TON Coin Price Analysis: How Stakers Drive Prices Upwards

Telegram’s cryptocurrencies, TON, or The Open Network, has been in the spotlight for the last couple of weeks after the arrest of the CEO Pavel Durov by the French Police.

However, his release seems to be a vital factor in rejuvenating investors’ hopes. With increasing network activity and more staked tokens, the Toncoin is preparing for a recovery.

Let’s look at the news surrounding this crypto and draw some TON coin price analysis.

TON Crypto Staking

The TON network experienced a noticeable uptick in activity. The daily transactions went from 11.2 million to 14.6 million between September 9th and 10th. This represents a massive increase from the last week of August when the Telegram CEO was arrested.

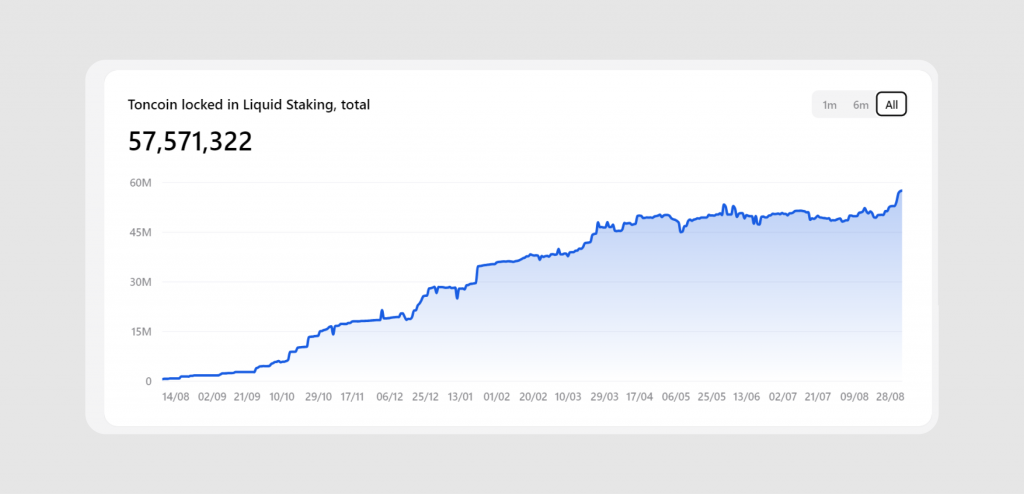

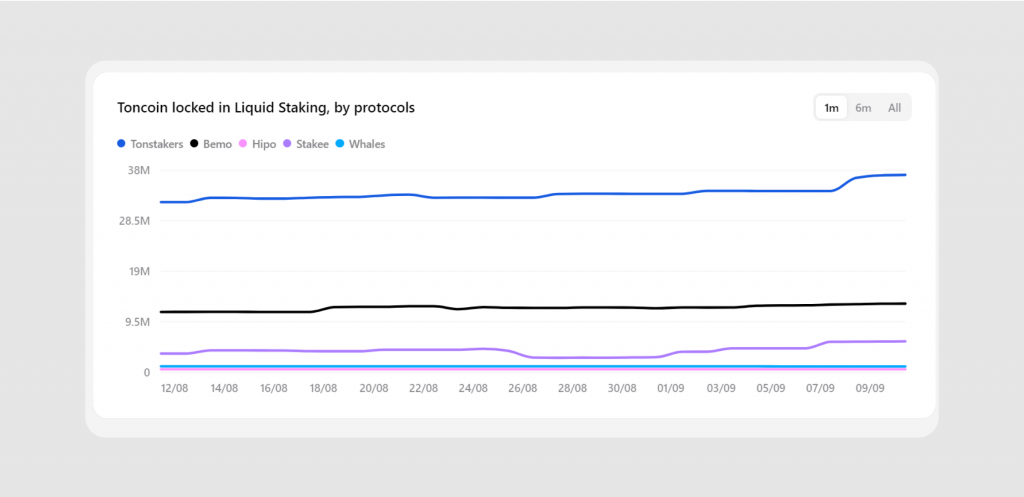

Moreover, the total value locked in liquid staking pools skyrocketed to an all-time high of 57.5 million.

Much of this increase was attributed to an uptick in the number of Tonstakers or contributors in liquid staking. Tonstakers can stake their tokens without locking them in. This protocol has been the pulling force for an increasing number of investors and crypto users, which has carried the Toncoin price to high levels in the last few days.

Toncoin News

This recovery in ton coin price and network is connected with the release of the CEO. When Telegram’s founder Pavel Durov was arrested on August 25th, the TON coin price dropped massively from $6.85 to $5.30 on the same day.

This free fall continued throughout the first week of September despite releasing Pavel on August 25th. However, the second week saw positive traction as the coin price started recovery, marking a 16% growth between September 5th and 12th, taking the coin to the ($5.40 – $5.50) region.

Ton Coin Price Prediction

Let’s take a look at the TON Coin price from an analytical perspective and assess how long this trend will hold. We use the exponential moving average (EMA) indicator over two timelines to measure Toncoin price changes.

First, we use 12-day and 24-day EMA to measure the short-term impact. We see that after lying under both EMA lines, the price picks up an upward trajectory through both EMAs.

At the same time, the short-term EMA line turns with an upward slope under the price line, suggesting a more positive movement in the coming day.

However, if we compare the TON price to the long-term EMA lines, we see that the market price is still under the 50-day and 100-day average values. Combining this with the downward slope of both EMA lines, we predict that the price is more likely to stay under $6 and around the $5.50 region.

Conclusion

After the freeing of the network’s founder, TON coin started its recovery phase after 2-3 weeks of bearish performance. The token recovered 16% of its value over the last week, and the network is experiencing high transaction and TVL activity. Could it be the return of Toncoin?

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in cryptocurrencies, including meme coins, carries ingrained risks, and individuals should conduct their own research before making any investment decisions.