Top 5 DEX Platforms in 2025

If 2024 was the year decentralized exchanges matured, then 2025 marks the rise of DEX platforms as the face of the cryptocurrency exchange landscape.

As concerns about custodial risk, censorship, and loss of autonomy mount, more users are abandoning centralized exchanges and turning to DEXs for transparency, resilience, and the ability to interact directly with blockchain protocols. With only an internet connection, users can now access a vast array of tokens, maintain self-custody, and start trading without reliance on a central authority.

But with a sea of choices and hundreds of DEX platforms available—some offering deep liquidity and cross-chain swaps, others with low trading fees or unique UX—how do you choose the best fit? Should you stick with well-established names like Uniswap or venture into more niche protocols delivering cutting-edge innovation?

In this guide, we break down the Top 5 DEX platforms in 2025—ranked not by hype, but by real-world performance, usability, fee efficiency, and technical capabilities. You’ll also discover emerging decentralized exchanges that are quietly reshaping how decentralized exchanges work, pushing the boundaries of what a decentralized trading platform can be.

Key Takeaways

- Uniswap v4, dYdX, and Curve v4 are leading the charge in DEX performance, scalability, and user engagement in 2025.

- The best DEX for you is one that suits your trading requirements, taking into consideration fees, liquidity, range of assets, and user experience.

- New platforms, including Aerodrome and ZetaChain DEX, are quietly redefining the future of decentralized trading.

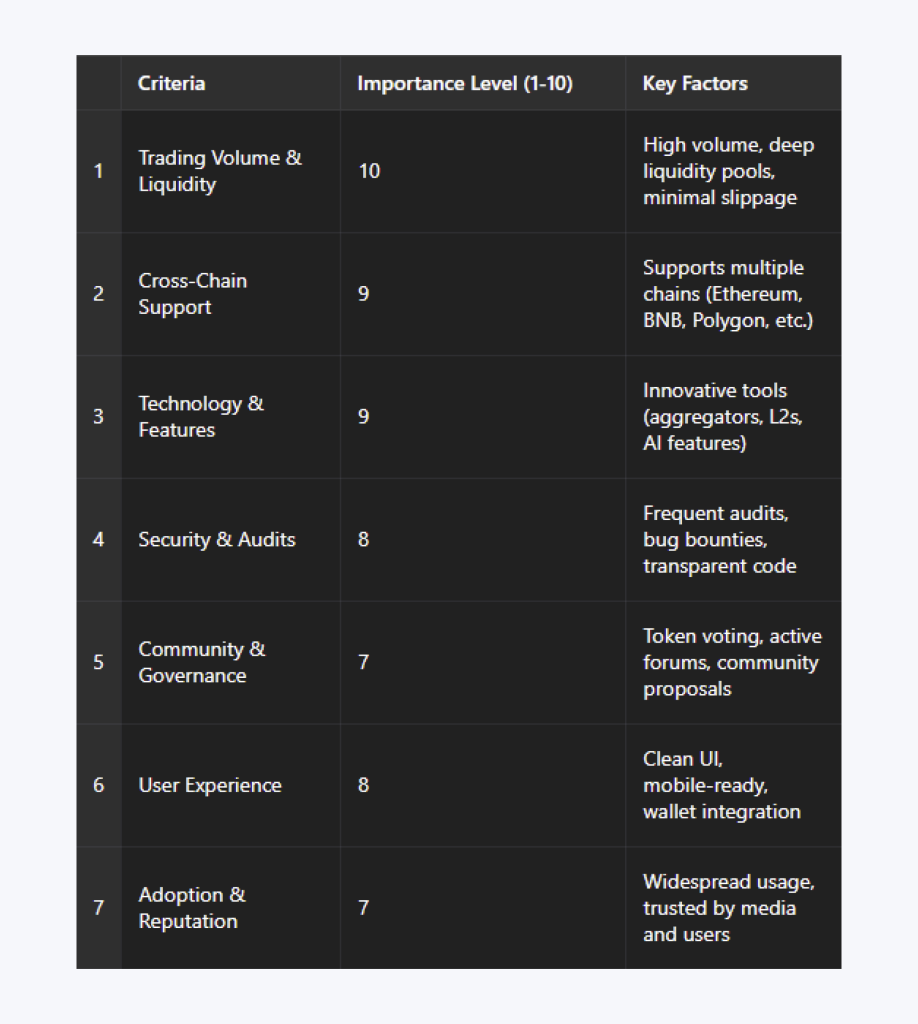

Criteria for Ranking Top DEXs in 2025

Picking the top decentralized exchanges (DEXs) in 2025 is not so much about seeing who is most hyped. It is about diving deeper—examining the actual-world performance, innovation, and user-friendliness that truly make a DEX shine.

