Bitcoin Price Reaches $31k Once Again As Blackrock Revives ETF Proposal: Could This Propel BTC to $38K?

The growing interest in a spot Bitcoin ETF further contributes to the optimistic perspective as BTC surpasses the $31,000 threshold.

In recent weeks, the overall structure of the crypto market has seen significant improvement. While not experiencing an explosive surge, the leading cryptocurrency, Bitcoin, has exhibited a 54.4% growth over the past 30 days, resulting in an impressive 63.5% gain for the year thus far.

The bullish momentum of Bitcoin, which gained traction in June, has carried forward into July, with market insights suggesting the potential for BTC to reach $38,000.

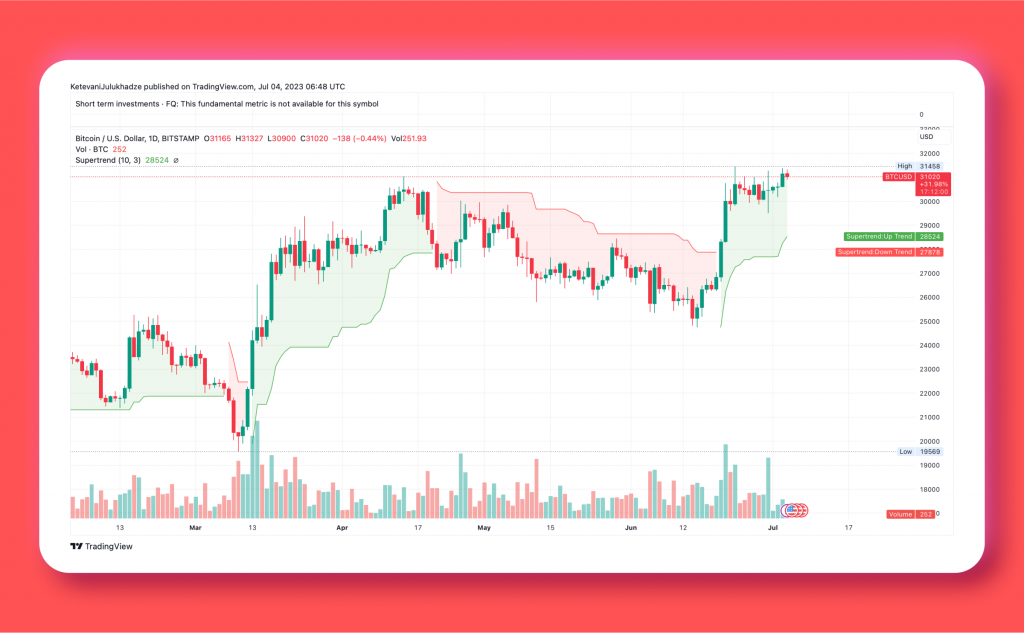

According to the daily chart from Tradingview, the price of Bitcoin has risen by 1.66% today. More significantly, the bulls have successfully reclaimed the resistance level at $31,000 and are striving to overcome the next hurdle at $32,000.

Understanding Bitcoin’s Recent Breakout And The Implications For Price Target

As discussed above, Bitcoin’s price has been supported by multiple buy signals, notably the Moving Average Convergence Divergence (MACD) indicator. In June, the MACD line (blue) crossed above the signal line (red), signaling a buying opportunity and reinforcing the bullish outlook. Additionally, the momentum indicator crossed above the mean line, further validating the positive sentiment.

Furthermore, the SuperTrend indicator confirmed the breakout from $25,000 as it flipped below Bitcoin’s price. This indicator incorporates readings from the true average range (ATR) to assess market volatility, and its positioning below the price indicates the continuation of the uptrend. Traders will anticipate a potential reversal if the volatility index surpasses the price.

It’s worth noting that maintaining a daily close above $31,000 will be crucial in sustaining Bitcoin’s upward trajectory. Investors will likely continue buying BTC if the support level at $31,000 holds in the upcoming sessions.

On the other hand, a breakout above $32,000 would signify a significant milestone for Bitcoin, potentially paving the way for further gains toward key levels at the seller congestion point of $35,000 and the psychological resistance at $38,000.

On-chain insights from Santiment, a leading analytics platform, indicate a commendable increase in investor confidence, driving interest in BTC accumulation. However, it is important to note that trader profits for BTC are currently relatively high, suggesting a possible cooldown in the market.

Given these factors, it is advisable to approach the situation cautiously while closely monitoring Bitcoin’s response to critical price levels, including the recently reclaimed $31,000 and the subsequent hurdle at $32,000.

Bitcoin’s price has surged above $31,000, reaching approximately $31,500. This recent price movement adds further significance to the aforementioned analysis. A breakthrough above $32,000 could serve as a game-changer and potentially propel BTC toward the $38,000 target. Conversely, a drop below $31,000 may indicate a setback for bulls, potentially emboldening bears to intensify their efforts and potentially pushing Bitcoin below $30,000, with a significant support level at $25,000 looming.

Conclusion

According to Bloomberg, Blackrock has resubmitted its spot Bitcoin exchange-traded fund (ETF) proposal to the US Securities and Exchange Commission (SEC) via Nasdaq. This move follows the SEC’s previous feedback requesting more comprehensive details in the initial filings. The new filings highlight the involvement of Coinbase Global Inc. in market surveillance for the proposed ETF. VanEck and Fidelity Investments have also amended their proposals.

If approved, the spot Bitcoin ETF could open doors for institutional investors and potentially fuel the next bull market. Stay informed for updates on this significant development.