Who Is John J. Ray III, the New CEO of FTX? — The Fate of FTX

In November 2022, the crypto industry was shaken by the collapse of FTX, one of the leading cryptocurrency exchanges at that time. As investigations into the company’s downfall and its former head, Sam Bankman-Fried, began, all eyes turned to the platform’s newly appointed CEO, John J. Ray III.

With a distinguished legal career spanning over three decades, Ray is no stranger to high-profile bankruptcy cases. In fact, his expertise in restructuring and salvaging collapsed companies has earned him a reputation as one of the top restructuring experts in the business.

In this article, we will take a closer look at John J. Ray III, his past achievements, and what we can expect from him as the new CEO of the infamous trading platform.

Key Takeaways:

- John J. Ray III is an experienced lawyer and restructuring expert who was recently appointed as the new CEO of the FTX cryptocurrency exchange.

- Ray was a key player in Enron’s bankruptcy proceedings and was praised for his successful efforts in salvaging the company’s remaining assets.

- FTX is a cryptocurrency exchange that suffered a major collapse due to financial mismanagement and fraud allegations.

Who Is John J. Ray III?

John J. Ray III is a highly accomplished lawyer and expert in restructuring troubled companies. He has played a pivotal role in managing the consequences of some of the biggest corporate failures in modern history, such as Enron’s collapse after its infamous accounting scandal in 2001.

Education and Early Career

Born and raised in Pittsfield, Massachusetts, Ray developed a strong interest in the field of law at an early age. He attended the University of Massachusetts, where he pursued a major in Political Science and also served as an intern in the office of Democratic Senator Ted Kennedy.

After graduating from university in 1980, Ray went on to earn his law degree from Drake University, where he honed his skills and expertise in the legal field. After that, he began his career at an accounting firm. However, his true calling and passion for the legal world led him to join the prestigious global law firm Mayer Brown in 1984.

Despite his success, Ray also explored other industries and had a brief stint in the waste management business. However, his true passion lay in bankruptcy and restructuring, which he eventually returned to and focused on extensively.

The Fruit of the Loom Case

Ray’s career as a corporate bankruptcy lawyer began at Fruit of the Loom, where he faced the challenging task of managing the company’s bankruptcy proceedings.

In 1998, he was appointed as the general counsel of this company. As general counsel, he led the legal team in implementing various strategies to reduce debt and recover funds for stakeholders.

One of the key tactics he used was halting payments to vendors, a controversial move that ultimately proved beneficial to the business. Ray also took legal action against the former CEO, William F. “Bill” Farley, who had been accused of financial mismanagement.

Fast Fact

Farley had been ousted from his position in 1999, as he had led the company into massive debt through unproductive business ventures and even restructuring it as an off-shore entity in the Cayman Islands to avoid taxes.

Perhaps one of his most significant achievements at Fruit of the Loom was orchestrating the sale of assets to Warren Buffet’s Berkshire Hathaway Corp in 2002. This not only helped recoup significant funds for the company but also saved thousands of jobs in the process.

The success of Ray’s strategies at Fruit of the Loom solidified his reputation as a skilled and strategic corporate bankruptcy lawyer. It also paved the way for him to start his own firm, Avidity Partners LLC, where he continued to handle high-profile bankruptcies with great success.

The Role of Corporate Bankruptcy Lawyers

What does John J Ray III law firm Avidity Partners LLC do? Corporate bankruptcies can be complex and daunting processes, requiring the expertise of a skilled bankruptcy lawyer. These lawyers guide companies through financial distress and find solutions to help them get back on their feet.

One of the key responsibilities of a corporate bankruptcy lawyer is to analyze the financial situation and advise clients on possible courses of action. This includes negotiating with creditors, filing for bankruptcy protection, and developing restructuring plans.

In addition to handling legal matters, bankruptcy lawyers also act as advisors and advocates for their clients. They provide guidance on how to navigate the complexities of the bankruptcy process and represent their clients’ interests in court.

