Best AI Crypto Trading Bots in 2025 — Top Automated Trading Bots for Profits

The crypto market shifts at lightning speed — blink, and you might miss an opportunity. In this high-stakes game, traders increasingly rely on AI-powered crypto bot trading to execute strategies precisely, eliminate emotional bias, and maximize gains.

However, not all automated trading bots are created equal. In 2025, AI-driven bots are no longer just executing trades; they’re learning, adapting, and predicting market shifts before they happen.

This article aims to shed light on what AI crypto trading bots are, what types they are divided into, and what functionality they have. You will also learn about the best options that can be used in crypto trading practice.

Key Takeaways:

- AI-powered automated trading bots adapt to market trends, reducing emotional trading risks.

- Crypto bot trading now integrates deep learning, blockchain security, and predictive analytics for better decision-making.

- Solana trading bots and cross-chain AI trading revolutionize DeFi.

What Are AI Crypto Trading Bots?

AI crypto trading bots are advanced software programs that leverage artificial intelligence and machine learning algorithms to automate cryptocurrency trading. These bots analyze vast market data, identify trading opportunities, and execute buy or sell orders based on predefined strategies.

AI-powered trading bots differ significantly from conventional trading bots that operate on fixed rule-based systems. These advanced bots can learn and adapt in real-time to changing market conditions, enhancing their decision-making capabilities as they gather more data over time.

AI trading bots typically use various techniques such as predictive analytics, deep learning, and natural language processing (NLP) to enhance their performance. Some bots are equipped with neural networks that allow them to recognize complex patterns in price action and adjust trading strategies accordingly. Others leverage reinforcement learning, where the bot improves its trading performance over time by learning from past successes and failures.

While AI trading bots offer increased efficiency and accuracy, they are not foolproof. Market conditions can change unpredictably, and even the most sophisticated AI models can struggle during periods of extreme volatility.

