What Is a Pegged Currency in Crypto? How These Cryptos Spur Economic Growth?

One of the main characteristics of decentralized economies is the lack of control and high speculation, making DeFi crypto assets vulnerable to high volatility and frequent price changes.

However, a pegged currency is one way to minimize these dynamics and make blockchain-based coins more stable by associating them with a fixed asset.

This motivates individuals and businesses to deal with digital assets and conduct crypto payments because their value is more predictable, which boosts economic stability. So, what does pegging mean in crypto, and how does it compare to conventional cryptocurrencies? Let’s discuss.

Key Takeaways:

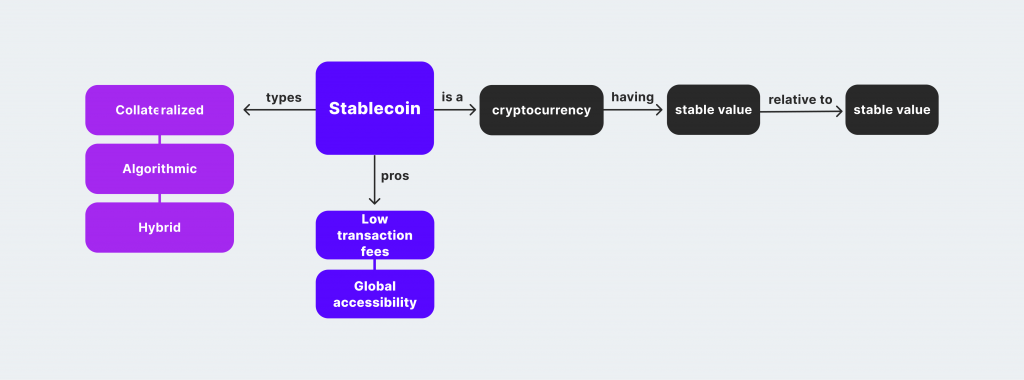

- Pegged currencies (stablecoins) are cryptocurrencies fixed to another currency, asset, algorithm, or a combination of them.

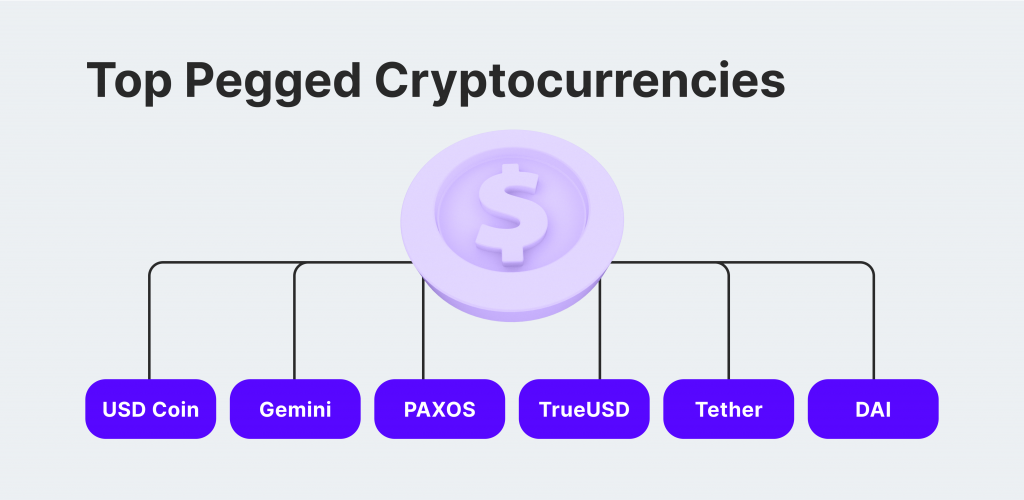

- USD is the most common currency peg, backing stablecoins like Tether, USD Coin, and TrueUSD.

- Algorithmic pegged tokens use smart contracts to mint/burn coins according to market conditions to maintain a 1:1 balance.

What Does a Pegged Currency Mean?

When money is tied to another asset’s value, it is a pegged cryptocurrency. This is usually done by fixing it to a more stable asset, which could be another currency, commodity, algorithm, or a mix of many.

This practice traces back to the gold standard when countries locked their local currency and entire economy to a treasury of gold. This practice continued for many years until the 1970s.

