Lido Staked ETH (stETH) From A To Z

Ethereum, the bedrock of smart contracts, has transformed our financial interactions and is a pivotal player in the decentralized landscape. However, it is also a valuable asset that can be staked for passive income. With over 16 million Ether (ETH) staked in Ethereum’s Beacon Chain contract, the allure of returns is clear.

However, the high staking requirement makes this a tall order for many. That’s where Lido Staked Ethereum (stETH) comes in, offering an ingenious, more accessible staking alternative.

In this guide, we’ll reveal the process of leveraging Lido stETH for Ethereum staking, providing a comprehensive yet brief introduction to this smart investment strategy.

Key Takeaways

- Ethereum blockchain is a platform known for introducing programmable smart contracts.

- Staking Ethereum via Lido Finance offers a less restrictive, liquid alternative to traditional methods.

- stETH brings benefits such as risk diversification, increased rewards, and potential for DeFi applications.

- Evaluating stETH as an investment involves considering its role in decentralization and liquidity provision.

Ethereum And Its Journey

Ethereum is an open-source, blockchain-based platform invented by Vitalik Buterin that enables developers to build and deploy decentralized applications (dApps). Introduced in 2013 in a white paper by Buterin, Ethereum’s development was crowdfunded in 2014, and the network went live on July 30, 2015.

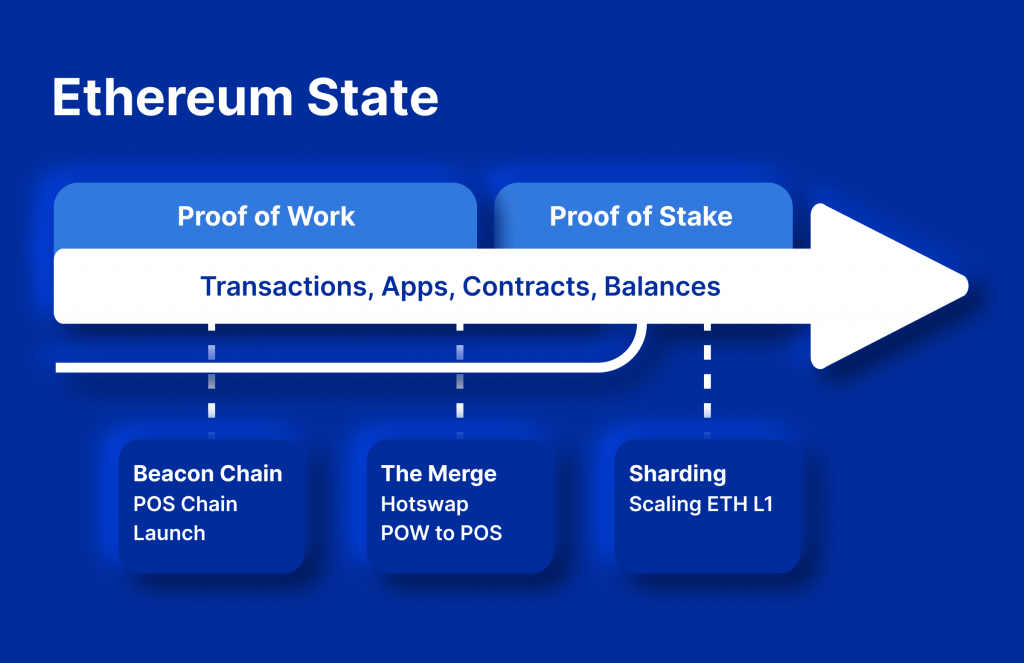

Initially, Ethereum used a consensus algorithm called Proof-of-Work (PoW), similar to Bitcoin. Under this consensus mechanism, miners solve complex mathematical problems using computational resources to validate transactions and create new blocks in the blockchain.

While effective, the PoW model has faced criticism for its high energy consumption and the centralization risks posed by mining pools.

Transition To Proof-of-Stake: The Ethereum Merge

To resolve these challenges and increase the network’s scalability and security, Ethereum planned a switch to the Proof-of-Stake (PoS) consensus algorithm. This upgrade was part of Ethereum 2.0 or “Serenity,” with the crucial phase referred to as “The Ethereum Merge,” marking the end of Ethereum’s PoW era.

Proof-of-Stake differs significantly from PoW. Instead of miners competing to solve problems, validators are chosen to create a new block based on the number of Ether (ETH) they hold and are willing to “stake” as collateral. These stakes validate transactions, create new blocks, and maintain the network’s security.