Fast Fact

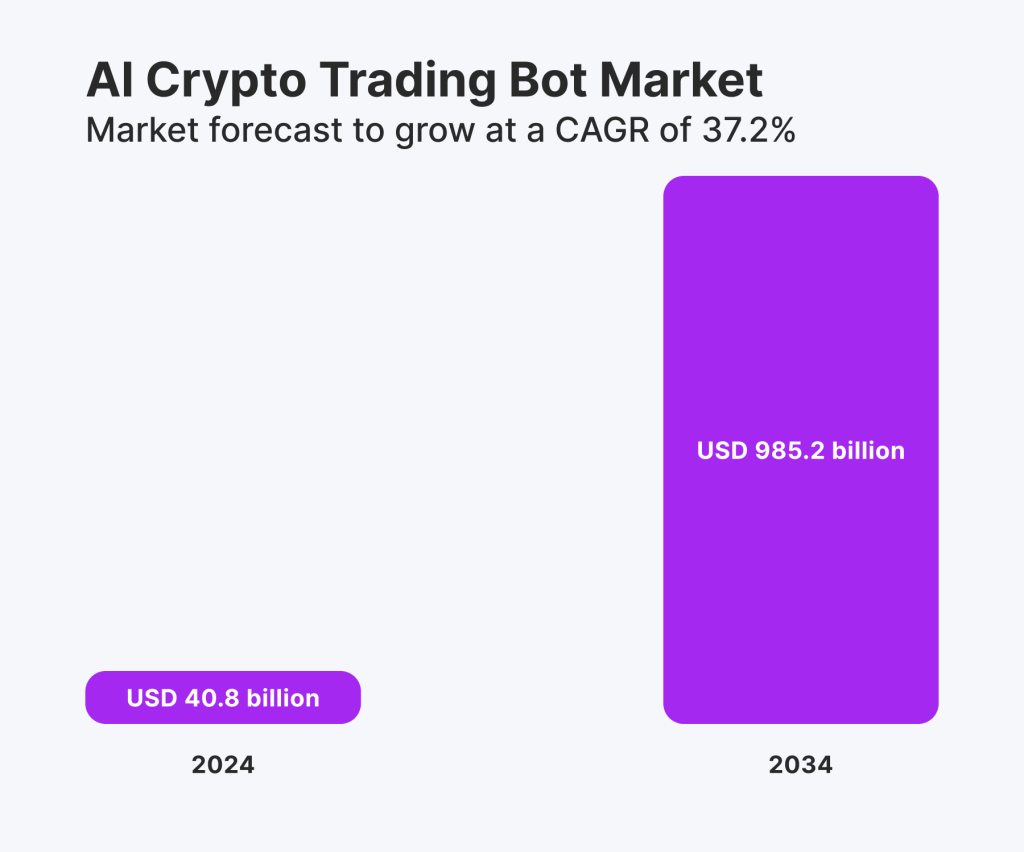

The global AI trading bot market is expected to surpass $30 billion by 2028 as more traders automate their strategies with AI-driven solutions.

Types of AI Trading Bots: Understanding How They Work

AI trading bots have revolutionized cryptocurrency trading by automating decision-making processes, executing trades precisely, and adapting to changing market conditions. However, not all AI bots function the same way. Different types of AI trading bots are designed for various trading strategies and market conditions.

Below are the most common and effective AI trading bots in 2025:

Trend-Following AI Bots

These bots identify and follow market trends by analyzing historical price movements and key technical indicators. They recognise bullish (upward) and bearish (downward) trends, entering long (buy) positions during uptrends and short-selling or exiting positions in downtrends. Over time, their AI algorithms refine predictions based on market behavior.

Best for traders who prefer medium to long-term positions in clear trend-driven markets. However, they can struggle in sideways (range-bound) markets and may react too late to sudden trend reversals.

Arbitrage AI Bots

Designed for cross-exchange trading, these bots scan multiple platforms in real time, detecting price differences and executing trades to exploit those gaps. AI enhances efficiency by predicting which exchanges are likely to show disparities, maximizing profit opportunities.

They are ideal for low-risk traders with access to multiple exchanges and low transaction fees. However, profitability depends on speed, and high network latency or trading fees can limit gains.

Market-Making AI Bots

Market-making bots ensure liquidity by placing simultaneous buy and sell orders slightly above and below the market price. Their AI systems adjust spread widths, optimize order sizes, and react to volatility to maintain a steady income from small price fluctuations.

These bots work best for high-frequency traders who prioritize unfilled orders or losses, and competition with institutional traders can be challenging.

Mean Reversion AI Bots

Based on the idea that prices revert to historical averages after extreme movements, these bots buy when an asset is oversold and sell when it is overbought. AI helps refine predictions by analyzing volatility patterns and past corrections.

They are useful in markets oscillating within a predictable range, making them a great choice for contrarian traders. However, strong trends can override this strategy, leading to prolonged losses in highly volatile or breakout markets.

Sentiment Analysis AI Bots

Using natural language processing (NLP), these bots analyze news, social media, and financial reports to assess sentiment. If market sentiment is positive, the bot takes long positions; if negative, it short-sells. AI assigns sentiment scores and continuously updates its assessment based on emerging trends.

Best suited for traders looking to capitalise on news-driven price movements, especially in hype-driven markets like meme coins. However, misinformation and rapidly shifting sentiment can make these trades risky.

High-Frequency Trading (HFT) AI Bots

HFT bots focus on executing thousands of trades per second, capitalizing on tiny price inefficiencies. AI optimizes execution speed, reduces latency, and identifies profitable micro-movements across various trading pairs.

They are most effective for traders with high computational resources and access to low-latency trading platforms. However, they require significant capital and infrastructure, and exchange-imposed trading limits can impact profitability.

Grid Trading AI Bots

These bots divide a price range into multiple grid levels, placing buy orders at lower and sell orders at higher levels. AI optimizes grid spacing and trade execution based on market conditions.

They work well in range-bound markets where prices fluctuate predictably, offering steady profits with minimal monitoring. However, if the market breaks out of the predefined range, the bot may struggle to adjust, leading to imbalanced trades.

Key Features to Look for in an AI Trading Bot

Selecting the perfect AI-powered crypto trading bot isn’t just about picking any automation tool — it’s about finding a digital trading companion that aligns with your strategy, risk tolerance, and market vision.

