Crypto Revolution in E-Commerce: How Online Retailers are Embracing Digital Currencies.

The rise of cryptocurrencies has brought about a significant shift in how we perceive and utilise money. As the world becomes increasingly digital, it is no surprise that the e-commerce industry is embracing this technological advancement. Currently, about 46% of merchants accept cryptocurrency as a form of payment, according to a PYMNTS and BitPay survey.

Cryptocurrencies offer numerous advantages over traditional payment methods. However, their adoption in the e-commerce sector is not without challenges. In this article, we will delve into the world of cryptocurrencies and explore how they are transforming the landscape of online retail.

Key Takeaways:

- Cryptocurrencies become increasingly popular in the online retail industry due to their decentralised nature and low transaction fees.

- There are several challenges related to the adoption and use of cryptocurrencies in e-commerce, such as lack of regulation, scalability, and volatility.

- Many big companies, such as Microsoft, Shopify, and PayPal, have already implemented crypto and blockchain in their operations.

Understanding Cryptocurrencies

Before getting into the details, let’s look at what cryptocurrencies are and how they work.

What are Cryptocurrencies?

Cryptocurrencies are digital or virtual currencies that use cryptography for security and operate independently of a central bank. They are decentralised and rely on a technology called blockchain, which is a distributed ledger that records all transactions securely and transparently.

After Bitcoin (BTC), the world’s first and most widely recognised cryptocurrency was introduced in 2009, thousands of different coins and tokens have emerged, with many more set to do so in the near future. According to CoinMarketCap data, there are more than 23,700 cryptocurrencies in the world today (as of September 2023), with a total market capitalisation of $1.07 trillion.

How Cryptocurrencies Work

Cryptocurrencies work through a decentralised network of computers called nodes that verify and record transactions on the blockchain. Each transaction is encrypted and added to a “block” of transactions, which is then added to the chain of previous blocks, creating an immutable and transparent record of all transactions.

On average, about 144 transaction blocks are added to the BTC blockchain every day. These records are publicly available and accessible to all users, which makes them secure and immune to manipulation. It also allows users to verify that their transactions are authentic and have not been altered.

Popular Cryptocurrencies

Bitcoin was the first cryptocurrency and remains the most well-known and dominant player in the market. However, there are many more cryptocurrencies available worldwide.

One of them, Ethereum, which is the second-largest digital currency, goes beyond just facilitating financial transactions – it functions as a platform for building decentralised applications (dApps).

Fast Fact:

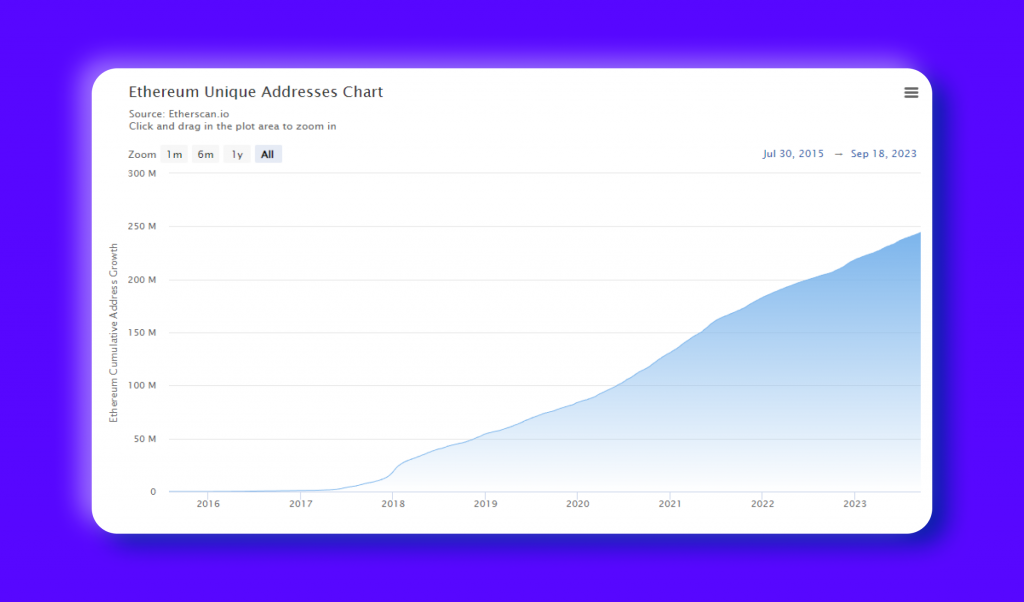

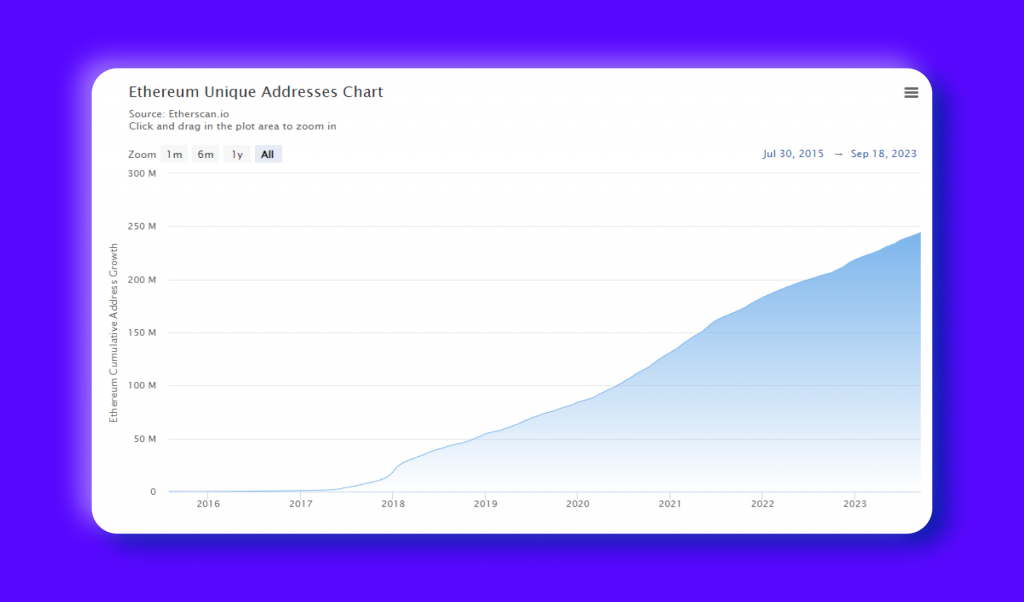

Currently, Ethereum has a total of 244 million unique addresses.

Litecoin, created in 2011, shares many similarities with Bitcoin but boasts faster transaction processing times. Litecoin is designed to be faster and more efficient, with lower transaction fees than Bitcoin, making it an attractive crypto option for retailers and consumers.

Ripple, also known as XRP, was designed for more complex and higher-value transactions. Ripple is also faster, has lower fees than Bitcoin, and is favoured by financial institutions for global payments. It is also more scalable than other cryptocurrencies.

Why are Cryptocurrencies Becoming So Popular in E-Commerce?

It’s no secret that digital assets are taking over e-commerce since cryptocurrencies offer several advantages to both customers and online retailers.

Here are a few of the benefits:

Lower Fees

One of the significant advantages of accepting cryptocurrencies for web merchants is the potential for lower transaction fees. Traditional payment methods, such as credit cards, often involve intermediary fees and processing charges. Cryptocurrencies eliminate the need for intermediaries, resulting in lower transaction costs for online retailers. This can lead to increased profit margins and cost savings in the long run.

Faster and Borderless Transactions

Cryptocurrency transactions are processed quickly, allowing for near-instantaneous payments. Unlike traditional banking processes that may involve clearance times and delays, cryptocurrency transactions are settled on the blockchain within minutes. This enables e-commerce firms to receive payments faster, improving cash flow and customer satisfaction. Additionally, cryptocurrencies enable cross-border transactions without the need for currency conversions, making it easier for international customers to make purchases.

International Transactions and Customer Base Expansion

Accepting cryptocurrencies opens up a world of opportunities for online retailers by tapping into a global customer base. Cryptocurrencies are not bound by geographical limitations or traditional banking systems, making them accessible to customers worldwide. By accepting cryptocurrencies, online merchants can attract customers from regions where traditional banking services are limited or inaccessible. This can lead to an expansion of the customer base and increased revenue potential.

Increased Security and Fraud Prevention

Cryptocurrencies provide enhanced security features that protect online retailers and customers from fraud. The use of cryptographic techniques ensures the integrity and security of transactions, making it extremely difficult for hackers to manipulate or counterfeit digital currencies. Additionally, cryptocurrency transactions are irreversible, reducing the risk of chargebacks and fraudulent activities. This enhances trust and confidence in the e-commerce ecosystem, benefiting both retailers and customers.

Challenges of Cryptocurrencies in E-Commerce

While the advantages of cryptocurrencies are enticing, their adoption in the e-commerce industry also comes with challenges.

