What is QuickSwap? New DEX Leading The Competition

The more technology advances, the more widespread DeFi becomes. What’s DeFi, though?

Simply put, Decentralized Finance (DeFi) is a collection of crypto initiatives that have made previously inaccessible financial products and services available to most people on the planet. Today, anyone with a computer and an internet connection may access them.

The DeFi industry offers many alternatives to traditional financial goods and services, becoming so competitive that one day may overtake them in terms of broad adoption. One of the essential representations of DeFi products is Decentralized Exchanges (DEX).

Centralized exchange has several drawbacks since it acts as a strong gatekeeper, determining what assets may be exchanged, when they can be traded, and who can trade them. This offers them tremendous leverage to affect transactions involving assets, buyers, and sellers.

With the introduction of DEX, the role of intermediaries disappears, leaving the people in charge of governance and control.

Over the past several years, numerous decentralized exchanges have emerged in the crypto space, each to offer users better prices, faster transactions, and a more streamlined trading experience.

QuickSwap, a Layer 2 decentralized exchange based on the Polygon network, is one of the newest participants. But what does any of these mean, and what is QuickSwap after all?

Key Takeaways

- QuickSwap is a Layer 2 DEX and automated market maker (AMM) built on Polygon.

- QuickSwap is on Polygon to offer faster and more efficient transactions with low fees.

- QuickSwap’s liquidity pools and swap feature allows for seamless trading of various cryptocurrencies at fair market prices.

- QUICK is the native token of QuickSwap, which can be used to access various platform features, including yield farming.

- QuickSwap’s yield farming features, including Dragon’s Lair, Dragon’s Syrup, and Dual Mining, allow users to earn rewards and additional tokens by staking their assets on the platform.

What is QuickSwap?

QuickSwap is a DEX fork from the widely-used Uniswap and is based on the polygon network. QuickSwap, like Uniswap, is an Automatic market maker. Therefore the price of assets is decided by algorithms based on supply and demand.

Similar to a financial robot or piece of code, the QuickSwap AMM may suggest a price between two assets. Rather than relying on an order book, the price is decided by the liquidity pool’s assets and is proportional to the number of tokens in circulation at any one time.

This enables smooth trading without the requirement for an order book or matching engine by ensuring that buyers and sellers may exchange assets at fair market values.

QuickSwap is likewise a Layer 2 DEX, where “Layer 2” describes a blockchain that works on top of the primary blockchain for enhanced transaction speeds and efficiencies.

Using Layer 2 technology, QuickSwap allows users to swap cryptocurrencies rapidly and at minimal transaction costs.

Why Polygon?

Although QuickSwap is a fork of Uniswap, an Ethereum-based exchange, it has decided to run its business on the Polygon network. Why?

The QuickSwap protocol was developed to address Ethereum’s user experience issues, such as slow transaction speeds and excessive transaction costs.

These problems have stopped DeFi from being widely available, primarily because transaction fees become prohibitively high during periods of heavy network traffic.

QuickSwap has developed a solution to this issue by expanding upon the Polygon Layer-2 scalability approach, allowing up to 65,000 transactions per second at nearly zero transaction costs.

Notably, The developers of QuickSwap forked the code behind Uniswap without altering the underlying code because of Uniswap’s proven success in the industry and its ability to conduct daily crypto transactions worth millions of dollars.

So, will QuickSwap conquer the decentralized exchange industry?

QuickSwap Features

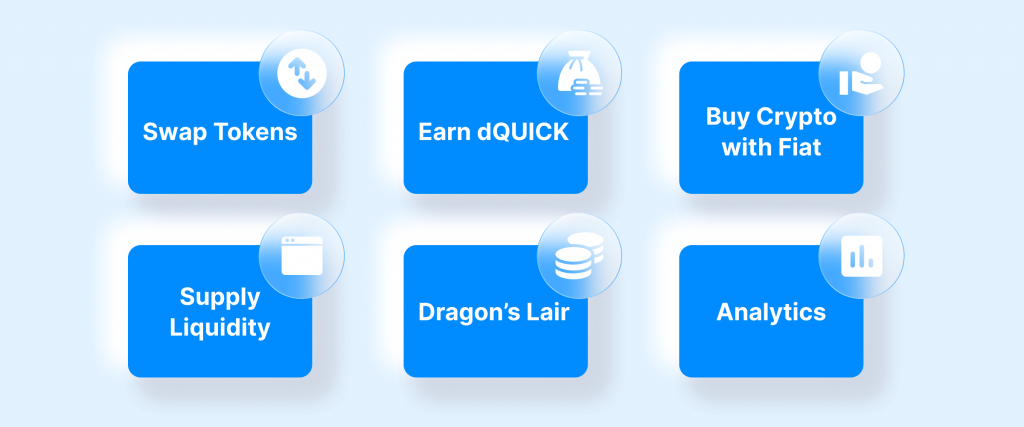

Using QuickSwap, you may trade, stake, farm, and provide liquidity. It shares some visual and functional similarities with Uniswap and operates via an off-chain governance mechanism. Let’s discuss several of its defining characteristics:

- QuickSwap DeFi App

As QuickSwap is a DeFi platform, a Web3-enabled browser with a crypto wallet plugin is required. If you want to use QuickSwap, but your assets are on Ethereum or another blockchain network, you’ll need to bridge them to the Polygon network first.

To achieve this, open the QuickSwap app and look for the “Bridge” button in the upper right corner of the screen. This will link you to exchanges that facilitate the bridging of digital currency between different blockchains.

- Liquidity Pools

Using an AMM model, anyone may set up a liquidity pool of tokens that can be traded with other users. There is no order book in the usual sense, with makers and takers. Instead, users deposit tokens of similar value, providing the liquidity necessary for trade.

Users who deposit into a liquidity pool are rewarded with a certain number of Liquidity Pool (LP) tokens. This will ensure that the liquidity providers are compensated fairly for their services.

QuickSwap’s liquidity providers receive 0.25% of all transaction fees following their trading volume.

Furthermore, LP token holders who contribute to a liquidity pool can farm yields for dQUICK tokens by depositing their tokens.

- Token Swaps

QuickSwap enables the fast, low-cost trading of ERC-20 tokens with a transaction charge of just 0.3%. Liquidity providers get compensation from the fees earned by the swaps.

Users just need MATIC in their wallets to execute the switch, as KYC is unnecessary. Hence, QuickSwap provides a straightforward and easy-to-use interface for token swapping.

- QUICK Tokens

At QuickSwap, QUICK serves as the platform’s native governance token. A staked QUICK token will get a proportional share of the transaction fees generated by the staking platform.

Staking QUICK tokens results in issuing dQUICK (Dragon’s Quick), a liquid staking token representing the staked QUICK. Staking QUICK results in a fixed amount of dQUICK tokens for the staker, with the exact amount depending on the QUICK-dQUICK exchange rate at the moment of staking.

When the platform collects trading fees, the value of dQUICK increases in relation to QUICK.

To put it another way, when you withdraw dQUICK from your staking contract, it will be converted back to QUICK at a rate that is equal to the sum of your initial stake plus any interest you’ve earned on your dQUICK from QuickSwap trading fees.

Therefore, dQUICK holders benefit from a split of all QuickSwap trading costs until they exchange their tokens for QUICK.

- QuickSwap Governance

Both QUICK and dQUICK are employed for voting on governance proposals to modify the QuickSwap protocol. Votes are awarded proportionally to the number of QUICK tokens in the voter’s wallet; votes cast using dQUICK are counted using the QUICK-dQUICK conversion rate in effect at the time of voting.

Facilitating governance using dQUICK encourages stakeholders in QuickSwap to remain engaged with the protocol over the long run.

How To Use QuickSwap? – Technical Guide

QuickSwap offers a fast, secure, and user-friendly way to trade your favourite cryptocurrencies. Here’s a quick guide on how to swap tokens on the platform.

Step 1: Open QuickSwap

First, open your web or mobile browser and navigate to quickswap.exchange. Always make sure you are on the official website to avoid opening phishing sites.

Step 2: Connect Your Wallet

On the right-hand side of the home page, click on the Connect Wallet button. You’ll be prompted to select a Polygon-supported wallet to connect, such as MetaMask or Trust Wallet. Once you have chosen your wallet, follow the instructions to connect it to QuickSwap.

Step 3: Select the Swap Function

Once your wallet is connected, click on the Swap option on the navigation bar at the top of the page. You’ll be taken to the Swap page.

Step 4: Select the Token Pair

On the Swap page, select the token pair you want to swap. The default token is usually MATIC, but you can select the tokens you need. For example, if you want to swap MATIC for SAND tokens, select MATIC in the “From” box and SAND in the “To” box.

Step 5: Initiate The Swap

After selecting your trading pair, click on the Swap button to initiate the swap. A pop-up window will appear, showing you the details of the transaction. Review the transaction details carefully and make sure you have enough MATIC tokens to cover the transaction costs.

QuickSwap Yield Farming

While most yield farming incentives are geared toward liquidity providers, QuickSwap allows you to earn DeFi yield without depositing your cryptos into a liquidity pool.