In 2025, AI bots have evolved beyond simple automation, leveraging machine learning, deep analytics, and real-time decision-making to stay ahead of the market.

Here’s what makes an AI trading bot truly stand out:

Advanced Algorithmic Trading Capabilities

AI trading bots use sophisticated algorithms to analyze market trends, predict price movements, and execute trades automatically. The best bots refine their strategies over time by integrating machine learning, deep learning, and reinforcement learning.

These AI-driven techniques allow bots to adapt to bullish and bearish markets, making real-time adjustments based on historical data and evolving conditions.

Backtesting and Simulation Tools

A high-quality trading bot should allow users to test their strategies using historical price data before deploying them in live markets. Backtesting helps traders refine their algorithms by simulating different market conditions and assessing performance metrics such as profitability and risk exposure. Some bots also offer paper trading, which lets users test strategies in real time without risking actual funds.

AI-Driven Market Analysis

Beyond simple price tracking, AI bots analyze market sentiment, technical indicators, and on-chain data. AI can gauge market sentiment and predict potential price movements by scanning news articles, financial reports, and social media trends. Some bots also track blockchain activity, such as whale transactions, and apply technical indicators like RSI and MACD to fine-tune their trading strategies.

Risk Management and Security

Effective AI trading bots have built-in risk management features to protect against market volatility. Stop-loss and take-profit orders allow traders to set limits on their trades, while trailing stop-loss mechanisms adjust dynamically based on price fluctuations. Security is also critical — bots should offer API key encryption, two-factor authentication (2FA), and IP whitelisting to prevent unauthorized access.

Multi-Exchange Integration

A good trading bot should support multiple cryptocurrency exchanges, allowing users to diversify their trades and exploit arbitrage opportunities. The ability to operate on major platforms like Binance, Coinbase, Kraken, and KuCoin provides flexibility and ensures access to a wide range of trading pairs.

Customization and User-Friendliness

AI trading bots should be accessible to both beginners and advanced traders. Some provide pre-configured strategies for ease of use, while others allow for custom strategy adjustments. A clean and intuitive dashboard with real-time trade monitoring enhances user experience, making it easier to track performance and make modifications as needed.

Automated Portfolio Management

Some AI bots offer portfolio rebalancing, ensuring asset allocation remains optimal over time. Bots can adjust portfolios periodically or based on market movements, reducing the need for constant manual oversight. Social trading features allow users to follow and replicate expert strategies and add an extra layer of convenience for less experienced traders.

Real-Time Notifications and Alerts

AI bots should provide instant updates on executed trades, market trends, and risk warnings via email, SMS, or mobile apps. Some integrate with platforms like Telegram and Discord, keeping traders informed even away from their trading dashboards.

Cost and Subscription Plans

Pricing models vary, with some bots offering free access with limited features, while others operate on monthly or yearly subscription plans. Commission-based models are also available, where the bot takes a percentage of profits. Traders should weigh the costs against their expected trading volume and profitability before selecting a bot.

Customer Support and Community Engagement

Reliable customer support is essential, especially for troubleshooting issues. The best AI bots provide 24/7 live chat or email assistance, extensive documentation, and active online communities. Bots with a strong community presence often receive faster updates and ongoing improvements based on user feedback.

Best AI Crypto Trading Bots in 2025

In the rapidly evolving world of cryptocurrency, AI-powered trading bots have become indispensable tools for traders seeking to optimize their strategies and maximise profits. As of 2025, several platforms have distinguished themselves by offering advanced AI-driven features, user-friendly interfaces, and robust security measures.

Here’s an in-depth look at some of the most effective AI-driven crypto trading bots that can elevate your trading strategy:

1. TradeSanta

TradeSanta is a widely recognised AI trading bot known for its ease of use and comprehensive automation features. It offers beginners and experienced traders tools, allowing users to execute trades using Dollar-Cost Averaging (DCA), Grid Trading, and Copy Trading. Its AI-driven interface simplifies trading strategies by automating buy and sell orders based on technical indicators.

With pricing plans starting at $25 per month for 49 bots, TradeSanta remains affordable for those looking to streamline their crypto trading. It integrates with major exchanges like Binance, OKX, and HitBTC, ensuring broad market access.