Among them are:

Volatility

One of the significant challenges of accepting cryptocurrencies for online retailers is the inherent volatility and price fluctuations associated with digital currencies. Cryptocurrencies are known for their price volatility, with values often experiencing significant fluctuations within short periods. For example, Bitcoin can increase or decrease in price by 5% or even 10% in just one day. Additionally, price fluctuations can make it difficult to accurately track the cost of goods sold, which can make it difficult to calculate profit margins accurately.

Regulatory and Legal Issues

The regulatory landscape surrounding cryptocurrencies is still evolving, and online retailers must navigate complex legal frameworks when accepting cryptocurrencies as payment. Compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations can pose challenges for businesses. Additionally, the tax implications of accepting cryptocurrencies may vary from country to country, requiring digital businesses to stay updated on relevant regulations and reporting requirements.

Limited Adoption and Customer Awareness

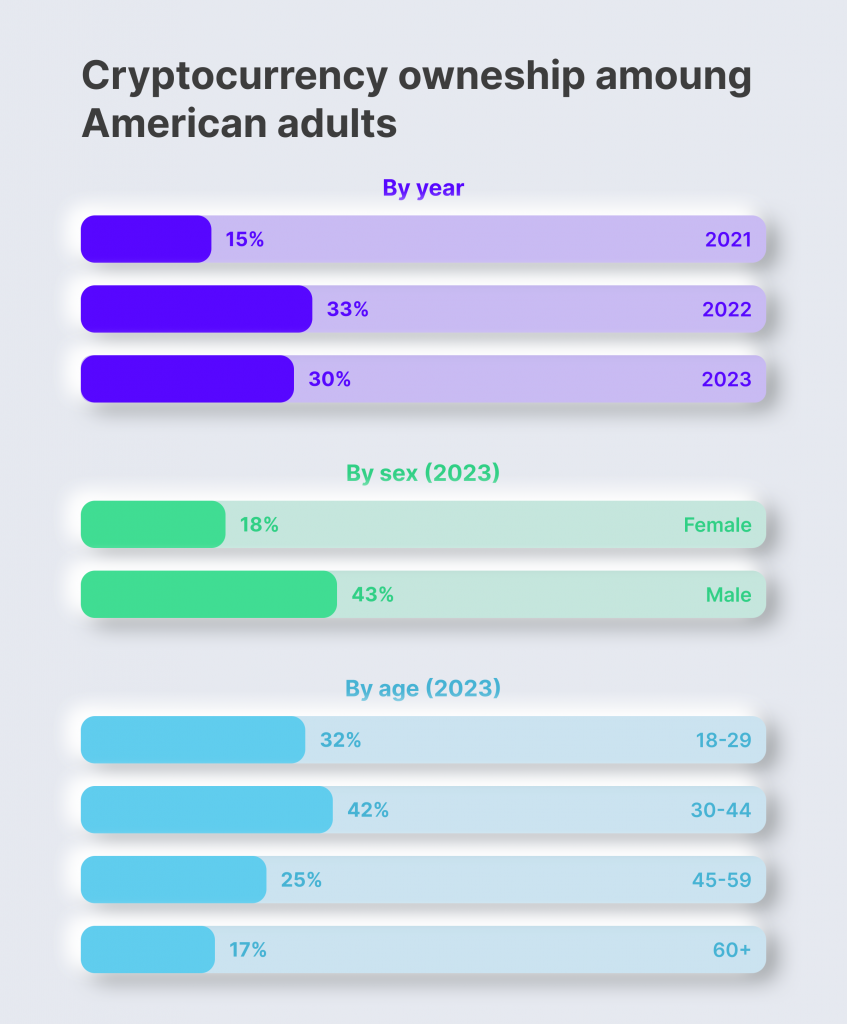

While the popularity of cryptocurrencies is growing, their adoption is still relatively low compared to traditional payment methods. Many customers may not be familiar with cryptocurrencies or may be hesitant to use them for online purchases. According to the security.org study, 69% of Americans currently consider themselves familiar with cryptocurrencies, and only 30% of them currently hold any crypto assets.

Stablecoins: A Major Trend and a Way to Resolve the Volatility Issue

Volatility has become one of the major headaches for online retailers when it comes to crypto. However, there is a solution to this problem – stablecoins.