Today, Ethereum’s PoS model requires validators to stake a minimum of 32 ETH to become full validators. Staking is a crucial part of the PoS mechanism as it aligns the validators’ incentives with the network’s health. If a validator tries to act maliciously, they risk losing their staked ETH.

Introducing Lido Finance

Ethereum staking has proven to be a lucrative approach for deriving passive income. However, the stringent stipulation of a 32 ETH minimum for direct staking posed a significant obstacle to many potential stakeholders. Before the Shanghai upgrade, this considerable amount of ETH, if engaged, was bound by an ETH 2.0 staking contract, making it inaccessible for other uses.

Such restrictions motivated many individual retail stakers to gravitate towards liquid staking platforms like Lido Finance. These platforms introduced an innovative solution to circumvent the mandatory staking limit.

The Importance Of Lido Staked ETH

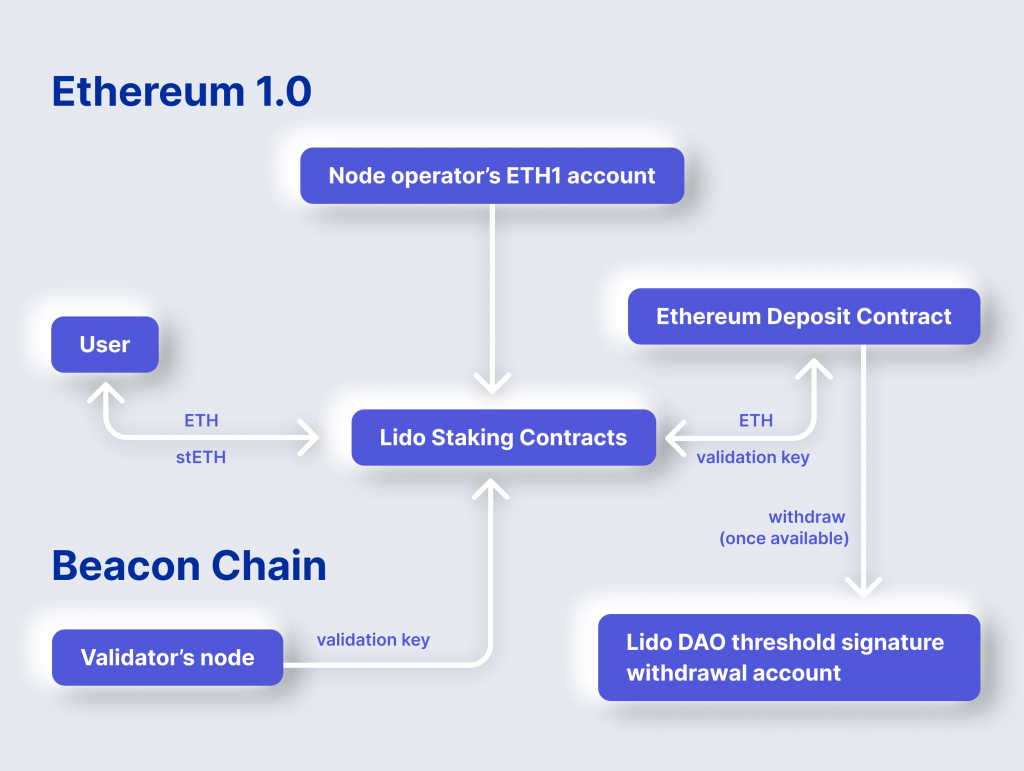

Lido Finance operates as a flexible staking protocol for Ethereum, uniquely designed to permit individuals with less than the mandatory 32 ETH to contribute jointly to establishing new validators and thereby partake in reward allocation.

The operational intricacies and technological demands associated with running an Ethereum validator are managed by a select consortium of validator operators, as arranged by Lido.

Upon contributing your ETH to Lido, you are awarded Lido’s specific liquid staking token, stETH. This token embodies your proportionate entitlement to the ETH held within Lido. As the validators under Lido’s oversight gain rewards, you, too, qualify to earn rewards correlating to your stake, a process typically set to transpire daily.

The distinct advantage of staking ETH with Lido lies in its issuance of stETH tokens, which mirrors your staked ETH on a one-to-one ratio. For instance, should you stake 1 ETH, Lido would reciprocate by providing 1 stETH.

Consequently, Lido’s approach introduces a unique layer of liquidity and inclusivity to the Ethereum staking process.

Difference Between Lido Staked Ether (stETH) and Lido DAO Token (LDO)

Lido Staked Ether, better known as stETH, is one among three tokens provided to users who participate in Lido’s liquidity pools. Other tokens include stSOL and stLUNA, corresponding to Solana and Terra liquidity pools, respectively.