2. 3Commas

3Commas is a favourite among traders who want an all-in-one trading automation solution with AI-enhanced bots. It provides advanced tools for portfolio management, seamless TradingView integration, and automated execution of AI-driven strategies such as AI Grid Bot, DCA, and SmartTrade.

Its user-friendly interface appeals to beginners and expert traders, while AI optimisations ensure real-time strategy adjustments. With a free tier and premium plans starting at $49 monthly, 3Commas suits traders looking for powerful automation features. The platform supports exchanges like Binance, KuCoin, and Bybit, allowing traders to diversify their portfolios efficiently.

3. Pionex

Unlike most AI trading bots that require API integration, Pionex functions as a cryptocurrency exchange with built-in AI bots, making it an attractive option for traders who want a simplified setup. Without requiring external software, it offers over 16 automated trading bots, including Grid Trading, DCA, and Arbitrage strategies.

Pionex eliminates monthly subscription fees, charging only a 0.05% transaction fee, making it one of the most cost-effective AI trading platforms. With liquidity aggregated from Binance and Huobi, Pionex ensures deep market access while allowing traders to execute sophisticated AI-powered strategies effortlessly.

4. Coinrule

For traders who want full control over their trading strategies without the need for programming skills, Coinrule provides a powerful rule-based automation system. It features an AI assistant that helps traders build and test strategies using an intuitive “If-Then” logic system. Users can also access a marketplace with over 50 prebuilt trading strategies.

Coinrule’s pricing starts at $39.99 monthly for seven active rules, with premium tiers offering greater customisation. It supports major exchanges like Binance, Kraken, and Coinbase Pro, making it an excellent option for traders who prefer customisable AI-driven trading solutions.

5. Gunbot

Gunbot is designed for traders who want extensive customisation and advanced trading automation. Unlike most cloud-based AI trading bots, Gunbot operates as standalone software, allowing traders to modify strategies like Spotgrid, Stepgrid, and Bollinger Bands.

Gunbot is available through one-time purchase plans, starting at $99 for one exchange and scaling up to $399 for unlimited exchange compatibility. It supports over 100 exchanges via CCXT integration, making it a top choice for experienced traders who prefer deep strategy customisation over preset AI algorithms.

6. CryptoHopper

CryptoHopper is a cloud-based AI platform allowing traders to buy, sell, and create trading strategies within a dynamic marketplace. It supports Market Making, DCA, Arbitrage, and Copy Trading, making it ideal for those who prefer automated trading and community-driven strategy-sharing.

CryptoHopper provides a free tier with basic features, while paid plans start at $29 monthly. Its integration with exchanges like Binance and Bittrex ensures broad compatibility, while its AI-driven insights help traders fine-tune their approaches.

7. Dawgz AI

Dawgz AI is an emerging AI trading bot integrating automated trading with staking rewards and a community-driven ecosystem. Built to cater to traders interested in meme coins with real-world utility, Dawgz AI uses proprietary AI algorithms to operate 24/7, seizing market opportunities with high efficiency.

In presale, Dawgz AI offers early investors a chance to participate before the full launch. The bot is expected to support major crypto exchanges, though specific details will be announced post-presale. Its unique blend of AI-powered trading and community engagement sets it apart in the evolving crypto landscape.

The Future of AI in Crypto Trading

AI-driven trading bots rapidly transform the crypto market by enhancing efficiency, decision-making, and automation. As AI and blockchain technologies continue to evolve, the future of AI in crypto trading looks promising, with advancements expected in predictive analytics, DeFi integration, and blockchain-based automation.

Predicted Advancements in AI Trading

AI-driven trading will shift towards greater self-learning capabilities and enhanced predictive analytics. Future AI bots will utilise deep learning to analyze vast datasets beyond traditional technical indicators, including on-chain activity, macroeconomic trends, and trader sentiment from news and social media.

Another major development is the rise of autonomous AI agents — bots that operate independently with minimal human intervention. These agents will continuously refine their strategies, adjusting risk management techniques in real-time, setting their entry and exit points, and optimising leverage based on evolving market conditions.

