DeFAI: How Machine Learning is Transforming Decentralized Finance

The future of finance is being built on the blockchain. While Decentralized Finance (DeFi) continues to redefine lending and trading without banks, a new evolution is taking place: DeFAI.

By combining Artificial Intelligence (AI) with DeFi, a different kind of financial ecosystem is emerging. It is designed to be smarter, faster, and more autonomous.

Key Takeaways

- DeFAI integrates AI into DeFi. The goal is to create smarter financial systems capable of self-optimization using real-time data.

- Use cases for this technology are already broad. They include risk management, automated trading, fraud detection, and portfolio optimization.

- The future development of DeFAI likely involves AI-managed treasuries, autonomous protocols, and a necessary focus on governance and regulation.

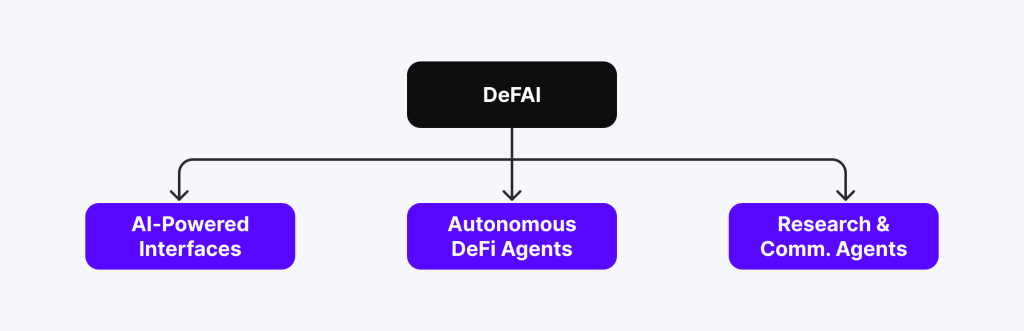

What Is DeFAI?

DeFAI stands for Decentralized Finance + Artificial Intelligence. It represents the combination of two transformative technologies: the open, permissionless nature of DeFi and the predictive power of AI.

While the primary goal of DeFi is to remove traditional intermediaries like banks, DeFAI seeks to enhance these new systems. The objective is to make decentralized finance more intelligent, efficient, and autonomous.