More precisely, users receive stETH when they deposit their Ethereum tokens into the Lido Ethereum liquidity pool. This action signifies their investment in the liquidity pool. As an ERC-20 token, stETH is also rewarded to participants for their engagement in liquidity pooling.

In contrast, the Lido DAO token (LDO) serves as the native asset of the Lido protocol. Primarily, it acts as a utility token within the platform. However, it also plays a significant role in facilitating various activities. For instance, LDO can bestow governance rights, manage fee parameters and distributions, and oversee adding or removing Lido node operators.

In essence, Lido Staked Ether is an integral part of the liquidity protocol, and its success in the crypto market hinges on the performance of the host protocol, as well as the broader decentralized finance (DeFi) ecosystem.

How Does stETH Work, Exactly?

Understanding the functionality of stETH entails comprehending two key components: oracles and the rebase function. The balance of stETH tokens is adjusted daily at 12 PM UTC, reflecting an oracle-based report on fluctuations in the total amount of staked ETH. As soon as a user stakes their ETH via Lido, they are eligible to accumulate daily rewards commencing from the initial day of staking.

This mechanism is enabled through Lido’s implementation of a collaborative staking process, whereby the rebases influence all stakers, regardless of the status of their ETH deposit in the queue. Given that the rewards are linked to the balance rebase, stETH token holders will notice an automatic adjustment in their wallet balance with no associated transaction.

The rebase functionality of stETH is interoperable with various DeFi platforms, indicating that diversely allocating and staking stETH across these protocols could yield additional rewards.

It’s important to note that the stETH staking rewards may appear lower than those of the Ethereum Beacon Chain. This discrepancy results from a queue system from which all stETH holders accumulate rewards, with only a small selection of Lido validators typically progressing through the queue each day.

Therefore, the reward rate is somewhat diminished since the collective rewards from the small group of active validators are apportioned among all ETH holders. Nevertheless, as more of Lido’s validators become operational, the stETH reward rate is expected to gradually align with the comprehensive ETH staking rate.

Guide To staking ETH With Lido Finance

Now, let’s discuss the exact steps you will need to take to start staking ETH on Lido.

Prepare Your Wallet

The first step before you start staking is to have a suitable digital wallet. Wallets like Metamask or Ledger are often used because they’re safe and easy to use. This wallet is your link to the Ethereum network and needs some Ethereum in it. This ETH will be used to cover transaction fees on the network (also known as gas fees) and for staking.

Go to Lido Finance

Start the process by visiting the Lido Finance staking page using this link: https://stake.lido.fi/. You’ll find the “Connect Wallet” button in the top right corner on this page. This button lets you connect your digital wallet to the Lido Finance platform.

Agree to Terms and Conditions

Before connecting your wallet, it’s important to read and agree to the platform’s terms and conditions. These terms are your agreement with the platform about how your staking will work. After you’ve read and agreed to these conditions, you can choose the wallet you want to use. In this example, we’ll use MetaMask.

Make a Connection

Check that your MetaMask or any other wallet you use is connected to the Ethereum Mainnet. This is the primary network where all transactions happen. You can choose the right account in your wallet and click the “Next” button.

After checking your account details, click on “Confirm.” Now, your dashboard on the Lido platform should show different information, like how much ETH you have for staking, how much you’ve already staked, Lido’s yearly rate (APR), and expected rewards.

Stake Your Ethereum

You can type in the amount of ETH you want to stake in the given field. After you’ve typed in the amount, click on the “Submit” button. Remember that gas fees will be taken from your wallet balance for each transaction, so keep enough ETH to cover these fees.

Confirm the Transaction

If you’re using MetaMask, you must confirm the transaction details. This is your chance to check the information and make sure it’s all correct. If everything looks right, click “Confirm” to continue.

Get Your stETH

After your ETH has been successfully deposited, you will get the same amount of stETH in your wallet. This means you’ve now started to earn staking rewards. Your wallet will show the amount of ETH you’ve staked as stETH. The rewards you’re earning will update your stETH balance every day.

Benefits Of Using StETH

Staking Ethereum With Lido Finance comes with many rewards and benefits. Let’s take a look at a few.

Daily StETH Balance Rebases

One of the fundamental aspects of Lido Staked ETH staking rewards is the daily rebasing of stETH balances. Essentially, once you stake your ETH with Lido and receive stETH, you start accruing rewards daily. Whether you’ve been holding stETH for a while or have just staked your ETH, everyone gets a piece of the rewards pie.

The automatic distribution impacts all stETH holders, no matter when their ETH was placed in the validator queue. This ensures a fair and consistent allocation of rewards to all stETH holders.

