How to Trade Crypto CFDs in 2024

So many trading methods have emerged in the last couple of years. Some are for newcomers, others for experienced traders. Financial products called CFDs let traders make predictions about how asset prices will change without owning them. With the extreme volatility and abundance of opportunities in the crypto market, this kind of trading has gained particular relevance. With cryptocurrency CFDs, traders can speculate on future price movements of virtual currencies, both up and down.

In this article, we offer a thorough guide to trading CFDs. We will cover all the essential points, such as how to pick the best CFD broker, why trading crypto CFDs is beneficial, and practical risk management techniques for the unpredictable cryptocurrency market. We will offer concise, accurate information regarding crypto CFD trading, the features of cryptocurrency CFD trading platforms, and the procedures involved in opening and maintaining a CFD trading account.

Key Takeaways:

- With the help of crypto CFDs, traders may predict market trends and profit from increasing and falling prices without holding the underlying assets.

- Understanding the trading platform, controlling risk with tools like leverage and stop losses, and regularly modifying strategies based on market research are all necessary for effective CFD trading.

- Analysis and advanced trading strategies are used to profit from short—and long-term market changes.

How to Define CFD Trading

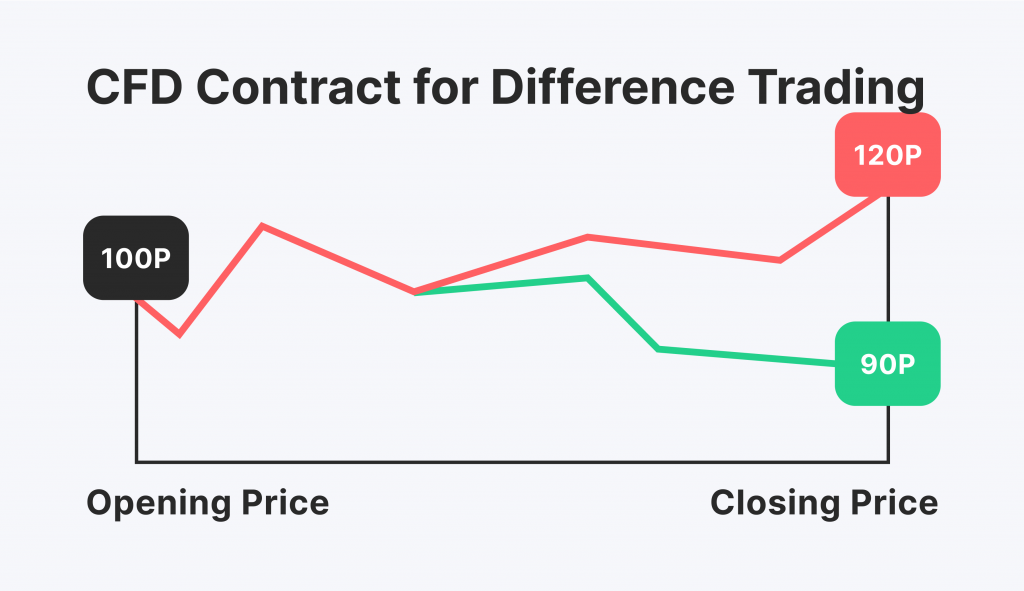

Cryptocurrency CFDs are agreements between a broker and trader that exchange the difference in a cryptocurrency’s price between the contract’s opening and closing dates. The digital currency that is being traded is not owned by the trader. This is how direct crypto trading differs from crypto CFD trading, in which the trader purchases and retains real digital currencies.

Working with a CFD broker to enable trades is fundamental to cryptocurrency trading. Traders have two options: bet on the rise in the cryptocurrency price by taking a “long” position or gamble on a fall in price. Cryptocurrency CFD traders gain enormously from speculating on rising and falling markets.