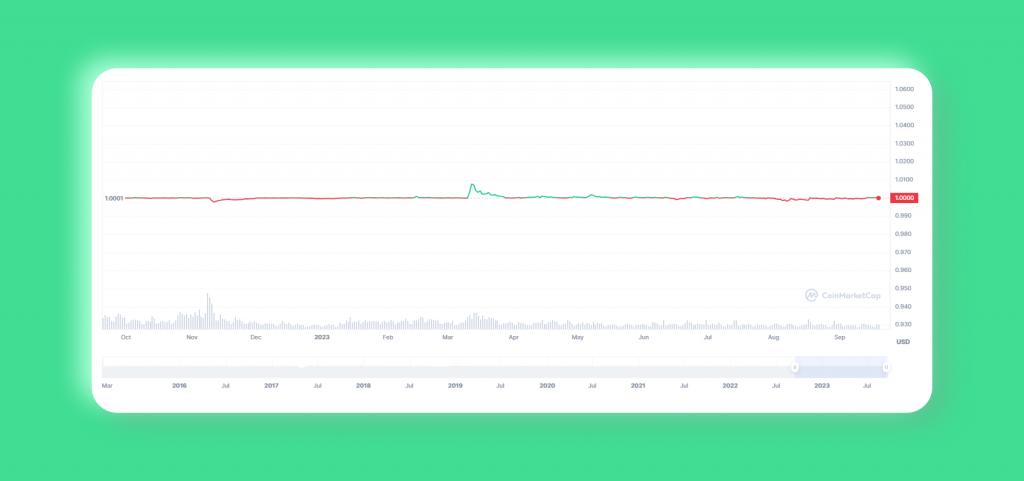

Stablecoins are becoming increasingly well-liked to limit the wildly fluctuating prices of conventional cryptocurrencies like Bitcoin. This is because stablecoins are pegged to traditional currencies, such as the US dollar. This makes stablecoins much more attractive to people who are hesitant to invest in cryptocurrencies due to their volatility.

There are more than 200 stablecoins in existence today. The most popular examples include Tether (USDT), which is considered the world’s first stablecoin and has the highest market cap of all its peers, sitting at just under $83 billion as of September 2023.

Stablecoins are often used as a medium of exchange or as a store of value. Stablecoins have the potential to bridge the gap between traditional finance and the cryptocurrency market, making them a viable payment option for online purchases.

Integrating Cryptocurrency Payments into E-Commerce Platforms

To enable cryptocurrency payments, online retailers can integrate payment gateways that support cryptocurrencies into their e-commerce platforms. These payment gateways provide a seamless and secure way for customers to make purchases using cryptocurrencies. Additionally, online retailers can choose to convert cryptocurrency payments into traditional fiat currencies instantly to mitigate the risk of price volatility.

Case Studies: Online Retailers Embracing Cryptocurrencies

Cryptocurrencies are increasingly being accepted as a form of payment across the e-commerce landscape. Payment giants like PayPal and online marketplaces like eBay are already starting to embrace digital transactions. For example, PayPal’s Checkout with Crypto feature allows US customers to use cryptocurrencies to pay at millions of online retailers.

Bed Bath & Beyond (formerly Overstock.com)

Overstock.com, an e-commerce site specialising in furniture and home goods, has been at the forefront of embracing cryptocurrencies. The company began accepting Bitcoin as a form of payment in 2014, becoming one of the first major online retailers to do so.

Overstock.com has since expanded its cryptocurrency acceptance to include other digital currencies such as Ethereum, Litecoin, and Bitcoin Cash. The company’s ex-CEO, Patrick Byrne, has been vocal about the benefits of cryptocurrencies and their potential to disrupt traditional financial systems.

Shopify

Shopify, a leading e-commerce platform, has integrated cryptocurrency payments into its platform, allowing merchants to accept cryptocurrencies as a form of payment. Through partnerships with cryptocurrency payment processors, Shopify enables seamless and secure cryptocurrency transactions for its merchants. This integration has empowered thousands of online retailers to embrace cryptocurrencies and tap into the growing market of crypto-savvy customers.

Microsoft

Microsoft, one of the world’s largest technology companies, has also recognised the potential of cryptocurrencies in the e-commerce sector. The company accepts Bitcoin as a form of payment for various digital content, including games, apps, and movies. Microsoft’s acceptance of cryptocurrencies has not only catered to the growing crypto community but has also showcased the company’s forward-thinking approach to technology and finance.

Strategies for Successful Integration of Blockchain Technology in E-Commerce

So, how does one fully embrace crypto in their business? There are a number of things to take into consideration.

