Where Can I Join a Crypto Pump? — And Why You Should Not Do It

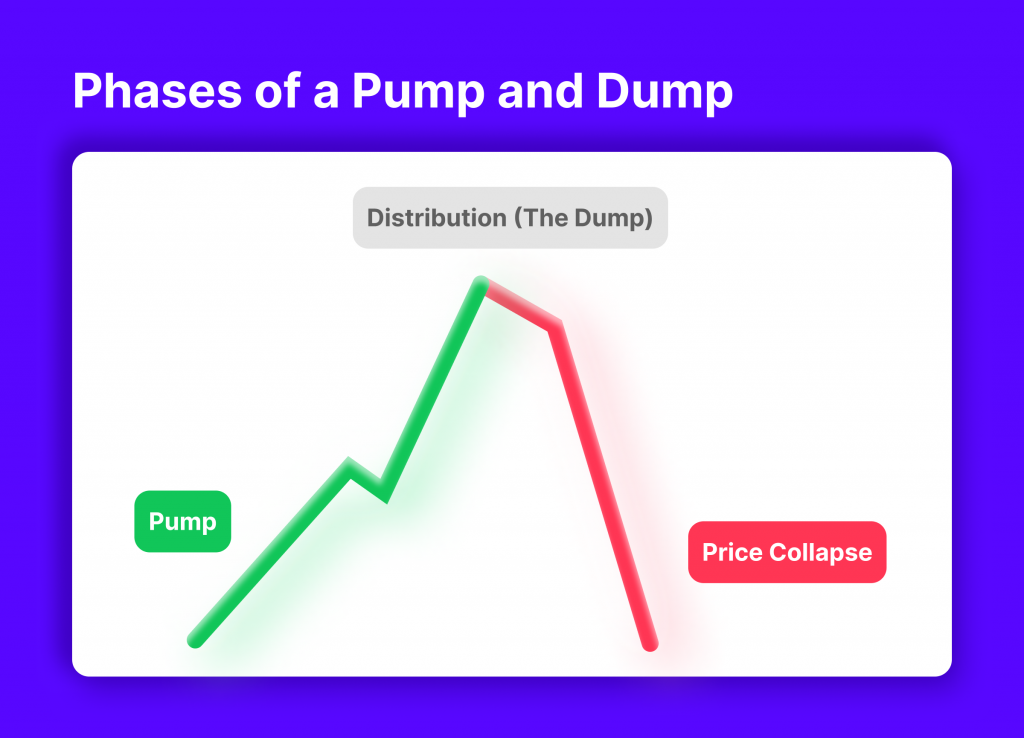

Crypto pump and dump schemes are notorious activities in the cryptocurrency world, which involve artificially inflating the price of a specific cryptocurrency for quick profit and then quickly selling off the assets, leading to a sharp price drop.

These schemes usually start in chat groups on platforms like Telegram or Discord, where organisers hype up certain low-market-cap coins. “But where can I join a crypto pump? Should I even try?” you probably wonder.

In this article, we will explore the opportunities, risks, and legal consequences associated with joining a crypto pump community.

Key Takeaways:

- Crypto pump and dump schemes are usually performed through groups on Telegram or Discord groups, through which organisers boost tokens with a low market capitalisation.

- Pump and dump schemes are illegal, as they are considered market manipulation and fraud. The organisers of these schemes can be prosecuted for their actions and are subject to civil and criminal penalties.

- Participants of such groups are likely to suffer heavy losses when the value of the pumped asset drops after the organisers sell off their holdings.

What is a Pump and Dump Scheme?

The crypto pump and dump scheme is a fraudulent practice that has become increasingly prevalent in the cryptocurrency market. This scheme involves artificially inflating the price of a particular cryptocurrency through coordinated buying and then quickly selling it at a profit, leaving unsuspecting investors with significant losses. The perpetrators of these schemes typically target low-volume cryptocurrencies that are more susceptible to manipulation.

Why are these schemes so popular in crypto? Well, since the crypto world is decentralised and people can remain anonymous, the perpetrators of this fraud can rarely be identified. Moreover, the entire process can be accomplished in just a matter of hours from your phone or PC, in just a couple of clicks. This makes such schemes very attractive to all sorts of fraudsters.

How Does Crypto Pump and Dump Happen?