Investors uncomfortable keeping their cryptos locked up to offer liquidity can still benefit from QuickSwap’s yield by staking QUICK tokens.

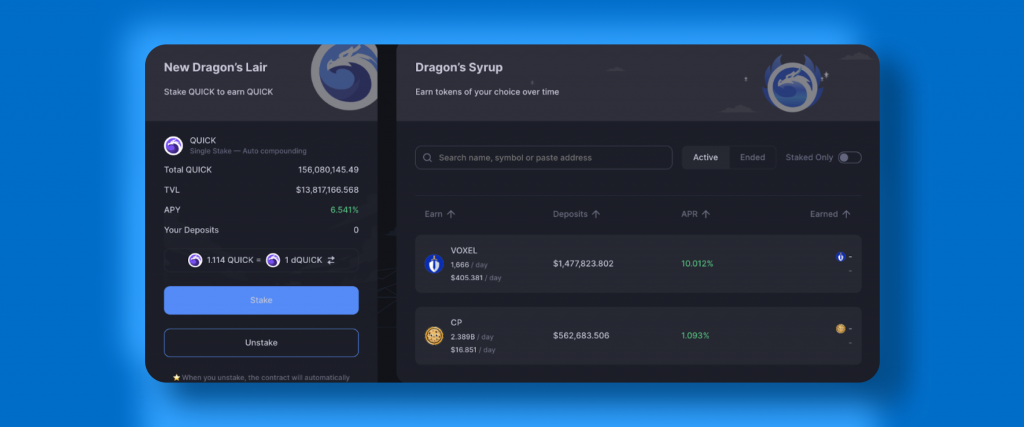

Dragon’s Lair

Dragon’s Lair Each trade incurs a 0.3% charge, of which 0.04% goes into marketing purchase QUICK and distributing it to QUICK stakers (AKA dQUICK holders).

The staking yield rate of QUICK changes depending on how much of the entire QUICK supply is currently staked. dQUICK must be deposited back into the Dragon’s Lair in return for QUICK tokens depending on the QUICK conversion rate.

Dragon’s Syrup

Individuals interested in staking QUICK but not in in-house incentives may instead stake their tokens in syrup pools. Staking QUICK on Dragon’s Syrup earns investors small-cap cryptocurrencies from new crypto ventures.

By enhancing token circulation and enabling QuickSwap users to support new projects without buying or trading, Dragon’s Syrup improves the liquidity of newly issued crypto tokens.

Unlike Dragon’s Lair, Syrup pool staking is a short-term yield technique that can only be used with less reputable tokens.

Dual Mining

Compared to other DEXs, Quickswap’s liquidity providers have a greater variety of alternatives for yield farming by staking their LP tokens in either LP mining pools or dual mining pools.

First, you may earn in-house income by staking your LP tokens in LP mining pools. And Dual Mining pools on QuickSwap are an even more lucrative option.

The yield on staked LP tokens in these pools is measured in wrapped MATIC (wMATIC) and dQUICK tokens.

For those providing liquidity and are optimistic about both the Polygon and QuickSwap ecosystems, or who just want passive MATIC income for future gas fees, dual mining is an excellent yield farming option.

FAQs

- What is QuickSwap, and how does it work?

QuickSwap operates on the Polygon blockchain and is a Layer 2 decentralized exchange and automated market maker (AMM). Like Uniswap, it allows users to contribute to liquidity pools and profit from transaction fees while exchanging tokens.

- What are the uses of QuickSwap?

QuickSwap is a DeFi platform built on the Polygon sidechain that adapts the AMM algorithm used by Uniswap. The platform enables users to trade cryptocurrencies, set up liquidity pools, stake liquidity pool tokens (LP), and earn interest.

- Is QuickSwap the same as Uniswap?

QuickSwap is a fork of Uniswap that operates on the Polygon network (formerly Matic Network), an Ethereum Layer-2 scaling solution. QuickSwap offers faster and cheaper transactions thanks to Polygon’s lower costs relative to the Ethereum main net.

- Is QuickSwap safe to exchange?

QuickSwap is open-source, and it derives its reliability and security from the verified code of Uniswap.

- What wallet works with QuickSwap?

MetaMask, BitKeep, Venly, Portis, Coinbase Wallet, and WalletConnect are some of the major crypto wallets that work with QuickSwap.

Conclusion

With the development of decentralized finance, the importance of fast, accessible, and secure decentralized exchanges increases on a daily basis.

QuickSwap is one of the advanced tools to swap tokens and gain yield, and it will likely replace many of the established exchanges available on the current market.