Educating Customers about Cryptocurrencies

To overcome the challenge of limited adoption and customer awareness, online retailers can focus on educating their customers about cryptocurrencies. This can be done through informative blog posts, tutorials, and FAQs that explain the basics of cryptocurrencies and how to use them for online purchases. By providing clear and accessible information, online retailers can demystify cryptocurrencies and instil confidence in their customers.

Offering Incentives for Crypto Payments

To encourage customers to use cryptocurrencies for online purchases, online retailers can offer incentives such as discounts, loyalty rewards, or exclusive deals for crypto payments. These incentives can help overcome customer reluctance and create a positive association with cryptocurrencies. Additionally, merchants can leverage partnerships with cryptocurrency payment processors to offer seamless and user-friendly payment experiences.

Leveraging Blockchain Technology for Supply Chain Management

Blockchain technology, the underlying technology behind cryptocurrencies, offers immense potential for supply chain management in the e-commerce industry. By leveraging blockchain, e-commerce companies can enhance transparency, traceability, and efficiency throughout the supply chain. Blockchain-based solutions enable secure and auditable tracking of products, reducing the risk of counterfeit goods and ensuring the authenticity of products.

Collaborating with Crypto Payment Service Providers

To simplify the integration of cryptocurrency payments into their e-commerce platforms, e-commerce retailers can collaborate with crypto payment service providers. These providers offer ready-to-use payment gateways and tools that enable seamless online transactions. By partnering with established crypto payment service providers, online retailers can leverage their expertise and infrastructure to streamline the acceptance of cryptocurrencies.

The Future of Crypto in E-Commerce

Crypto has the potential to revolutionise the e-commerce industry. So, what is in store for the future of this sector?

Mainstream Adoption and Integration

Despite the early stages of cryptocurrency adoption in e-commerce, the future looks promising. As more brands embrace cryptocurrencies and customers become more familiar with their benefits, we can expect to see increased mainstream adoption. E-commerce platforms are likely to integrate cryptocurrency payment options as a standard feature, making it easier for online retailers to accept digital currencies.

Evolution of Stablecoins for E-Commerce

Stablecoins, a type of cryptocurrency pegged to a stable asset, are poised to play a significant role in the future of e-commerce. By utilising stablecoins, online retailers can mitigate the challenges of price fluctuations and provide a more reliable and consistent payment experience for customers.

The Role of Decentralised Finance (DeFi) in E-Commerce

DeFi refers to a set of financial applications and platforms built on blockchain technology. DeFi has the potential to revolutionise various aspects of e-commerce, including lending, borrowing, and payment systems. By leveraging DeFi protocols, online retailers can access decentralised liquidity pools, offer alternative financing options to customers, and streamline payment processes.

Conclusion

The rise of cryptocurrency in e-commerce is transforming the way online retailers conduct transactions. With major brands and payment processors embracing digital currencies, the future of cryptocurrency as a mainstream payment method looks promising.

Digital payment methods on your e-commerce store can offer benefits such as faster transactions, expanded market reach, increased security, and lower fees. So, are you ready to embrace the future of digital payments with cryptocurrency?

FAQs

How can I accept crypto for my online store?

The easiest way to accept cryptocurrency payments on your e-commerce store is to use a cryptocurrency payment gateway. These services allow you to integrate cryptocurrency payments into your store easily, and they provide a secure platform for accepting payments.

Also, you can create a crypto wallet and integrate a QR code with your address to your website. This wallet can be used to receive and store cryptocurrency payments. You can also use it to transfer cryptocurrency to other wallets or exchanges. Additionally, you can also use a cryptocurrency exchange to convert cryptocurrency into fiat currency.

When it comes to online shopping, are cryptocurrencies risky?

Cryptocurrencies are risky investments, as their values can fluctuate drastically. Additionally, cryptocurrency transactions are irreversible, so you cannot reverse them if you make a mistake. It is important to be aware of the risks when shopping online with cryptocurrency.

How does blockchain technology work?

Blockchain technology works by using a decentralised network of computers to store and validate data. All transactions are recorded on a public ledger, which is accessible to all participants in the network. This allows for secure, transparent, and immutable transactions.

Are cryptocurrencies environmentally friendly?

Sadly, cryptocurrencies couldn’t be considered environmentally friendly as they require large amounts of energy to mine and create. Additionally, the amount of energy consumed by the network increases with the size of the network, so as cryptocurrencies become more popular, so does their environmental impact.

However, some projects are trying to address this issue by creating more efficient validating algorithms (such as Proof of Stake). This can help reduce cryptocurrencies’ environmental impact and make them more sustainable.