The efficiency of arbitrage and market-making strategies will also improve as AI bots leverage Layer-2 scaling solutions such as Optimism and Arbitrum to increase transaction speed. This will allow AI-driven bots to instantly seize arbitrage opportunities, preventing exchange price discrepancies from disappearing before trades are executed.

AI’s deeper integration with DeFi smart contracts will be a groundbreaking innovation. Future AI trading bots will autonomously engage in yield farming, flash loan arbitrage, and cross-chain trading without requiring human oversight as well as optimize liquidity provisioning and lending strategies, ensuring that capital is allocated efficiently in real time.

Symbioses of Blockchain Technology and AI Trading Algorithms

Blockchain technology will make AI-powered trading bots more secure, transparent, and decentralized. Currently, most trading bots operate on centralized platforms, which can pose security risks. Future AI bots will be deployed on decentralized networks, ensuring immutable trade records and decentralized execution.

One of the most promising innovations is the integration of smart contracts for trustless AI trading. These smart contracts will allow AI bots to execute trades automatically based on real-time market data, eliminating the need for intermediaries. The combination of AI and blockchain will enable automated profit-sharing, where AI-driven trades execute and distribute profits transparently based on predefined conditions encoded in smart contracts.

Another game-changer will be real-time AI blockchain data integration through decentralised oracles such as Chainlink. AI trading bots will have instant access to verifiable market data, enabling them to make split-second trading decisions with improved accuracy.

This integration will also allow cross-chain trading, where AI bots seamlessly execute trades across different blockchain networks, optimising real-time strategies based on liquidity and price movements.

AI-Powered DeFi Trading

DeFi is already transforming traditional financial systems, and AI is set to amplify its impact even further. AI-powered trading bots will be instrumental in managing liquidity pools, optimising yield farming, and identifying arbitrage opportunities across decentralized exchanges (DEXs).

One of the most significant use cases will be automated liquidity provisioning. AI bots will dynamically adjust liquidity positions based on price volatility, ensuring that capital is placed in the most profitable pools at any moment.

AI bots will determine the best staking and farming opportunities by continuously analyzing yield fluctuations and smart contract activity, automatically shifting assets between different DeFi protocols to maximize returns.

With the increasing number of exploits and flash loan attacks in DeFi, AI bots will monitor smart contracts in real time, flagging vulnerabilities before they are exploited. These bots will track whale movements, detect large transactions that could impact liquidity pools, and alert traders before potential market disruptions occur.

Another major shift will be AI-governed trading strategies for DAOs. As DAOs manage increasingly large treasuries, AI-driven governance will ensure that funds are diversified intelligently into yield-generating assets. Token holders can vote on AI trading strategies, enabling community-driven algorithmic trading executed transparently on the blockchain.

AI will also revolutionize DeFi arbitrage, as bots capitalise on price variations across different AMMs. These bots will execute cross-chain arbitrage between Ethereum, Binance Smart Chain, Solana, and emerging Layer-2 solutions, taking advantage of price inefficiencies with minimal slippage.

Additionally, AI-powered flash loan arbitrage will allow traders to borrow and repay funds within a single transaction, profiting from temporary price discrepancies without needing upfront capital.

Final Remarks

The age of AI bot trading is no longer a vision of the future — it’s happening now. From Solana trading bots optimising DeFi transactions to high-frequency trading bots making split-second decisions, AI is rewriting crypto trading rules.

As AI continues to evolve, the traders who embrace its power will lead the next financial revolution, turning automation into profit, precision, and long-term success. The only question left: Are you ready to let AI trade smarter for you?

FAQ

What is the best AI trading bot in 2025?

Top contenders include TradeSanta, 3Commas, Pionex, and CryptoHopper, each offering unique AI-driven automation features.

Can AI trading bots work on Solana?

Yes! Solana trading bots are gaining popularity for their speed and low transaction costs, making them ideal for automated DeFi strategies.

Are AI crypto bots safe to use?

Most reputable AI trading bots use API key encryption, 2FA, and risk management tools to enhance security.

Can AI trading bots guarantee profits?

No trading bot guarantees profits, but AI-powered bots optimize strategies, manage risk, and execute trades faster than humans in volatile markets.