What Is a BALD Crypto Token? – From a 100x Gain to a Controversial Crash

The meme token BALD, launched on the new blockchain called Base, became the talk of the town in the cryptocurrency world several months ago. However, from skyrocketing gains to a dramatic crash, the journey of BALD has been a controversial one.

In this article, we will delve into the details of the BALD crypto token, its tumultuous story, and the lessons learned from its rollercoaster ride.

Key Takeaways:

- BALD crypto token on the Base blockchain, which at the moment was still in the testing phase, has generated significant excitement among users.

- This token is a typical example of a rug pull scam, where the developer abandoned the project with millions of dollars, leaving investors with worthless digital assets.

- To avoid falling for crypto scams, it is important to do thorough research on the background of a crypto project, its team, and potential risks before investing in it.

What Is BALD?

BALD is a meme token created by an anonymous developer, based on the Base blockchain. The name BALD is a humorous reference to Coinbase CEO Brian Armstrong, who is known for his balding head.

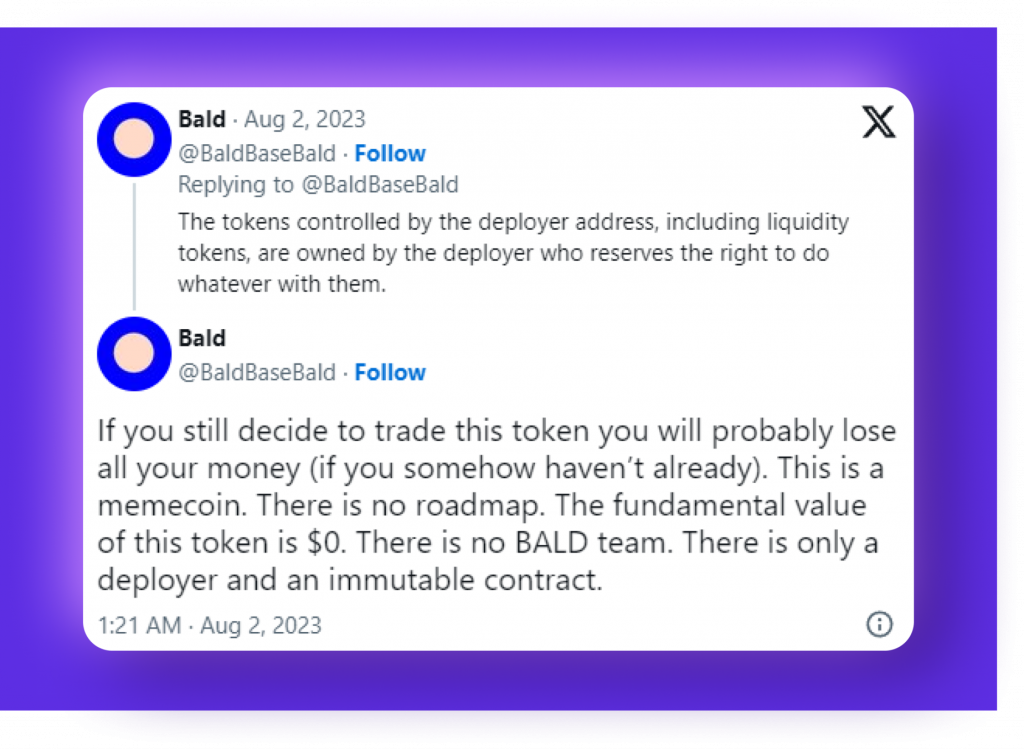

Meme coins like BALD are primarily created for entertainment purposes and do not possess a roadmap or strong fundamental value. These digital tokens are often fueled by internet trends and jokes, appealing to a specific community or group of individuals. The developer behind BALD made it clear through their Twitter account that the token is simply a meme and should not be considered a serious investment opportunity.

Fast Fact

According to CoinMarketCap, there are more than 1270 meme coins on the crypto market as of October 2023.

What Caused the Hype?

BALD was launched on the Base network, a cutting-edge Layer 2 Ethereum blockchain developed by Coinbase and Optimism. But what is so special about this new chain?

The Base Blockchain

The aim of Base is to reshape the world of decentralized applications (dApps). By leveraging the security of the Ethereum blockchain and integrating with Coinbase, Base provides developers with a powerful platform to create dApps with certain advantages:

- One of the main goals of Base is to simplify the process for dApp developers to access Coinbase’s products and distribution channels. The integration with Coinbase allows developers to seamlessly connect their dApps with the Coinbase ecosystem, providing them with the opportunity to work with fiat currencies and tap into a vast user base comprising millions of verified users.

- In addition, Base offers developers the ability to conduct zero-fee transactions. This feature eliminates the financial burden typically associated with blockchain operations, enabling developers to focus on building and enhancing their dApps without worrying about incurring additional costs.

