What Are Ethereum Gas Fees? Why Are They So High?

In the 21st century, no developed person is surprised to pay a service fee in any field and leave tips for the service staff. Of course, blockchain and crypto space would not be an exception. The second-largest blockchain platform, Ethereum, functions on a complex fee system known as a gas fee. They are important in streamlining transactions, operating smart contracts, and defending the network’s safety. Let’s examine the sophistication of Ethereum gas fees and find out essential concepts and the factors impacting gas prices.

Key Takeaways:

- Ethereum gas fees, paid in ETH, are critical for facilitating transactions and defending network security.

- The gas fee is affected by network demand, block size, transaction difficulty, imperativeness, and external events.

The Essence of Ethereum Gas Fees

First of all, let’s determine what ETH is. It is a transactional token that streamlines operations on the Ethereum network. While ETH is the digital coin of the Ethereum network, metaphorically speaking, it is more accurate to refer to it as the “fuel” of the network.

Gas fees are something like salary for stakers and validators. They acquire them as compensation for their role in conducting transactions on the Ethereum network. The gas fee is essential for executing various actions, including sending ETH, minting non-fungible tokens (NFTs), and running decentralised applications (dApps).

The scope of the gas fee is:

- Resource Share: The gas fee prevents network misuse by guaranteeing that users pay for the computational resources they use. This supports effective resource allocation and prevents denial-of-service attacks.

- Motivation: As mentioned above, validators on the Ethereum network are rewarded with gas fees for processing and validating transactions. The gas fees act as an encouragement for validators to maintain the network’s safety.

These expenses vary depending on network demand. During high “traffic”, users may experience higher gas prices as they compete to process their transactions quickly. Conversely, during periods of lower demand, gas fees may be lower.

The Structure of Gas Fees

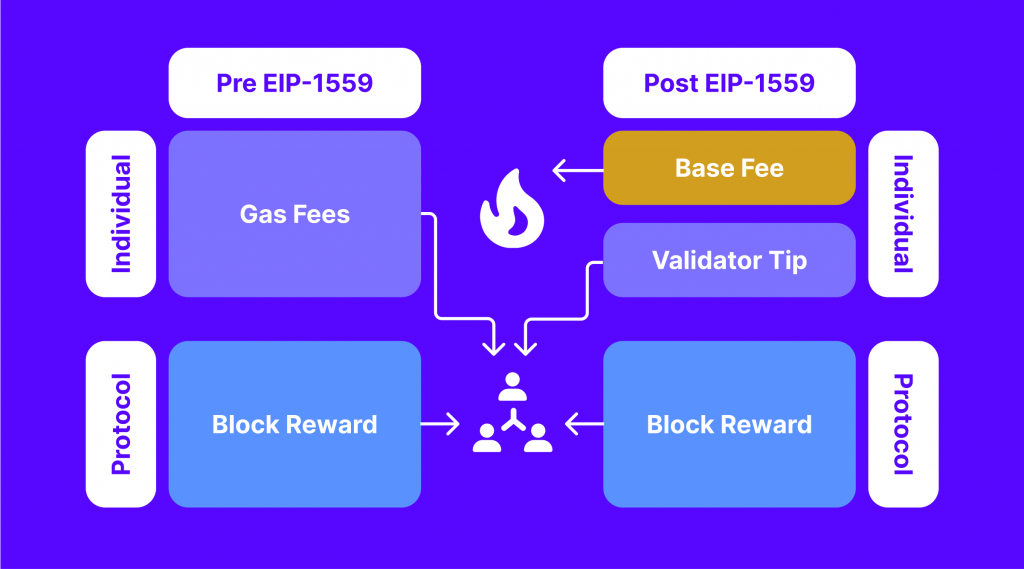

In the beginning, ETH gas fees were calculated slightly differently than nowadays. Changes took effect in August 2021 when the Ethereum Improvement Proposal (EIP)-1559 was introduced. This upgrade changed the structure of gas fees by introducing a “base fee + tip” mechanism. The primary goals of EIP-1559 were to improve the predictability of transaction fees and make the fee market more efficient.

Under the EIP-1559 model:

1. Base Fee: is a component of the burned transaction fee, meaning it is removed from circulation, reducing the overall supply of Ether. The base fee is dynamically adjusted based on network congestion. It is determined algorithmically and is designed to increase or decrease to keep block sizes within a target range.

2. Tip: users can still include a priority tip along with the base fee to incentivise validators to prioritise their transactions. The tip goes directly to them as an additional reward and is not burned like the base fee.

