How a Matching Engine Powers Your Trading Platform Behind the Scenes

In the world of electronic trade, milliseconds matter, and precision is always the ultimate priority. Whether you’re an individual trader hitting the “buy” key on a cryptocurrency or you’re a financial institution entering a multimillion-dollar Forex trade, behind the scenes is an unheralded hero: the matching engine.

With this high-speed system as its underlying technology, it ensures that your trade is carried out quickly, fairly, and accurately. Yet, the typical trader is unaware of this technology’s existence.

Here, we’ll lift the cover off the operation of the matching engine technology, its sheer necessity for market categories of all kinds, and where it is headed to meet the requirements of next-generation platforms.

Key Takeaways

- Modern matching engines are crucial to the execution of trades, as they rapidly match buy and sell orders submitted impartially and precisely.

- Different markets require different engine behaviors — Forex, cryptocurrency exchanges, and stock exchanges have different performance and regulation requirements.

- New technologies such as cloud-native design, AI routing, and blockchain are redefining the design and deployment of future matching engines.

What Is a Matching Engine?

A matching engine is a powerful piece of technology that pairs buy and sell orders in real-time — the traffic cop of the exchange, in short.

Each time the trader inputs an order to buy Bitcoin, sell EUR/USD, or trade Apple stock, the matching engine finds an adequate counterparty from the other side of the market and finalizes the trade.

Matching engines also have pre-programmed algorithms or rules to determine the manner in which orders are filled. While some use the First-In-First-Out (FIFO) method, prioritizing the earliest available orders at individual maximum price levels, others use the pro-rata method, where the match is extended across multiple counterparties. The algorithm chosen can have a significant impact on the quality of liquidity, fairness, and how market traders interact with the system.

First and foremost, matching engines are built with high-volume and high-speed capacity. When it comes to electronic trade of any kind, delays of as little as milliseconds can mean loss rather than profit.

That is why the engines are designed to process tens or even hundreds of thousands of transactions every second — accurately, openly, and constantly.

Fast Fact

Some matching engines can process over 100,000 order-matching events per second.