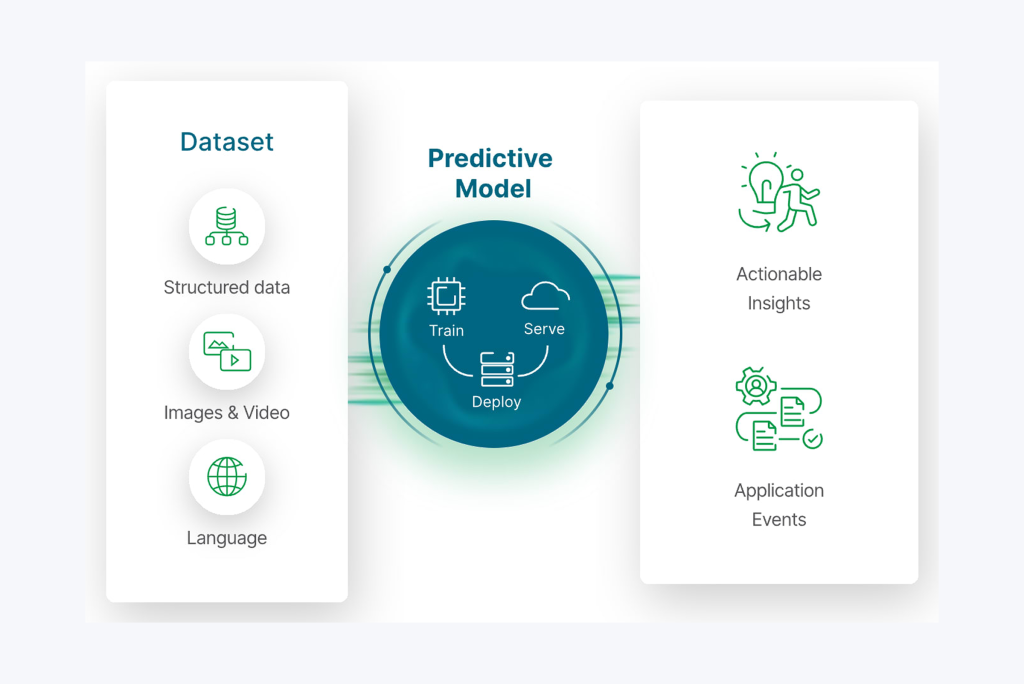

The core function of DeFAI is the application of machine learning models to analyze large amounts of on-chain and market data. The insights from this analysis are then used to optimize decision-making directly within financial protocols. For example, an AI-powered smart contract could be designed to identify and stop a fraudulent transaction before it is confirmed.

A decentralized lending platform could use AI to automatically assess a borrower’s risk and offer a custom interest rate, without needing a traditional credit score. These are practical examples of how DeFAI expands the capabilities of decentralized finance.

This is a different approach from legacy financial systems. There, decisions are often made using static models behind closed doors. DeFAI, by contrast, relies on real-time data and algorithms designed for continuous improvement. This gives a protocol the capacity to evolve. It can adapt to changing market conditions, new security threats, or shifts in user behavior.

The ecosystem is made more resilient and effective in the long term. As finance becomes more decentralized and digital, DeFAI is well-positioned to be the layer of intelligence that drives the next set of financial tools and services.

Fast Fact

Chainlink, a decentralized oracle network, plays a critical role in DeFAI by feeding real-world data into smart contracts—essentially acting as the blockchain’s “eyes and ears.”

Key Use Cases of Machine Learning in DeFi

As DeFi expands in depth and breadth, artificial intelligence is becoming its quiet ace in the hole. From enhancing risk management to enabling smarter, automated trading systems, AI’s emergence in DeFi is transforming what’s possible.

With machine learning, DeFi applications are examining unprecedented volumes of on-chain data in real-time, ushering in a new frontier—DeFAI platforms—that’s revolutionizing decentralized finance.

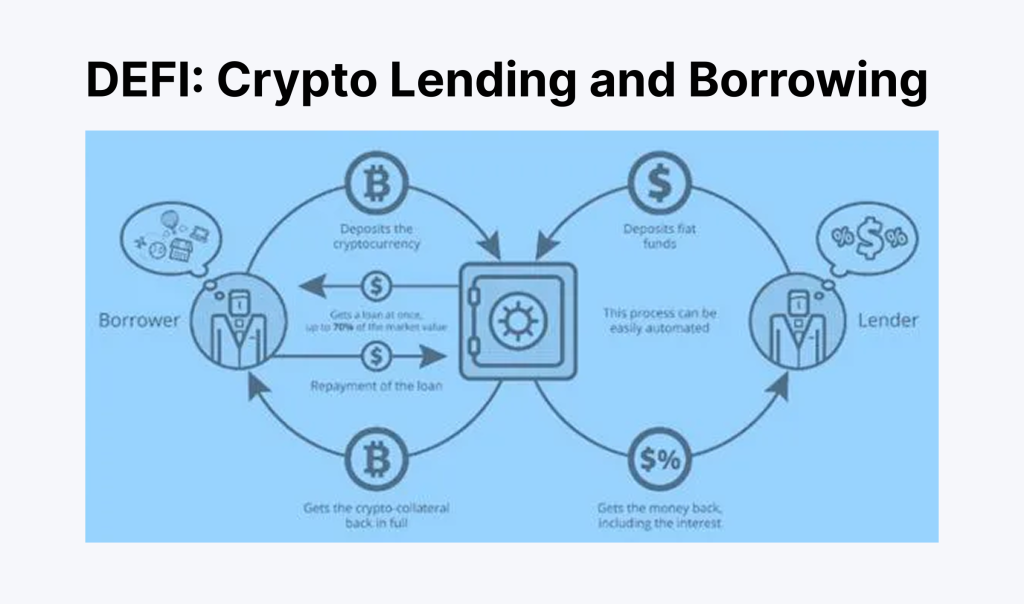

Risk Assessment and Credit Scoring in DeFAI

The most thrilling application of AI in decentralized finance is smart lending. Unlike banks, DeFi protocols do not rely on credit scores. AI-based crypto exchanges, however, employ machine learning algorithms to observe user wallet activity, token trading, history of loan-taking, and even sentiment on X.

