Save Time, Trade Smarter? What Are Crypto Trading Signals?

In 2025, Telegram remains the go-to platform for receiving trading signals for cryptocurrency trades. Thousands of channels — both free and paid — deliver real-time trade ideas to millions of crypto traders across the globe. Instant, mobile-first, and community-driven, Telegram has become a central hub for those seeking an edge in the market.

So, what exactly are these crypto trading signals? How do they actually come about? And maybe the most critical question: can following them genuinely help you trade better and more profitably?

Key Takeaways:

- Crypto trading signals provide trade ideas with entry, exit, and risk levels to help traders act faster.

- Effective use of signals requires risk management, context, and your own judgment.

- Signals are a helpful tool, but they should support, not replace, your trading strategy.

What Are Crypto Trading Signals?

Сrypto trading signals are specific trade suggestions or alerts. They are actionable tips designed to highlight potential trading opportunities someone else believes they’ve identified. Instead of a vague “Bitcoin looks bullish,” a useful signal provides concrete details you can potentially act on.

Typically, a signal will include key pieces of information:

- The Asset: Which cryptocurrency to trade (e.g., BTC, ETH, SOL, or maybe a lesser-known altcoin).

- Entry Price Zone: A recommended price range where opening the trade might make sense, according to the signal provider’s analysis.

- Take-Profit (TP) Target(s): Suggested price levels where you could close the trade to lock in profits. Often, signals might offer multiple targets.

- Stop-Loss (SL) Level: This is crucial – it’s the predetermined price point to exit the trade and cut your losses if the market turns against you. Never trade without one.

- Trade Direction: Is the signal suggesting a long position (buying, expecting the price to go up) or a short position (selling, expecting the price to drop)?

- Timeframe Idea (Sometimes): Some signals might hint at whether it’s intended as a quick scalp, a swing trade over a few days, or something longer-term.

For example:

BTC/USDT – Long

Entry: $65,500 – $65,700

TP1: $66,500 | TP2: $67,400

SL: $64,800

Leverage: 3x (optional)

(Warning: not a real trading signal!)

In essence, a well-constructed signal aims to give you a clear potential game plan: what to trade, when to consider getting in, and predefined points for getting out, both for gains and for limiting losses.

Where Do These Signals Originate? The Human vs. The Machine

It’s useful to know that signals aren’t all generated the same way. Broadly, they come from two main camps:

- Human-Generated Signals

These originate from the minds of professional traders or analysts. They typically combine various analysis forms: scrutinising price charts and technical indicators (like RSI, MACD, moving averages, Fibonacci levels), monitoring trading volume, reacting to significant news events, and perhaps even considering on-chain data or broader economic trends.

Because there’s a person behind them, manual signals often come with extra commentary or reasoning, which can be valuable for learning why a trade looks appealing.

- Automated Signals

These are the output of automated systems or trading bots executing predefined strategies. Some might be straightforward rule-based systems (e.g., “If indicator X crosses threshold Y while condition Z is met, trigger signal”). Others might employ machine learning techniques to adapt to changing market behavior over time.

They are typically faster than humans and can process much more data without emotion, potentially generating more signals. However, faster doesn’t always mean better, and they lack the nuanced judgment a human can sometimes provide.

In practice today, many signal providers likely use a hybrid approach – perhaps leveraging automation for speed and initial filtering, with human oversight adding a final layer of analysis or context.

Why Are They So Popular?

The appeal of trading signals is pretty clear, especially for certain types of traders:

- Newcomers Feeling Overwhelmed: If you’re just starting out and complex technical analysis seems daunting, signals can feel like a helpful starting point to get involved.

- Busy Individuals: Don’t have the time or desire to stare at charts all day? Signals promise pre-digested, actionable ideas, saving considerable analysis time.

- Community-Oriented Traders: Some people thrive on trading within a group, sharing insights and experiences. Many signal channels foster this kind of community environment.