Here’s a breakdown of the key criteria we’ve used to rank the top players in this space:

Trading Volume and Liquidity Depth

High trading volume is a positive sign—it indicates that the platform is actively used and trusted by a large number of traders. But volume alone doesn’t tell the full story.

Liquidity depth is just as crucial. It determines how smoothly you can execute large trades without massive slippage. The best DEXs offer deep liquidity pools for a wide variety of assets, minimizing price impact even during volatile market conditions.

Cross-Chain Support and Interoperability

Being single-chain DEX is akin to having one hand tied behind one’s back by 2025. Multichain ecosystems are how the DeFi space is quickly moving, so the premier DEXs are those that have the functionality to fluidly cross-pollinate assets across chains.

Platforms that connect to Ethereum, BNB Chain, Polygon, Arbitrum, and newer L2s are heading in the direction of accessibility and flexibility.

Technology and Features

Whether it’s offering limit orders, perpetual contracts, yield farming, or gas fee optimization, the feature set of a DEX can significantly impact the trading experience.

The best DEX platforms don’t just copy what others are doing—they innovate. Some introduce aggregated routing for the best swap rates, while others bring forward AI-based trading tools, auto-compounding rewards, or layer-2 scaling for faster, cheaper transactions.

Security and Audits

No one wants to trade on a platform that feels like it could be compromised at any moment. In a space where smart contract bugs and exploits are real risks, top DEXs invest heavily in third-party security audits, bug bounty programs, and transparent codebases. The presence of clear documentation, security updates, and community-driven checks is a huge plus.

Community Engagement and Governance

True decentralization isn’t just about the tech—it’s also about the people. DEX platforms with active communities and governance tokens provide users with a genuine voice in shaping the platform’s evolution.

Whether it’s voting on protocol upgrades or fee structures, user participation is a key indicator of long-term sustainability and alignment with trader interests.

User Experience (UX) and Accessibility

Let’s face it: even the most powerful DEX won’t survive if it’s clunky or confusing to use. In 2025, DEX platforms are competing not only on backend sophistication but also on clean, intuitive interfaces, mobile compatibility, and easy onboarding.

The best platforms offer wallet integrations, quick token discovery, and streamlined navigation—making decentralized trading less intimidating for newcomers.

Real-World Adoption and Market Reputation

Finally, reputation matters. We considered factors like user reviews, media coverage, and integrations with other DeFi tools (like wallets and portfolio trackers). A DEX that’s recognized by other platforms and widely used by institutions and retail traders alike has earned its spot on this list.

Fast Fact

In 2025, more than 68% of all on-chain crypto trades are executed through decentralized exchanges, marking a record shift from centralized platforms.

Top 5 DEX Platforms in 2025

As decentralized finance matures, the landscape of DEXs in 2025 is expected to be more competitive—and more innovative—than ever.

Gone are the days when DEX platforms were seen as risky or niche. Today’s top platforms are fast, secure, user-friendly, and loaded with features that rival (and sometimes surpass) their centralized counterparts.

Below, we break down five of the best-performing DEXs in 2025 based on usability, technology, adoption, and innovation.

Uniswap v4

Uniswap isn’t just surviving—it’s thriving. With the release of Uniswap v4, the platform has doubled down on efficiency and flexibility. Thanks to its new “hooks” architecture, developers can now build custom liquidity pool logic, leading to the emergence of specialized markets and tailored strategies. Liquidity provisioning is more capital-efficient, and the interface is cleaner than ever.

Uniswap continues to lead Ethereum-based DEX volume and has rolled out seamlessly onto several Layer-2 networks, such as Arbitrum and Optimism.

In addition, its system of administration is still developing through robust community engagement. From exchanging a meme token to launching a new DeFi application, Uniswap is probably your first stop.

dYdX

dYdX has firmly established itself as the go-to decentralized exchange (DEX) for serious traders. While most platforms focus on spot trading, dYdX offers a comprehensive derivatives experience, including perpetual futures, high leverage, and advanced order types.

What’s new in 2025? dYdX migrated to its own Cosmos-based app chain, enhancing speed and slashing fees without compromising decentralization. The platform now rivals traditional exchanges in performance while maintaining a non-custodial approach. It’s a dream come true for pro traders who want the best of both the DeFi and CeFi worlds.

Curve Finance v4

Curve continues to be the king of stablecoin trading, and version 4 has only cemented that position. The protocol’s unique bonding curves and concentration of liquidity around predictable price ranges ensure incredibly low slippage and minimal impermanent loss.

Curve v4 also introduces innovations such as cross-chain swaps, dynamic fee structures, and enhanced incentives for long-term liquidity providers. Its native token (CRV) now plays a more active role in governance and boosting rewards through vote-locking mechanics. If you’re moving stablecoins or engaging in yield farming, Curve remains a top-tier choice.