However, with the rising popularity of cryptocurrencies, many criticized their volatile nature, where the value of virtual coins and tokens diverges daily, and a company’s holdings can change dramatically in a short period of time.

Thus, pegging a cryptocurrency provides a solution to hold decentralized assets more stable.

Businesses increasingly use stablecoins, given their unique value and ability to accept crypto transactions without worrying about changing market dynamics and price volatility. Companies and e-commerce merchants use stablecoins to convert their sales revenues from Bitcoin and Ethereum to USDT or USDC as more stable currencies.

How Does a Pegged Currency Work?

The pegging mechanism is quite simple. A stablecoin is backed by another – more stable – asset, giving it more weight and resistance to market fluctuations.

There are many ways to fix a digital currency. However, the most common way is to link it to cash reserves, which is a considerable amount of fiat money, such as USD or EUR, backing the stablecoin.

So, what happens when a currency is pegged to the US dollar?

This makes the coin valued at $1, for example, like Tether (USDT). In this case, the cryptocurrency keeps its fixed price with little to no volatility. When the demand increases in bull markets, investors and institutions behind the USD backings that peg USDT conduct various transactions to sell off or buy more fiat USD to balance the 1:1 ratio and maintain the peg.

Fast Fact:

Tether (USDT) is the largest stablecoin with a market capitalization of $110 billion, ranking as the 3rd best cryptocurrency.

Key Components of a Currency Peg

The crypto market moves constantly, and it is challenging for a human to keep track of coins’ values and manually maintain the link with the pegging assets or the anchor. Therefore, two actors play a significant role in this stabilization: smart contracts and oracles.

Smart Contracts

Smart contracts are programmed machines that execute orders when particular conditions are met. These instructions are entered into the code of the smart contracts.

In stablecoins, when markets fluctuate, the pegged value is more likely to change as the demand increases or decreases. In this scenario, these self-executed contracts perform several operations to return the peg to the initial exchange rate.

For example, if the market price is over the peg rate, smart contracts mint more coins to lower their value and maintain the peg. Similarly, if the market price is under the peg rate, coins will be automatically burnt to increase the coin’s value and return the balance.

Blockchain Oracles

Oracle technology facilitates communication between market news and smart contracts, dictating market conditions and what must be done.

Oracles connect decentralized ecosystems to the external world, collecting price updates and delivering real-time newsfeeds so smart contracts can do their job accurately and efficiently.

These tools can be used in decentralized autonomous organizations, where voting and decisions are made regarding technical changes to a blockchain, crypto coin, or their features. In this context, the oracle is used by investors and participants to make fact-based decisions.

Types of Pegging Cryptocurrencies

There are different ways to stabilize a cryptocurrency, and the pegging mechanism determines the coin’s valuation and how quickly it regains its peg following market shifts. Here are five standard pegging systems.