Understanding the basics is good, but how are these signals actually created and delivered day in, day out?

How to Find Trading Signals for Crypto?

Once a potentially profitable setup is identified and a signal is created, how does it land on your screen?

Telegram

Still overwhelmingly the dominant platform in 2025 for signal distribution. Why? It’s instant, mobile-friendly, allows for easy creation of channels and groups, and offers users a degree of privacy.

You’ll find thousands of channels here – a mix of free ones (often a starting point, but be wary of constant upsells or potentially delayed info) and paid subscription groups promising premium features like faster alerts or more detailed analysis.

When wading through Telegram, be critical. Look for channels that show some transparent performance history (not just highlighting winning trades), provide clear risk management advice (like stop-losses) with every signal, have an active community or accessible support, and most importantly, avoid anyone promising “guaranteed profits.” That’s a massive red flag in trading.

Dedicated Signal Platforms & Tools

Beyond simple chat channels, there are specialized platforms (names like 3Commas, CoinCodeCap, or Cornix often come up) built specifically around signals. These often offer more structure, providing analytics on signal performance, direct integration with crypto exchanges (allowing for automated trading based on signals), and ways to filter signals by type or provider. Many even integrate with Telegram bots.

Social Trading Networks (Copy Trading)

Platforms like eToro or Zignaly offer a slightly different approach. Here, you can automatically copy the exact trades of successful, ranked traders in real-time. While not “signals” in the traditional alert format, they achieve a similar goal – letting less experienced traders follow strategies with proven track records.

A key advantage here is often transparency; you can usually scrutinize a trader’s historical performance and risk metrics before deciding to copy them.

Discord Servers & Online Communities (Reddit etc.)

Some traders find valuable signals or insights within curated Discord servers, often as part of a broader trading community. These can be more interactive, allowing for discussion around trade ideas. Places like Reddit (subreddits focused on crypto trading) can be a mixed bag – useful for discovering providers or hearing about scams, but require careful filtering due to the sheer volume of opinions and noise.

Remember, too, that signals vary in their intended timeframe. Some are aimed at quick scalping (lasting minutes to hours), others suit swing trading (days), while some might target longer-term position trades.

Consequently, the frequency of signals also differs greatly – some providers might send out many signals each day, whereas others are much more selective, perhaps only sharing one or two high-confidence ideas per week.

Best Cryptocurrency Trading Signals Groups in 2025

Given Telegram’s dominance, knowing some of the visible players can be helpful, though finding genuinely high-quality, consistent groups remains a challenge. Here are a few groups often mentioned in discussions:

Crypto Whale Pumps

This group focuses on identifying potential short-term ‘pump’ opportunities, often in early-stage tokens or coins on decentralized exchanges (DEXs). They seem to use algorithmic tracking to spot momentum shifts quickly.

Subscribers: 34,000+

Access: Free & Premium

Ideal for: Traders chasing momentum in small caps

Learn2Trade

Often presented as being run by a team of professional traders, Learn2Trade typically provides more structured signals, often with technical justifications, primarily for major crypto pairs (but sometimes includes Forex/indices too). Some sources report accuracy rates around 79%, but verify independently.

Subscribers: 26,000+ (free Telegram channel)

Access: Free or VIP (several tiers)

