Japan Crypto Exchange Mt. Gox Begins Repaying Customers 10 Years After Infamous Hack

It’s been almost a decade since the infamous hack of the japan crypto exchange called Mt. Gox, one of the largest cryptocurrency exchanges at the time. In 2011, the exchange was hacked for 25,000 BTC, causing it to collapse and leaving over 24,000 creditors with losses. This was followed by another hack in 2014, resulting in the loss of an additional 750,000 BTC.

But finally, after years of uncertainty and legal proceedings, it seems that Mt. Gox has taken a step towards repaying its customers who lost their funds in the hack.

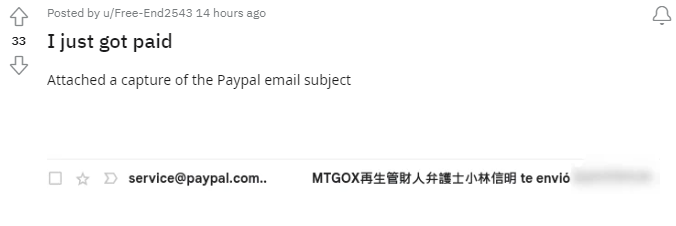

Reports from participants on the r/mtgoxinsolvency subreddit group suggest that some have received payouts in Japanese Yen via PayPal. However, others who had chosen to receive cash in their bank accounts have not yet seen any inflows.

One user shared that he received 30,283 JPY ($212) in his PayPal account for a claim of 0.125 BTC and BCH. This amount is only a fraction of the total 106,502 JPY ($747) he is supposed to receive, according to his claim form.

Some users even reported receiving double payments and questioned whether the Mt. Gox rehabilitation trustee would address this issue. The trustee has extended the repayment deadline for creditors multiple times, with the latest date set for October 31, 2024. It is also speculated that those who registered on time and without any errors will receive their payments by the end of 2023, but this has not been confirmed.

The recent payments from Mt. Gox have come as a pleasant surprise to creditors who had lost hope of ever recovering their funds. Despite the hacks, Mt. Gox still holds a significant amount of assets, including 142,000 BTC, 143,000 BCH, and 69 billion JPY. With this news, there is renewed hope for all creditors to finally receive some compensation for their losses.

The japan crypto exchange Mt. Gox hack was a major event in the cryptocurrency world, exposing vulnerabilities in the industry and leading to changes in security measures for exchanges. The case has also sparked debates on whether centralized exchanges are truly safe and reliable for storing large amounts of crypto assets.