Polkadot 2.0 and the Future of DOT: A New Era in Blockchain Technology?

In the ever-evolving world of blockchain, projects and protocols always experience constant development and updates to keep up with the new challenges and community needs. For example, Ethereum, the leading platform in the decentralised finance (DeFi) space, has been grappling with scalability issues for years. Transferring to the Proof-of-Stake system was a viable solution for Ethereum to address this problem.

However, a new contender has emerged on the scene with ambitious goals to revolutionise the industry – Polkadot. With its upcoming release of Polkadot 2.0, this platform aims to address several major problems, introduce a range of new features and make it easier for developers to interact with the network.

Key Takeaways:

- Polkadot consists of three components: the Relay Chain, parachains (parallel chains), and bridges.

- In Polkadot 2.0, blockspace is allocated in a new way rather than through leases.

- Polkadot 2.0 introduces elastic cores, which enable the ecosystem to adapt dynamically to compute needs, greatly enhancing its efficiency.

- DOT is the native token of Polkadot, which serves several different roles in the network.

Understanding the Polkadot Network

To understand the impact of Polkadot 2.0, it is essential to grasp the concept of Polkadot and its core components.

What is Polkadot?

Polkadot, an open-source project founded by Gavin Wood, one of the co-founders of Ethereum, has gained significant attention in recent years due to its unique approach to scalability and interoperability.

The main feature of the Polkadot protocol is that it enables interoperability between different blockchain networks. With it, blockchains can communicate with each other by transferring value and data.

How Does the Protocol Work?

Polkadot comprises three fundamental components that collectively form its intricate structure, namely the Relay Chain, parachains, and bridges.