The Enron Case: A Turning Point

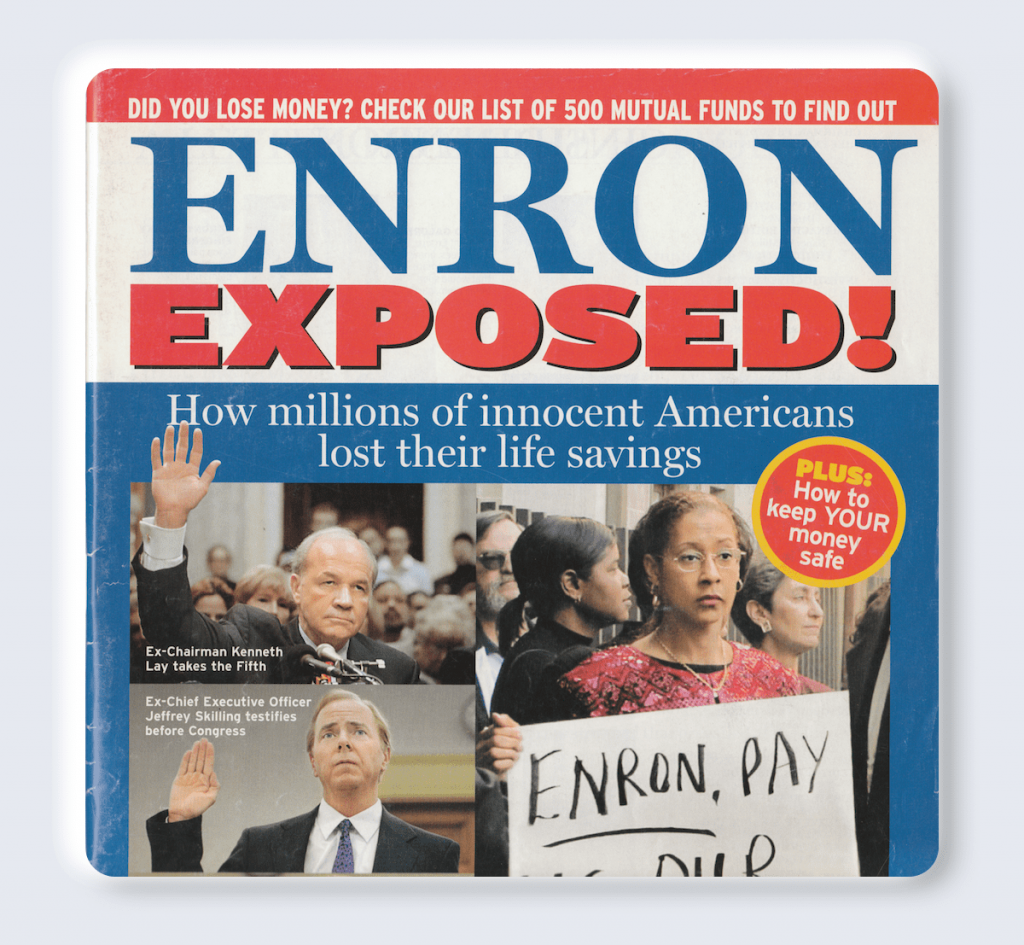

One of the most significant cases in John J. Ray III’s career was his involvement in the Enron bankruptcy. Enron, an energy-trading company, collapsed in 2001 amidst a massive scandal.

Prior to its downfall, Enron had been hailed as one of America’s most innovative companies with a skyrocketing stock price. However, behind the facade of success, the company was riddled with fraudulent accounting practices and a toxic corporate culture.

When Ray stepped in as CEO in 2004, he faced the daunting task of leading Enron through its bankruptcy proceedings and repairing its damaged reputation.

The Enron case was highly complex, involving the sale of numerous assets, energy contracts, and business units to repay creditors and stakeholders who had suffered substantial losses. Ray and his legal team worked tirelessly to recover creditors’ assets. Their efforts paid off when they successfully negotiated agreements with the banks implicated in Enron’s downfall, resulting in the recovery of over $22 billion of funds. This was no small feat, considering the complexity and magnitude of the problem.

The Enron case brought to light the need for increased transparency and accountability in corporate practices. It sparked discussions about ethical standards and regulatory reforms, ultimately leading to stricter regulations for businesses.

Ray’s role in the Enron case not only showcased his exceptional legal skills but also gained him a reputation as a champion for solving hard bankruptcy cases in the corporate world. The case illuminates why appointing John J Ray III Enron as the new FTX’s CEO is such a big deal.

What is FTX?

FTX is a cryptocurrency exchange that was founded by Sam Bankman-Fried in 2019. Bankman-Fried, often referred to as SBF, quickly became a prominent figure in the crypto space, gaining massive attention and amassing a net worth of $26.5 billion at the peak of his wealth.

His exchange was viewed as a rising star of crypto. Prior to its collapse, it was the third-largest crypto exchange on the market, with millions of users utilizing its services. It gained popularity by offering high returns and attracting high-profile endorsements from celebrities like Tom Brady, Stephen Curry, and Shaquille O’Neal.

FTX made headlines by acquiring high-profile partnerships, investing heavily in marketing campaigns, and promising higher yields for users compared to traditional banks. FTX’s valuation soared to $32 billion, and it even secured the naming rights to the Miami Heat Arena, signing a 19-year deal worth $135 million.