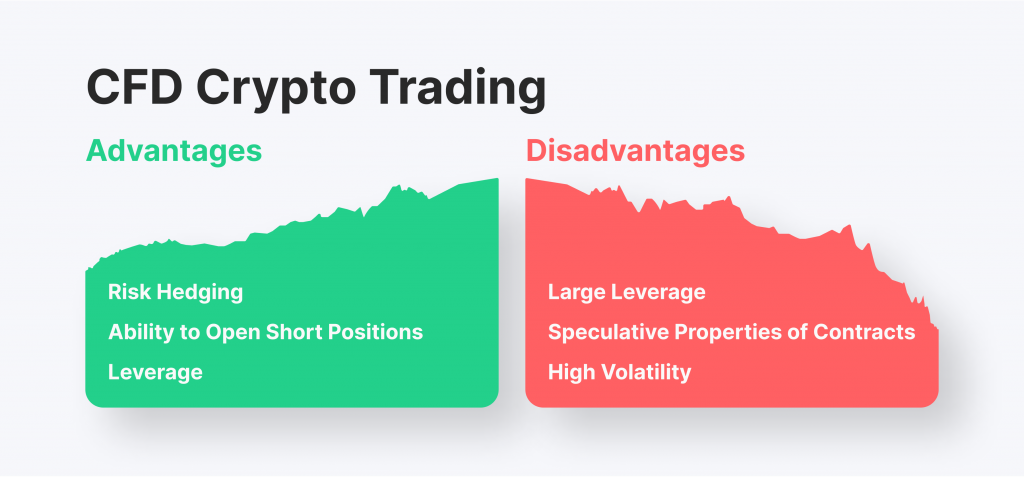

CFD trading is entirely speculative and dependent on price changes; it does not call for the actual exchange of assets. Because of this, trading cryptocurrency CFDs carries a significant risk and the possibility of large rewards, particularly considering how unstable the crypto market is. To win, traders must understand these characteristics and create a solid CFD crypto trading strategy.

Brokers play a crucial role by giving users access to the trading platform, leverage options, and essential instruments for efficient risk management. All trading operations occur on the trading platform, including opening, managing, and closing positions. These systems have the tools to manage digital assets, track price changes, and perform technical analysis—all crucial for making well-informed trading decisions.

Anyone hoping to trade cryptocurrency CFDs successfully needs to understand the core elements of CFD trading and the operations of a crypto CFD trading platform.

Difference Between Trading Cryptocurrency and Cryptocurrency CFDs

The immediate result of trading cryptos is purchasing and keeping digital currencies through cryptocurrency exchanges. Depending on the coin, this strategy enables traders to hold the actual cryptocurrency, giving them rights like involvement in blockchain governance. Direct ownership, however, exposes the holder to market risks because of its unstable value, which can fluctuate dramatically.

On the other hand, trading CFDs involving cryptocurrencies does not require ownership of the underlying asset. Traders do not enjoy the privileges of owning, such as dividend payments or the ability to vote, and instead wager on the fluctuations in cryptocurrency prices. This type of trading is done on a trading platform with a CFD broker.

The main benefits of trading cryptocurrency CFDs are the opportunity to short-sell or wager on decreasing prices to make money and the use of leverage, which can magnify gains from modest price swings. Additionally, CFDs give traders access to international marketplaces and let them make bets on a variety of virtual currencies from a single platform. Being easily accessible enables one to take advantage of price fluctuations and respond swiftly to developments in the market from any location at any time.

Fast Fact:

CFDs were first created in Britain in 1974 for trading gold. Later, the Trafalgar House deal in the early 1990s turned it into a financial derivative.

How to Trade Crypto CFDs: A Guide

As we already mentioned, trading cryptocurrency CFDs and taking part in the financial markets is possible without holding the underlying digital currencies. With this method, traders may predict how the prices of cryptocurrencies will change. By leveraging changes in the market, traders can profit from increasing and falling values using a CFD trading platform. It’s essential to choose the finest trading platform, learn how to use crypto CFDs, and develop successful trading techniques before you engage:

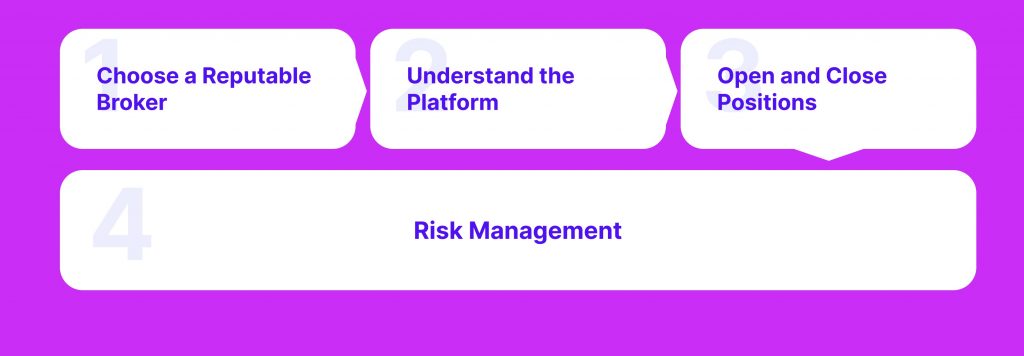

Step 1: Choose a Reputable Broker

Choosing a trustworthy broker is essential when trading CFDs on cryptocurrencies. To ensure security and integrity in your trading activity, provide an established institution that governs the broker. Look for features like adjustable leverage possibilities, a large selection of available assets, and ease of use on the platform. Your trading experience can also be improved by selecting a broker that offers excellent customer service and educational materials.

Step 2: Understand the Platform

Learn how to use the trading platform, which is usually MetaTrader 4 or MetaTrader 5. Develop your understanding of market indicators, technical analysis tools, and chart setup and interpretation. Effectively utilizing these tools is crucial for making well-informed trading decisions in the volatile crypto market.