Relay Chain: The Heart of Polkadot

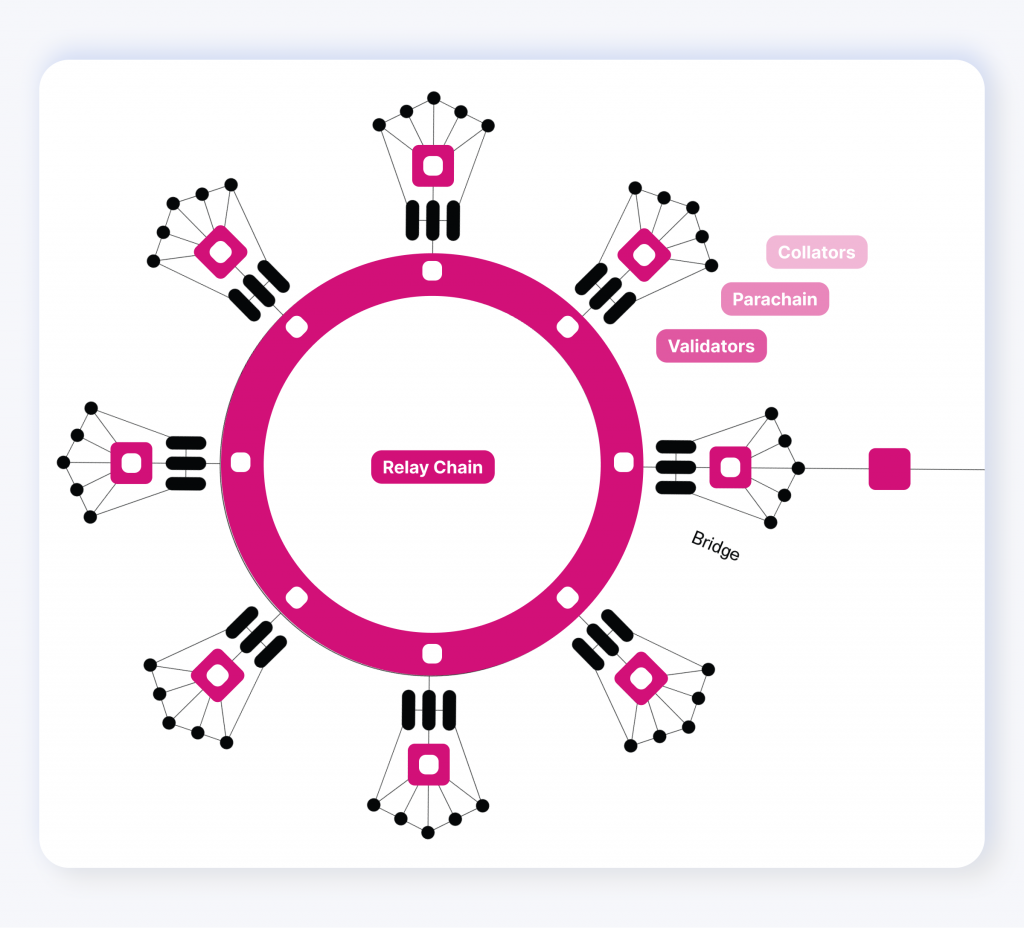

At the core of the Polkadot ecosystem lies the Relay Chain, which functions as the primary blockchain of the network. It plays a crucial role in ensuring network integrity, facilitating communication among parachains, coordinating the overall operations of the network, and providing security for the entire system.

The Relay Chain does not support smart contracts directly but relies on the connected parachains to handle the execution of decentralised applications (DApps) and various blockchain-driven projects.

Parachains: Parallel Blockchains

Parachains are specialised blockchains that are connected to the Relay Chain and are used to process transactions. Each parachain represents a distinct Layer-1 project within the ecosystem and serves as a host for decentralised applications and specific use cases.

For example, they can be used to store and process data and can also be used to create new tokens and smart contracts.

The versatility of parachains lies in their ability to adapt to the specific requirements of the projects they host. To illustrate, a parachain designated for decentralised exchanges can be optimised to handle high transaction volumes efficiently.

Bridges: Interconnecting Blockchains

Bridges serve as vital conduits that connect the Polkadot network to other blockchain networks. Their primary purpose is to enhance the blockchain interoperability, enabling them to communicate and interact effectively.

Bridges play a crucial role in enabling the seamless transfer of assets and data across different blockchains. By eliminating the need for third-party intermediaries, Polkadot bridges empower users to migrate assets between blockchains directly.

A New Era: Polkadot 2.0

Polkadot 2.0 was first announced by Wood in June 2023 during the Polkadot Decoded event held in Copenhagen. He unveiled a new vision for the network, highlighting its ability to allocate block space more flexibly and cater to the needs of developers and businesses even better.

Flexibility in Blockspace Allocation

Polkadot 2.0 introduces a new system for allocating block space, moving away from the current lease model.

Under the new system, developers will have the option to buy blockspace as needed, either in bulk or on demand. This change is expected to make it easier for new projects to enter the Polkadot ecosystem and attract Web2 businesses looking to adopt Web3 frameworks. By offering more flexibility in blockspace allocation, Polkadot aims to foster innovation and expand the possibilities within the Web3 ecosystem.

