Crypto Tax Explained: What You Need to Know About Filling Crypto Taxes

According to a report by Checkout.com, more than 15,000 businesses worldwide accept BTC payments as of 2023. As more and more companies around the world turn to cryptocurrencies, governments and tax authorities have taken notice. Today, most countries require individuals and businesses to report their crypto earnings and pay taxes on them.

However, the world of crypto taxes can be complex and confusing for many. In this article, we will take a general look at the basics of crypto taxes and what you need to know when filing them.

Key Takeaways

- Most countries treat cryptocurrencies as assets or property for tax purposes, meaning any gains or losses from crypto transactions are taxable.

- Exchanging crypto assets for fiat, using crypto to buy goods or services, and receiving digital assets as income are common instances of taxable crypto events.

- Some non-taxable cryptocurrency events include gifts, donations, transfers between personal wallets, and HODLing.

- Failure to report crypto taxes can result in serious consequences, including back taxes, penalties, and even criminal charges.

The Basics of Crypto Taxes

Do you have to pay taxes on crypto? All cryptocurrencies like Bitcoin, Ethereum, and Solana can be taxed in two ways:

- capital gains tax

- income tax

While every country has its own set of rules and regulations on the taxation of cryptocurrencies, the most common approach is to treat them as assets or property. Any selling or trading profits or losses from crypto are taxable.

Capital Gains Tax

How much tax do you pay on your earnings?

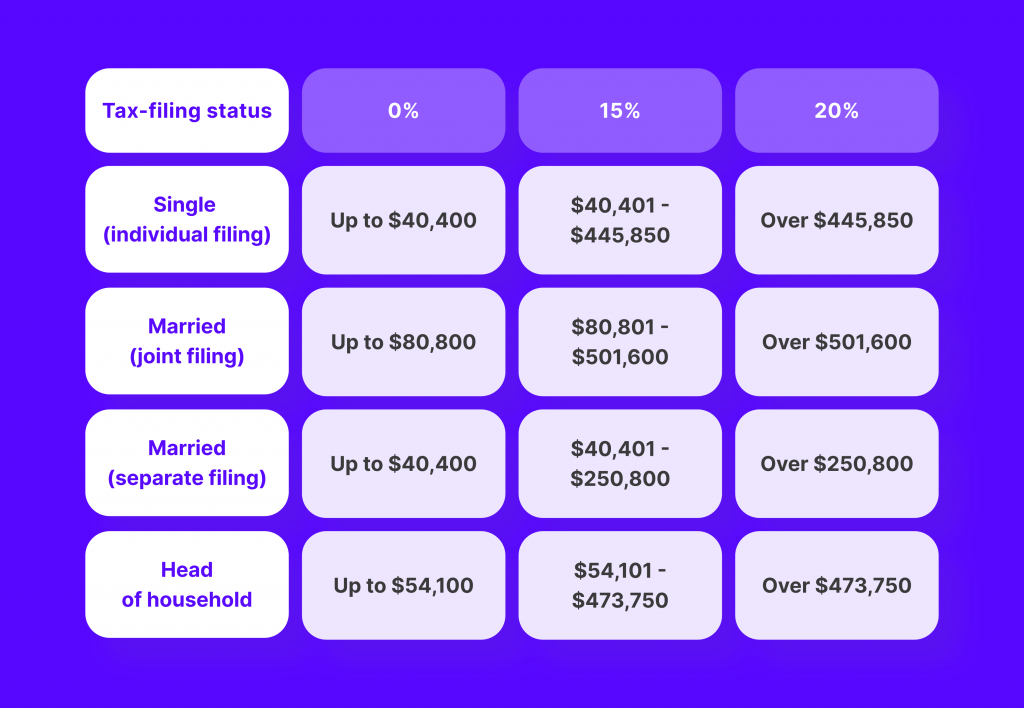

As mentioned, most countries follow the capital gains tax method when taxing cryptocurrencies. In this approach, individuals must report their cryptocurrency earnings on their tax return and pay a certain percentage of taxes on them. The tax rate for short-term capital gains (less than a year) is usually higher than for long-term capital gains (more than a year).

For example, the Internal Revenue Service (IRS) treats cryptocurrencies as property for capital gains tax purposes in the US. Short-term capital gains are taxed at rates ranging from 10% to 37%, while long-term capital gains range from 0% to 20%, depending on your income bracket.

Similarly, in the UK, the HM Revenue & Customs (HMRC) agency also treats cryptocurrencies as property. Individuals need to pay capital gains tax when they sell or exchange their cryptocurrencies, with the tax bill rate varying from 10% to 20%, depending on their income.