This structure aims to provide users with a more predictable fee environment. Users can specify this priority fee to influence the preference of their transactions, but the base fee is the primary mechanism for adapting to network crowding.

Fast Fact

According to IntoTheBlock, the gas fees for Ethereum typically reach their lowest levels during weekends (UTC time), especially from 12 AM on Saturday to 12 PM on Sunday. This is the time when it’s Friday night in the U.S. and Saturday morning in Asia and Europe.

Factors Influencing ETH Gas Fees

Gas fees on Ethereum are subject to market dynamics. The cost of Gas is impacted by the complexity of transactions, network jams, and the overall demand for Ethereum block space. Gas fees tend to fluctuate based on the day of the week and time of day, with off-peak hours generally offering lower fees. Gas fee calculators and trackers, such as those integrated into wallets like MetaMask, help users control and optimise transaction costs.

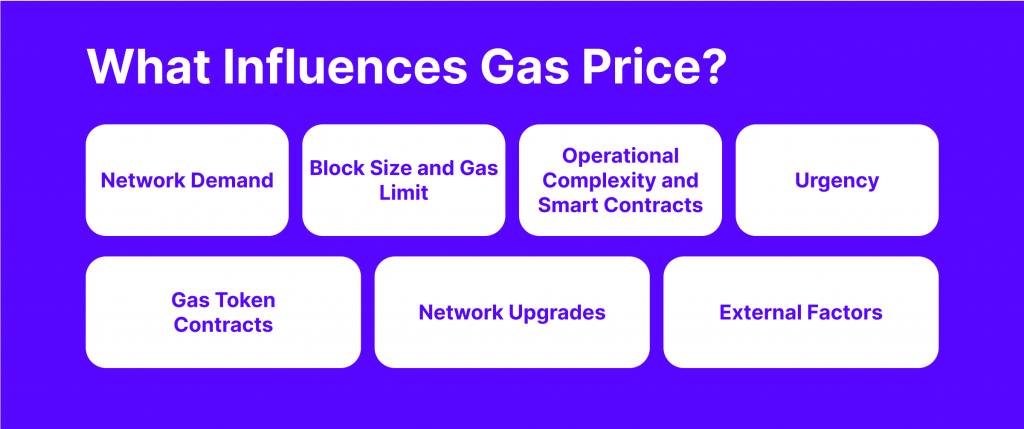

Here are the key factors influencing gas fees on the Ethereum network:

- Network Usage: Gas fees tend to rise during periods of high network demand. When many transactions are waiting to be processed, users compete by offering higher tips to have their transactions prioritised by validators.

- Block Size and Gas Limit: Each block in the Ethereum blockchain has a maximum size, and the validator groups transactions into blocks. The gas limit per block constrains the total amount of computational work that can be included in a block. If the request for processing exceeds this limit, users may need to augment their gas prices to compete for block inclusion.

- Operational Complexity and Smart Contracts: More complicated transactions and smart contract executions need additional computational resources, leading to more heightened gas fees. Operations that contain complex computations, loops, or storage changes consume more gas than simpler operations.

- Urgency: Users can modify the gas price based on how fast they want their transactions to be completed. Augmented gas prices increase the likelihood of faster confirmation, especially during periods of high demand.

- Gas Token Contracts: Gas token contracts, like the “gastoken.io” contract, allow users to buy and store gas when fees are low and use it later when costs are higher. The existence and popularity of such contracts can impact gas prices.

- Network Upgrades: Modifications to the Ethereum network, such as upgrades or improvements, can affect gas fees. For example, the transition to Ethereum 2.0, which aims to move from a proof-of-work to a proof-of-stake consensus mechanism, may affect gas fees.

- External Factors: External events, such as airdrops, token launches, or large-scale DeFi activities, can lead to sudden increases in network demand and impact gas fees.

It’s advised to monitor the Ethereum gas market, use available tools to check current gas prices and adjust transaction parameters accordingly to optimise cost and speed based on the prevailing network conditions.