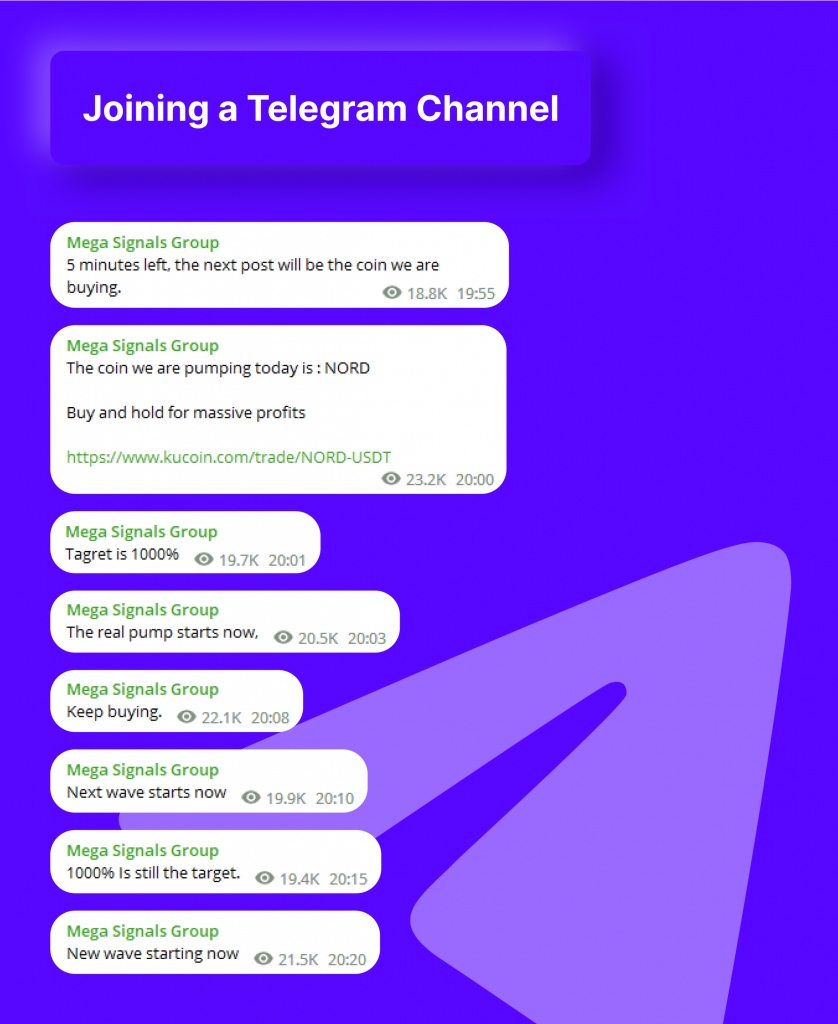

There are many Telegram and Discord “signal” communities, among which members collaborate to increase a specific cryptocurrency’s value. Through these groups, the whole coordination of the scheme happens.

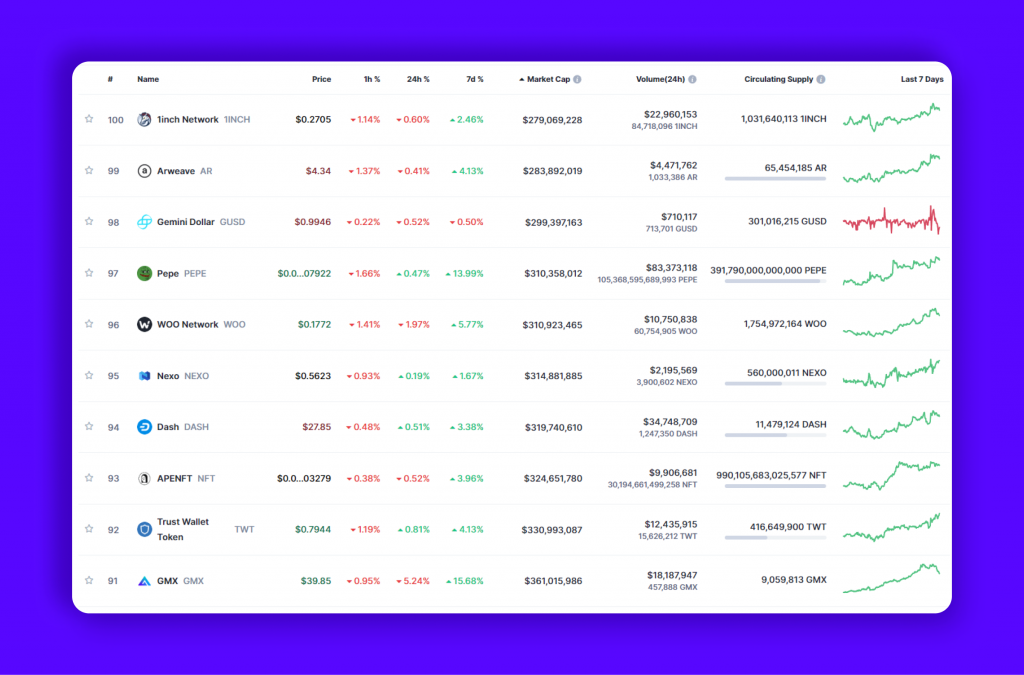

The first step in a crypto pump-and-dump scheme is identifying a cryptocurrency with low liquidity and market capitalisation. These cryptocurrencies are easier to manipulate as even a small influx of funds can significantly impact their price.