Income Tax

Individuals may also be required to pay income tax on their crypto investments. This method is less common and usually applied when an individual receives a regular income from mining, staking, or providing services in exchange for crypto. The income tax rate is usually based on the individual’s total earnings and can vary from country to country.

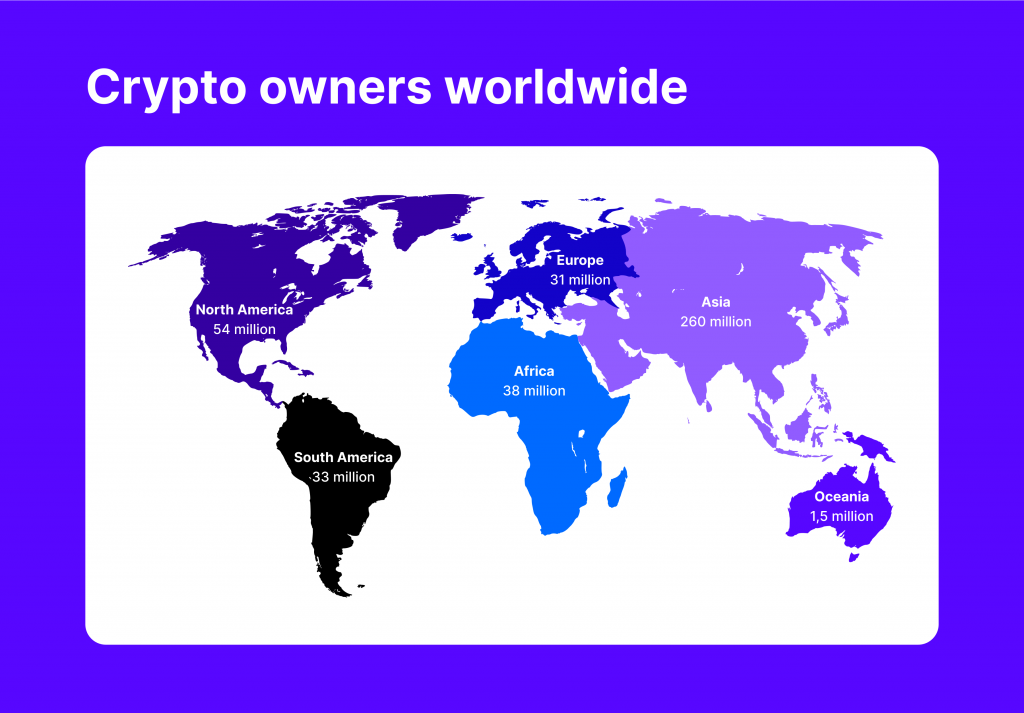

Crypto Taxes Around the World

Some countries have strict rules and regulations on the taxation of cryptocurrencies, while others have more lenient policies. In general, most developed countries have generally implemented some form of taxation on cryptocurrencies.

For instance, countries like Australia, Ireland, France, and Japan allow cryptocurrencies as a legal payment method but require individuals to report their earnings for tax purposes.

In contrast, some developing countries have either banned or imposed heavy restrictions on the use of cryptocurrencies. In these cases, it is essential to research and understand the local laws and regulations before engaging in any crypto-related activities.

Fast Fact

Only 0.53% of global cryptocurrency owners pay taxes on cryptocurrency transactions, underscoring the low compliance rate and emphasizing the necessity for heightened awareness and enforcement of crypto tax regulations.

Taxable Events in Cryptocurrency

Taxable events refer to any action or transaction involving cryptocurrencies that may result in tax obligations. These can include buying, selling, exchanging, or receiving crypto as payment for goods and services.

In most countries, these taxable events are treated similarly to the sale of property – gains or losses are calculated based on the difference between the purchase and selling prices of the cryptocurrency.

Note: Always consult a tax professional regarding your tax circumstances, as the regulations can vary depending on your location.

Let’s take a look at instances of crypto-taxable events in the US.

These particular events are taxable as capital gains:

Selling Crypto for Fiat Currency

This is the most common taxable event for crypto investors. If you sell your cryptocurrency for U.S. dollars or any other fiat currency, you will owe taxes on any gains made from the sale.

For example, if you bought 1 BTC for $50,000 and sold it for $55,000, you would have a capital gain of $5,000 that you need to report on your taxes.

The tax rate for capital gains varies based on your income bracket and the holding period of the cryptocurrency.

As already mentioned, holding the crypto for less than a year is considered a short-term capital gain and is taxed at your regular crypto income tax rate. If you held it for more than a year, it is considered a long-term capital gain and subject to a lower tax rate.

Exchanging One Cryptocurrency for Another

Even if you’re not selling your cryptocurrency for fiat currency, exchanging one crypto for another is still considered a taxable event. When you trade, say, Bitcoin for Solana, the difference between the purchase price and the current market value of both currencies will be subject to capital gains taxes.