Predictive algorithms enable the protocol to estimate risk levels and set interest rates with greater accuracy. The eureka moment is in financial inclusion, as we open gates for less threatening lending interfaces, entailing less collateral.

With DeFAI thus described, we are discussing a revolution for loan takers without formal credit but stone-solid on-chain cred.

Fraud Detection and Real-Time Threat Monitoring

Security remains a persistent challenge in DeFi, despite the emergence of flash loan attacks and exploit bots. Here is where AI blockchain tech applies most.

AI crypto systems, through real-time analytics and outlier detection, can spot anomalous token swaps, determine exploit methods, and even act autonomously to prevent damage. Such systems do in their operations what historically took human intervention, boosting DeFi protocol resistance.

As the market cap for DeFi continues to expand, the inclusion of ML-based risk management is critical for retaining user trust as well as making sure liquidity integrity is maintained.

Automated Trading and Price Prediction

Among the most thrilling frontiers on which AI in DeFi is thriving is trading. ML algorithms parse old price data, market sentiment, and social sentiment to provide predictions that inform automatic trading bots.

The bots can automatically respond to shifts in market sentiment and optimize gains using yield optimization as well as arbitrage. With the use of reinforcement learning, some of the platforms even develop bots that learn optimal strategies for themselves in the long run.

Such an AI-driven crypto platform is transforming trading in decentralized markets and cross-chain intelligence as we know it.

AI-Driven Portfolio Management and Yield Optimization

Handling a DeFi portfolio can be intimidating—particularly with ever-changing market capitalization, staking, and yield farming strategies. The good news is that AI in decentralized finance is the answer. Artificial intelligence-powered robo-advisors assist in allocating assets, swapping between tokens, and automatically rebalancing positions.

The products present intuitive, data-driven portfolio strategies that can perpetually study user behavior and market trends. The end result? Smarter DeFAI platforms that provide customized financial experiences and optimize ROI without ongoing human intervention.

Smart Contract Auditing and Security Automation

Everything is powered by smart contracts, but bugs and vulnerabilities can trigger complete losses. AI blockchain technology enables development teams to audit smart contracts using NLP and ML algorithms that identify potential weaknesses before launch.

Models do not just check code—they parse logic, point out anomalies, and emulate attacks to test strength. After contracts are in production, these tools provide real-time, ongoing detection to catch exploits early.

As crypto becomes ever more complex, automated security such as this is no longer an option—it’s the foundation for the future of secure, horizontally scalable defense systems.

Technological Stack of a DeFAI System

Creating a DeFAI system—in which AI and DeFi intersect—is about more than clever code. It’s about scaling and modular tech infrastructure capable of supporting massive data sets, making smart decisions in real-time, and running in a secure, decentralized setting.

Let’s dissect the basic building blocks for the next-generation AI-based crypto platform.

Oracles

At the core of every smart DeFi protocol lies access to real-world information. Blockchains are closed systems by nature. They are not capable of retrieving data such as price feeds, market news, or economic data without assistance. That is where oracles step in.

Platforms like Chainlink act as decentralized middleware that delivers off-chain data to on-chain smart contracts. Whether it’s the price of ETH, the volatility index, or even weather data used in insurance DeFi apps, oracles make it possible for DeFAI systems to react to real-world conditions. For AI in DeFi, this is essential.

The more accurate and real-time the input, the better the machine learning models can analyze and respond intelligently. It’s like giving DeFi eyes and ears to the outside world.

ML Engines

The brains behind any DeFAI platform lie in its machine learning (ML) engine. Popular frameworks like TensorFlow and PyTorch provide the foundation for building models that can analyze blockchain data, detect anomalies, predict market trends, and maximize returns through yield optimization.

These engines usually run off-chain, where there is additional computational ability and freedom. However, nowadays, thanks to new AI blockchain tech, light versions of these ML models are also brought on-chain.

This makes for real-time decision-making without sacrificing decentralisation. As an example, a smart contract can trigger an AI model that adjusts lending rates or rebalances liquidity according to user behavior and system performance.