Ideal for: Traders who prefer technical setups with clear risk/reward

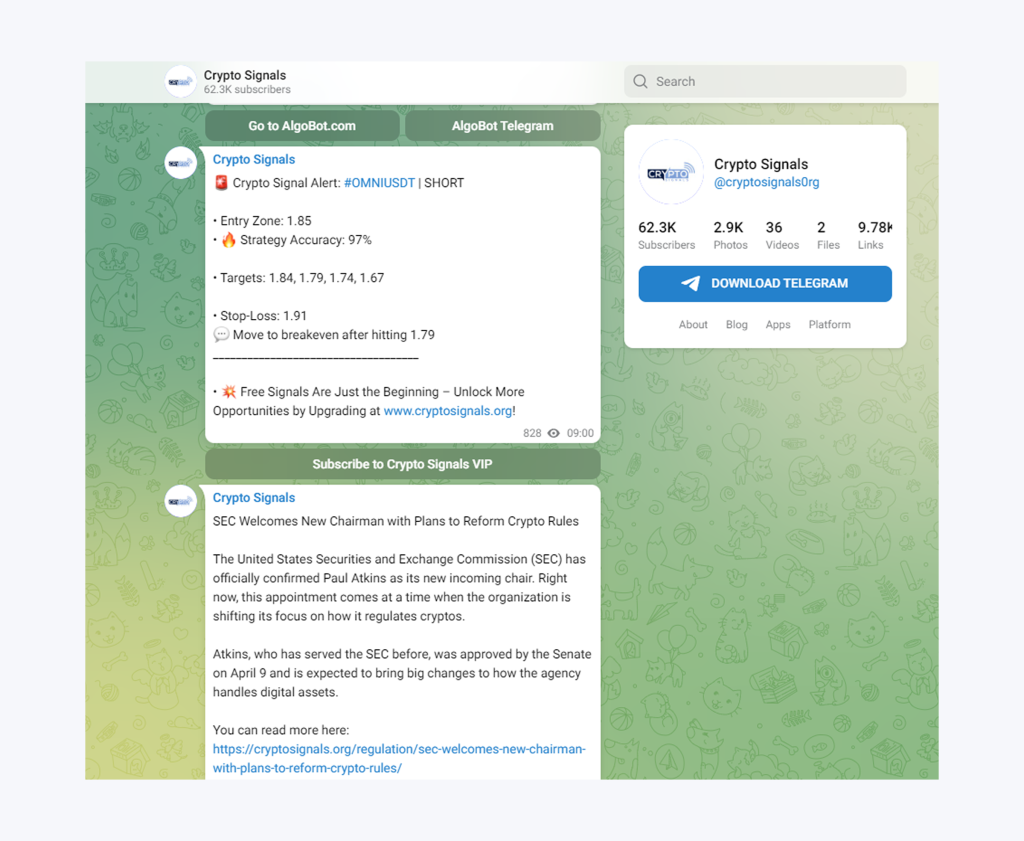

CryptoSignals.org

An older player, established back in 2014, according to their site. CryptoSignals.org is often noted for clear signal formatting, usually including technical reasoning, risk levels (SL/TP), and sometimes multiple profit targets. They might suit traders looking for a service with a longer track record.

Subscribers: 62,000+ (free Telegram channel)

Access: Free or VIP (several tiers)

