SEI Price Prediction – Is It Time to Buy SEI Coins?

With the buzzing news about Bitcoin and Ethereum ETFs and the fluctuating BTC price after the Fed interest rate cut, altcoins are silently surging and growing tremendously.

After we discussed the Monero price growth between August and September, the SEI coin is now making a move. The noticeable network activity and the increasing total value locked did not go unnoticed.

The token finally recovered from the 2024 summer slump and has now reached $0.45 and is heading towards $0.50. What does the SEI price prediction tell us? Shall you add SEI to your crypto investment portfolio?

Understanding SEI Crypto Coin

SEI is an innovative solution for DeFi platforms and decentralized applications (dApps). It is a layer-1 scaling solution that extends the capacity and performance of decentralized finance platforms and exchanges.

The SEI network integrates with DEXes, crypto games, NFT marketplaces, and trading platforms to boost their execution speed. It uses an in-house matching engine and order book to lower the block finality time to less than 400 milliseconds using a twin-turbo consensus algorithm.

SEI Token Price in 2024

The coin started the year strong at $0.55, which surged with the crypto boom and reached over $0.70 in less than one month. In March, the SEI price crossed the $1 mark and reached an all-time high of $1.04.

The token’s price retracted in Q2 and Q3, reaching as low as $0.22 in August. However, the hope was restored in the second half of September, as bulls pushed the coin north of $0.35, with a massive jump from $0.36 to $0.46 in one day.

This optimistic SEI token price prediction was coupled with a rising trading volume, taking the total SEI transaction value to $1 Billion in return for March’s volume figures.

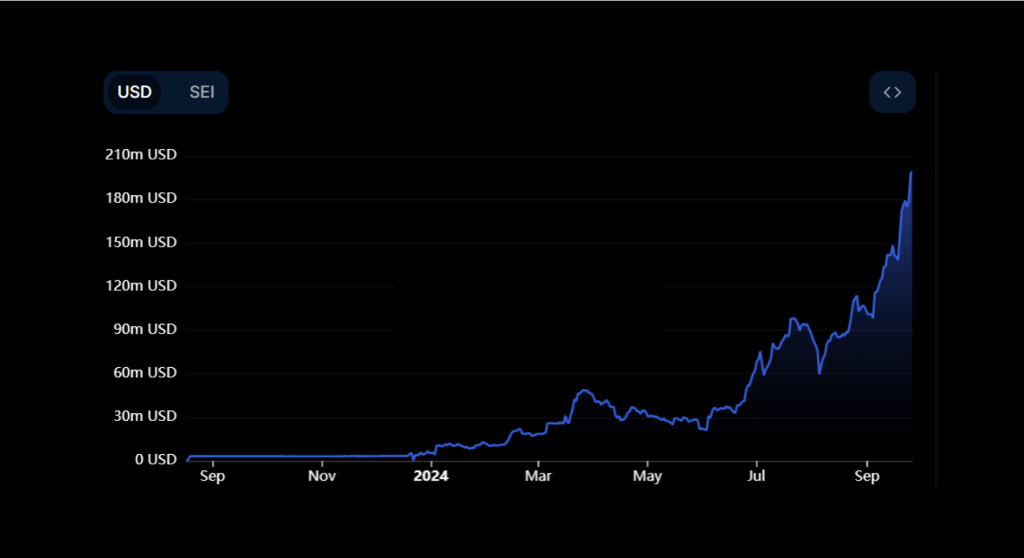

At the same time, staking activities are climbing as investors capitalize on improved economic indicators, boosting their crypto passive-income generation models. The SEI total locked value witnessed a considerable hike by the end of September, as an increasing interest in the coin.

SEI Price Prediction

Let’s analyze this price growth and make SEI crypto price predictions using a long-term and short-term trend indicator, the exponential moving average.

Let’s analyze the short-term impact using a 12-day and 24-day EMA indicator. We see the market price was moving under both EMA lines for most of the year, with temporary crossovers in August. However, starting in the middle of September, the SEI price crosses above both EMA lines with an upward slope, suggesting a strong price uptick.

The long-term analysis looks more solid as the SEI coin price crosses over both EMA lines in a similar fashion to the March market surge. This movement hints that the bull run is more likely to continue, with the SEI crypto price prediction for 2025 suggesting a continuous bullish sentiment that might return the token’s value to the $0.60-$0.70 region.

Is SEI Crypto a Good Investment?

The surge in the SEI network’s coin is a positive sign for crypto investors and blockchain developers who use the scaling solution to boost their DeFi apps and projects. Activities from market bulls and trading volume suggest that SEI can be a good investment, especially if the price increase persists as analyzed.

The SEI crypto price prediction in 2025 might see another bull run that will pick up the support level just under the $1 threshold.

Conclusion

Altcoin activities have been remarkable in the last quarter of the year, with coins like SEI building a positive sentiment and recovering from the disappointing performance between May and August 2024.

The SEI price prediction suggests that the ongoing positive trend that surged the price from $0.22 to $0.45 in the last weeks is more likely to continue. Bulls are hoping to register a new support level at $0.50, with another attempt by the end of the year.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your research and consult a financial advisor before investing.