Once the target low-market-cap coin is chosen, the schemers post info on the token in their own channel so that the group members begin to actively buy it in large quantities at a low price, creating an artificial demand and driving up the price. This sudden surge in price catches the attention of other investors who believe that there must be some valuable information driving the price increase.

As more investors jump in, hoping to ride the wave and make a quick profit, the schemers continue to buy more of the target cryptocurrency, further driving up the price. At a certain point, when the price has reached its peak and enough investors have invested in the cryptocurrency, the schemers begin to sell off their holdings quickly. This triggers a panic among other investors who start selling as well, resulting in a dramatic drop in value.

The individuals behind the pump-and-dump scheme make substantial profits by selling their holdings at the peak of the pump, leaving other investors with significant losses. The scheme relies on creating hype and manipulating market sentiment to attract unsuspecting investors who believe they are getting in on a lucrative opportunity.

Joining a Telegram Channel

One way to participate in a crypto pump is by joining a pump and dump group on Telegram. These groups serve as platforms for members to coordinate their efforts in inflating the value of a specific cryptocurrency and subsequently selling it for a profit. Some popular groups on Telegram include Mega Signals Group, Pump Signals, WallstreetBets, KuCoin Pumps, and more.

It is important for you to be aware that pump-and-dump schemes carry a great deal of risk, with many people losing their money in these schemes. Before joining a group like this, it is recommended that you do extensive research and weigh the risks involved.

Joining a Pump and Dump Discord Server

Additionally, there are discord servers where you can join crypto pumps. Such communities usually offer trading tips to their members besides pump signals. Also, unlike Telegram, Discord actually gives you an opportunity to interact with other users.

While these servers may seem like a more legitimate option compared to Telegram groups, it is important to exercise caution and conduct thorough research before participating in any pump-and-dump activities. Some of the most famous groups on Discord for crypto pump and dump include AXION Crypto-Community, Cryptohub, and others.

Fast Fact

According to the SEC study, on average, investors lose about 30% of their investment in pump-and-dump schemes, with some losing over 60%.

Utilising a Crypto Pump App

The use of crypto pump apps may be a good option for those interested in crypto pumping. With Crypto Pump Finder, for example, traders can track their crypto portfolios, analyse markets, receive signals, and receive alerts. These apps can help individuals stay updated on the latest pump and dump opportunities.

However, it is crucial to exercise caution when using such apps and to conduct thorough research. Many of these apps may not have been thoroughly vetted and may contain malicious code. Additionally, these apps may not be reliable and may provide inaccurate information.

Risks And Consequences of Crypto Pump and Dump Schemes

Before asking yourself “Where can I join a crypto pump?”, it is crucial to understand the risks associated with cryptocurrency pump and dump schemes. These risks can have serious implications and potentially lead to financial losses.

Here are some key risks to consider:

Financial Losses

One of the main dangers associated with participating in a crypto pump-and-dump community is the potential loss of funds. These communities manipulate the value of a cryptocurrency, giving rise to an artificial perception of demand. Consequently, when the price eventually drops, investors who purchase at the inflated rate may encounter substantial financial setbacks.

Unethical and Illegal Activities

Crypto pump-and-dump groups are known for unethical practices and potential criminal activity. In certain jurisdictions, engaging with these groups is viewed as market manipulation, which is a violation of securities laws. Regulatory agencies, such as the United States Securities and Exchange Commission (SEC), have actively pursued legal action against individuals and organisations connected to pump-and-dump schemes in the crypto market.

Scams

There are numerous fraudulent groups that engage in crypto pump-and-dump schemes, preying on unsuspecting investors. These scammers frequently exploit chat groups on popular platforms such as Discord and Telegram to promote unfamiliar cryptocurrencies and lure others into participating in their deceptive activities. Unfortunately, falling victim to these scams can have dire financial implications for the individuals involved.

Is It Legal to Participate in Crypto Pump and Dump Schemes?

Engaging in crypto pump and dump activities can lead to serious legal ramifications. Those who are part of such activities, including both the organisers and participants who knowingly manipulate the market, could be subject to penalties under securities laws. These repercussions may comprise monetary fines, forfeiture of profits, and potentially even imprisonment.

Pump-and-dump schemes are inherently illegal due to their misrepresentation and fraudulent nature. Regulatory bodies, like the SEC, have taken decisive action against individuals and groups involved in such schemes. The legal penalties associated with pump-and-dump activities are designed to deter individuals from engaging in market manipulation.

An example of legal consequences in place is a case from Deventer, Netherlands, which saw three individuals arrested for masterminding a pump-and-dump scheme. Law enforcement swiftly took action by confiscating property, vehicles, computers, and the cryptocurrencies linked to the suspects involved in this fraudulent scheme.