- Furthermore, Base enables cross-chain application development, which is crucial in today’s decentralized ecosystem. Cross-chain functionality allows dApps to interact and share data across different blockchain networks, thereby enhancing interoperability and expanding the capabilities of these applications.

The announcement of the Base project was made in February 2023, and in May, its roadmap was published, outlining the planned development and milestones.

OP Stack

The Base network is built on the OP Stack. So, what is it?

The OP Stack is a critical component of the Optimism blockchain, providing the necessary software infrastructure to power its operations. Currently, it powers the Optimism Mainnet, the primary blockchain network of the Optimism ecosystem. However, it is designed to expand its capabilities in the future and will extend its support to the Optimism Superchain and its governance mechanisms.

The OP Stack serves as a foundational framework for developers who are interested in leveraging the benefits of Optimism’s Layer 2 solutions. It offers a set of pre-built modules, tools, and libraries that streamline the development process and provide developers with the necessary building blocks to create new L2 blockchains.

Thus, with OP Stack, blockchain developers do not need to build their networks from the ground up. Instead, they can take advantage of the existing infrastructure to quickly create secure and scalable L2 networks, saving time and money.

Because of the reasons mentioned above, the issuance of the $BALD crypto token on the Base blockchain, which at the moment was still in the testing phase, has generated significant excitement among traders.

The Rise and Fall of BALD

On July 29, 2023, the BALD token entered the market and caught the attention of enthusiasts. An anonymous creator of this meme coin gradually began to contribute to the liquidation of the BALD tokens.

Buying and selling of BALD was first exclusively available on the LeetSwap DEX. A few days later, the meme token was also listed on SushiSwap and SwapBased exchanges.

It is crucial to understand that anyone has the liberty to list tokens on any decentralized cryptocurrency exchange. Unlike traditional centralized exchanges, DEXs do not have strict regulations or gatekeepers who determine which tokens can be listed. This freedom allows for a more open ecosystem, but it also comes with heavier risks.

On July 30, the anonymous creator of the token made a series of transactions that caught the eye of many in the crypto community. He added over 100 ETH in each transaction to the BALD liquidity pool, ultimately depositing a total of 6,187 ETH.

The following day, on July 31, the anonymous creator continued to make waves in the market. He executed over 80 orders, each worth 10 to 30 ETH, buying up large quantities of BALD tokens. In total, he injected 1,150 ETH into the market.

This sudden increase in demand caused the BALD crypto price to skyrocket, reaching an all-time high of $0.09578.

Following the price increase, the BALD deployer made a sudden and substantial move by withdrawing a staggering amount of 10,705 ETH from the BALD liquidity pool, equivalent to approximately 20 million dollars worth.

The $BALD crypto price saw a drastic 90% decline following a market capitalization peak of $32 million. The sudden crash raised allegations of a rug pull, a fraudulent practice where liquidity is removed from a project, causing the token’s value to collapse.

How Does a Rug Pull Work?

A rug pull is a scam commonly associated with the world of cryptocurrency. It involves a sudden and unexpected exit of developers, investors, or creators from a project, leaving behind users with worthless tokens or coins. In simpler terms, it is an exit scam where the people involved disappear with investors’ money without any warning.

The term “rug pull” comes from the idea of literally pulling a rug out from under someone, causing them to fall. In the context of cryptocurrency, it refers to pulling the proverbial rug from under investors’ feet, leaving them with nothing.

Rug pulls typically happen in smaller and lesser-known projects that have gained some attention and investments. These projects often promise high returns on investment and use various tactics to attract users, such as creating hype around their tokens or offering exclusive rewards for early investors.

However, once enough money has been raised, the developers or creators suddenly “pull the rug” by selling their tokens and disappearing with wild gains.

So, by gradually adding liquidity to the BALD pool and initiating a series of token purchases, the developer of the BALD created an illusion of value and stability. However, once the price reached its peak, the liquidity was swiftly withdrawn, resulting in a catastrophic price drop.

The rug pull strategy is not unique to BALD; similar incidents have occurred in crypto markets many times. One notable example is the Squid Game (SQUID) token, where the developer suddenly withdrew all funds and abandoned the project. Rug pulls exploit the lack of regulation and anonymity prevalent in the crypto space, leaving investors vulnerable to significant financial losses.

Is BALD a Scam?

The controversial crash of the BALD token has led many to categorize it as a scam. There are a few red flags:

- Anonymous Developer: BALD was created by an anonymous developer, raising concerns about transparency and accountability. The lack of a known team behind the project increases the risk of scams and fraudulent activities.

- Lack of Roadmap and Fundamental Value: Meme tokens like BALD often lack a clear roadmap or underlying value proposition. Their popularity primarily stems from social trends and speculative trading rather than tangible utility or innovation.