Core Components of a Matching Engine

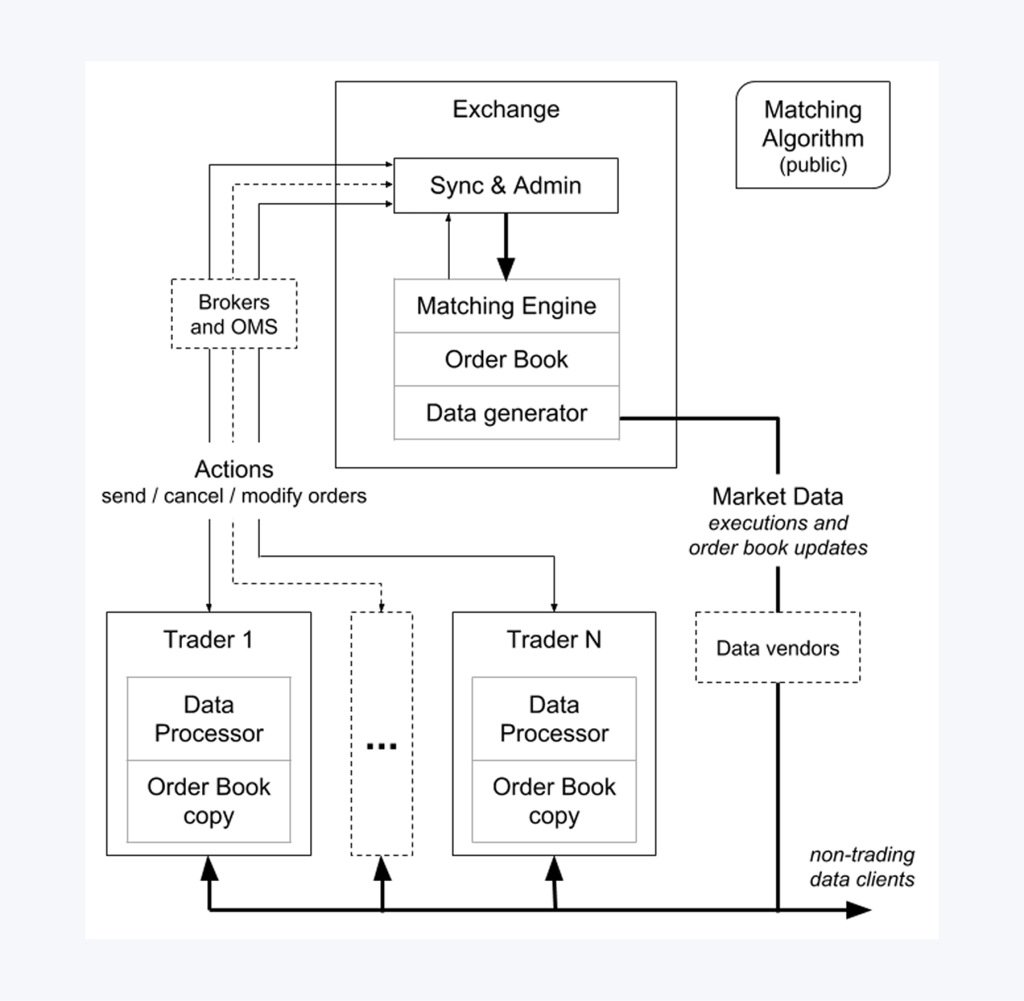

The high-performance trading system is powered by the matching engine. While most traders only see the front-end interface, the matching engine technology at work behind the scenes is the engine powering the show — from the matching of orders and filling trades to the live price feeds.

Whether you’re operating an institutional-grade system or a crypto exchange, the matching engine application is responsible for driving frictionless interaction between buyers and sellers.

In the sections ahead, we’ll break out the four main components of the modern-day trading matching engine and outline how they cooperate to deliver speed, fairness, and efficiency in today’s complex financial markets.

Order Book

The order book is the electronic memory of the order matching engine itself. It contains an up-to-date record of the outstanding buy and sell orders, listed by price level and time of submission.

When the trader places a new order, it is filled immediately if there is a match; otherwise, it is retained in the order book until a sufficiently good counter-order arrives.

This dynamic, real-time configuration enables market users to perceive liquidity at multiple price levels, making it the primary driver of price discovery.

A clear order book also facilitates the elimination of human mistakes and labor-intensive procedures, particularly in high-speed electronic marketplaces. Finally, it provides the matching engine program with the information it needs to rapidly and accurately match orders.

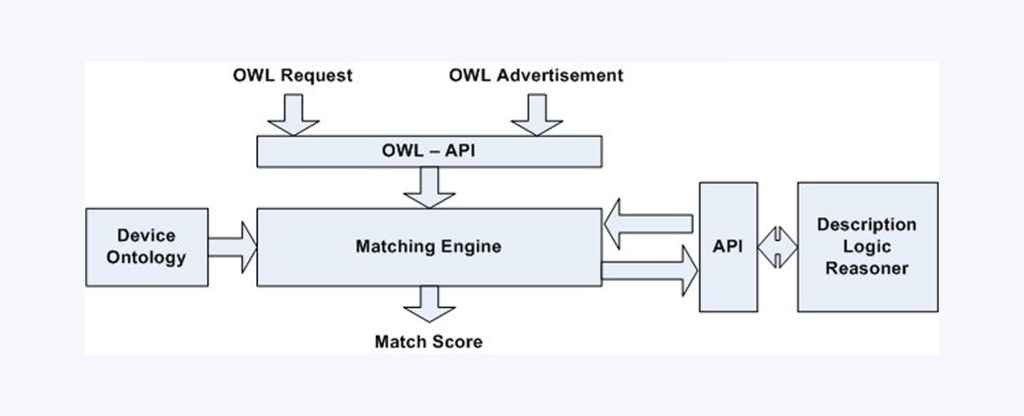

Matching Logic

The matching algorithm is a set of predefined rules that dictate the manner in which incoming purchase and sales orders are matched. In the majority of electronic exchanges, the default rule is First-In, First-Out, also known as price-time priority.

This implies that whenever multiple sell orders are entered at the same price simultaneously, the first order placed is executed first. This is a fair and straightforward system that promotes fast participation and liquidity.

Another industry-standard method is the Pro Rata algorithm, in which the trades are allotted proportionally to multiple market participants who have entered orders at the best price.