Risk Diversification Benefits

Staking your Ethereum with Lido offers a unique benefit-risk diversification. Usually, when staking ETH, you either run your validators or select a single operator. However, using Lido, your staked ETH spreads across numerous node operators.

This approach significantly reduces the risk of diminished rewards or loss of staked ETH due to the possible slashing of a single operator.

It further encourages network decentralization as stakes are spread across operators in various regions, running different infrastructures and utilizing diverse client software like Prysm, Teku, Lighthouse, and Nimbus.

MEV-Boosted Rewards

Another distinct advantage of staking with Lido is using Maximum Extractable Value (MEV) boosted rewards. The MEV-Boost system allows validators to delegate the task of block creation to specialized third-party block builders.

These builders assemble blocks and forward their bids to validators. The validators then select the most valuable bid, sign it, and return it to the builder, who reveals the block’s content and broadcasts it to the network. This mechanism enhances the rewards earned by validators, passed on to stETH holders via daily balance rebases, offering potentially higher returns than traditional staking methods.

Professional Node Operator Selection

Finally, a significant aspect of the reward distribution system in Lido is its selection of professional node operators. The Lido DAO and Lido Node Operator Sub Governance Group collaboratively elect a reliable and secure set of node operators from different jurisdictions.

When you deposit ETH via Lido, your stake gets divided among these carefully chosen operators and allocated to their respective validators. This thorough selection and monitoring process ensures optimal performance, reliability, and risk diversification, enhancing the overall rewards from stETH staking.

Additional Applications of stETH

The utility of stETH goes beyond just staking. Here’s a list of several other applications you can use stETH for.

Participation in Liquidity Pools

StETH, representing staked Ether (ETH), carries various potential applications. For instance, stETH tokens and ETH can be integrated into liquidity pools. This integration facilitates a process known as a pool swap, which lets users exchange their stETH for ETH at their convenience, effectively allowing them to “unstake” their Ether.

Lending Platforms

Another notable application of stETH is its use in lending platforms like Aave. These platforms let users “wrap” their stETH and other cryptocurrencies, tying their value to another underlying cryptocurrency, to provide loans to other users. In essence, this form of lending involves a double-wrapping of a cryptocurrency.

Here, the lent token’s worth relies on the wrapped token’s value, which, in turn, depends on the value of the staked underlying token.

Yield Farming

Additionally, stETH tokens can serve as a vehicle for yield farming. While users who stake their ETH earn interest, choosing stETH provides an extra avenue for generating yield. They can deposit their stETH tokens on platforms such as Harvest to achieve additional profits. This mechanism effectively allows doubling the yield earnings on a single token.

Derivatives

The rise of stETH has also led to the emergence of various derivatives. Examples include insurance derivatives and put/call options. This development further expands the versatility of stETH and enhances its appeal as a tool in decentralized finance. Remember, each application inherently carries risk, and users should exercise caution when exploring these options.

So, Is Investing in stETH a Good Idea?

Lido has gained quite a reputation in cryptocurrencies and is now one of the key players providing liquid staking solutions for Ethereum. stETH tokens, a part of Lido, offer a fresh and innovative approach to staking. This not only strengthens Ethereum’s decentralization and security but also gives ETH owners total control over their staked ETH.

Furthermore, Lido is aiming to offer a fully trustless and permissionless staking solution. Once this model is in place, it will enhance the role of stETH in the growth of the DeFi ecosystem. It will make staking on Ethereum completely decentralized, unlike staking on centralized exchanges, which goes against Ethereum’s decentralization goal.

There were concerns in June 2022 about the potential for stETH to split from ETH following a crash in Luna’s value. Investors were worried that a liquidity crisis could develop due to the growing gap between the value of stETH and ETH. However, stETH is backed 1:1 with staked ETH so that it won’t hurt ETH’s value. The exchange rate shows the price on the secondary market, not the real value of stETH.

Therefore, when Ethereum transactions become available, you’ll be able to get back the same amount of ETH that you staked. Unlike a stablecoin, Lido won’t cause a situation like the de-pegging of the TerraUSD stablecoin against the U.S. dollar, which led to Luna’s value crashing.

The main goal of stETH is to decentralize staking on Ethereum and solve the lack of liquidity in the Beacon Chain. So far, it seems to be doing a good job of achieving this goal. Therefore, we think investing in Lido’s stETH could be a good move, considering its contribution to the DeFi ecosystem and its solution to several staking problems on Ethereum.

However, remember that this isn’t financial advice, and it’s always important to research before investing in cryptocurrencies.