- Price Manipulation: The rug pull orchestrated by the BALD developer involved deliberate price manipulation through liquidity adjustments and strategic token purchases. This manipulation misled investors and resulted in significant financial losses.

How to Avoid Crypto Scam Projects

The BALD case is an important warning to investors which highlights the necessity of conducting extensive research in the cryptocurrency market. To avoid falling victim to scam projects, it is crucial to follow these guidelines:

Thorough Research

Before making any investments in a project, conduct comprehensive research. Take the time to thoroughly scrutinize the team behind the project, carefully assessing their track record and experience in the cryptocurrency industry. Look for transparency in their communication and operations, as well as active community engagement that reflects a strong and dedicated user base. Additionally, consider the credibility of their partnerships and collaborations, as this can provide valuable insights into the project’s potential for success.

Avoid FOMO (Fear of Missing Out)

FOMO can cloud judgment and lead to impulsive investment decisions, potentially resulting in regrets later on. It’s important to resist the urge to jump into a project solely out of fear of missing out on potential gains. Instead, take the time to thoroughly understand the project’s fundamentals, evaluate its long-term viability, and consider the risks involved.

Remember, it’s better to miss out on a fleeting opportunity than to make hasty choices that may not be in your best interest in the long run.

Diversify and Allocate Responsibly

One key aspect is to avoid allocating a significant portion of your funds to meme tokens, such as Shiba Inu, or any high-risk investments. Instead, aim to diversify your portfolio by spreading your investments across different asset classes.

Remember, it’s important to only allocate what you can afford to lose, as no investment is entirely risk-free. Striking a balance between potential gains and risk mitigation is essential for long-term financial success.

Transparency and Community Involvement

When evaluating projects, it’s crucial to prioritize transparency, active community involvement, and regular updates. Look for projects that not only share information openly but also engage in meaningful discussions with the project team and community members.

Actively participating in these discussions allows you to contribute your thoughts and concerns, fostering a sense of collaboration and shared responsibility. This level of engagement enhances the overall community involvement and creates a more robust and trustworthy project ecosystem.

Choose Fundamentals Over Hype

Look for projects that boast strong fundamentals, innovative technology, and real-world use cases. Review project’s indicators like market cap, trading volume and turnovers. While meme tokens may promise quick gains, it is important to remember that projects with solid foundations have a greater potential for long-term success and sustainability.

Conclusion

The BALD crypto token’s journey from meteoric rise to a controversial crash serves as a stark reminder of the risks associated with meme tokens and the importance of thorough research in the market. The anonymity of developers, lack of a roadmap, and price manipulation tactics make BALD a cautionary tale for investors.

To navigate the market safely, it is crucial to exercise caution, conduct due diligence, and select projects with strong fundamentals. Following these guidelines and remaining vigilant can lower the risk of falling victim to scams and lead to better investment decisions.

Remember, the crypto market is dynamic and ever-changing. Stay informed, adapt to new developments, and rely on reliable sources of information to make sound investment choices.

FAQ

What types of frauds are there in the digital currency market?

There are many different types of fraud in the crypto market. In a pump-and-dump scheme, for example, fraudsters will artificially inflate the price of a cryptocurrency by promoting it heavily to investors and then quickly sell their holdings, resulting in a sudden drop in the price. Exit scams involve fraudsters disappearing with investor funds after raising money for a project. In a Ponzi scheme, investors are promised high returns that are paid out with funds from subsequent investors instead of from actual profits. Phishing attacks involve fraudsters sending fake emails and other messages with the intention of stealing personal information and funds from unsuspecting victims.

Are crypto exchanges secure?

Exchanges are designed to keep user funds secure, but it is important to note that there is no guarantee that your funds will be completely safe. Crypto exchanges have been the target of cyberattacks in the past, and user funds have been stolen as a result. It is essential that users take the necessary steps to protect their funds, such as using two-factor authentication, setting up secure crypto wallets, and keeping their funds in cold storage. Additionally, users should do their due diligence when selecting a crypto exchange; researching the security features and reputation of the exchange is recommended.

What are the risks associated with trading meme coins?

Trading meme coins can be a risky investment due to their lack of fundamentals and underlying value. Meme coins have become popular due to their low cost, but without a real-world application, they are susceptible to large price swings due to speculation and hype. Additionally, meme coins may not be backed by reliable custodians, so there is a risk of losing all of your investments if the coin fails.

What measures can I take to keep my crypto safe?

There are several measures you can take to keep your virtual currency safe. First, you should use a reliable and secure wallet. Make sure to use a wallet that supports two-factor authentication and other security measures, such as multi-signature authentication. You should also keep your wallet backed up in a secure offline location. Additionally, you should use a strong password and never share it with anyone. Finally, you should use a trusted and reputable exchange and only transact with reputable sellers.