What is Long and Short in Crypto Trading

For some, trading can be a valuable source of income, and the process itself can be exciting. However, with so many methods and strategies out there, it’s easy to feel overwhelmed. The essence of crypto trading is buying and selling digital assets. Knowing long and short positions is essential for anyone hoping to be effective. These terms describe particular tactics traders use to profit from price changes, regardless of whether they predict a rise or fall in the value of cryptocurrencies.

This article clarifies long and short in trading, their advantages and disadvantages, and how to trade them. By understanding these tactics, you can improve your trading, make better decisions, and implement effective risk management measures.

Key Takeaways

- Purchasing assets with the hope that their value will increase and provide a profit when sold later is known as a long position.

- In a short position, you borrow money, sell assets, and believe the price will drop so that you may repurchase them later at a profit.

- For both techniques to be successful, thorough market analysis and risk management are necessary.

What Does Going Long Mean in Trading

A long position is when a trader purchases an asset, like a cryptocurrency, hoping its value will increase over time. This strategy is based on the idea that the cryptocurrency’s value will rise, and the trader will eventually be able to sell it for a profit at a greater price. Both the highly volatile crypto market and conventional stock markets frequently employ this tactic.

Let’s say you chose the crypto X you want to trade with. You researched and believe that X is undervalued and its price will increase. So, you decide to go long by purchasing 1 X with, for example, $1,000. If everything goes according to your plan, the price of the X becomes $2,000, and you will be able to sell your 1 X for a profit of $1,000.

How to Trade

Here are a few steps for trading a long position that will help you get started:

- To figure out when it is optimal to enter a trade, you need to examine the market carefully. Studying price fluctuations, market sentiment, and current trends are all necessary actions.

- Choose a cryptocurrency based on the likelihood that its value will rise. Do thorough research, read price analysis, and rely on your and the expert’s experience. Consider external factors that might influence the pricing as well.

- Complete the first transaction by paying the current market price for the coin of your choice. This establishes the long position.

- Hold onto the position while monitoring current market trends and cryptocurrency price fluctuations.

- Sell the cryptocurrency when its price reaches the level of your choice to earn profit.

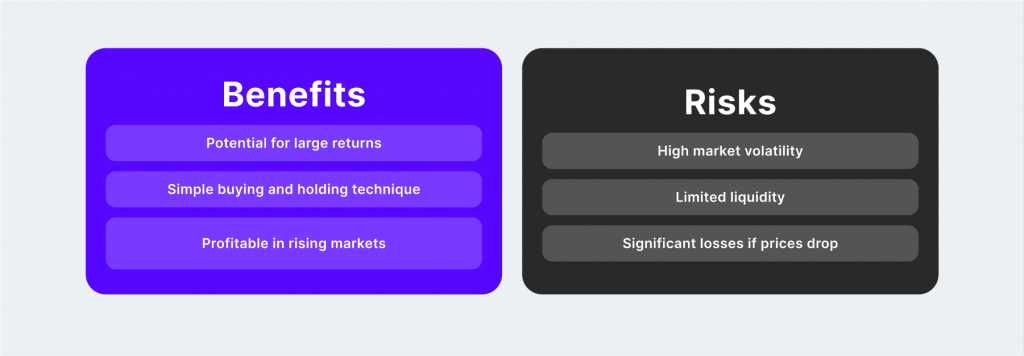

Benefits and Risks

One major advantage of a long position is the possibility of large returns; traders can make massive earnings if the crypto price increases significantly. Buying and holding is a simple technique that is even accessible to beginners. In addition, since long positions are profitable when prices are generally rising, they align with the market’s bullish mindset.

However, medals always have two sides, and there are dangers connected to this tactic. One of the main concerns is market volatility; prices in the cryptocurrency market can shift very quickly, which could result in losses if the market goes against a trader’s position. Limiting liquidity due to funds being locked up in the position until they are sold is another danger. Also, the trader can sustain sizable losses if the price falls dramatically. To reduce this risk, it is necessary to practice efficient risk management techniques like commonly used stop-loss orders.

What Does Going Short Mean in Trading

Borrowing and selling an asset with the hope that its value would decrease is known as a short position. Traders aim to repurchase the asset at a reduced cost and return it to the lender, keeping the difference for themselves. Traditional investment strategies adapted and became popular in crypto as well.

If you believe there should be a correction for the inflated crypto Y, you decide to go short and borrow 1 Y from the broker. Then, you immediately sell that coin at the current price, let’s say $1,500. Since it was borrowed, you must return it to the broker later. So, here, the short position strategy comes into play: You believe that the price of Y will go down, and if it drops to $1,000, you can repurchase it and return it to the broker. Your debt is settled, and you will gain a profit of $500.