Step 3: Open and Close Positions

Open a position by choosing the digital currency, deciding on the trade size, and cautiously using leverage to begin trading. To control risks, set stop losses, and accept orders for profits. Keep a close eye on your holdings and make necessary adjustments to halt losses and take profits in response to changes in the market. Close a position by placing a trade that is the opposite of the opening or by waiting for your take-profit or stop-loss orders to activate.

Step 4: Risk Management

Implementing strong risk management techniques is essential. Leverage should be used carefully since too much might increase both possible gains and losses. Make sure your margin levels are sufficient to cover your open positions. Recognize and use the trading platform’s risk management features, such as stop losses, to reduce possible losses and guard against market volatility.

You can start trading, for example, with bitcoin CFDs in the financial markets by following these guidelines and keeping up-to-date on market conditions and trading tactics. Before switching to live trading, always start with a demo account to test tactics without any financial risk.

Advanced Strategies for Crypto CFD Trading

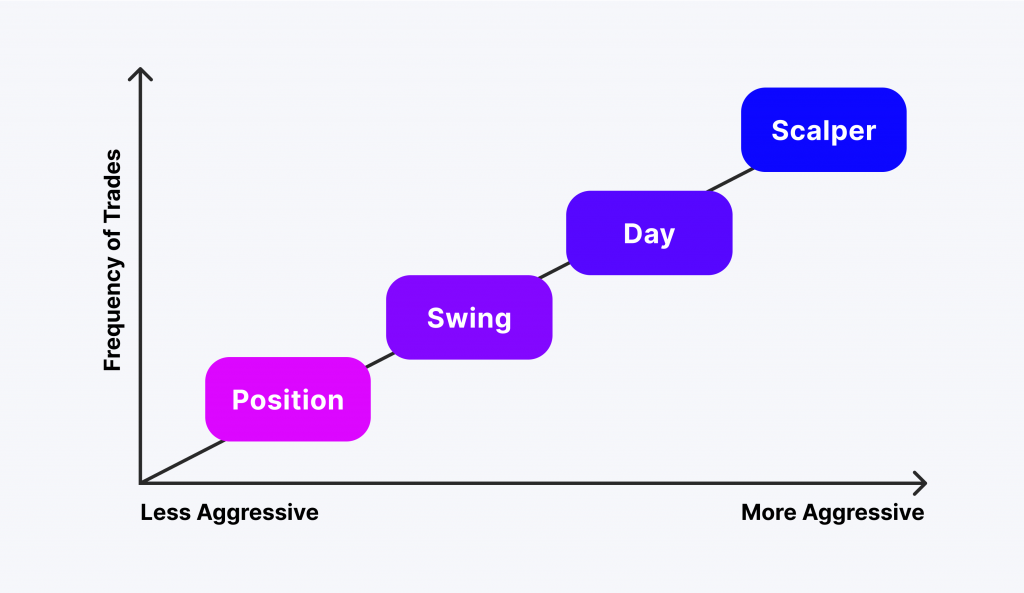

Scalping, swing, and day trading are advanced trading tactics that can improve trading efficiency. Scalping involves entering multiple daily transactions to capitalize on small price fluctuations. Swing trading capitalizes on more significant market trends by aiming to capture gains from price swings over a few days to weeks. Day trading is a full-time activity that aims to take price fluctuations by initiating and selling positions on the same day.

Thorough market research is essential for these techniques to be successful. Through examining charts and other market indicators, technical analysis generally forecasts price movements based on historical market data.

On the other hand, fundamental analysis entails determining a cryptocurrency’s worth using market news, economic reports, and other qualitative and quantitative variables. Both types of analysis are essential for creating a winning trading plan on crypto exchanges and for controlling the risks posed by the erratic nature of the cryptocurrencies and crypto derivatives that regular traders purchase.

Final Thoughts

We covered some essentials in this article, including selecting a reliable broker, being aware of trading platforms, and using advanced trading techniques. As financial products, cryptocurrency CFDs provide volatile trading opportunities in the cryptocurrency market. However, because of the significant leverage risks and speculative nature of these products, it is essential to approach crypto CFD trading cautiously.

It is advisable to follow responsible trading procedures, which include careful market analysis and risk management. By utilizing their knowledge and strategic preparation on crypto trading platforms, traders may efficiently manage the complexity of cryptocurrency CFD trading. As you begin trading, remember that the potential of cryptocurrency CFD trading is found in careful and knowledgeable market participation.

FAQs:

How Do CFD trades operate?

When trading CFDs, two distinct trades are made to open and close a position. The position is opened by the first trade and closed by the second trade, made with the CFD provider at a different price. If the opening trade is a purchase or takes a long position, the closing trade will be a sale, reversing the initial move.

Why trade cryptocurrency CFDs?

With leverage, you can use trading crypto CFDs to profit from modest price changes. Leverage increases your market exposure at the expense of less initial funds.