Elastic Cores: The Backbone of Polkadot 2.0

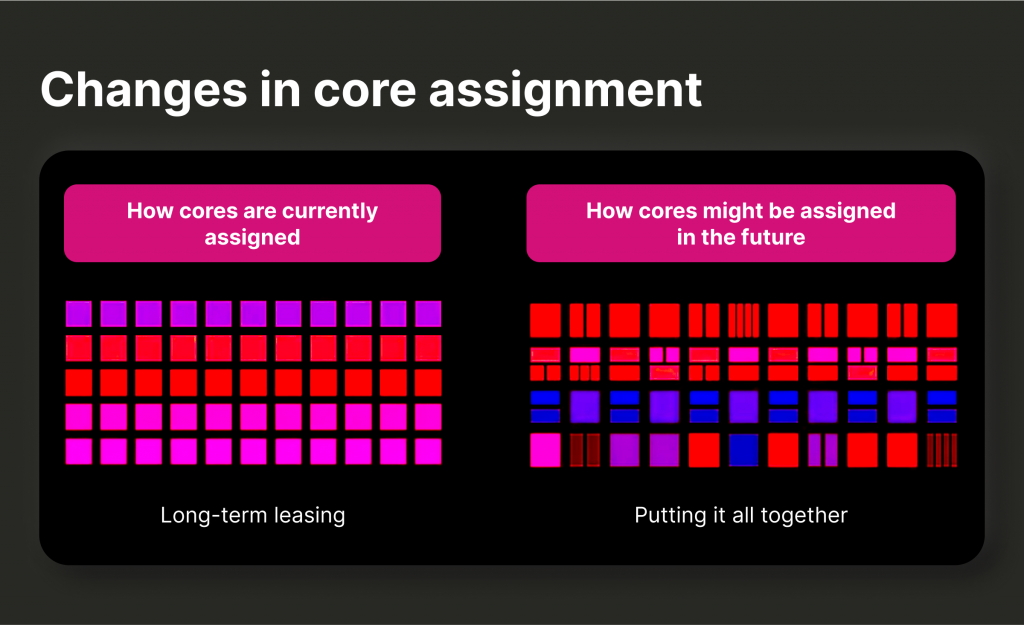

The fundamental innovation in Polkadot 2.0 is the introduction of elastic cores. These cores are designed to adapt to dynamic computational needs, significantly enhancing the efficiency of the ecosystem.

Currently, parachains in the Polkadot network function like fixed CPU cores within a supercomputer. However, the upcoming system will allocate resources, such as Relay Chain security, in a more flexible and adaptable manner. This approach will allow the network to respond to real-time needs and significantly enhance efficiency throughout the ecosystem.

Tradable Coretime Allocation

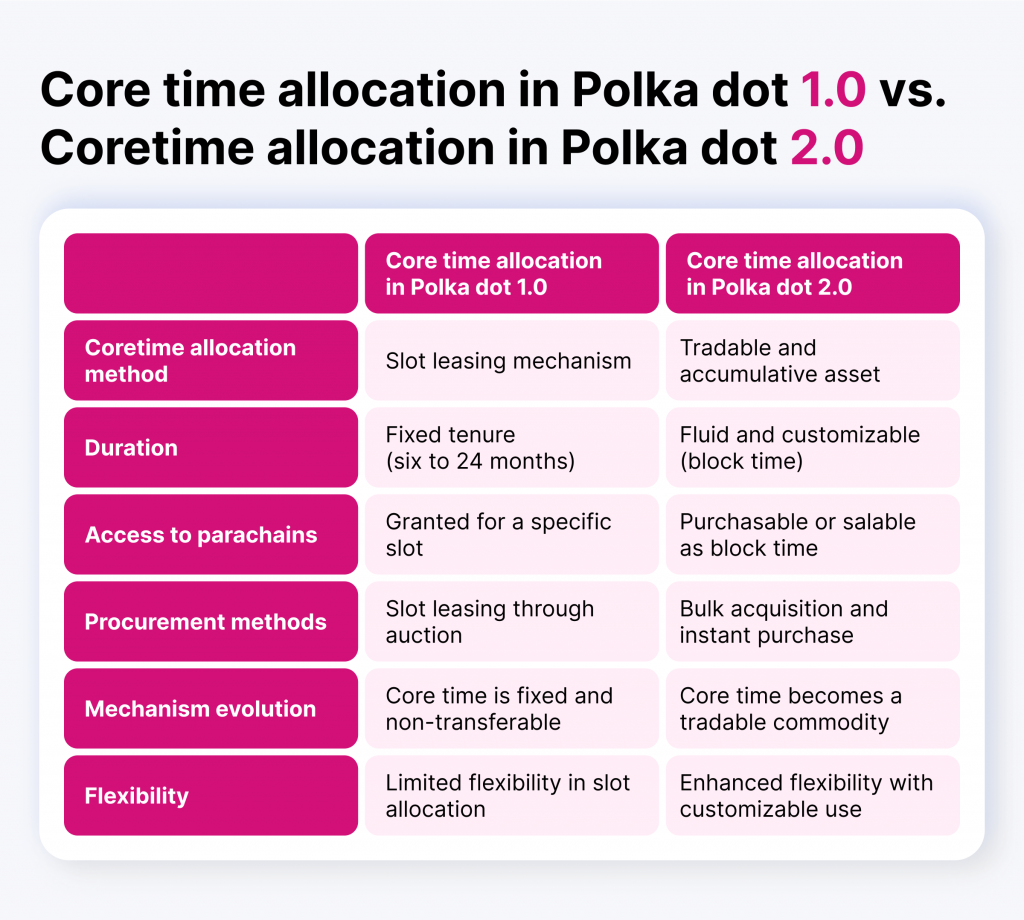

Polkadot 2.0 has also made significant changes to its coretime allocation strategy. Coretime refers to the time needed for validation and consensus on the Polkadot Relay Chain.