How FTX Collapsed

However, in November 2022, FTX experienced a fast downfall. The controversial exchange faced numerous accusations from various stakeholders, including users, regulators, media, and industry experts. The former CEO of FTX has been charged and is currently on trial. But what exactly happened?

Signs of Trouble – November 2

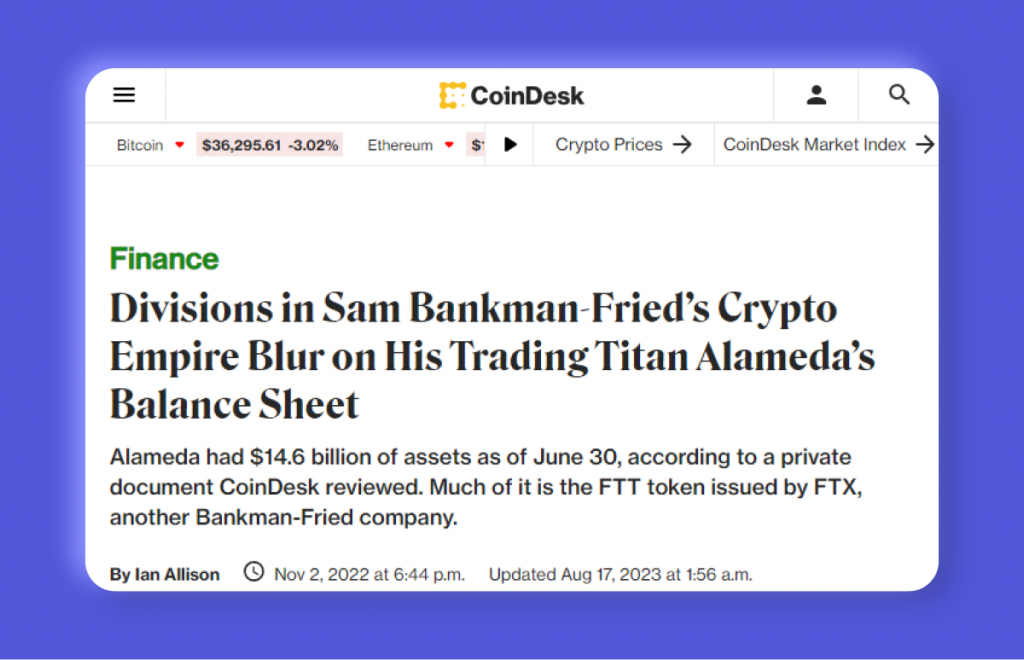

FTX encountered its first signs of trouble on November 2nd when CoinDesk published an article expressing concern about the company’s financial stability.

The article shed light on the fact that FTX’s primary asset, FTT, was being utilized as collateral on the balance sheet of the Alameda Research trading company and the FTX exchange, both of which were founded by SBF, thereby exposing clients to significant risks. This revelation sparked apprehension regarding FTX’s capital and its potential impact on customer repayment.

Binance Sells FTT Holdings – November 6

Just a few days later, on November 6, the head of Binance, a rival crypto exchange and the largest crypto trading platform in the world, announced that the company would be selling around $530 million worth of FTT tokens. The move was a direct response to the concerns raised in the CoinDesk article.

The announcement itself led to a sharp drop in the price of FTT tokens and sparked panic among FTX users, who rushed to withdraw their funds from the platform.

Liquidity Crunch and Withdrawal Freeze

As a consequence, the cryptocurrency trading platform faced a massive liquidity crunch that left investors in a state of confusion and uncertainty.

The platform was unable to cope with the overwhelming number of requests. In just 72 hours, FTX received an estimated $6 billion in withdrawal requests, a number that far exceeded its reserves.

This created a liquidity crunch for the platform, meaning that it did not have enough funds to fulfill all the orders. As a result, FTX was forced to pause withdrawals, leaving many investors unable to access their funds.