How to Trade

To fully understand a short position, follow these steps:

- Usually, you have to create a margin account to borrow the asset from a broker. You can trade with borrowed funds in this account, but you will have to pay interest on the borrowed amount.

- After borrowing an asset, you sell it at market value to later buy it back at a reduced price.

- Since short trading is subject to market changes, monitor developments carefully. Significant market events, such as the release of economic data or earnings reports, may impact the asset’s price.

- When the asset reaches your goal level, repurchase it at a lower price. This is an essential stage since timing the market impacts your trade’s profitability.

- Return the borrowed asset to the lender to finish the short selling cycle. Paying off any interest or fees accumulated over the borrowing term is part of this phase.

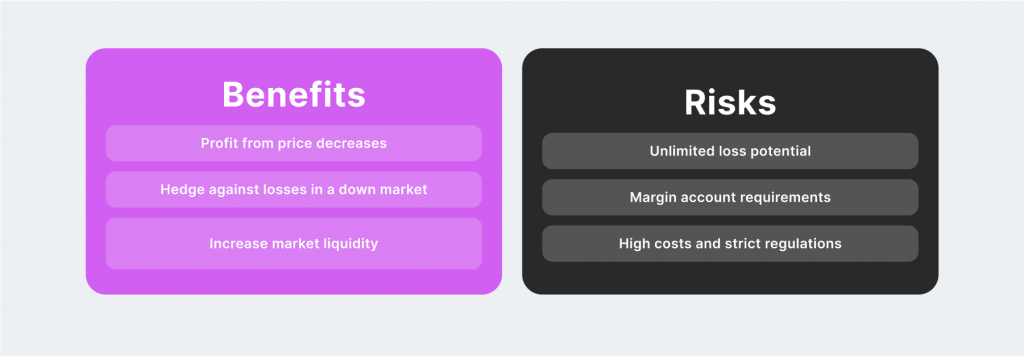

Benefits and Risks

Short positions have different benefits. They give traders an advantage over conventional trading techniques that depend on price growth by allowing them to profit from price decreases. Also, short selling can reduce losses in a down market by hedging against other investments. Short selling has the potential to dramatically affect market liquidity by raising trade volumes.

Still, there are significant risks connected to short positions. In contrast to long positions, where losses are limited to the initial investment, short positions involve potentially limitless dangers should the asset’s price rise and carry bearish market conditions. Because short sellers need to have a margin account, they must have a minimum amount to offset any losses. Margin calls may require the trader to take on more money or liquidate losing positions if this isn’t done. Because of how unpredictable markets can be, short sellers may suffer large losses when prices rise quickly. In addition, traders must pay interest and other expenses when borrowing the asset, which can add up to holding the position. Moreover, there are strict laws governing short sales that differ by nation.

Fast Fact

Launched in 1971, Nasdaq gained popularity quickly. By 1992, it accounted for 42% of US trade volume. That year, Globex was unveiled as the first electronic trading platform.

What’s the Difference Between Them

The main distinctions between long and short in trading are the traders’ outlook on the market and expectations for price fluctuations. A trader holding a long position hopes that the asset’s price will increase, while a trader holding a short position expects the price to decline. This distinction is crucial since it determines the trading strategy and risk control method.

In general, long positions are less risky than short ones. A short position has a potentially infinite risk since the asset’s price might grow indefinitely, while a long position’s potential loss is restricted to the initial investment. This also means that traders who engage in short selling must implement risk management strategies to avoid suffering significant losses. Short positions sometimes need margin trading, which adds another level of complexity.

Both long and short positions affect the market. While short positions can significantly impact market liquidity by raising trading volumes, long holdings drive price increases by boosting demand for the asset. This dynamic interplay maintains an active and balanced market.

The trader’s investment perspective, market context, and risk tolerance all play a major role in determining the question of long vs short in trading. Thorough investigation and meticulous evaluation of the underlying item’s price fluctuations and demand patterns are necessary for both tactics.

Last Remarks

To sum up, knowing long and short positions is crucial for successful financial market trading. A short position is selling an asset you do not own with the expectation of a price decrease, whereas a long position is purchasing an asset with the hope of price appreciation. Careful market research and efficient risk management techniques are necessary to implement these initiatives. It’s not just a defensive strategy; it is a proactive method that enables traders to profit from market swings. Not only an understanding will strengthen your chances of success and effectiveness, but trading requires practice, patience and psychological readiness.