In tandem, these engines enable DeFAI platforms to automate processes, identify risks, and even respond dynamically as circumstances evolve—all without human intervention.

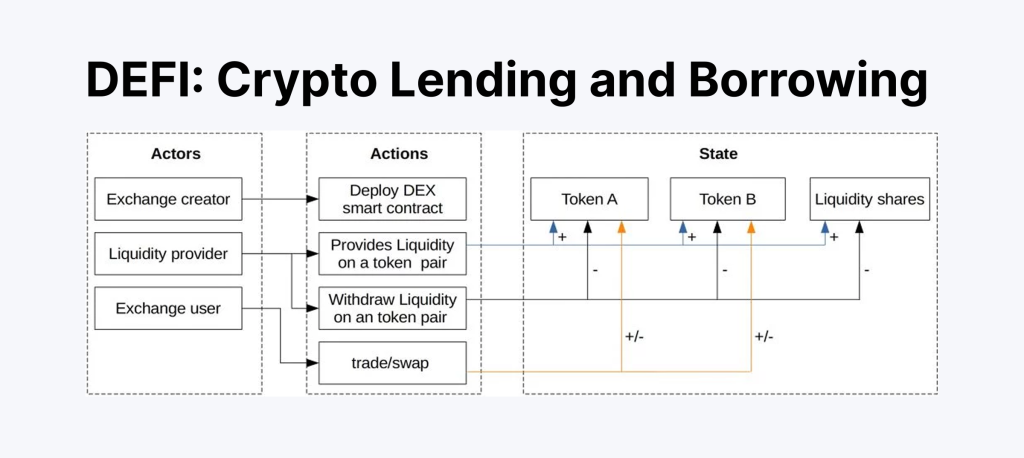

AI-Integrated Smart Contracts and Modular DeFi Protocols

Regular smart contracts run deterministic logic—they do not adjust or learn. However, DeFAI smart contracts are an exception. By incorporating artificial intelligence within their logic, they dynamically change as a function of end-user behavior, price changes, as well as market sentiment. As such, the DeFi experience is smoother, smarter, and easier to use.

Imagine a lending protocol that adjusts collateral requirements based on a borrower’s on-chain creditworthiness—or an automated trading bot that rewrites its own strategy as the crypto market changes. That’s the power of AI in decentralized finance.

Modularity is also very important. Rather than being fixed to a single inflexible system, DeFAI platforms are plug-and-play in nature: prediction engines, risk management modules, liquidity routers, and yield farming optimizers. They can be changed or upgraded without rebuilding the entire system–just about as easy as replacing components of an automobile in order to assemble a superior engine.

Risks, Limitations, and Ethical Concerns in DeFAI

While DeFAI—the fusion of artificial intelligence and decentralized finance—holds enormous promise, it’s not without its flaws. Beneath the innovation lies a mix of technical vulnerabilities, governance challenges, and complex ethical questions.

Overfitting and Adversarial Attacks on Financial Models

At the core of each machine learning DeFi system is a data-trained model. The problem is that when such models are trained too narrowly on historical data—the so-called overfitting—they can fail when confronted with novel market conditions.

Consider a prediction model that performed beautifully in a bull market but catastrophically in a downturn. Such instability isn’t just an annoyance—it can cost people money and even topple an entire Defi system.

And that’s not all: assailants can sometimes fool the inputs to such models—with price manipulation or fake transaction behavior, for example—triggering what’s termed an adversarial attack. Under an automated regime, that might cause faulty trades, false alarms, and even financial losses on a mass basis.

Governance Risks in Automated DeFi Systems

Governance is always a problematic factor in decentralized finance, but when you add AI, it all becomes very complicated. With classic DeFi, people vote on proposals as well as parameter shifts.

However, in DeFAI, AI can dynamically make decisions, changing the interest rates, shifting the liquidity, or altering smart contract behavior according to real-time data.

Then, when the AI commits a mistake, who is held accountable?

If an AI blockchain technology misjudges a user’s risk profile or triggers an unintended token swap, there may be no clear path for recourse. Without transparent oversight or human input, we risk creating black-box financial systems that are difficult to audit or reverse.