For example, when three traders all offer sales at the same price and an offer to buy is made that cannot cover the entire amount, the traders are allotted the amount of the fill accordingly, based on the order of their offers. This method is most favored where equality and fairness of accessibility are most important, as is the case with cryptocurrency and future exchanges.

Some matching engine technologies utilize hybrid or specialized logic to accommodate diverse asset classes, market models, or behavioral trader profiles. The choice of a matching algorithm is also a crucial factor in market liquidity and achieving rapid and reliable trade execution on the platform.

Latency Management

In today’s financial markets, low latency is of high priority. A single moment of delay can result in missing out on opportunities or unfavorable pricing, especially in continuous trading environments, such as cryptocurrency exchanges and Forex brokers. This is why the most powerful trading engines are optimized to deliver lightning-fast action with no noticeable lag.

Latency reduction is all about decreasing each component of the workflow of the matching engine from the receipt and processing of the orders to their execution.

The new generation of trading software utilizes ultra-efficient code, colocated servers near key trading hubs, and performance-tuned hardware to enable constant matching with high throughput.

Certain platforms handle up to several hundred thousand order-matching events every second, so traders always enjoy the quickest path to execution.

In short, when we’re talking engine vs trading platform, the engine is the high-performance tech under the hood — and without efficient latency management, even the best trading platform is going to sputter.

Market Data Feed Integration

No engine operates in complete solitude. It constantly processes and digests market data feeds — streams of up-to-the-millisecond information regarding new buy and sell orders, price movements, trade volumes, and so on. These feeds are completely integral to the accurate order matching and price dissemination, as well as the system diversity, of an engine.

With new orders, the engine comes to life instantly, replenishes the order book, works out market price positions afresh, and is ready to execute trades based on the latest available information.

Merging with high-grade market feeds ensures the site consistently returns the correct quotes and executes trades accurately, regardless of volume spikes or volatility surges.

This synchronization is particularly crucial in multiple asset classes, including stocks, commodities, cryptocurrencies, and foreign exchange. As the world of financial exchanges is always open, it is no longer desirable — and absolutely necessary — to keep the engine of commerce in harmony with worldwide market activity.

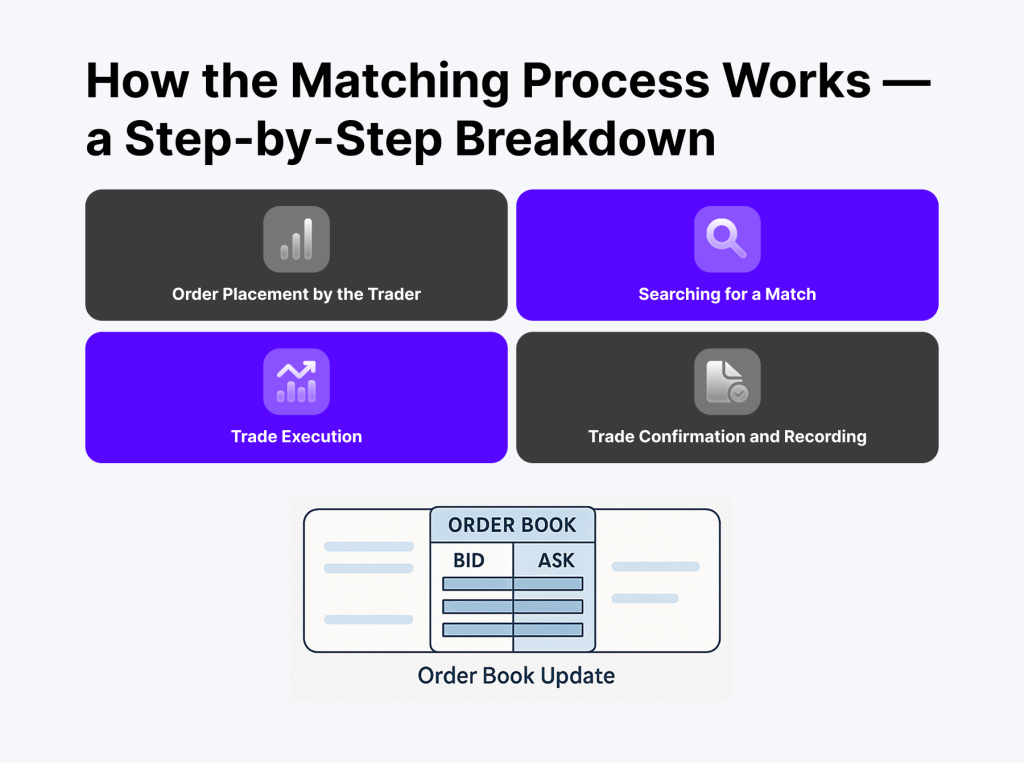

How the Matching Process Works — A Step-by-Step Breakdown

Let’s outline the process of how matching of buy and sell orders occurs, step by step, behind the scenes:

Order Placement by the Trader

It begins with the trader placing a buy or sell order through the trading terminal. The order contains extremely critical information, including the asset, price, volume, and type of order (market, limit, stop, etc.). Once input, the order is immediately forwarded to the primary order book of the site.

Searching for a Match

The matching engine comes alive now. It checks the order book for any available competing orders to fulfill the request. Suppose it is a buy request at a specific price; the engine verifies the lowest available sell order at or below the price. This is where price-time priority shines — orders are matched first by the best price and then by the earliest time stamp.

Trade Execution

Once the match is found, the system executes the trade by itself. This action determines the price and the quantity mutually agreed upon by the buyer and the seller. This is carried out in milliseconds or less in most sites — execution is speedy in today’s markets.

Trade Confirmation and Recording

Instantaneously, upon execution, both traders receive confirmations, and the trade details are also recorded. This includes the time of execution, price, and volume of the trade. The trade is also updated live on traders’ accounts and imprinted eternally in the system ledger for the sake of compliance and auditing.

Order Book Update

Once the trade is executed, the order book is updated. If the original order was only partially filled, the remaining portion of the order is live until another order is matched with it or until the trader cancels it.

Matching Engine in Different Markets

While the basic task of every matching engine remains the same — i.e., matching buy and sell orders quickly and accurately — its functioning can vary significantly from market to market.

Whether it’s Forex, crypto, or traditional stock exchanges, each class of assets carries its own unique challenges, behaviors, and technological requirements.

Let’s break down the responses of matching engine technology to fluctuating financial atmospheres.

Forex

Forex is the largest and most liquid financial market, operating 24 hours a day, 7 days a week, and 365 days a year globally. Unlike an individual all-in-one exchange, Forex is decentralized — i.e., transactions occur over a network of brokers, banks, and liquidity providers rather than a single trading platform.

In this case, the trading matching engine is the core of aggregating quotes from diverse sources and executing trades at the best possible price. Due to the volume and velocity of high Forex transactions, low-latency performance is of extreme significance.

The engine must handle large quantities of buy and sell orders with virtually instant execution to remain competitive. Most sites utilize advanced price-time priority models or hybrid matching algorithms specifically designed for high-frequency institutional trading.

Foreign exchange order-matching engines also need to handle various kinds of orders, ranging from market and limitation orders to stop-loss and complex conditional orders — and do them with rock-solid reliability and lightning-fast performance.

Crypto

The cryptocurrency market introduces another dimension to the technology of the matching engine. Crypto is traded continuously 24/7 with no central control, and each crypto exchange also has its own trade engine and pools of liquidity. There is no common market price; instead, the price is determined by the order book and the trading activity of each exchange.

Matching engines for cryptocurrencies aim to provide flexibility and accommodate various tokens and asset classes, typically including spot, futures, margin, and perpetual swaps.

With the maturing market comes growing attention to transparency, current market data, and deep-order book accessibility for end-users. The majority of the crypto exchanges favor the FIFO matching system to maintain fairness and reward market liquidity.

Some of the exchanges also employ pro-rata mechanisms or offer market participants incentives, such as lower fees for market makers, to encourage higher levels of liquidity. And since cryptocurrency exchanges are the primary targets of high-frequency and algorithmic traders, low-latency execution is always a top priority.

Stock Exchanges

Time-honored exchanges like the NASDAQ, NYSE, or the defunct Mid-West Stock Exchange are tightly governed and operate with defined parameters. Such exchanges require robust, proven-in-testing matching engine software with a focus on reliability, regulatory compliance, and fairness.

In such interactions, the order-matching engine must always comply with pre-established rules and maintain a complete audit trail for every single trade. Regulators such as the SEC demand openness, so every single order, cancellation, and execution must be documented and traceable.

