Tips for Successful Crypto Portfolio Building

Building a strong crypto portfolio is not just about picking a few coins and hoping for the best. You’ve got to plan it out, spread your investments smartly, and keep an eye on things.

This article aims to provide valuable insights into creating and maintaining a robust cryptocurrency portfolio. We will explore key strategies that can help align your investments with your financial objectives and risk tolerance.

By following these guidelines, you can develop a more informed and systematic approach to cryptocurrency investing, potentially enhancing your long-term economic outcomes.

Key Takeaways

- Craft a stable foundation for your crypto portfolio by realising your risk resistance and investment goals.

- Embrace diversification by allocating your investments across different asset classes within the crypto market, including established coins, DeFi tokens, and stablecoins.

- Utilise effective portfolio management techniques like dollar-cost averaging and rebalancing to minimize risk and capitalize on market opportunities.

What is a Crypto Portfolio?

A crypto portfolio is a collection of various digital assets an investor holds. Like traditional investment portfolios, it includes different types of assets to spread risk and potentially increase returns over time.

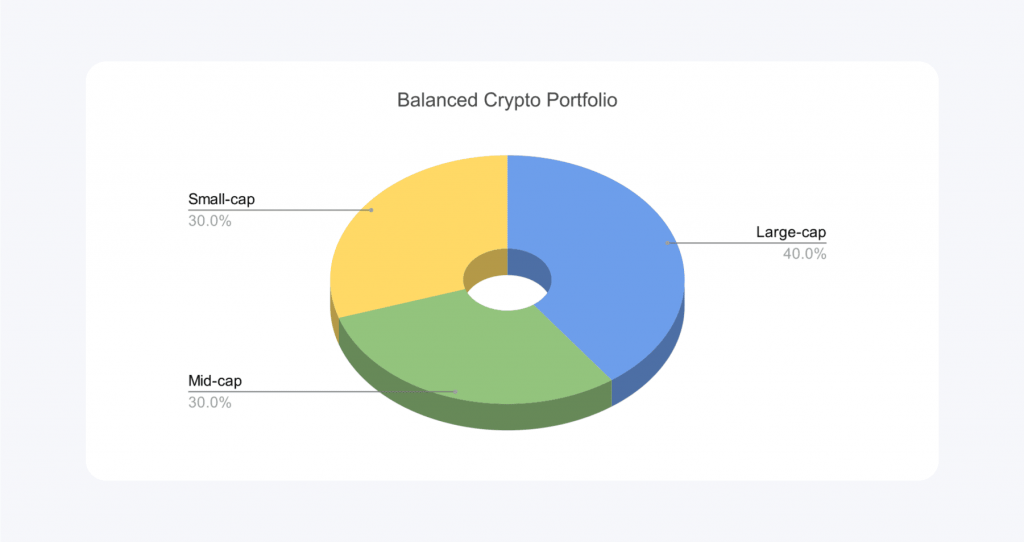

A well-balanced crypto investment portfolio refers to an investment strategy where different types of cryptocurrencies are allocated to minimize risks while potential returns are maximized.

The goal of a balanced portfolio is to spread out investments across various types of assets, reducing the impact of volatility in the highly unpredictable cryptocurrency market.

A key aspect of balance is diversification. Instead of investing all your money into one or two cryptocurrencies, a well-balanced portfolio contains a mix of different types of coins, such as:

- Large-cap coins, like Bitcoin (BTC) and Ethereum (ETH), are more established and generally less volatile.

- Mid-cap coins like Solana (SOL) or Cardano (ADA) have growth potential but come with more risk.

- Small-cap or speculative coins are newer and riskier but may offer high rewards if they succeed.

A successful crypto portfolio carefully allocates assets based on the investor’s risk tolerance:

- High-risk assets: These may include newer, smaller coins or altcoins that have the potential for explosive growth but come with higher risks.

- Low-risk assets: These include more established cryptocurrencies like Bitcoin or Ethereum that are considered less volatile.

- Stablecoins: Holding a portion of the portfolio in stablecoins like USDT or USDC provides stability since their value is tied to fiat currencies, helping protect your capital during market downturns.

A well-balanced portfolio has a clear weighting strategy, which means the investor’s financial goals determine the investment amount in each type of digital coin.

For instance, a conservative investor might allocate 50% to large-cap coins (BTC, ETH), 30% to mid-cap altcoins, and 20% to speculative coins. A more aggressive investor might lean more heavily toward speculative assets, but in both cases, the portfolio is structured to suit individual risk tolerance.

A successful crypto portfolio isn’t static; it needs regular adjustments or rebalancing. As the market changes and certain coins increase or decrease in value, rebalancing ensures that the portfolio maintains its desired structure.

For example, if Bitcoin’s value doubles and now makes up too much of the portfolio, an investor might sell some of it and reinvest in other assets to maintain balance.

A well-balanced crypto portfolio includes both long-term holds and short-term opportunities. Long-term holds may involve large-cap cryptocurrencies that are expected to grow steadily over time, while short-term opportunities can involve trading more volatile assets to capture quick profits.