Ideal for: Traders looking for professionalism and experience

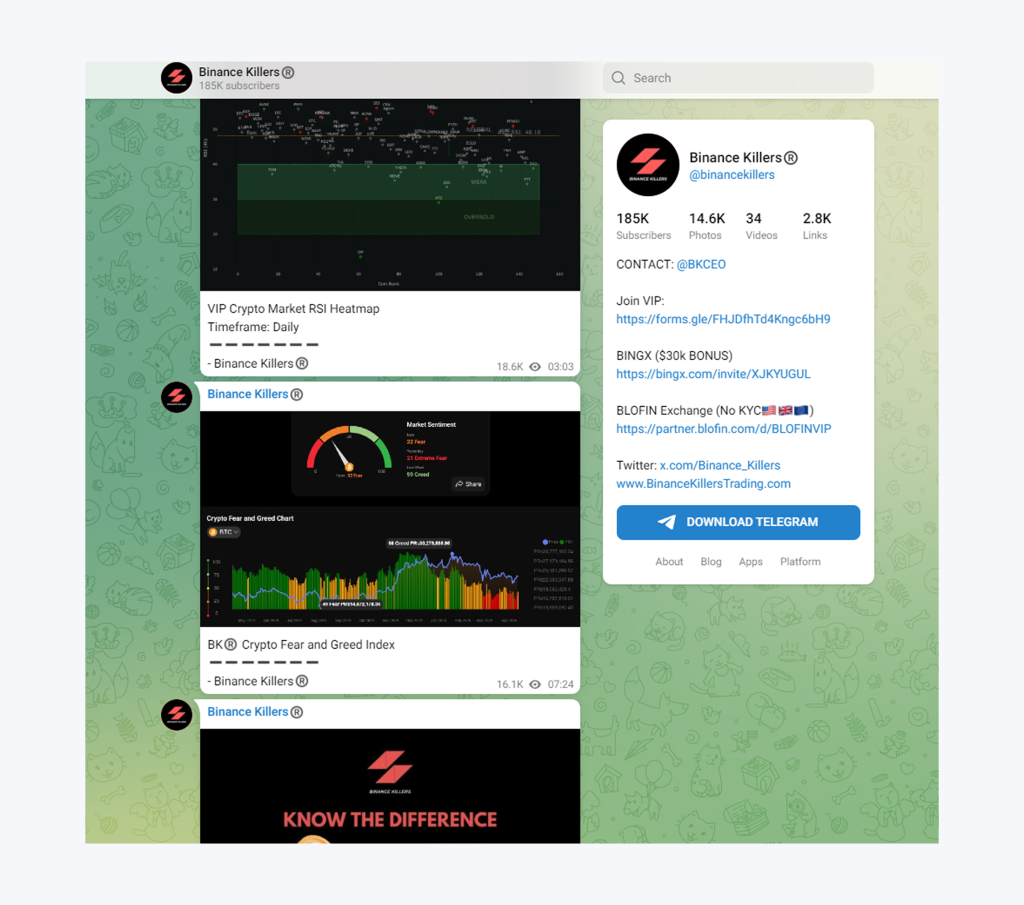

Binance Killers

This is one of the larger Telegram groups by subscriber count. As the name suggests, Binance Killers’ focus tends to be on coins listed on the Binance exchange. They generally provide straightforward trade setups aimed at being actionable.