Matching engines typically also stick to the strict FIFO scheme and provide specialized functionality such as pre-trade risk checks, circuit breakers, and batch auctions for open and close sessions.

Compared to decentralized crypto markets, stock exchanges usually involve auction-based open and close phases, continuous daytime trading, and specific halts or interruptions to restrain volatility.

Because of this system, the job of the matching engine is no longer simply about speed — it is also about fairness, compliance, and synchronization with clearing mechanisms.

Emerging Trends in Matching Engine Technology

With trade happening at lightning speeds, so is the technology driving them. Modern match engines aren’t just fast and precise — they’re also smart, adaptable, and decentralized.

Let’s take three of the most innovative advancements shaping the way match engines are developed and installed in the modern world of trade.

Cloud-Native Matching Engines

One of the most significant trends of the last years has been the move towards cloud-native matching engines. Traditionally, matching engines ran on high-performance physical servers in close proximity to main financial hubs. While this arrangement still accommodates ultra-low latency, the approach is costly and less scalable.

Cloud-native designs flip the prior model on its head. Exchanges now with the elasticity and global accessibility of cloud infrastructures like AWS, Google Cloud, or Azure can spin up matching engines in several regions, scale up and down with demand in real time, and significantly reduce infrastructure overhead. This is most applicable to new or fast-moving exchanges wanting to be responsive without compromising performance.

In addition, cloud-native designs allow for simpler integration with other cloud services, such as analytics and monitoring, real-time data feeds, and compliance tools, thus simplifying the complete trading infrastructure.

AI-Powered Order Routing and Risk Checks

Artificial Intelligence is no longer hype alone — it has become increasingly pervasive as a driving force behind trade technology. These days, we’re seeing AI-enabled functions being built into matching engine technology itself, particularly in the areas of order routing and risk management in real time.

For instance, the system could be aided in determining where and how to route an order based on the current market conditions of the day, liquidity levels, or even the activity of the traders. This smart type of routing is superior to simple rule-based logic and helps get the trades filled at the best price with less slippage and rejections.

In the risk department, the AI algorithms can observe order flow and user activity in real time and recognize anomalies, likely fraud, or over-exposure before the trade is matched. This also provides the brokers and platforms with another degree of safety, without hampering the execution process itself.

The final result? The smarter, more responsive, and secure matching engine with real-time decision-making capabilities without the loss of speed and usability.

Blockchain and DEX Matching Engines

With the emergence of blockchain technology arose the possibility of a new generation of trading exchanges — decentralized exchanges (DEXs). There is no controlling authority; peer-to-peer exchanges are instead facilitated by smart contracts and distributed ledger technology.

In this context, the classical matching engine is redesigned. Rather than being run from the centralized servers, the DEX’s matching engine is built into the blockchain or kept alive from off-chain solutions with settlement on-chain. The objective is to enable trustless order matching, transparency, and verifiability by anyone — all with no intermediaries involved.

Whereas DEXs typically make compromises on throughput and speed in favor of the centralized locations, they possess inherent benefits of higher control, privacy, and security for the users.

Some of the next-generation DEXs are trying out hybrid models, where they mix decentralized custody and settlement with centralized matching for the best of all worlds.

With the growing development of decentralized finance (DeFi), DEX-compatible matching engines are continuously evolving and will play an increasingly important part in the future of electronic trading.

Conclusion

The matching engine may not be something traders see, but it’s the silent powerhouse that brings every trade to life. From coordinating global buy and sell orders in milliseconds to adapting to the unique challenges of Forex, crypto, and stock markets, this technology is the foundation of today’s digital trading infrastructure.

As innovations such as AI, blockchain, and cloud computing continue to reshape the financial world, matching engines are becoming increasingly intelligent, scalable, and decentralized.

FAQ

What is a matching engine in trading?

A matching engine is the software that matches buy and sell orders to execute trades on a trading platform.

Is a matching engine the same as a trading platform?

No. The matching engine powers the trading platform but works behind the scenes to handle order processing and execution.

Are matching engines used in crypto trading?

Yes, all cryptocurrency exchanges utilize matching engines to execute trades, often with a particular emphasis on speed and transparency.

Can matching engines run in the cloud?

Absolutely. Many modern engines are now cloud-native, offering scalability and cost-efficiency without sacrificing performance.