By balancing between different asset classes – large-cap, mid-cap, small-cap, and stablecoins – a well-balanced portfolio reduces the risk of losing a significant portion of investment due to the volatility of a single coin. It also allows for diverse growth opportunities, as not all coins simultaneously move in the same direction.

Fast Fact

Key strategies for effective crypto portfolio allocation include diversification across different currencies, considering market capitalization, and investing in various sectors like DeFi, NFTs, and smart contract platforms.

Building a Millionaire Crypto Portfolio

While there’s no guaranteed path to becoming a crypto millionaire, successful investors often share these traits:

- They focus on the long-term potential of projects rather than short-term price fluctuations.

- They stay informed about market trends and new technologies.

- They diversify their portfolios and never invest more than they can afford to lose.

- They understand that building wealth takes time, and they avoid making impulsive decisions based on FOMO (fear of missing out) or FUD (Fear, uncertainty, and doubt).

Here are crypto portfolio tips and a step-by-step guide to building a winning one for your success.

Realize Your Investment Goals

Before diving into crypto investing, define your objectives. Are you looking for long-term growth, short-term gains, or a mix of both? Your goals will guide your investment strategy and risk tolerance.

Understand Your Risk Tolerance

Crypto investments are inherently volatile, and while they offer high-reward opportunities, they also carry substantial risks. Your risk profile will dictate the composition of your crypto portfolio, including the percentage of high-risk assets like emerging altcoins or governance tokens, compared to more stable assets like Bitcoin and Ethereum.

A clear understanding of your risk appetite will help you make informed decisions about how much capital you allocate to digital assets.

This is particularly important in a market as unpredictable as the crypto sector, where market conditions can change rapidly. High-risk assets may yield high returns but can also cause significant losses. Therefore, balancing your portfolio based on your risk profile is key to achieving long-term success.

Mix Your Crypto Portfolio

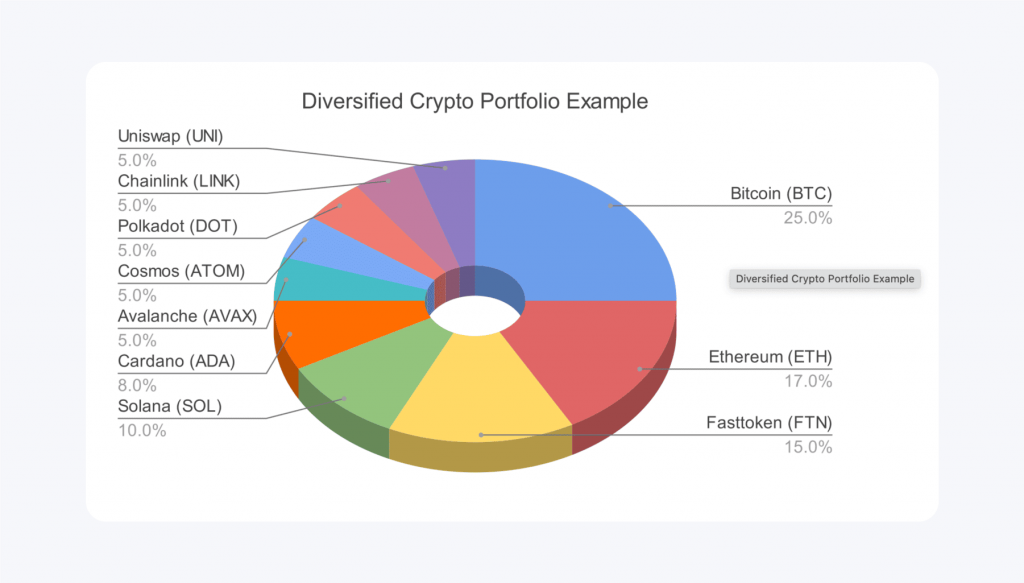

A well-balanced crypto portfolio involves diversification across various crypto assets. Limiting your exposure to just one asset class, such as Bitcoin, may limit your growth potential and increase the overall risk of your portfolio.

Including different assets such as Ethereum, stablecoins, and other altcoins helps spread the risk and allows you to gain exposure to various segments of the crypto market.

Diversification strategies also involve mixing high-risk and stable assets. For instance, Bitcoin and Ethereum are considered safer assets than emerging tokens.

However, adding governance tokens, security tokens, and utility tokens from different blockchain projects can offer growth potential and risk mitigation.

This kind of portfolio diversification ensures that no single asset dominates your entire portfolio and protects you from market volatility.