In Polkadot 2.0, coretime will be purchasable as block time through an auction and a pay-as-you-go model with a fixed price. This shift from fixed slot leasing in Polkadot 1.0 to a tradable coretime asset in Polkadot 2.0 offers greater flexibility and customisation in coretime allocation.

The Role of DOT in Polkadot’s Ecosystem

DOT is the native token of the Polkadot ecosystem. Currently, as of October 2023, the token holds the 14 position among all tokens by market capitalisation with $ 4.9 billion, making the project one of the most sought-after DeFi and cross-chain protocols out there. The DOT price is $4.02.

DOT has various use cases in the network:

Governance

First, it facilitates network governance by allowing DOT holders to participate in network governance proposals. These proposals may encompass important decisions such as an upgrade to the network or an adjustment to the fees. With this feature, Polkadot brings transparency and democracy to network operations by allowing DOT holders to influence the system’s direction.

Bonding for Parachain Slots

Secondly, DOT tokens are used for bonding in slot auctions to acquire parachain slots. Bonding involves dedicating tokens to the system for a certain time frame in exchange for maintaining a project in a parachain.

The whole process is quite straightforward: the project with the highest number of DOT tokens in the auction will gain the parachain slot. Projects can bid for a parachain slot by using their own DOT holdings or by using a crowd loan. If a certain project is no longer maintained, tokens will be returned to the project’s initiators.

Staking

Finally, DOT tokens contribute to the operation of the network by strengthening network security and transaction processing through the staking process. Similar to other PoS networks, Polkadot allows DOT holders to be rewarded with additional DOT tokens for staking. This allows holders to benefit from the network’s growth and participate in the decision-making process.

Polkadot 2.0 vs Ethereum 2.0: A Comparative Analysis

Ethereum, launched in 2015, introduced the world to smart contracts and decentralised applications, revolutionising the blockchain landscape.

To address the scalability concerns, Ethereum underwent a significant upgrade known as Ethereum 2.0. This upgrade involves a transition from the PoW consensus model to a more efficient proof-of-stake (PoS) model. Ethereum 2.0 aims to improve scalability, security, and energy efficiency, offering a more sustainable and robust platform for decentralised applications.

Having explored the key features and developments of both Polkadot 2.0 and Ethereum 2.0, it’s time to compare the two platforms and understand their respective strengths and potential implications for the DeFi world.

Architecture: Shards and Parachains

A key feature of Ethereum 2.0 is the introduction of shard chains, which enable the network to process multiple blocks of transactions simultaneously. The Beacon Chain serves as the central coordination mechanism for the network, while shards are individual blockchains that process transactions in parallel.

Polkadot 2.0’s architecture is similar to that of Ethereum’s shards and revolves around the Relay Chain and parachains. The Relay Chain acts as the central coordinating blockchain, while parachains are independent blockchains that run alongside the Relay Chain.

Consensus Algorithm: Proof-of-Stake

Both Polkadot 2.0 and Ethereum 2.0 leverage a proof-of-stake (PoS) consensus algorithm, which offers several advantages over the traditional proof-of-work (PoW) model.

Though there are some differences in how this model is adopted in both protocols, the main idea is the same.

Scalability and Throughput

Polkadot introduced sharding through parachains, where each parachain processes transactions independently, enabling high transaction throughput. Initially, Polkadot provided up to 20 shards per block initially, with plans to gradually increase this number to 100 shards per block. This approach allows the Polkadot blockchain to achieve impressive transaction throughput, estimated to be around 166,666 transactions per second (TPS).