Another example is this case, where a group of people with over 1.5 million followers on Twitter were arrested for a ‘pump and dump’ scheme they allegedly conducted through popular social media platforms. Millions of dollars were lost by investors as a result of their actions.

Chainalysis estimated that there have been nearly 9,900 different suspected fraudulent pump-and-dump tokens as of 2022, with investors spending $4.6 billion on them.

Crypto pump-and-dump schemes have the potential to harm the reputation of the broader cryptocurrency market, impeding its overall growth and discouraging new potential investors. These schemes cast doubt and speculation over legitimate cryptocurrencies and blockchain projects, causing a shadow that even affects the value of credible coins.

Before participating in any pump-and-dump group, you should be familiar with the laws and regulations in your jurisdiction. Research thoroughly, consult trusted sources, and make informed decisions to ensure that you are not subjected to any legal penalties.

Alternatives to Crypto Pump and Dump Schemes

Despite the lure of quick profits offered by crypto pump-and-dump schemes, it can be extremely risky. However, there are ethically and financially safer investment strategies you can consider:

Investing for Long Term

One alternative to consider is long-term investing. Instead of chasing short-term gains through pump-and-dump schemes, long-term investing focuses on holding onto cryptocurrencies for an extended period. This approach allows you to ride out the market fluctuations and benefit from the overall growth of the cryptocurrency market.

As long as you carefully select projects with solid fundamentals, you can potentially enjoy significant returns over time without the stress and risks associated with pump-and-dump schemes.

DeFi Opportunities

Another exciting alternative is decentralised finance (DeFi). DeFi has gained tremendous popularity in recent years due to its ability to provide financial services without relying on traditional intermediaries like banks. DeFi platforms allow users to lend, borrow, and earn interest on their crypto assets in a secure and transparent manner. As of September 2023, more than $70 billion in crypto assets are locked in over 1,800 DeFi protocols.

By taking part in DeFi activities like staking, liquidity mining, and yield farming, users can generate income from their crypto holdings. The DeFi ecosystem is constantly evolving, offering a wide range of innovative opportunities for crypto enthusiasts.

Fund-Raising Opportunities

If you’re looking for a more hands-on approach, you might consider participating in Initial Coin Offerings (ICOs), Initial Exchange Offerings (IEOs), and Initial DEX Offerings (IDOs). These fundraising methods allow you to invest in promising blockchain projects at an early stage. According to the ByBit data, more than 2365 IDOs have taken place since 2018, raising more than $1.6 billion in total.

If you do thorough research and choose projects with strong teams and innovative ideas, you can potentially get in on the ground floor of the next big thing in the crypto world. While ICOs, IEOs and IDOs do come with their own risks, with ICOs being the most risky approach among all, these methods are a more legitimate and regulated way to invest in the future of blockchain technology than pump-and-dump schemes.

Other Opportunities (DCA, algo trading)

Lastly, you could explore strategies like dollar-cost averaging or algorithmic trading.

Dollar-cost averaging involves regularly investing a fixed amount into a cryptocurrency over time, regardless of its current price. This approach helps mitigate the impact of market volatility and allows you to accumulate more coins when prices are low.

On the other hand, algorithmic trading involves using computer algorithms to execute trades based on predefined strategies. This automated approach eliminates human emotions from the equation and can potentially generate consistent profits over time.

Last Thoughts

In conclusion, while joining a crypto pump may seem tempting, it is crucial to approach this practice with caution and awareness. Don’t forget that pump-and-dump groups carry significant financial risks and legal consequences.

Make sure to conduct thorough research, exercise caution, and seek advice from trusted sources before investing your money into any type of investment. Invest responsibly in cryptocurrencies by staying informed, vigilant, and taking measures to protect yourself.

FAQs

How legal are pump-and-dump groups?

Crypto pump-and-dump groups are generally considered to be illegal in most countries due to the potential for financial manipulation and fraud. The US SEC has warned investors to be wary of pump-and-dump schemes, as they can be used to manipulate the market and artificially inflate prices. To protect investors, many countries have put in place regulations that prohibit such activities. However, as cryptocurrencies are not regulated by any central body, pump-and-dump groups can still operate in a largely unregulated environment.

How do you detect a crypto pump when trading?

There are some signs to look out for that may indicate a pump and dump is taking place. These include sudden and extreme price movements, large buy orders, and a sudden increase in trading volume. Additionally, suspiciously high-priced coins and coins with low liquidity should also be avoided.

How profitable are crypto pump-and-dump schemes?

Crypto pump and dump schemes can be very profitable for the people who initiate them, as they can buy the currency at a low price and then quickly sell it at a higher price. However, these schemes are often highly risky and can lead to significant losses for those who invest in them.