Subscribers: 185,000+

Access: Free & VIP

Ideal for: Active Binance users and short-term traders

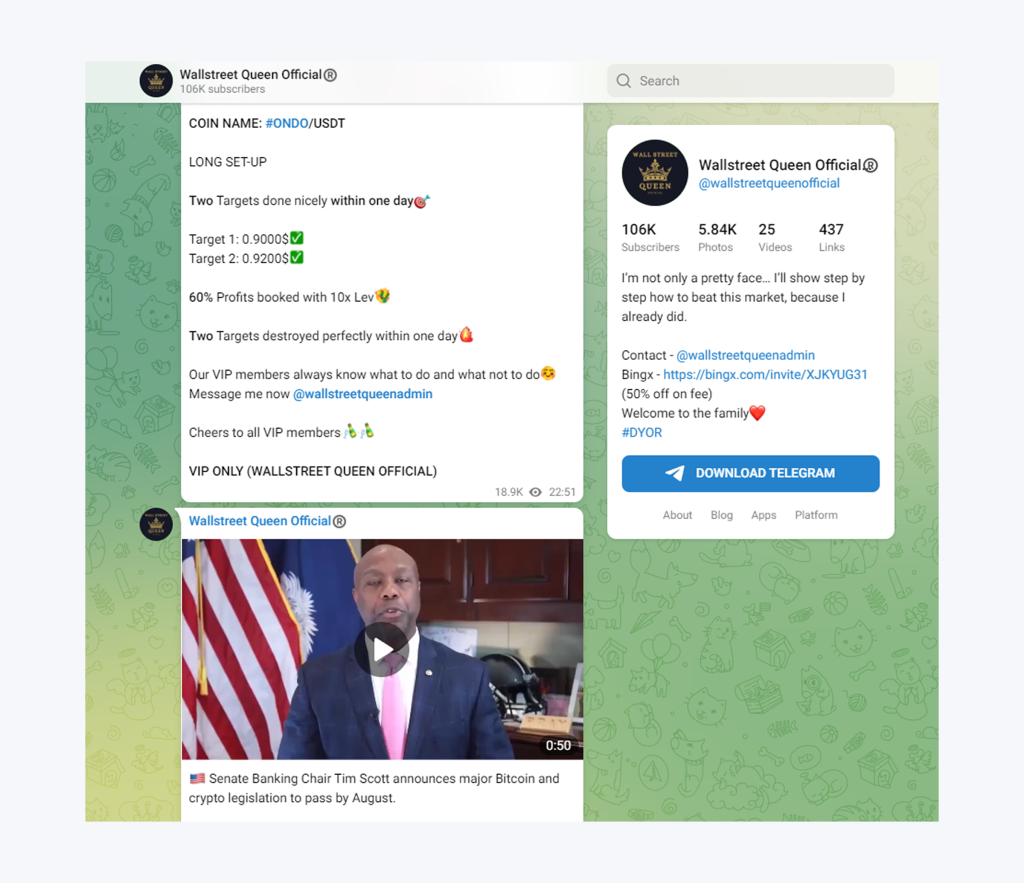

Wallstreet Queen Official

Often highlighted as being led by an experienced female trader (“WSQ”). This channel combines signals with more educational content, like annotated charts or brief analysis, aiming for a supportive community feel. VIP members might get access to more detailed setups or mentoring.

Subscribers: 106,000+

Access: Free & VIP

Ideal for: Traders who value explanation, context, and a supportive community

Always do your own thorough research before subscribing to or acting on signals from any provider. Check independent reviews (if available), try to track their free signals for a while if possible, understand their methodology, and critically assess any performance claims.

Pros and Cons of Using Crypto Trading Signals

Crypto trading signals can definitely offer some advantages, like saving you time scanning charts or giving you insights you might have missed.

But let’s be realistic – they’re not a magic bullet for guaranteed profits, and relying on them too heavily can backfire. Like any tool in your trading kit, they work best when you understand both their strengths and their very real limitations.

What’s Good About Using Signals?

- Major Time Saver: One of the biggest plus points? Signals can free you from having to watch the charts all day. You get potentially ready-to-go trade ideas delivered to you, often complete with suggested entry, exit, and stop-loss levels.

- Great Learning Aid for Beginners: If you’re new to trading, seeing how a signal is structured – where to potentially enter, how to set profit targets, and crucially, where to place a stop-loss – can be a practical way to understand trade mechanics. It’s like looking over a more experienced trader’s shoulder, if you use it as a chance to learn, not just copy blindly.

- Access to Different Perspectives: Especially with paid groups, signals might come with analysis or commentary explaining the rationale behind the trade. This can offer valuable insights into how others interpret market movements or use certain indicators.

- Discovering New Opportunities: A good signal provider might highlight potential trades in assets or market niches (like DeFi or obscure altcoins) that weren’t even on your radar. They can broaden your horizons beyond the coins you usually follow.

- Community & Accountability: Being part of a signal group’s chat or community can sometimes provide support, allow you to ask questions, and even create a sense of accountability, knowing others are potentially looking at the same setups.

But What Are the Downsides and Dangers?

- The Risk of Over-Reliance: Just blindly following signals without developing your own understanding of the market is risky. What happens if the market suddenly changes, or the signal provider makes a mistake? You need your own judgment.

- Transparency Can Be Sketchy: Not all providers are upfront about their results. It’s easy to showcase winning trades and quietly ignore the losers. Finding providers with genuinely transparent, verifiable track records can be tough.