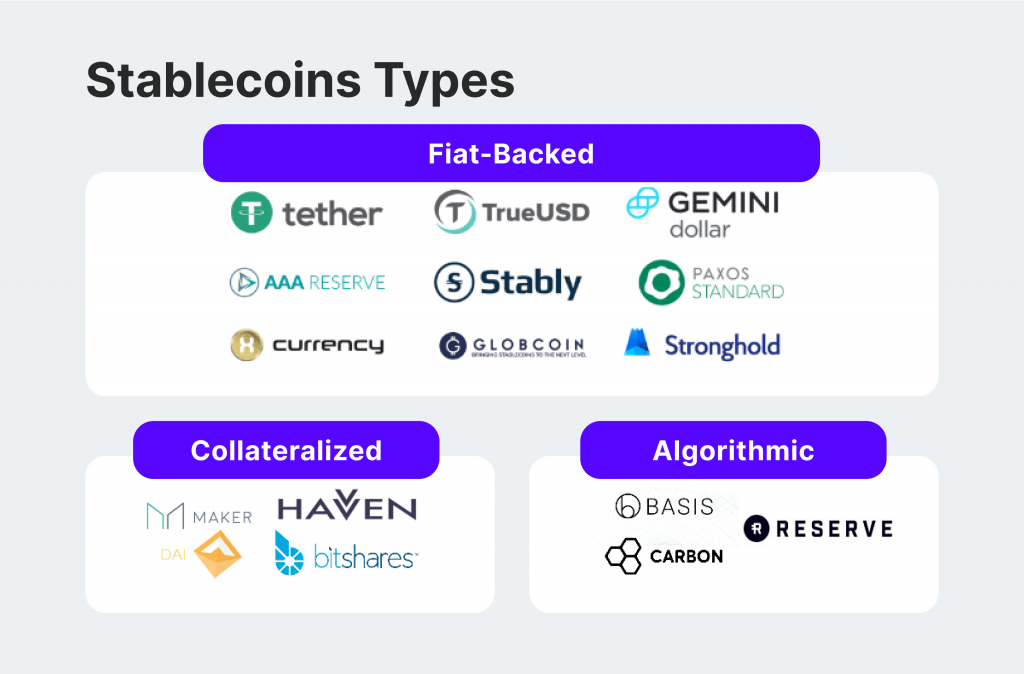

Commodity-Backed

Commodity-pegged cryptocurrencies are stablecoins backed by physical assets, such as gold. Paxos Gold (PAXG) is a stablecoin minted with the ERC-20 standard fixed with gold. Each PAXG token is backed by a London Good Delivery gold bar.

Tether gold (XAUt) is a crypto pegged to gold used in exchange for physical commodities.

Algorithmic Pegging

The systematic pegging mechanism relies on smart contract technology, which maintains the reserves backing the cryptocurrency. Algorithmic pegging entails minting or burning tokens in circulation to sustain the balance and minimize price changes.

DAI is an algorithmic-pegged stablecoin on the Ethereum blockchain. TerraUSD was also fixed algorithmically before losing its fixation in 2022.

Fiat-Backed Peg

These are the most common stablecoins backed by cash reserves and treasuries, usually in USD or EUR. The token’s peg is held by maintaining a fixed amount in fiat currency and conducting exchanges as the crypto market fluctuates to keep the peg.

USDT and USDC are famous cryptos pegged to dollars that rank among the top cryptocurrencies. Similarly, EURC is a Euro-pegged stablecoin backed by the Euro in a 1:1 ratio.

Crypto-Backed Peg

A given amount of cryptocurrencies fixes these stablecoins and utilizes smart contract mechanisms to ensure their peg. In most cases, crypto pegging issues coins that mimic another cryptocurrency.

For example, Wrapped Ethereum uses crypto backing to track the price of Ethereum.

Hybrid Pegging

Hybrid stablecoins use a collection of fiat currencies, cryptocurrencies, and commodities as collateral to fix their value.

For example, LUNA was a stablecoin pegged to US Dollar reserves and TerraUSD crypto, and when UST lost its to the dollar, Luna coin crashed tremendously in 2022.

Pros and Cons of Crypto Pegging

Some consider pegged currencies the best solution for volatile cryptocurrencies and sending and receiving digital assets, while others refrain from using them due to their limited use cases. Let’s highlight the advantages and disadvantages of stablecoins.

Advantages

- Low price volatility as pegged crypto tokens are not affected by market changes and price fluctuations.

- Stablecoins provide more reliable investment options where the currency value does not change.

- Risk management tools as companies and merchants can store their funds in pegged digital currencies to minimize market impact.

- Like common cryptocurrencies, stablecoins facilitate business globality, allowing companies to enter new markets and expand their offerings to new clients.

Disadvantages

- Some pegging mechanisms are subject to centralized control, deviating from the concept of the decentralized economy.

- Relying on external factors like other crypto and fiat money exposes the pegged currency to transparency and market risks.

- Technical glitches in blockchain oracles can severely harm the pegging mechanism or price accuracy when maintaining the peg.

Conclusion

A pegged currency, or stablecoin, is a blockchain-based coin or token whose value is tied to another asset or collateral. These coins keep their price fixed in a 1:1 ratio in most cases. For example, using multiple pegging systems, a pegged asset may equal $1.

Fiat money pegging is the most common way to issue a stablecoin, such as USDT, USDC, and EURC. However, other pegged currencies are associated with gold, other cryptocurrencies, smart contract algorithms, or a combination.

Stablecoins are becoming more popular among businesses that store and transfer funds using these currencies to minimize market impact and price fluctuations.