Gas Fee Denominations

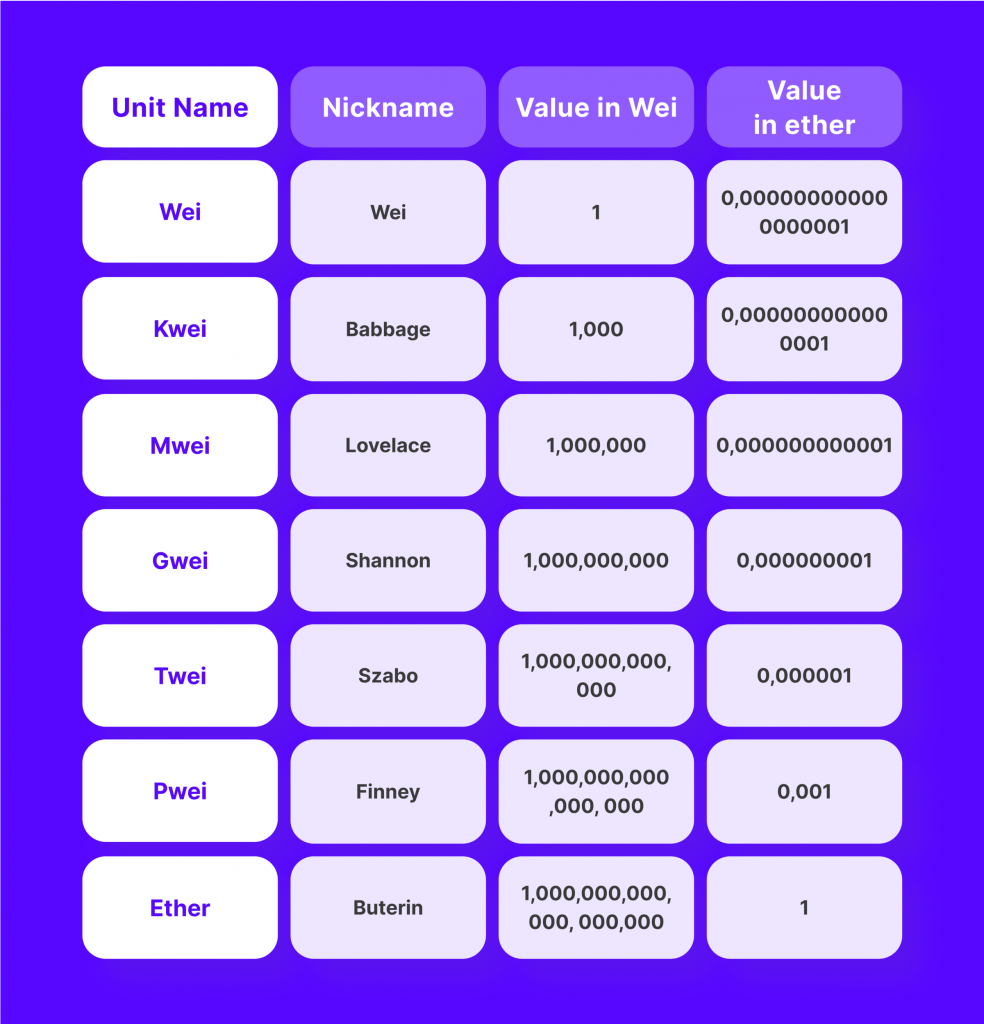

To simplify transaction cost calculations, gas fees are commonly denominated in Gwei, a smaller unit of ETH. This method helps users track current gas fees more competently. Layer-2 solutions, such as dYDX, Loopring, and Polygon, have been developed to address rising gas fees by processing transactions off-chain before settling them on the Ethereum mainnet.

To be more clear, gas is not a subunit of Ether; rather, it’s a separate unit used to measure computational effort. Gwei is a denomination of Ether, which stands for “gigawei,” where “giga” represents one billion. 1 Gwei is equivalent to 0.000000001 Ether.

Calculate Gas Fees

Calculating ETH gas fees involves multiplying the base fee (and tip if included) by the maximum gas unit limits a user is willing to pay. Including the gas limit in the calculation ensures that users pay for the actual computational resources consumed during the execution of the transaction.

Total Fee (ETH)=Base Fee+Tip×Gas Limit

Let’s go through a simple example to illustrate how are ETH gas fees calculated in Ether (ETH) using gas prices denominated in Gwei (gigawei).

Suppose you have a transaction with the following parameters:

Gas Limit: 40,000 gas

Gas Price: 20 Gwei (Base Fee+Tip)

Total Fee (ETH) = 40,000×(20×0.000000001) = 40,000×0.00000002 = 0.0008

So, the total transaction fee for this example is 0.0008 ETH.

It’s important to note that this formula applies to transactions following the EIP-1559 upgrade. Users can adjust the priority fee (tip) to influence transaction preference, but the base fee remains a vital component of the total cost.

Final Remarks

It’s evident that Ethereum gas fees seem a little bit challenging for users, but their integral role in providing the network’s security and efficiency is invaluable. The evolving fee structure and advancements like Layer-2 solutions aim to balance operational expenses and network profitableness.

Day by day, the method of paying and setting gas fees on Ethereum is becoming more capable, donating to a more user-friendly experience.