Bitcoin’s $26K Support Holds Firm As Derivatives Trends Hint at Quieter Times.

Over the past few months, Bitcoin traders have become accustomed to reduced volatility. However, the historical context reminds us that price fluctuations of up to 10% over two to three days are not unusual for cryptocurrency.

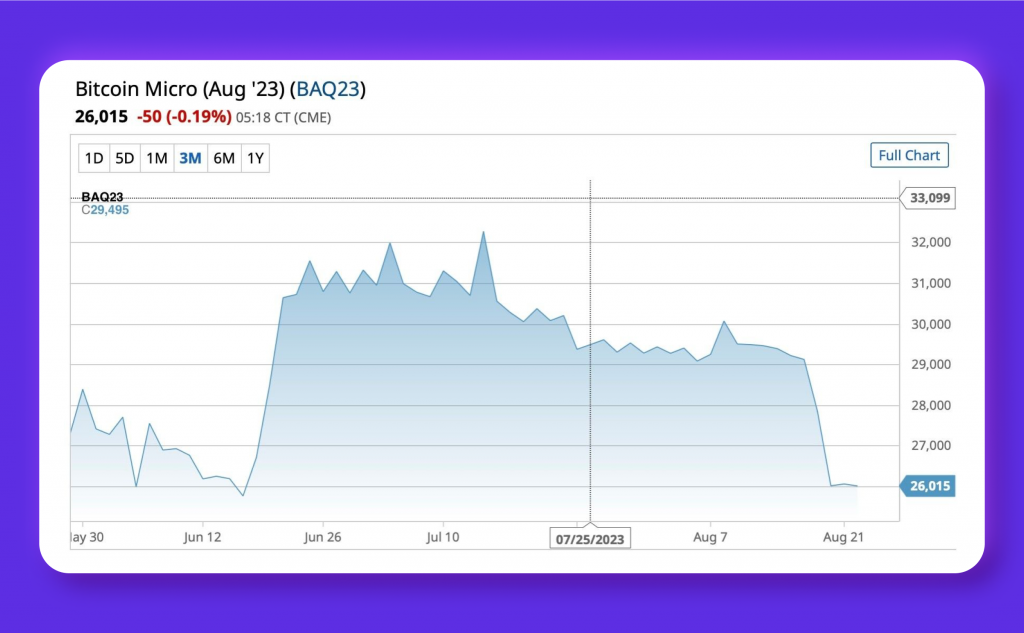

The unexpected 11.4% correction that occurred between August 15 and August 18, causing Bitcoin to drop from $29,340 to $25,980, caught many off guard and led to the most significant liquidation since the FTX collapse in November 2022. The central question that remains is whether this correction holds significance within the broader market structure.

Some experts attribute these recent spikes in volatility to diminished liquidity, but does this explanation hold true?

As highlighted by the Kaiko Data chart, the 2% decline in the Bitcoin $26,034 order book depth mirrors the concurrent reduction in volatility. It’s plausible that market makers recalibrated their algorithms to better align with the prevailing market conditions.

Given this backdrop, it’s prudent to delve into the derivatives market to gauge the repercussions of the drop to $26,000. This examination aims to ascertain whether significant players, such as whales and market makers, have adopted a bearish stance or if they’re requesting elevated premiums for safeguarding hedge positions.

To initiate this investigation, traders ought to identify analogous instances from the recent past, and notably, two prominent events stand out:

In a reminiscent pattern, the first decline unfolded between March 8 and March 10, leading to a sharp 11.4% drop in Bitcoin’s value, which settled at $19,600. During this period, Bitcoin marked its lowest point in over seven weeks. This downturn followed the liquidation of Silvergate Bank, a pivotal operational partner for numerous cryptocurrency firms.

Building upon this backdrop, another notable occurrence transpired between April 19 and April 21, resulting in a considerable 10.4% reduction in Bitcoin’s price. During this episode, Bitcoin retraced its steps to the $27,250 level, revisiting this threshold after a hiatus of more than three weeks. The trigger for this decline emerged from Gary Gensler’s address to the House Financial Services Committee. Gensler, the chair of the United States Securities and Exchange Commission, offered limited reassurance that the agency’s enforcement-focused regulatory efforts would undergo a significant shift.

10% Bitcoin Price Falls: A Closer Look at Individuality

Delve into Bitcoin’s quarterly futures dynamics, shows which tend to exhibit a slight premium in comparison to spot markets. This premium underscores sellers’ willingness to postpone settlement in exchange for added compensation. In robust markets, annualised BTC futures contracts are frequently traded with a premium spanning 5 to 10%, a phenomenon commonly referred to as “contango.” It’s worth noting that this dynamic is not exclusive to the cryptocurrency realm.

Heading into the downturn of March 20, Bitcoin’s futures premium stood at 3.5%, reflecting a moderate level of confidence. However, as Bitcoin’s price dipped below $20,000, a heightened sense of pessimism gripped the market, causing the indicator to shift into a discount of 3.5%. This scenario, known as “backwardation,” aligns with typical bearish market sentiments.

Contrarily, the correction experienced on April 19 left Bitcoin’s futures primary metric relatively unaffected, maintaining a premium of approximately 3.5% even as the BTC price retraced to $27,250. This could potentially indicate that professional traders either held significant confidence in the market’s underlying robustness or were well-prepared for the ensuing 10.4% correction.

The more recent 11.4% Bitcoin crash spanning from August 15 to August 18 displays distinct deviations from prior occurrences. Notably, the outset for Bitcoin’s futures premium began at a higher level, surpassing the pivotal 5% threshold denoting neutrality.

An intriguing observation lies in the rapid absorption of shock within the derivatives market on August 18. Swiftly thereafter, the BTC futures premium bounced back to a neutral-to-bullish position of 6%. This phenomenon implies that the drop to $26,000 did not significantly erode the optimism of both whales and market makers concerning the cryptocurrency’s future trajectory.

Bottom Line

In summary, as Ethereum trends upwards at $1671, the cryptocurrency market’s recent reduced volatility contrasted with an unexpected 11.4% Bitcoin correction in August highlights the ever-present unpredictability. While volatility spikes are linked to liquidity, order book depth also plays a role. Bitcoin’s quarterly futures premiums, reflecting seller compensation for delayed settlement, have shown consistency across markets.

Responses to historical shifts underscore traders’ resilience. The recent 11.4% crash revealed quick derivatives market rebound, reflecting optimism among significant players despite price fluctuations. In essence, the cryptocurrency realm remains intricate and evolving, shaping asset trajectories amid dynamic forces.