Ethereum 2.0’s sharding mechanism involves dividing the network into multiple shards, each capable of processing transactions. The introduction of shard chains enables Ethereum 2.0 to process multiple blocks simultaneously, significantly improving scalability. About 64 shards will be supported by the network. Vitalik Buterin, the co-founder of Ethereum, has stated that sharding will ultimately lead to an average network throughput of 100,000 TPS.

Governance: On-chain vs Off-chain

Polkadot adopts an on-chain governance model, allowing stakeholders to actively participate in the decision-making process. Proposals can be issued by various entities, such as the Technical Committee, on-chain Council, or the public. All proposals undergo a public referendum, where the majority of tokens determine the outcome. This on-chain governance approach ensures transparency and decentralisation in the decision-making process.

Ethereum 2.0 currently relies on off-chain governance procedures, such as GitHub discussions and All Core Devs calls, to make decisions. However, Ethereum has plans to transition to a more formalised on-chain governance model in the future.

Community Support

As of writing, Polkadot’s DOT market capitalisation stands at over $4,9 billion. While the volume is lower than Ethereum’s, it has shown significant growth in the past and has garnered attention from investors and developers alike. With the future Polkadot 2.0 update, the project has all the chances to grow even further.

Ethereum is currently one of the most popular blockchain platforms, with a market capitalisation exceeding $197 billion. Ethereum’s widespread adoption and a large community of developers contribute to its robust ecosystem and overall market dominance.

What is Expected for Polkadot and DOT?

With the advent of Polkadot 2.0, the enhanced utility of the Polkadot network could spur the DOT value. This is because projects will need DOT tokens to acquire slots for time in a parachain, and increased demand could drive up the token’s value.

This will, however, happen if Polkadot 2.0 receives positive feedback from the community, and more projects will consider Polkadot 2.0 to be the core of their initiatives. Still, the second version of the Polkadot network has a lot of potential to gain more traction.

It is possible that businesses and projects with surplus coretime will be selling it to other projects. This, in turn, will provide token holders with additional revenue, as well as boost the value of the DOT, which, consequently, may increase its value on the secondary market.

Moreover, DeFi services on Polkadot provide an opportunity for DOT holders to earn income. This may raise the token’s usability and liquidity, which will boost its value as well.

Polkadot Treasury

Moreover, Polkadot Treasury will receive revenue from coretime sales.

The Polkadot Treasury consists of DOT tokens generated from transaction fees and other network activities. It is managed by holders of DOT, and Treasury spending proposals can be submitted for projects and activities that benefit the network by any DOT token holder.

Tokens not assigned to projects bidding for funds are periodically burned by the Treasury. Since DOT is nominally an inflationary token, the burning mechanism creates deflationary pressure. As a result, the overall supply of DOT will be balanced, which could impact its future value.

The Impact of Other Factors

It is always important to keep in mind that it is impossible to accurately predict how the project and its value will perform in the future. Remember the so-called “crypto winter” of 2022, when even the most promising projects in the industry were down due to broader factors, such as the collapse of large projects like FTX and Terra Luna, the overall market downturn, and external economic concerns.

Be cautious and do your research before investing any of your funds. Always be mindful of the risks, seek advice from experienced investors, and be prepared for any direction of the market, especially in the ever-changing and volatile cryptocurrency industry.

FAQs

What are the main features of Polkadot?

Polkadot is a blockchain protocol designed to facilitate secure and low-cost communication between multiple blockchains, allowing them to interact and transfer value. Its main features include cross-chain transfers, shared security, and a shared pool of validators. It also has an advanced consensus mechanism, which enables its users to securely and efficiently manage their own validators and stake DOT tokens for rewards.

What will the 2.0 update bring to the network?

The Polkadot 2.0 update will bring a number of new features, including a flexible block allocating mechanism, elastic cores to adapt to dynamic computational needs, and a purchasable coretime. These features will make the network more scalable and reliable, as well as more convenient for developers of DeFi projects.

How does a parachain differ from a blockchain connected through a bridge in Polkadot?

Parachains refer to chains supported by the Polkadot network. Using Polkadot’s native blockchain support, the greater network achieves consensus, enhancing security and contributing to it.

With bridges, existing blockchains with their own state histories and consensus methods will be able to link with Polkadot without having to become native parachains. Bitcoin and Ethereum are examples of these.