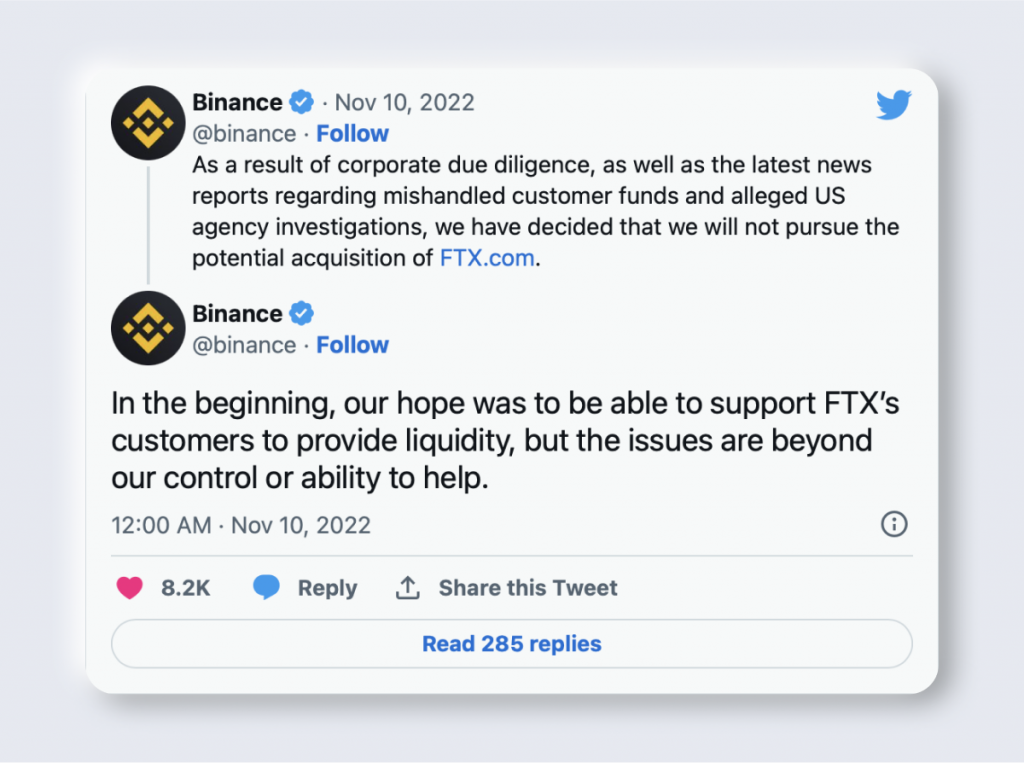

Failed Acquisition Attempt by Binance – November 8

In an attempt to rescue FTX from its liquidity crisis, Binance announced on November 8 that it had reached a non-binding agreement to acquire the struggling exchange.

However, due diligence conducted by Binance revealed concerns about FTX’s handling of customer funds and ongoing investigations by U.S. regulatory agencies. As a result, Binance backed out of the deal, leaving FTX in an even more unstable position.

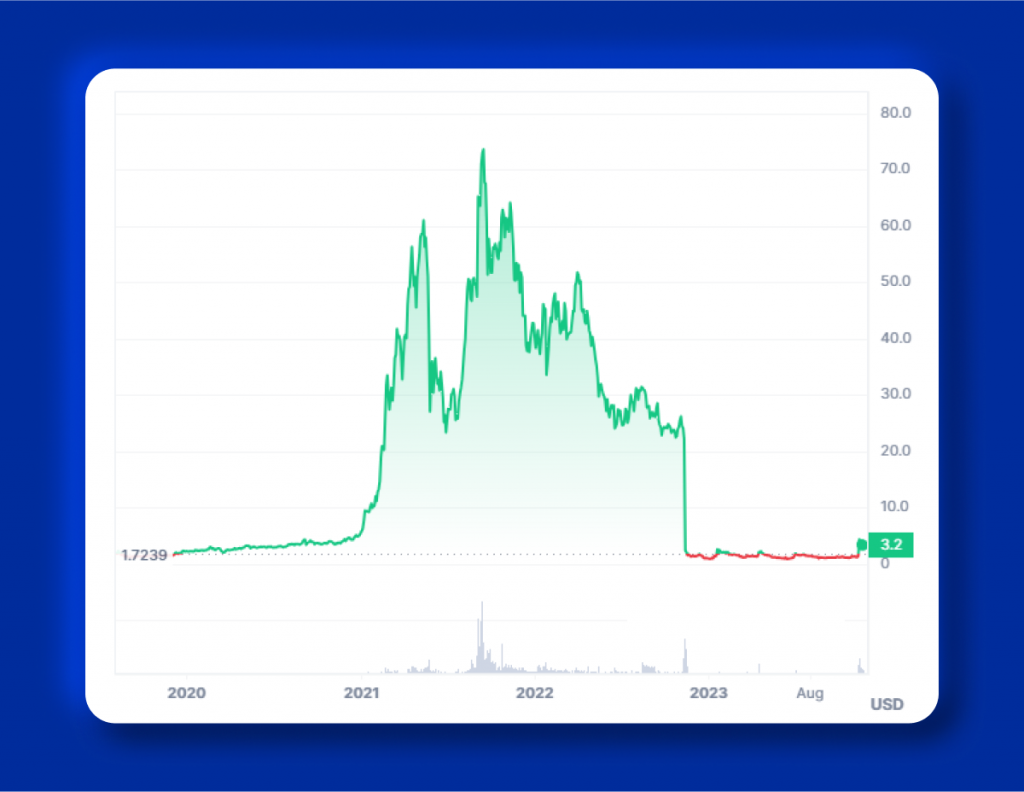

In just two days, the FTT token dropped by 85%. Though it has recovered some of its value since then, the token no longer has any use and may be liquidated by the company in order to settle its debts as a part of FTX bankruptcy proceedings.