In some cases, protocols may become so autonomous that they’re practically ungovernable—a serious challenge for long-term sustainability.

Ethical Implications of AI-Driven Financial Decisions

Let’s not overlook the human side. As AI in DeFi begins to influence lending, investing, and risk management, we’re essentially letting algorithms decide who gets access to capital and under what terms. That raises some tough questions.

- What if the model develops biases based on geographic region or wallet behaviour?

- What happens when users are denied access to services because an opaque algorithm deems them too risky?

- Should AI crypto platforms be allowed to make value-based financial decisions without human oversight?

These are not just theoretical questions—they’re very real ethical dilemmas we’ll have to tackle as DeFAI platforms become more mainstream. Ensuring transparency, explainability, and fairness in these systems is just as important as optimizing for price, performance, or scalability.

The Future of DeFAI

As DeFi keeps on transforming, the inclusion of artificial intelligence—it’s what we can term DeFAI today—is building a completely new financial world. We are not discussing wiser dashboards or risk-based automated warnings. We are moving toward self-governing finance: systems that not only conduct transactions but learn, adjust, and tune as well, without human intervention, on an ongoing basis.

That’s where decentralized finance and AI are heading in the future– and sooner, rather than later.

Autonomous Finance: The Rise of Intelligent Protocols

Picture a world where DeFi protocols don’t just follow pre-coded instructions—they actually make decisions. We’re seeing the early stages of this already in automated market makers (AMMs) and AI-powered treasuries.

These systems go beyond basic token swaps or fixed yield formulas. Instead, they dynamically adjust liquidity, rebalance portfolios, and allocate funds based on real-time data and predictive models.

Regulatory Outlook

As AI-powered crypto platforms grow in complexity, they’re also drawing more attention from regulators around the globe. The big question is: how do we regulate something that operates autonomously on the blockchain?

Unlike traditional financial firms, DeFAI platforms don’t always have a corporate structure, a CEO, or even a clear legal jurisdiction. That makes compliance a serious challenge.

Still, governments and financial watchdogs are beginning to examine AI in DeFi more closely—especially when it comes to automated lending decisions, trading behaviours, and anti-money laundering (AML) compliance.

In the near future, we expect a push for greater transparency in AI decision-making, clearer auditing tools for smart contracts, and licensing requirements for autonomous financial protocols. Navigating this terrain will be tricky, but it is necessary to build trust and support mass adoption.

The Roadmap

Right now, DeFAI is still in its early innings. Most projects are experimental, often running pilot models or limited-use cases to test functionality. But the pace of progress is rapid.

The expanding circulating supply of AI-integrated tokens, the rise in market capitalization of smart AI crypto assets, and the increasing demand for user-friendly, automated financial tools all point in one direction: mainstream usage.

We’ll likely see DeFAI evolve in three phases:

- Phase 1: Augmentation – AI assists existing DeFi platforms with automation, analytics, and risk management.

- Phase 2: Integration – ML models and AI tools become embedded into core defi systems, making smart contracts more intelligent and adaptive.

- Phase 3: Autonomy – Fully self-governing AI DeFi protocols operate independently, making strategic decisions and evolving over time without centralized input.

The roadmap is ambitious, but the path is already being paved by innovators across crypto, DeFi, and AI.

Conclusion

DeFAI isn’t just a passing trend—it’s the next major leap in the evolution of finance. By merging the transparency of decentralized finance with the intelligence of AI and machine learning, we’re building systems that can not only execute but also learn, adapt, and improve autonomously.

FAQ

What is DeFAI?

DeFAI is the fusion of decentralized finance (DeFi) and artificial intelligence (AI), enabling smarter, adaptive, and automated financial systems.

How does AI improve DeFi lending?

AI uses machine learning to analyze user data and assess risk, allowing undercollateralized lending without relying on traditional credit scores.

Are DeFAI platforms secure?

Yes, many DeFAI systems use real-time monitoring, anomaly detection, and AI-audited smart contracts to enhance security and prevent fraud.

What’s next for DeFAI?

Expect self-governing protocols, AI treasuries, and increased regulation to support wider adoption and build trust in AI-powered crypto platforms.