Using Crypto to Purchase Goods and Services

While it may seem like just a regular transaction, using cryptocurrency to buy goods or services is also considered a taxable event. The IRS treats this similarly to selling your crypto for fiat currency and may require you to report any gains made from the transaction.

These events are taxable as capital gains as income:

Receiving Cryptocurrency as Income

If you receive cryptocurrency as payment for services rendered, it will be taxed as regular income according to your income tax bracket. This can include wages paid in crypto by an employer or compensation for freelance work.

Mining Cryptocurrency

Mining cryptocurrency involves using computer power to verify transactions on the blockchain and earn rewards. These rewards are considered income and must be reported as such on your taxes. The fair market value of the mined coins at the time they were received will determine the amount of taxable income.

Staking Rewards

Staking is another way to earn crypto, but it involves holding a certain amount of a particular cryptocurrency in a wallet for a set period to earn rewards. Similar to mining, the fair market value of the rewards on the day they were received will determine the amount of taxes owed.

Receiving Crypto from Hard Forks

When a cryptocurrency undergoes a hard fork, creating a new coin, any coins received as a result are considered taxable income. The amount owed will be based on the fair market value of the new coins at the time they were made available to you.

Receiving Airdrops

Airdrops occur when companies or projects distribute free cryptocurrency to users. These airdropped coins are also considered taxable income and must be reported on your taxes at their fair market value at the time of receipt.

Other Incentives and Rewards

Apart from the events mentioned above, there are various other ways to earn or receive cryptocurrencies. These can include rewards for participating in learning programs or incentives for referring friends to a crypto exchange.

Non-Taxable Events in Cryptocurrency

Non-taxable events in cryptocurrency refer to any action or transaction involving cryptocurrencies that are not subject to income tax or capital gain tax obligations. These can include gifts, donations, and transfers between personal wallets.

Gifts of cryptocurrency are typically not taxable as long as they are within a certain value threshold set by the country’s tax laws. Similarly, donations made in cryptocurrencies may also be considered non-taxable, depending on the recipient and purpose of the donation.

Let’s take a closer look at these non-taxable events:

Gifts in Crypto

Gifts in cryptocurrency are considered non-taxable if they fall within the gift tax exclusion limit set by the IRS. In the US, this limit is currently set at $18,000 per recipient in 2024.

If you transfer crypto to someone else outside of a purchase for goods or services, it may count as a gift, even if you didn’t intend it as one. In this case, you will need to keep track of the value and date of the transfer for potential tax implications.

Donations in Cryptocurrency

Donating cryptocurrency directly to a qualified tax-exempt charity or non-profit organisation may be eligible for a charitable deduction on your taxes. This can provide an advantageous benefit when you pay tax while also supporting a good cause.

However, it’s important to note that not all organisations or individuals may qualify for tax-exempt status. Before making a cryptocurrency donation, make sure to verify the recipient’s eligibility for tax deductions with the IRS.

Transfers Between Personal Wallets

Transferring cryptocurrency between your own personal wallets or accounts is not considered a taxable event. You can transfer over your original cost basis and date acquired without incurring any tax obligations.

HODLing

Holding cryptocurrency is also not a taxable event. Buying and owning crypto does not incur any tax obligations until you sell or participate in another taxable activity, such as staking.

How Do You Calculate and Fill Out a Report on Your Cryptocurrency Taxes?

Calculating your crypto taxes involves assessing your capital gains and losses. The formula for this is simple:

Fair Market Value (sale price) – Cost Basis (purchase price) = Capital Gain/Loss.

If the fair market value is higher than the cost basis, you’ve made a capital gain; if it’s less, you’ve incurred a capital loss.

These gains or losses are then subject to either short-term or long-term capital gains tax, depending on how long you hold the cryptocurrency.

Example of Calculation:

Let’s say you bought 0.5 BTC for $40,000 on January 1st and then sold it for $45,000 on May 1st. Your capital gain would be $5,000. However, since you held the BTC for less than a year, it would be considered a short-term gain and taxed at your regular income tax rate.

Now, let’s say you bought 0.5 BTC for $40,000 on January 1st and sold it for $60,000 on February 1st of the following tax year. Your capital gain would be $20,000. Since you held the BTC for over a year, it would be considered a long-term gain and taxed at a lower rate.

What Information Do You Need to Calculate Crypto Taxes?

To accurately calculate your crypto taxes, you need to have the following information:

- The date and time of every transaction (including trades or swaps).

- The cost basis or purchase price of each cryptocurrency.

- The fair market value or sale price of each cryptocurrency.

- Any transaction fees associated with buying, selling, or trading cryptocurrencies.

