Celestia Suffers The Biggest Overnight Loss: TIA Price Prediction

Celestia is a relatively new cryptocurrency that gained momentum during its first months of operations. The blockchain introduced new capabilities and features that attracted investors’ attention and interest.

However, the coin quickly dropped after the crypto market rush in March 2024 slowed down. The token struggled to maintain its pace and failed to keep the same price level it had in 2023 and early 2024. What happened to the coin? Shall you buy the crash this time?

Let’s take a closer look at TIA price prediction and see the backstory of this decline.

Celestia Crypto News

Celestia blockchain was launched in September 2023 and appeared on major crypto exchanges in November of the same year. Its development grabbed investors’ and crypto communities’ attention due to its unique offerings.

It offered a modular blockchain network that allows other crypto projects and DeFi applications to build on Celestia’s robust environment effortlessly. This model adopts TIA as the central cryptocurrency and payment method and enables other crypto utilities to use the blockchain’s core functions at low development costs and requirements.

The data sampling structure and customization tools that the network offered were the main selling points of the blockchain, spurring massive speculations and boosting the TIA price from $2 to $11 in Q4 of 2023.

TIA Crypto Price Performance in 2024

TIA continued its phenomenal growth in 2024, especially as the market was mustering for another crypto bull run amidst the BTC spot ETF approval, the Bitcoin halving event, and the ETH spot ETF negotiations.

These events saw the overall market uprise, including the Celestia coin, which peaked on February 2024 at $20, recording a significant growth from $2 less than six months earlier.

However, the TIA coin price quickly left the $20 level and kept sliding over the next months. In April, the coin slid under $10, marking a dark era for the token and rising fear among investors.

TIA Crypto Price Prediction

In August 2024, the coin slid under the $5 mark, signaling danger and a crash possibility as investors pulled out of their investments. Is the coin destined to fail? Or is it just the calm before the storm? Let’s analyze the TIA price performance and draw some predictions.

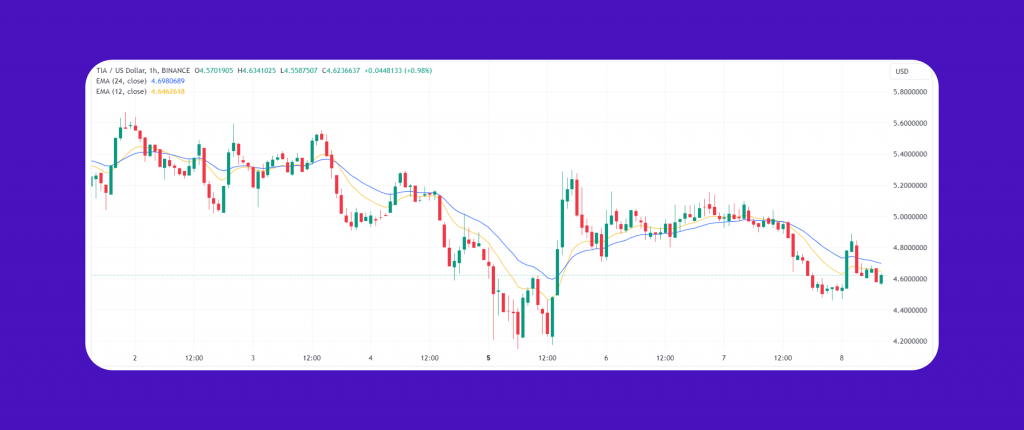

For this, we use the exponential moving average (EMA) indicator in two instances, a short-term and a long-term. Let’s start with the short-term analysis using the 12-day and 24-day EMA lines.

Here, we see that from 5 August, the upward-looking EMA lines pushed the TIA coin price line from $4.2 to $5.1 in one day, which remained until 7 August. However, the coin dropped massively, with the EMA lines pushing the price line down to under the $4.5 mark.

However, a bit of hope was restored as the EMA lines rose slightly to pick up the price from $4 to $4.8, then to $4.4, with steady EMA lines.

Now, if we look at the long-term 50- and 100-day lines, we see the market price way under the EMA lines, signaling a continued downward trend. However, on the flip side, the slope is less steep compared to that of 7 August, which can be a sign of hope that with more support and buying pressures, that coin might restore some of its lost value.

Conclusion

After growing tremendously in the few months after its creation, Celesita struggled to keep the momentum as the TIA price dropped from $20 to $10 in two months. This decline continued as the coin slid under the $5 mark in August, losing most of its value and investors’ confidence.

With a promising blockchain model and a solid offering that boosts other Web 3.0 utilities, the coin could recover and restore some of its value with some support and trust. Will the Celestia coin recover soon?

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in cryptocurrencies, including meme coins, carries ingrained risks, and individuals should conduct their own research before making any investment decisions.