FTX Files for Bankruptcy – November 11

Unable to withstand the mounting pressure and facing a severe liquidity crisis, FTX was left with no choice but to file for bankruptcy on November 11. The collapse of FTX sent shockwaves through the entire crypto industry, leaving many investors and stakeholders reeling from the sudden turn of events.

As per Chainalysis data, the FTX collapse has led to a staggering $9 billion in losses for its customers. However, the consequences are likely to be much more severe.

The Impact on the Crypto Industry

The collapse of FTX had far-reaching consequences beyond the exchange itself. As a major player in the crypto market, it was deeply interconnected with other platforms and businesses, creating a domino effect when it fell. One such platform was BlockFi, a popular crypto lending platform that had significant exposure to FTX.

In the aftermath of FTX’s collapse, BlockFi made the difficult decision to suspend customer withdrawals in order to assess the impact and mitigate any further losses. However, this was not enough to save BlockFi from the fallout. The platform eventually filed for bankruptcy, further compounding the turmoil in the crypto market.

The collapse of FTX has been deemed a major turning point for the cryptocurrency industry, being compared to infamous corporate scandals like Enron. This event has triggered far-reaching implications, including heightened scrutiny from regulators, diminished trust in centralized platforms, and the introduction of proof-of-reserves mechanisms.

John J. Ray III: The New CEO of FTX

Following bankruptcy FTX, John J. Ray III stepped into the role of CEO on November 11th. In the days that followed, Ray revealed that the cryptocurrency exchange represented the largest accounting failure he had encountered throughout his career.

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here,” he wrote in the filing.

Ray’s appointment as CEO of FTX holds significant importance for the troubled exchange. His reputation as a turnaround expert and his track record of successfully recovering funds for creditors make him an ideal candidate to salvage the collapsed exchange. Through his experience managing large corporate bankruptcy cases and a commitment to transparency and compliance, Ray aims to rebuild trust with customers, investors, and regulators.

Fast Fact

Mr. Ray and the other members of FTX’s new leadership have made it clear that they are separate from Mr. Bankman-Fried. In the bankruptcy court filing, they stated that Mr. Bankman-Fried is not employed by the debtors and does not represent them.

What’s Next?

With John J Ray III lawyer at the helm, FTX is undergoing a comprehensive restructuring process. Ray’s immediate focus is on addressing the liquidity crisis and regulatory scrutiny faced by the exchange.

As part of the restructuring efforts, Ray has already recovered over $7.3 billion in cash and liquid crypto assets for FTX. This recovery process has shed light on various concerning practices within the exchange, including the misuse of corporate funds and inadequate accounting and auditing teams.

One of the main focuses has been on restoring trust in FTX by improving transparency and compliance measures. Ray has brought in a new team of experienced professionals to handle accounting and auditing processes. The team started a thorough review of corporate funds and started to implement stronger oversight from the board of directors. In terms of regulation, FTX is actively working with authorities to ensure full compliance and prevent any future scrutiny.

But it’s not just about fixing past mistakes – FTX CEO John J. Ray III is also determined to take the exchange to a whole new level. With his expertise in corporate restructuring, he plans on relaunching the exchange as a more fair and balanced platform.

Ray’s remarkable track record in managing significant corporate bankruptcies undeniably positions him as one of the most qualified candidates for the role.

FAQ

Why did FTX collapse?

The collapse of FTX was caused by a combination of factors, including a report that revealed that Alameda Research, run by Mr. Bankman-Fried, held an abnormally large amount of FTT tokens. This revelation caused major holders of the token, like Binance, to sell their holdings, resulting in a run on the exchange as customers rushed to withdraw their funds. In the long term, FTX ultimately failed due to poor corporate controls, lack of trustworthy financial information and fraudulent practices.

How much money did FTX lose?

It was discovered that $8.9 billion in customer assets were missing from FTX.

What is the biggest crypto exchange today?

The biggest crypto exchange today is Binance, with a daily spot trading volume of over $14 billion.