Practice Dollar-Cost Averaging

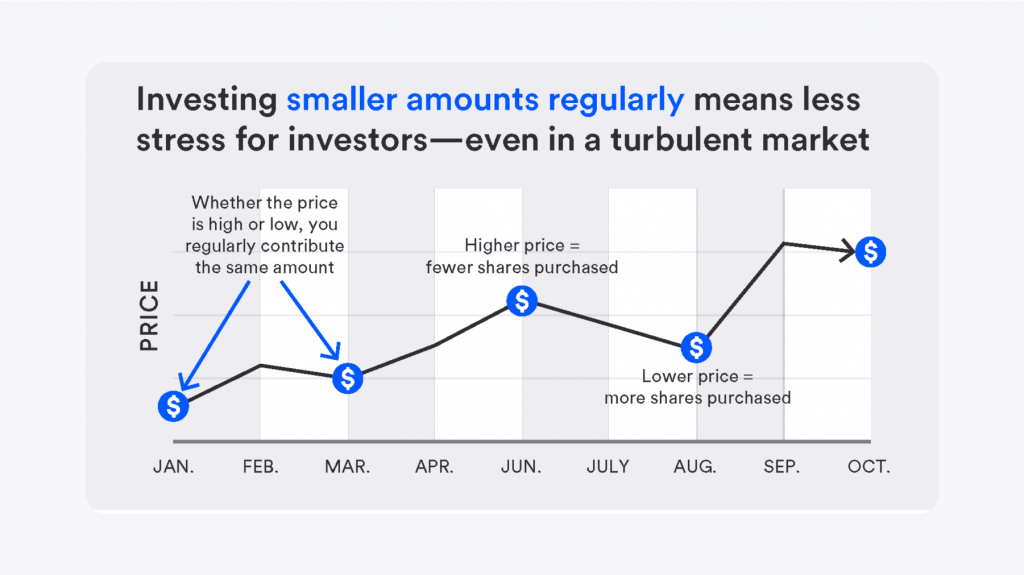

One of the most reliable crypto portfolio tips is to practice dollar-cost averaging (DCA). This investment strategy involves regularly buying a fixed amount of cryptocurrency, regardless of market conditions.

Doing so prevents you from trying to time the market and spread out your investment risk over time. DCA is particularly effective in crypto, where market volatility can make lump-sum investments risky.

Dollar-cost averaging also helps you stay consistent with your crypto project plan and minimizes emotional decision-making, often leading to buying high and selling low during market swings.

Implementing DCA into your crypto portfolio management strategy can help you steadily build your crypto holdings without exposing yourself to the risks associated with large, one-time purchases.

Use Portfolio Tracking Tools

Monitoring your portfolio’s performance using a crypto portfolio tracker becomes essential as it grows. The best free crypto portfolio tracker will allow you to monitor real-time price changes, market opportunities, and overall portfolio performance.

You can also utilize crypto portfolio management software, which offers advanced features like risk assessment, asset allocation suggestions, and tax reporting.

A portfolio tracker will help you stay on top of your investments and ensure that your portfolio remains correctly balanced as you add new assets. These tools also allow you to make necessary adjustments based on market trends or your changing investment goals.

Stay Updated

Successful crypto investors continuously stay updated on the latest developments in the crypto space. The cryptocurrency market constantly evolves, with new crypto projects, smart contracts, and blockchain technology emerging regularly.

As part of your investment strategy, make sure to conduct your own research before making any new investments. Keeping an eye on market leaders and exploring market conditions can provide valuable insights into future market trends.

Crypto investors should also consider the influence of the stock market and traditional finance on the crypto ecosystem. By understanding the broader financial landscape, you can better anticipate how macroeconomic factors, such as interest rates and inflation, may impact the crypto markets.

Review and Rebalance Your Portfolio Regularly

Building a diversified crypto portfolio is not a one-time effort. It requires ongoing attention to ensure your portfolio remains well-balanced and aligned with your investment goals.

Over time, certain assets may outperform others, leading to an imbalanced portfolio. For instance, if Bitcoin’s market cap rises significantly, it may represent an outsized portion of your overall portfolio, potentially increasing your risk.

Rebalancing involves selling overperforming assets and reallocating funds to underperforming or more stable assets. This is crucial in maintaining a balanced crypto portfolio that can withstand market volatility while capitalizing on long-term growth.

Mitigate Risk Through Stable Assets

Another important tip for successful crypto portfolio building is to include stablecoins. These digital assets are pegged to fiat currency and tend to exhibit less volatility than other cryptocurrencies. Stablecoins can provide a safety net during market turbulence, ensuring that a portion of your portfolio retains value even in bear markets.

Consider Staking or Earning Interest

Many cryptocurrencies offer staking or interest-earning opportunities. Staking involves locking up your assets in a wallet to support the network in exchange for rewards, while earning interest typically involves lending your assets on a decentralized finance (DeFi) platform. Both methods can provide additional income streams, helping to grow your portfolio passively.

Final Takeaways

Creating a thriving crypto portfolio requires a blend of examination, strategy, and ongoing management. By following these tips and staying informed about the ever-evolving crypto landscape, you can create a robust portfolio that aligns with your investment goals and risk tolerance.

Remember, crypto investing carries inherent risks, so always invest responsibly and never lose more than you can afford to lose.