- Signal Overload and Confusion: If you follow multiple groups, you’ll inevitably get conflicting signals – one says buy BTC, another says sell. Without your own analysis framework, this can lead to confusion, hesitation, or ‘analysis paralysis’.

- Scams Are Everywhere: Telegram and other platforms are rife with scammers posing as trading gurus. They lure people in with promises of unrealistic, guaranteed profits, often using fake screenshots or testimonials. Be incredibly skeptical.

- They Don’t Replace a Proper Strategy: Signals are just trade ideas. They won’t help you long-term if you don’t have solid risk management, control your position sizing, manage your emotions, and have an overall trading plan. Accurate signals plus poor execution still equals losses.

Crypto signals can be a genuinely useful part of your trading approach, especially for saving time or generating ideas. But they’re not a substitute for learning, critical thinking, and disciplined trading habits.

Common Mistakes That Cost Traders Money (Even With Good Signals)

It’s frustrating but true: traders often lose money even when following potentially decent signals. Usually, it’s not the signal itself, but avoidable errors in execution or mindset. Watch out for these common pitfalls:

- Blind Copy-Pasting: Treating Telegram crypto trading signals like infallible commands without engaging your brain. The market changes fast; context matters.

Always glance at the chart and consider the current situation before acting on any signal. Does it still look valid?

- Forgetting About Risk: Getting overconfident after a few wins and putting way too much capital on the next “sure thing.” One unexpected market move can erase prior gains.

Stick to your risk-per-trade rule religiously. Use stop-losses. Every single time. No exceptions.

- Signal Information Overload: Being in too many groups, getting bombarded with conflicting alerts, leading to confusion and poor decisions.

Be selective. Choose one or two providers you trust and whose style fits yours. Less noise often means clearer thinking.

- Chasing Trades You Missed: Seeing a signal, watching the price move quickly without you, and then jumping in late out of fear of missing out (FOMO). This often means buying near a temporary top or selling near a bottom.

Accept that you’ll miss some moves. If the entry window passed, let it go. Discipline pays off more than chasing.

- Letting FOMO or Urgency Drive Decisions: The rapid-fire nature of some signal groups can create a sense of pressure to trade constantly. This leads to rushed entries and taking lower-quality setups.

You don’t have to take every signal. Be patient and selective. Wait for setups that align well with your own rules and risk tolerance.

- Falling for Crazy Promises: Believing anyone who guarantees profits or claims impossibly high win rates (like 95%+ consistently). Real trading involves losses.

Prioritize transparency over hype. Look for providers willing to discuss losses as well as wins. Be deeply skeptical of guarantees.

Conclusion

In the always-on, often chaotic world of crypto trading in 2025, signals have definitely found their place in many traders’ toolkits. They can offer structure, potentially save time, and expose you to opportunities you might have otherwise overlooked.

But crucially, they aren’t a replacement for skill, strategy, or common sense. A signal’s effectiveness ultimately depends on the trader wielding it.

- If you’re newer to trading, use signals as a learning tool. Focus on reputable sources, start small, manage your risk carefully, and track everything to understand what works (and what doesn’t).

- If you’re more experienced, think of signals as supplementary data or idea generators. Use them to confirm or challenge your own analysis, not dictate your actions. Stick with providers who are transparent and emphasize risk control.

Use signals smartly, combine them with your own analysis and discipline, and they can be a valuable asset; rely on them blindly, and they can quickly become a liability.

FAQ:

Where to find free cryptocurrency trading signals?

You can find free signals on Telegram channels, Discord servers, Reddit forums, and some trading communities. While free signals are accessible, always verify the credibility of the source before acting on them.

How to read crypto signals?

A typical crypto signal includes the asset, entry price, stop-loss, and take-profit levels. Some may also specify leverage, timeframes, or trade type (long/short) — read carefully before executing.

Are crypto trading signals legit?

Yes, some are — especially from well-known, transparent providers. However, the space is full of scams and overhyped claims, so always do your research before trusting any signal group.