PancakeSwap

Don’t let the playful name fool you—PancakeSwap has evolved into one of the most powerful multichain DEX platforms in the game. Born on the BNB Chain, it now supports assets across Ethereum, Arbitrum, zkSync, and even Aptos.

What makes it special in 2025? It’s the platform’s easy onboarding, low fees, and highly gamified experience. From trading and staking to lotteries and NFTs, PancakeSwap makes DeFi fun and accessible. Its native token, CAKE, is now backed by strong tokenomics and an active burn mechanism, helping it retain value in a crowded market.

1inch Network

Unlike the others on this list, 1inch isn’t a traditional exchange—it’s a decentralized exchange (DEX) aggregator. That means it scans dozens of decentralized platforms to get you the best deal on every trade. In 2025, 1inch has doubled down on its Fusion Mode, offering gasless swaps and even the ability to set limit orders across chains.

Is it real strength? Efficiency. For traders looking to maximize return and minimize fees or slippage, 1inch is the ultimate tool. With new integrations, wallet support, and advanced routing algorithms, it’s become an essential part of any DeFi user’s toolkit.

Upcoming or Niche DEX Platforms to Watch in 2025

While the big names in decentralized exchanges dominate headlines and trading volumes, there’s a new generation of DEXs quietly pushing the boundaries of what’s possible in DeFi.

These emerging platforms might not yet be household names, but they’re bringing fresh ideas, targeting specific market gaps, and showing real signs of growth.

Here are three under-the-radar DEXs worth keeping an eye on in 2025:

Aerodrome – The Optimism-Focused Liquidity Engine

Aerodrome has been gaining significant momentum as a liquidity-focused decentralized exchange (DEX) explicitly built for the Optimism Layer 2 ecosystem.

Backed by the team behind Velodrome, Aerodrome brings a unique twist to AMM design by combining ve-tokenomics (vote-escrowed tokens) with emissions-based incentives, making it particularly attractive for protocols looking to bootstrap liquidity.

Its growth has been organic yet strategic: Aerodrome is positioning itself as the go-to DEX for new L2 tokens, DAOs, and DeFi builders launching on Optimism.

As L2 adoption increases in 2025, so does Aerodrome’s relevance. It’s not just another Uniswap fork—it’s building infrastructure for next-gen DeFi coordination.

MetalSwap – Hedging and Decentralization

While most DEXs focus on token swaps or farming, MetalSwap is carving out a completely different niche: hedging for commodities and synthetic assets.

The platform allows users to enter into decentralized swap contracts that mimic hedging positions—something more common in traditional finance than in DeFi.

Still relatively early-stage, MetalSwap’s approach is gaining attention from traders interested in real-world asset (RWA) exposure and DeFi-native risk management tools.

It’s building a bridge between traditional commodity trading logic and blockchain-native infrastructure—something few platforms are doing in earnest. With broader RWA tokenization expected to surge in 2025, MetalSwap may be quietly positioning itself for a breakout.

ZetaChain DEX – Omnichain Swaps

ZetaChain’s native DEX is still flying under the radar, but it could ultimately prove to be a game-changer. Built on ZetaChain’s omnichannel protocol, the DEX allows users to swap assets across different blockchains directly without needing wrapped tokens or third-party bridges.

The promise here is a seamless, natively cross-chain trading experience that preserves the principles of decentralization. It’s a complex challenge, but if ZetaChain delivers on its mission, this DEX could become one of the first truly universal liquidity layers in DeFi. It’s not just innovation for innovation’s sake—this platform is tackling one of the most frustrating user pain points head-on.

Conclusion

In the debate between centralized and decentralized exchanges, it’s becoming increasingly clear that DEXs aren’t just here to stay—they’re shaping the future. From the dominance of Uniswap v4 and the precision of dYdX to the innovative rise of Aerodrome and ZetaChain, the DeFi landscape in 2025 is packed with opportunity.

As more users seek control, transparency, and interoperability, knowing how to choose a DEX will become a vital skill for any crypto enthusiast. Whether you’re here to farm yields, trade derivatives, or just swap tokens securely, the decentralized path is more accessible—and more exciting—than ever.

FAQ

What is a DEX, and how does it work?

A DEX is a decentralized exchange that allows users to trade cryptocurrency directly from their wallets without a middleman.

Is a DEX safer than a centralized exchange?

Yes, because users retain control of their private keys, reducing custodial risks and central points of failure.

How do I choose the best DEX?

Consider factors such as liquidity, token support, fees, security audits, and the ease of use of the platform.

Can I trade anonymously on a decentralized exchange (DEX)?

Most DEXs don’t require KYC, allowing you to trade anonymously as long as you have a crypto wallet.

What makes DEXs popular in 2025?

Their decentralization, cross-chain capabilities, community control, and freedom from third-party custody.