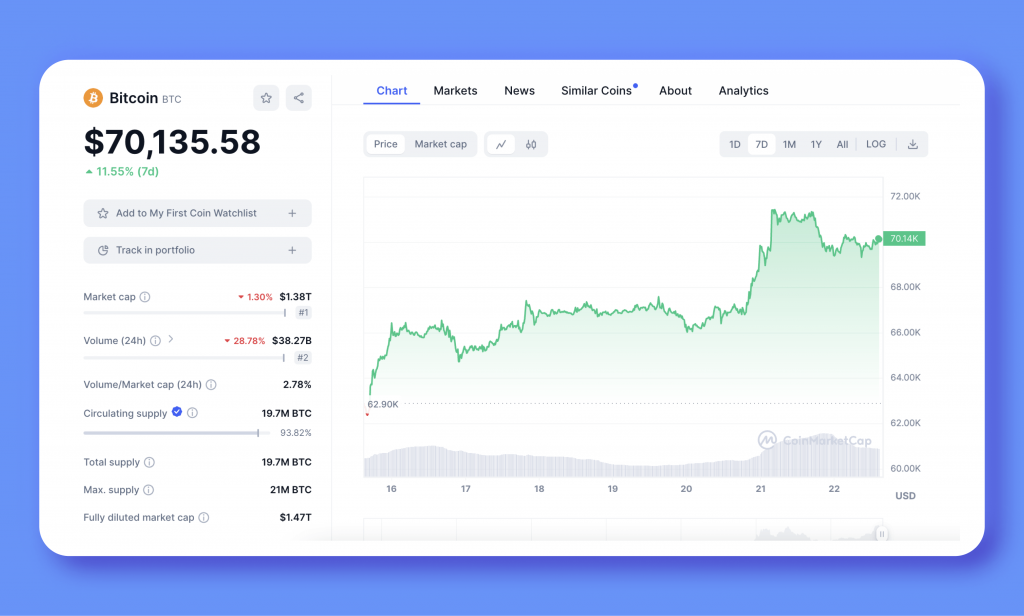

Bitcoin Hits $70K: An Increase Towards New Highs

By reaching the $70K mark, Bitcoin has accomplished a noteworthy milestone. This occurrence is significant in Bitcoin’s price history since it suggests an essential spike in interest and investment. Several measures, including spot purchases and ETF purchases, show this rise.

Bitcoin Reaches 70K: A Milestone in Crypto History

Several significant events contributed to Bitcoin’s rise above the $70K threshold. First, there has been an apparent increase in spot purchases and spot purchases of BTC ETFs, suggesting rising interest in and investment in Bitcoin. Adding to the rising momentum, on-chain data indicate that a bull market is just starting. The price increase has also been fueled by investors’ increased enthusiasm following the recent bounce in support of around $60,000.

According to technical analysis, given the present trading levels and indications like the 20-day EMA and RSI, Bitcoin might surpass expectations. We’re carefully monitoring resistance levels because an upward breakout is possible. However, given how unstable the cryptocurrency market is, it’s critical to recognize the potential for adverse reactions and downside dangers.

Bitcoin Price News

Wider economic issues, such as expectations of U.S. monetary growth and worries about increasing inflationary pressures, impact the price spike of Bitcoin. The Federal Reserve’s policies significantly impact the liquidity and appeal of liquid assets like Bitcoin.

A narrative of scarcity has surfaced, marked by a decline in Bitcoin reserves to a level not seen in seven years and the effect of the recent halving event on the number of new bitcoins produced by miners.

Aside from market mechanics, investor mood plays a significant role in determining how much Bitcoin costs. The price of Bitcoin has surged in tandem with a resurgence of trader interest, as evidenced by substantial swings in other cryptocurrencies like meme coins and Ether. Positive news and rising consumer interest in cryptocurrencies drive this movement toward optimism in the market.

Crypto Market Cap Forecast: A Look Ahead

According to an analysis of previous price movements, Bitcoin’s breach of the $70k threshold suggests that there may be a second breakout in the coming months, which would show rising investor interest and confidence. The impact of the interest and Bitcoin ETF inflows highlights the upward trend in the price of Bitcoin.

Macroeconomic issues heavily influence Bitcoin’s future. Conjecture about possible Fed measures based on economic news increases market uncertainty. Bitcoin’s price dynamics may also be impacted by SEC Bitcoin ETF approval, mainly conjecture over Ethereum ETFs.

People’s opinion of Bitcoin is still positive, even with occasional liquidations. Analysis of price movements from February to May shows that market activity and investor optimism are reflected in steady gains and substantial trading volumes. It is imperative to recognize the inherent unpredictability of markets while highlighting the consensus in favor of Bitcoin.

Final Thoughts

Finally, Bitcoin’s $70,000 milestone is important for this sector. Its rise is caused by several variables, including macroeconomic trends and technological indications. Despite market volatility, the general bullish sentiment points to the possibility of additional growth. Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in cryptocurrencies carries ingrained risks, and individuals should conduct their own research before making any investment decisions.