You can gather this information by keeping a detailed record of your transactions, using cryptocurrency tax software, or consulting with a tax professional.

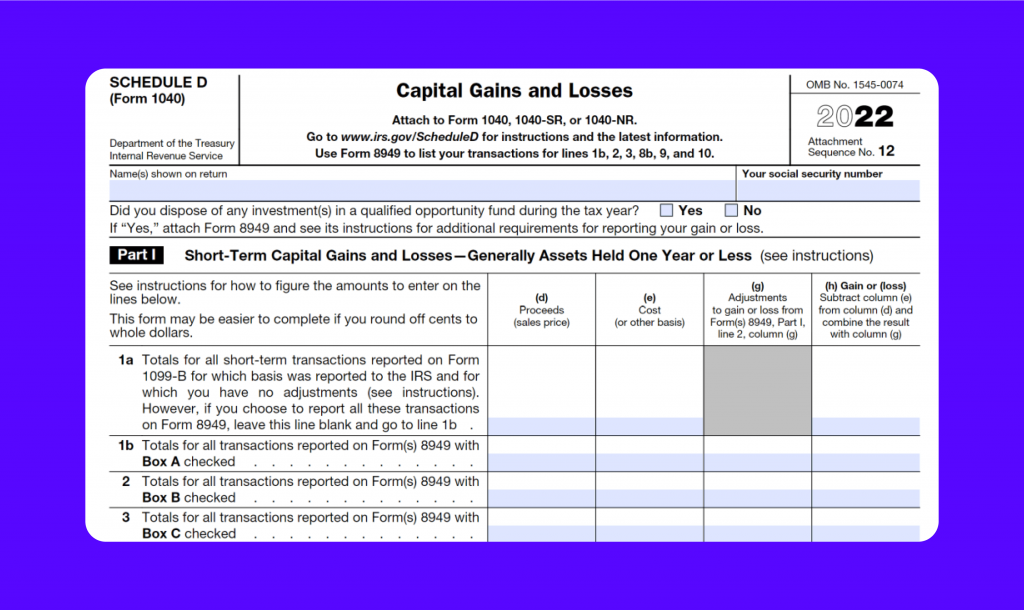

Cryptocurrency Tax Forms

In the United States, crypto taxes are reported on Form 8949 and Schedule D of your individual income tax return. In the UK, gains or losses from digital currencies must be included in the Capital Gains Tax section of your tax return.

Tips for Accurate Crypto Tax Reporting

- Keep a detailed record of all cryptocurrency transactions.

- Use cryptocurrency tax software or work with a tax professional to ensure accuracy.

- Be aware of any changes in tax laws regarding cryptocurrency.

- Report all transactions, even small ones, to avoid any potential penalties.

What Happens If You Don’t Report Your Crypto Taxes?

Failure to report cryptocurrency taxes can have serious consequences, similar to failure to report any other tax. The IRS in the US and HMRC in the UK can conduct audits on individuals suspected of not paying their crypto taxes.

If an individual is found to have not reported their crypto taxes, they may be required to pay back taxes, interest, and penalties. The exact consequences depend on the reason for the reporting failure.

If an individual makes a genuine mistake or does not understand their tax liabilities, they may face milder consequences than those who willfully try to evade taxes. Willful tax evasion can result in criminal charges and penalties, including hefty fines and even imprisonment. In the US, for example, evading taxes can lead to a $250k fine and a maximum of five years in prison.

Bottom Line

Understanding crypto taxes can be complex, but it’s necessary for engaging with cryptocurrencies. Whether you’re a casual investor, a full-time crypto trader, or a small business, you need to be aware of your tax obligations.

As the crypto space continues to evolve, so will its tax implications. Being proactive in understanding and meeting your tax obligations will make your crypto journey much smoother.

Disclaimer: The information contained in this article is for informational purposes only and should not be considered financial or tax advice. Always consult with a qualified tax professional to understand your specific tax circumstances.

FAQ

Is sending crypto to another wallet taxable?

No, transferring crypto from one wallet to another is not taxable. The transfer itself does not involve selling or exchanging the cryptocurrency, and you retain ownership throughout the process.

Do big crypto exchanges report to tax authorities?

Yes, most major cryptocurrency exchanges in the United States must report certain transactions to tax authorities, including the IRS. For example, exchanges like Binance and Coinbase must provide information on customers’ transactions to the IRS.

What is the best way to avoid cryptocurrency taxes?

As much as you want to avoid paying taxes on your cryptocurrency, the fact remains that any gains made from using, trading or selling digital assets are subject to capital gains tax.

What countries are the best for cryptocurrency tax treatment?

Several jurisdictions have been known for their favourable tax laws for cryptocurrency investors. Some of the top countries include El Salvador, Singapore, Belarus, and Portugal.